Allstate Declares $29.3 Million in Preferred Stock Dividends

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1 hour ago

0mins

Should l Buy ALL?

Source: PRnewswire

- Dividend Announcement: The Allstate Corporation declared approximately $29.3 million in dividends for three series of preferred stock for the period from January 15 to April 14, 2026, indicating the company's stable cash flow and commitment to shareholders.

- Dividend Details: The annual dividend rates are 5.100% for Series H, 4.750% for Series I, and 7.375% for Series J, with quarterly amounts of $0.31875, $0.296875, and $0.4609375 per depositary share, reflecting the company's appeal to diverse investors.

- Payment Schedule: All preferred dividends will be payable in cash on April 15, 2026, to shareholders of record as of March 31, 2026, ensuring timely returns for investors and enhancing confidence in the company's financial health.

- Company Background: Allstate currently has 211 million policies in force and is dedicated to providing comprehensive protection services, with its stability and market position allowing it to maintain a competitive edge in the insurance industry.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy ALL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on ALL

Wall Street analysts forecast ALL stock price to rise

16 Analyst Rating

9 Buy

6 Hold

1 Sell

Moderate Buy

Current: 203.220

Low

207.00

Averages

239.64

High

281.00

Current: 203.220

Low

207.00

Averages

239.64

High

281.00

About ALL

The Allstate Corporation protects people from life’s uncertainties with a wide array of protection for autos, homes, electronic devices and identity theft. The Company’s products are available through Allstate agents, independent agents, major retailers, online and at the workplace. Its Allstate Protection segment offers private passenger auto, homeowners, other personal lines and commercial insurance. Its Run-off Property-Liability segment includes property and casualty insurance coverage. The Company’s Protection Services segment provides consumer product protection plans, device and mobile data collection services and analytic solutions using automotive telematics information, roadside assistance, protection and insurance products and identity protection and restoration through Allstate Protection Plans, Allstate Dealer Services, Allstate Roadside, Arity and Allstate Identity Protection.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Catastrophe Loss Overview: Allstate estimates catastrophe losses for January at $175 million, primarily due to Winter Storm Fern, with an after-tax impact of $138 million, which could negatively affect the company's financial health and future profitability.

- Policy Count Changes: As of January 31, 2026, Allstate's auto insurance policies totaled 254,840, a slight decrease of 0.1% from 255,040 on December 31, 2025, but a 2.6% increase from 248,350 a year earlier, indicating stable market demand.

- Homeowners Insurance Growth: Homeowners insurance policies reached 77,090 by January 31, 2026, up 0.2% from 76,970 on December 31, 2025, and a 2.5% increase from 75,210 a year ago, demonstrating the company's continued appeal in the residential insurance market.

- Commercial Insurance Decline: Commercial insurance policies fell from 17,600 on December 31, 2025, to 17,500, a decrease of 0.6%, and down 14.2% from 20,400 a year prior, reflecting challenges and increased competition in the commercial insurance sector.

See More

- Dividend Announcement: The Allstate Corporation declared approximately $29.3 million in dividends for three series of preferred stock for the period from January 15 to April 14, 2026, indicating the company's stable cash flow and commitment to shareholders.

- Dividend Details: The annual dividend rates are 5.100% for Series H, 4.750% for Series I, and 7.375% for Series J, with quarterly amounts of $0.31875, $0.296875, and $0.4609375 per depositary share, reflecting the company's appeal to diverse investors.

- Payment Schedule: All preferred dividends will be payable in cash on April 15, 2026, to shareholders of record as of March 31, 2026, ensuring timely returns for investors and enhancing confidence in the company's financial health.

- Company Background: Allstate currently has 211 million policies in force and is dedicated to providing comprehensive protection services, with its stability and market position allowing it to maintain a competitive edge in the insurance industry.

See More

- Dividend Announcement: The Allstate Corporation declared approximately $29.3 million in cash dividends on three series of preferred stock for the period from January 15, 2026, to April 14, 2026, reflecting the company's stable financial health and commitment to shareholders.

- Payment Details: All preferred dividends are payable on April 15, 2026, to stockholders of record as of March 31, 2026, ensuring timely returns for investors and enhancing confidence in the company's governance.

- Preferred Stock Series: Specifically, Series H has an annual dividend rate of 5.100% with a quarterly amount of $0.31875 per depositary share; Series I has a 4.750% rate with $0.296875 per share; and Series J offers a 7.375% rate with $0.4609375 per share, showcasing the company's appeal to diverse investors.

- Company Background: Allstate protects 211 million policies, providing affordable and connected protection for autos, homes, and identities, thereby reinforcing its leadership position in the insurance market.

See More

- Market Size Outlook: According to BMO Capital Markets, the total addressable market for personal auto insurance is expected to peak at approximately $560 billion by 2040, followed by an annual decline of about 4%, which will have profound implications for insurers.

- Accident Rate Reduction: The rise of autonomous vehicles is projected to reduce accident rates by 75% to 90%, while current advanced driver-assistance systems can lower collision rates by 40%, directly impacting insurance claims and premium revenues.

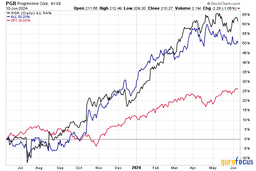

- Valuation Pressure on Stocks: Analysts note that auto insurance accounts for over 90% of Progressive's insurance premiums, and the anticipated lower terminal growth rates could lead to significant declines in stock valuations, prompting investors to remain cautious.

- Market Reaction: Despite Progressive's stock falling over 11% this year, Wall Street expects a rebound, with analysts generally holding a buy rating on Allstate, forecasting over 19% upside potential in its stock price over the next 12 months.

See More

- Loss Estimates: Allstate has projected January catastrophe losses of $175 million, or $138 million after-tax, primarily due to winter storm Fern, indicating the company's financial vulnerability to extreme weather events, which could impact future profitability.

- Comparative Analysis: In contrast, Allstate's estimated losses for December were $80 million, or $64 million after-tax, reflecting an increasing impact of winter weather on the insurance industry, which may lead to higher premiums.

- Stock Price Reaction: Following the loss forecast, Allstate's shares fell 0.50% in pre-market trading to $208.38, indicating investor concerns about the company's financial health, which could affect market confidence.

- Stable Policy Count: The number of protection policies in force in January remained virtually unchanged from December at 38.26 million, suggesting stability in customer retention but potentially limiting revenue growth opportunities.

See More

- Dividend Run Concept: Allstate Corp is set to go ex-dividend on March 2, 2026, with a dividend of $1.08, and historical data indicates that in three out of the last four dividends, the stock experienced capital gains exceeding the dividend amount, highlighting the potential for a dividend run.

- Capital Gains Performance: Between November 13 and December 1, 2025, Allstate's stock price rose from $211.16 to $212.98, an increase of $1.82, suggesting that a pre-dividend buying strategy could yield significant capital gains for investors.

- Dividend Frequency and Yield: With a quarterly dividend frequency and an implied annualized yield of 2.08%, Allstate presents itself as an attractive option for investors focused on dividend runs, particularly in a stable income environment.

- Diverse Investment Strategies: Investors have varying perspectives on the timing of dividend runs, with some opting to buy two weeks prior and hold, while others prefer to sell the day before the ex-dividend date to maximize capital gains, offering flexibility in investment strategies.

See More