Puma Biotechnology Grants 3,500 Restricted Stock Units to New Employee

- Stock Award Plan: On December 1, 2025, Puma Biotechnology approved the grant of 3,500 restricted stock units to a new non-executive employee, aimed at attracting talent and enhancing employee loyalty.

- Vesting Conditions: The stock units will vest over three years, with one-third unlocking in the first year and one-sixth every six months thereafter, ensuring continued service for full benefits.

- Incentive Mechanism: This award is granted under Puma's 2017 Employment Inducement Incentive Award Plan, complying with Nasdaq Listing Rule 5635(c)(4), designed to attract and retain key talent through equity incentives.

- Corporate Strategy: By implementing such incentive measures, Puma not only boosts employee motivation but also strengthens its market position in the highly competitive biopharmaceutical industry.

Trade with 70% Backtested Accuracy

Analyst Views on PBYI

About PBYI

About the author

- Stock Award Program: On February 3, 2026, Puma Biotechnology approved the grant of 14,750 restricted stock units to two new non-executive employees, aimed at attracting talent and enhancing employee loyalty.

- Vesting Conditions: Under the 2017 Employment Inducement Incentive Award Plan, the stock units will vest over three years, with one-third vesting on the first anniversary and one-sixth every six months thereafter, ensuring continued employee service.

- Product Development Progress: Puma focuses on developing innovative cancer treatment products, having received FDA approval for neratinib in 2017, which further solidifies its market position in breast cancer treatment.

- Clinical Trial Initiation: In 2024, Puma initiated the ALISCA™-Lung1 Phase II clinical trial for small cell lung cancer, demonstrating the company's ongoing efforts and market potential in cancer drug development.

- Trade Agreement Reached: Indian Prime Minister Modi announced a free trade agreement with the EU, dubbed the 'mother of all deals,' covering 25% of global GDP and a third of global trade, which is expected to significantly enhance economic cooperation and market access between the two regions.

- Positive Market Reaction: European stocks broadly rose, with the pan-European Stoxx 600 index up 0.3%, reflecting investor optimism regarding the new trade agreement while preparing for an influx of corporate earnings reports.

- Significant Industry Impact: The EU's major exports to India include machinery, transport equipment, and chemicals, while India's key exports to the EU are also machinery, chemicals, and fuels, indicating a complementary relationship that will foster collaboration and growth across multiple sectors.

- Earnings Season Kicks Off: As the earnings season begins, investors are keenly watching financial reports from ASML, Volvo, LVMH, and Deutsche Bank, with market sentiment appearing more positive in light of the new trade agreement.

- Employee Incentive Program: On January 6, 2026, Puma Biotechnology approved the grant of 10,500 restricted stock units to three new non-executive employees, aimed at attracting and retaining talent to enhance the company's competitiveness.

- Stock Vesting Arrangement: The stock units will vest over three years, with one-third vesting on the first anniversary and one-sixth every six months thereafter, ensuring continued service and alignment with company growth.

- Compliance Assurance: This stock grant complies with Nasdaq Listing Rule 5635(c)(4), demonstrating Puma's commitment to transparency and compliance in attracting new employees, which bolsters investor confidence.

- Support for R&D Investments: Puma's focus on innovative cancer treatment products will benefit from this incentive, helping to attract key talent to advance R&D projects, including the new drug alisertib, thereby enhancing market competitiveness.

- Nasdaq Recognition: Puma Biotechnology is officially added to the Nasdaq Biotechnology Index effective December 19, 2025, marking a significant acknowledgment of the company's ongoing commercial execution, profitability, and clinical progress, thereby enhancing its visibility within the biotechnology investment community.

- Sustained Product Demand: With continued demand for NERLYNX® and advancements in the development of alisertib, Puma's CEO stated that this milestone will help create greater value for patients and shareholders, further solidifying the company's market position.

- Clinical Trial Advancement: In February 2024, Puma initiated the ALISCA™-Lung1 clinical trial focusing on alisertib monotherapy for patients with extensive-stage small cell lung cancer, demonstrating the company's commitment to research and development in cancer treatment.

- Market Entry Standards: Companies in the Nasdaq Biotechnology Index must meet various criteria, including minimum market capitalization and average daily trading volume, and Puma's inclusion reflects its maturity as a public company and market recognition.

- Stock Award Plan: On December 1, 2025, Puma Biotechnology approved the grant of 3,500 restricted stock units to a new non-executive employee, aimed at attracting talent and enhancing employee loyalty.

- Vesting Conditions: The stock units will vest over three years, with one-third unlocking in the first year and one-sixth every six months thereafter, ensuring continued service for full benefits.

- Incentive Mechanism: This award is granted under Puma's 2017 Employment Inducement Incentive Award Plan, complying with Nasdaq Listing Rule 5635(c)(4), designed to attract and retain key talent through equity incentives.

- Corporate Strategy: By implementing such incentive measures, Puma not only boosts employee motivation but also strengthens its market position in the highly competitive biopharmaceutical industry.

Ironwood Pharmaceuticals Overview: Ironwood focuses on gastrointestinal disorders with its sole marketed drug, Linzess, which has seen significant sales growth, leading to an optimistic revenue outlook for 2025. The company is also developing apraglutide for short bowel syndrome, although it remains heavily reliant on Linzess for revenue.

Puma Biotechnology Overview: Puma Biotechnology specializes in cancer treatments, particularly with its drug Nerlynx for breast cancer, which has shown modest sales growth. However, the company faces risks due to its dependence on a single product and competition in the crowded breast cancer market.

Investment Comparison: Analysts suggest that Ironwood may be a better investment opportunity compared to Puma Biotechnology, given its steady earnings momentum and positive growth outlook, despite Ironwood's higher price-to-sales ratio.

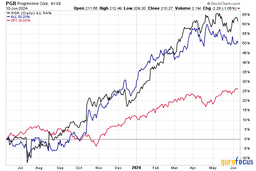

Market Performance: Year-to-date, Ironwood's shares have declined while Puma's have surged, reflecting differing market perceptions. Ironwood's strong revenue guidance and rising earnings estimates contrast with Puma's vulnerability to regulatory and competitive challenges.