PTC Q1 2026 Earnings Call Highlights

- Strong Financial Performance: PTC reported a constant currency ARR of $2.341 billion in Q1, reflecting a 9% year-over-year growth, while including Kepware and ThingWorx, the ARR reached $2.5 billion, up 8.4%, indicating robust market growth and solid cash flow performance.

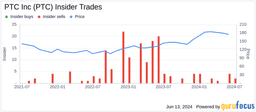

- Share Repurchase Program: The company repurchased $200 million of common stock in Q1 and plans to increase buybacks to $250 million in Q2, aiming to reduce the diluted share count to approximately 119 million shares, thereby enhancing shareholder value and market confidence.

- Accelerating Strategic Transformation: Management emphasized that PTC is at a strategic inflection point with accelerating product roadmap releases and record deferred ARR under contract, showcasing the company's strong demand capture capabilities under its Intelligent Product Lifecycle vision.

- Optimistic Future Outlook: CFO DiRico reaffirmed fiscal 2026 ARR growth guidance of 7.5%-9.5% and projected Q2 free cash flow between $310 million and $315 million, reflecting the company's confidence in future performance and ongoing financial health.

Trade with 70% Backtested Accuracy

Analyst Views on PTC

About PTC

About the author

- Strong Financial Performance: PTC reported a constant currency ARR of $2.341 billion in Q1, reflecting a 9% year-over-year growth, while including Kepware and ThingWorx, the ARR reached $2.5 billion, up 8.4%, indicating robust market growth and solid cash flow performance.

- Share Repurchase Program: The company repurchased $200 million of common stock in Q1 and plans to increase buybacks to $250 million in Q2, aiming to reduce the diluted share count to approximately 119 million shares, thereby enhancing shareholder value and market confidence.

- Accelerating Strategic Transformation: Management emphasized that PTC is at a strategic inflection point with accelerating product roadmap releases and record deferred ARR under contract, showcasing the company's strong demand capture capabilities under its Intelligent Product Lifecycle vision.

- Optimistic Future Outlook: CFO DiRico reaffirmed fiscal 2026 ARR growth guidance of 7.5%-9.5% and projected Q2 free cash flow between $310 million and $315 million, reflecting the company's confidence in future performance and ongoing financial health.

- Earnings Announcement: PTC is set to release its Q1 earnings report on February 4, with consensus EPS estimates at $1.56, reflecting a 41.8% year-over-year increase, which could further solidify its profitability in the industry.

- Revenue Expectations: The anticipated revenue of $634.33 million represents a 12.3% year-over-year growth, indicating that the company is maintaining strong performance in a continuously growing market, potentially attracting more investor interest.

- Historical Performance: Over the past two years, PTC has achieved a 100% accuracy rate in EPS estimates and an 88% accuracy rate in revenue estimates, showcasing its strong forecasting capabilities and enhancing market confidence in its future performance.

- Estimate Revision Dynamics: In the last three months, EPS estimates have seen 8 upward revisions and 4 downward revisions, while revenue estimates experienced 5 upward and 7 downward revisions, reflecting varying market perceptions of PTC's future performance, which may influence investor decisions.

- Surge in Natural Gas Demand: The massive snowstorm has led to a significant rise in natural gas demand, drawing attention to midstream companies like Targa Resources, whose stock is nearing all-time highs, reflecting market interest in energy infrastructure.

- Strong Performance by Targa Resources: Targa Resources reported a record adjusted EBITDA of $1.27 billion for Q3 2025, a 19% year-over-year increase, with net income reaching $478.4 million, showcasing robust growth in the natural gas transmission sector.

- Devon Energy Merger Talks: Devon Energy achieved an oil production average of 390,000 barrels per day in Q3 2025 and is in discussions to merge with Coterra Energy, potentially creating a $57 billion independent U.S. shale producer, indicating a trend towards industry consolidation.

- Corteva Raises Guidance: Corteva has raised its full-year 2025 EBITDA guidance to between $3.8 billion and $3.9 billion, representing a 14% growth, highlighting strong performance and renewed market confidence in the agricultural sector.

- Autodesk Upgrade: J.P. Morgan upgraded Autodesk from Neutral to Overweight with a price target of $319, highlighting its leadership in design and BIM software, rapid adoption of cloud and AI technologies, and positioning to capture larger market share in high-growth areas like data centers and infrastructure.

- PTC Downgrade: PTC's rating was downgraded to Underweight with a price target reduced from $205 to $162, as analysts noted its strategic narrowing and focus on legacy CAD and PLM, which diminishes growth options and exposes the company to risks as customer needs evolve.

- Accelerated Technological Change: Analysts emphasized Autodesk's forefront position in AI integration, enabling design optimization, rapid data access, and predictive modeling that streamline workflows and reduce project timelines, with customer feedback indicating a trend towards standardization on Autodesk for design and compliance needs.

- Intensified Market Competition: PTC faces strong competition from Siemens and Dassault in the PLM space, with analysts noting that its desktop-heavy CAD business and slow cloud evolution further weaken its competitive position, while customer dissatisfaction with reduced flexibility may lead them to explore alternative vendors.

Market Volatility: Last week saw increased volatility in equities, with the S&P 500 ending slightly up and the Nasdaq Composite slightly down after a steady interest rate announcement by the Federal Open Market Committee.

Microsoft's Earnings Impact: Microsoft experienced a significant drop of 10% in its stock value, resulting in a loss of $357 billion in market capitalization following a disappointing earnings report.

Silver Market Collapse: The silver market faced a dramatic decline, falling 31% in a single day, attributed to the nomination of hawkish Kevin Warsh as the next Fed Chair and a prior 50% increase in value this year.

Overall Economic Sentiment: The combination of these events reflects a turbulent economic sentiment, with investors reacting to both corporate earnings and shifts in monetary policy.

- Earnings Reaction Analysis: Nucor's latest earnings report missed both revenue and profit expectations, causing a 6% drop in stock price post-release, but subsequent buying activity indicates investor confidence in future performance.

- Growing Market Demand: Nucor's steel mill shipments are expected to grow by 5% year-over-year, with a 15% increase in backlog for the steel products segment, reflecting robust demand across infrastructure and advanced manufacturing sectors.

- Optimistic Profit Outlook: Management anticipates improved earnings across all segments in the coming quarters due to higher volumes and price increases, with price hikes announced across nearly all product categories.

- Risk Management Strategy: Nucor's stock price is supported near the 50-day moving average, and despite the pullback, market confidence remains strong, prompting investors to watch for a breakout to new highs to confirm the upward trend.