Nvidia's Stock Price Outlook for 2026

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1 hour ago

0mins

Should l Buy NVDA?

Source: Fool

- Surge in AI Spending: In 2026, major companies like Amazon, Alphabet, and Meta are projected to spend around $500 billion on artificial intelligence, which will directly boost demand for Nvidia's GPUs and solidify its market leadership.

- Recovery in China: After facing export restrictions, Nvidia's sales to China have been approved again, and although an export tax will apply, this market's recovery is expected to significantly enhance the company's revenue and profitability in FY 2027.

- Analyst Optimism: Wall Street analysts forecast Nvidia's growth rate to reach 65% in FY 2027, with earnings per share (EPS) expected to rise from $4.69 to $7.74, providing strong support for the stock price.

- Significant Price Potential: Based on a conservative P/E ratio of 40, Nvidia's stock price could reach $309.60, representing a substantial increase from the current price of $185, and if the company exceeds earnings expectations, the stock could rise even higher, indicating strong investment appeal.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy NVDA?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on NVDA

Wall Street analysts forecast NVDA stock price to rise

41 Analyst Rating

39 Buy

1 Hold

1 Sell

Strong Buy

Current: 187.980

Low

200.00

Averages

264.97

High

352.00

Current: 187.980

Low

200.00

Averages

264.97

High

352.00

About NVDA

NVIDIA Corporation is a full-stack computing infrastructure company. The Company is engaged in accelerated computing to help solve the challenging computational problems. The Company’s segments include Compute & Networking and Graphics. The Compute & Networking segment includes its Data Center accelerated computing platforms and artificial intelligence (AI) solutions and software; networking; automotive platforms and autonomous and electric vehicle solutions; Jetson for robotics and other embedded platforms, and DGX Cloud computing services. The Graphics segment includes GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems, and Omniverse Enterprise software for building and operating industrial AI and digital twin applications.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Earnings Potential Analysis: Oppenheimer anticipates Nvidia's Q4 sales could see a typical upside of $2B to $3B, primarily driven by the GB300 Ultra, indicating strong performance in the AI sector.

- Growing Market Demand: Expected capital expenditures from cloud service providers are projected to reach $650B in 2026, up from over $400B in 2025, reflecting sustained demand for Nvidia's products.

- New Product Outlook: The average selling price for Vera Rubin is expected to be 40% to 50% higher than that of GB300, potentially adding around $8B in revenue for Nvidia, further solidifying its market leadership.

- Market Size Expansion: With China now included, Nvidia's total addressable market is estimated to be around $4T, showcasing its dominant position in the global AI platform and future growth potential.

See More

- Weak Market Performance: Since August 2025, Nvidia's stock has only risen by 5%, significantly lagging behind the S&P 500's 10% gain, indicating market caution regarding its future growth despite optimistic prospects in the AI sector.

- Surge in Capital Expenditures: Amazon, Alphabet, and Meta expect to spend at least $500 billion in capital expenditures in 2026, positioning Nvidia as a primary beneficiary; if it maintains its market share, it could see substantial revenue growth, with global data center capital expenditures projected to reach $3 trillion to $4 trillion by 2030.

- China Market Resumption: Nvidia has regained the ability to export GPUs to China, re-entering the world's second-largest AI market; although the stock has not significantly reacted to this positive development, it provides new momentum for future growth.

- Attractive Valuation: With a forward P/E ratio of less than 24, Nvidia's stock appears cheap compared to the S&P 500's 21.9, suggesting that investors should consider buying during this pullback, especially with upcoming spending increases on the horizon.

See More

- Market Volatility: U.S. markets experienced volatility on Thursday due to escalating tensions with Iran, with the S&P 500 down 0.28%, the Dow Jones Industrial Average down 0.54%, and the Nasdaq Composite down 0.31%, indicating investor concerns over geopolitical risks.

- Rising Oil Prices: Oil prices surged nearly 2% in U.S. trading amid fears that military action could disrupt oil supplies from Iran, reflecting market anxiety over energy security and potentially leading to increased costs for related industries, impacting the broader economy.

- Blue Owl Capital Liquidity Tightening: Blue Owl Capital's sale of $1.4 billion in loan assets resulted in a nearly 6% drop in its stock, raising alarms about the stability of the private credit market, which could undermine investor confidence and exacerbate market volatility.

- Japan's Inflation Data: Japan's headline inflation rate fell to 1.5% in January, the lowest since March 2022, with core inflation easing to 2%, which may influence the Bank of Japan's monetary policy decisions and subsequently affect global market liquidity.

See More

- Surge in AI Spending: In 2026, major companies like Amazon, Alphabet, and Meta are projected to spend around $500 billion on artificial intelligence, which will directly boost demand for Nvidia's GPUs and solidify its market leadership.

- Recovery in China: After facing export restrictions, Nvidia's sales to China have been approved again, and although an export tax will apply, this market's recovery is expected to significantly enhance the company's revenue and profitability in FY 2027.

- Analyst Optimism: Wall Street analysts forecast Nvidia's growth rate to reach 65% in FY 2027, with earnings per share (EPS) expected to rise from $4.69 to $7.74, providing strong support for the stock price.

- Significant Price Potential: Based on a conservative P/E ratio of 40, Nvidia's stock price could reach $309.60, representing a substantial increase from the current price of $185, and if the company exceeds earnings expectations, the stock could rise even higher, indicating strong investment appeal.

See More

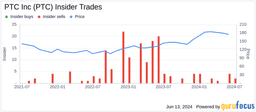

- Slowing ARR Growth: PTC forecasts adjusted organic ARR growth of 7.5% to 9.5% for fiscal 2026, significantly lower than the previously predicted mid-teens growth, reflecting market concerns about its growth prospects and contributing to a 10% decline in stock price over the past year.

- AI Embedding Strategy: CEO Neil Barua emphasizes that customers prefer AI embedded directly into trusted record systems rather than as standalone systems, which positions PTC to transform AI from a threat into an opportunity by enhancing value in future enterprise workflows.

- Future Cash Flow Expectations: Management anticipates reaching $1 billion in free cash flow by 2026, which, based on the current market cap of $18.7 billion, would result in a free cash flow multiple of 18.7, indicating a favorable valuation not seen in years.

- Large Deals Driving Growth: Management expects a significant increase in ARR starting in Q4 of fiscal 2026, primarily driven by large deals not yet reflected in ARR, with deferred ARR being about three times what it was entering the last fourth quarter, indicating strong future growth potential.

See More

- Slowing ARR Growth: PTC forecasts adjusted organic ARR growth of 7.5% to 9.5% for fiscal 2026, significantly lower than the previously predicted mid-teens growth, indicating weakness in key metrics that may affect investor confidence.

- AI Opportunities and Challenges: While the market fears AI could threaten PTC's business, CEO Neil Barua emphasizes that customers want AI embedded in existing systems, presenting PTC with an opportunity to integrate AI into its digital record systems, thereby enhancing product value.

- Future Cash Flow Expectations: Management expects to reach $1 billion in free cash flow by 2026, which, based on the current market cap of $18.7 billion, would result in a free cash flow multiple of 18.7, indicating an attractive valuation.

- Market Strategy Adjustment: PTC reorganized its go-to-market strategy in late 2024 to focus on large enterprise deals, with expectations of significant ARR growth in the fourth quarter of fiscal 2026, reflecting the company's potential in key industry verticals.

See More