Rise of Retail Investors in the Stock Market

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Source: Fool

- Rise of Retail Investors: According to BlackRock, retail ownership of U.S. stocks has surged to nearly one-fifth of average daily trading activity, a significant increase from the low single-digit percentages seen before the pandemic, highlighting the growing influence of retail investors in the market.

- ETF Investment Surge: The Vanguard S&P 500 ETF and SPDR S&P 500 ETF Trust have become popular among retail investors on the Robinhood platform, as they provide broad exposure to approximately 500 large-cap U.S. stocks, reflecting investor confidence in overall market performance.

- Bond Market Opportunities: The Vanguard Total Bond Market ETF offers exposure to high-quality investment-grade bonds with an average coupon of 3.8%, making it suitable for medium- to long-term investors seeking reliable income, particularly as part of a 60-40 investment strategy.

- International Market Diversification: The Vanguard FTSE Developed Markets ETF and Vanguard FTSE Emerging Markets ETF provide investors with opportunities in international stocks, and while emerging markets carry higher risks, their long-term growth potential attracts investors looking for diversification.

Get Free Real-Time Notifications for Any Stock

Monitor tickers like TSM with instant alerts to capture every critical market movement.

Sign up for free to build your custom watchlist and receive professional-grade stock notifications.

Analyst Views on TSM

Wall Street analysts forecast TSM stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for TSM is 313.46 USD with a low forecast of 63.24 USD and a high forecast of 390.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

8 Analyst Rating

7 Buy

1 Hold

0 Sell

Strong Buy

Current: 339.550

Low

63.24

Averages

313.46

High

390.00

Current: 339.550

Low

63.24

Averages

313.46

High

390.00

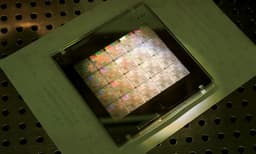

About TSM

Taiwan Semiconductor Manufacturing Co Ltd is a Taiwan-based integrated circuit foundry service provider. The Company is primarily engaged in integrated circuit manufacturing services. It offers advanced process technologies, specialised process solutions, advanced photomask and silicon stacking, and packaging-related technologies, while supporting a comprehensive design ecosystem. The Company's products serve diverse electronic sectors including artificial intelligence, high-performance computing, wired and wireless communications, automotive and industrial equipment, personal computing, information applications, consumer electronics, smart internet of things, and wearable devices.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

AI Growth Forecast Positions TSMC as a Key Player

- Market Forecast: Renowned investor Cathie Wood's Ark Invest predicts that AI data center spending will triple from $500 billion to $1.4 trillion by 2030, creating substantial market opportunities for companies like TSMC.

- Technological Edge: TSMC, as a leading chip manufacturer, maintains close relationships with top AI chip designers like Nvidia and Broadcom, ensuring a dual advantage in both GPU and AI ASIC markets, positioning itself favorably in the rapidly growing AI sector.

- Enhanced Pricing Power: With a near monopoly in advanced chip manufacturing, TSMC has laid out a four-year price hike schedule for customers, which not only boosts its gross margin but also strengthens its pricing power, further solidifying its market leadership.

- Increased Capital Expenditure: TSMC plans to raise its capital expenditure budget from $41 billion in 2025 to between $52 billion and $56 billion, reflecting strong confidence in AI revenue growth at a mid- to high-50% compound annual growth rate (CAGR), indicating an optimistic outlook on long-term market trends.

Continue Reading

Retail Investors Show Strong Preference for ETFs

- Retail Investment Trend: According to BlackRock, retail ownership of U.S. stocks has surged to nearly 20% of average daily trading activity, a significant increase from the low single digits prior to the pandemic, highlighting the growing importance of retail investors in the market.

- Popularity of ETFs: ETFs like the Vanguard S&P 500 ETF and State Street SPDR S&P 500 ETF Trust are favored on the Robinhood platform for their low costs and convenience, serving as primary vehicles for gaining exposure to large-cap U.S. stocks, reflecting confidence in overall economic performance.

- Attraction of Bond ETFs: The Vanguard Total Bond Market ETF offers high-quality investment-grade bonds with an average coupon of 3.8%, making it suitable for medium- to long-term investors seeking reliable income, underscoring the importance of bonds in a 60-40 investment portfolio.

- International Market Investment Opportunities: The Vanguard FTSE Developed Markets ETF and Vanguard FTSE Emerging Markets ETF provide investors access to international stocks, and while emerging markets carry higher risks, their long-term growth potential attracts investors looking for diversified investment options.

Continue Reading