Novo Nordisk, the Manufacturer of Ozempic, Encounters Board Restructuring

Mikael Dolsten Withdraws Candidacy: Novo Nordisk board director Mikael Dolsten will not seek election to the Board of Directors due to personal circumstances, and the Novo Nordisk Foundation will not propose a replacement candidate.

Board Overhaul and Shareholder Concerns: The Novo Nordisk Foundation aims to appoint its chair, Lars Rebien Sørensen, to lead the board amid a shareholder revolt, with mixed reactions from investors regarding governance and strategic direction.

Aggressive M&A Strategy: Novo Nordisk CEO Mike Doustdar is pursuing a more aggressive strategy in the obesity drug market, including a significant bid for Metsera Inc, signaling a shift towards rapid growth and competitiveness against Eli Lilly.

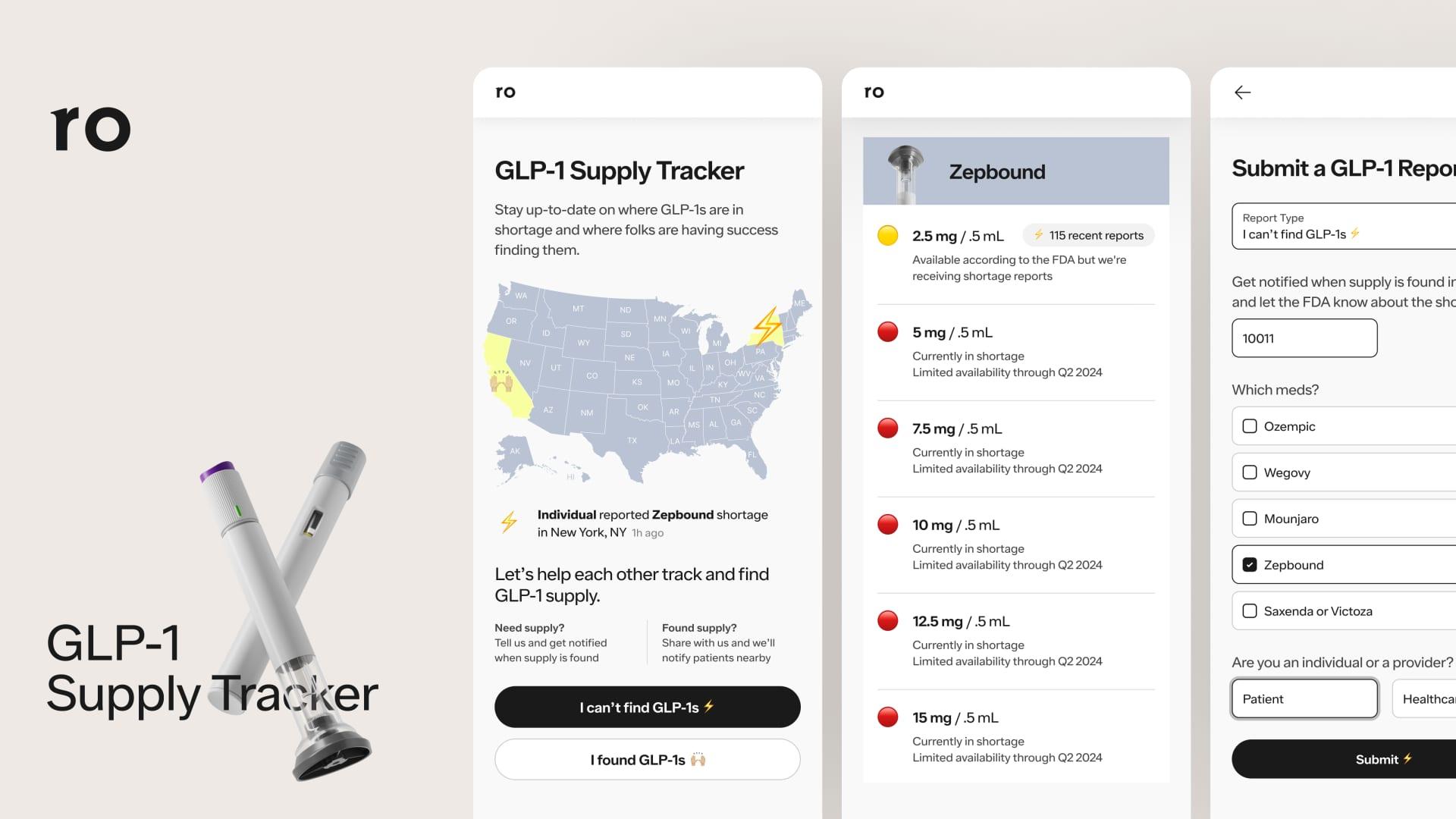

Drug Access Initiatives: Mangoceuticals launched programs providing direct access to GLP-1 medications, aligning with recent pricing agreements from the White House aimed at reducing costs for government programs and Medicare patients.

Trade with 70% Backtested Accuracy

Analyst Views on LLY

About LLY

About the author

- Platform Launch: Eli Lilly has introduced the Employer Connect platform, aimed at collaborating with independent program administrators to provide flexible obesity management medication solutions, thereby improving access for over 100 million American adults and potentially enhancing healthcare coverage for obesity patients significantly.

- Cost Reduction: The Zepbound® KwikPen® is priced at $449, and with flexible cost-sharing options, employers can offer more affordable obesity treatment to employees, which is expected to improve treatment adherence and overall health outcomes among the workforce.

- Clinical Trial Results: In the SURMOUNT-1 trial, adults taking Zepbound 15mg lost an average of 20.9% of their body weight over 72 weeks, compared to just 3.1% in the placebo group, demonstrating the drug's significant efficacy in obesity management, which could drive its widespread adoption in the market.

- Strong Market Demand: Zepbound was the most prescribed weight management medication in the U.S. in 2025, and with FDA approval, it is expected to further increase its market share in obesity treatment, addressing the growing patient demand effectively.

- Platform Launch: Eli Lilly's newly introduced Employer Connect platform aims to enhance access to obesity management treatments for employees, particularly as insurance coverage remains inconsistent for over 100 million American adults affected by obesity.

- Addressing Coverage Gaps: The platform connects employers to independent program administrators and cost-sharing solutions, enabling employees to access prescribed treatments at reduced out-of-pocket costs, thereby alleviating financial barriers for obesity patients.

- Partner Network: The platform launches with over 15 independent administrators and a nationwide pharmacy network, including Teladoc Health and GoodRx, ensuring that Lilly's obesity medication Zepbound KwikPen is available at a discounted price of $449 through network pharmacies.

- Drug Indications: Zepbound is approved for adults with obesity and overweight adults with at least one weight-related medical condition, as well as certain patients with obstructive sleep apnea, highlighting Lilly's strategic positioning in the obesity treatment market.

- Solution for Obesity: Eli Lilly's launch of the Employer Connect platform targets the approximately half of commercially insured American employees lacking access to obesity medications, addressing an economic burden exceeding $1.7 trillion annually due to obesity-related costs.

- Platform Partnerships: The platform collaborates with over 15 independent program administrators, including pharmacies like HealthDyne and CenterWell, ensuring nationwide drug availability and enhancing employee access to medications.

- Zepbound Pricing Strategy: Lilly's Zepbound KwikPen is priced at $449 across all doses, although final costs for employers and employees will vary based on the chosen administrator and cost-sharing model, potentially lowering out-of-pocket expenses for employees.

- Clinical Trial Demand Support: In the SURMOUNT-1 trial, adults using Zepbound lost an average of 20.9% of body weight over 72 weeks compared to just 3.1% for the placebo group, demonstrating the drug's effectiveness in obesity management and further driving market demand.

- Program Launch: Eli Lilly has introduced the 'Employer Connect' platform aimed at helping more employers cover obesity drugs, addressing a major barrier to patient access and expected to enhance employee drug accessibility.

- Price Transparency: Through this platform, employers can purchase a multi-dose form of Zepbound at a net discounted price of $449 per month, avoiding traditional rebate models, thereby providing clearer visibility on drug pricing for employers.

- Flexible Benefits Design: Employers can choose from 15 different third-party administrators to design benefits tailored to their budget and workforce needs, offering comprehensive obesity management services including telehealth, nutrition, and lifestyle support.

- Government Insurance Coverage: Under landmark deals with President Trump, Medicare will cover obesity drugs for the first time, which is expected to further expand drug accessibility and benefit more patients.

- Platform Launch: Eli Lilly has introduced the Employer Connect platform to collaborate with independent program administrators, providing flexible obesity management medication solutions aimed at helping over 100 million obese adults in the U.S., which is expected to significantly improve employee health and productivity.

- Cost Reduction: The Zepbound® KwikPen® is priced at $449, with cost-sharing options available through the Employer Connect platform, substantially lowering out-of-pocket expenses for employees and enhancing accessibility to obesity treatment while aligning with employer budgets.

- Expanded Coverage: The platform collaborates with over 15 independent program administrators, offering nationwide pharmacy support that allows employers to design personalized obesity management programs tailored to their needs, thereby increasing employer control and flexibility in employee health management.

- Significant Clinical Outcomes: In the SURMOUNT-1 trial, adults taking Zepbound 15mg lost an average of 20.9% of their body weight over 72 weeks, compared to just 3.1% in the placebo group, demonstrating the drug's strong efficacy in obesity management and further driving market demand.

- Eli Lilly's Growth Momentum: Eli Lilly has demonstrated revenue growth rates exceeding mid-double digits in recent quarters, significantly outperforming large pharmaceutical companies, showcasing its leadership in the anti-obesity drug market, with new drug launches expected to further solidify its market share.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, with the anticipated launch of the oral GLP-1 drug forglipron this year and additional approvals expected in the coming years, enhancing the diversity of its product pipeline.

- Veeva Systems' Market Opportunity: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, with a goal to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, reflecting its strong competitive position in a rapidly growing market.

- Growth Potential in Cloud Market: Veeva Systems estimates an addressable market of $20 billion, significantly higher than its trailing 12-month revenue of $3.1 billion, indicating substantial growth opportunities ahead, prompting investors to consider buying at current low levels.