Monolithic Power Systems Q4 2025 Earnings Call Highlights

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy MPWR?

Source: seekingalpha

- Strong Financial Performance: In 2025, Monolithic Power Systems achieved full-year revenue of $2.8 billion, reflecting a 26.4% increase, with Q4 revenue hitting a record $751.2 million, representing a 1.9% sequential rise and a 20.8% year-over-year growth, indicating robust market performance and sustained growth potential.

- Increased Shareholder Returns: The company announced a 28% increase in its quarterly dividend to $2 per share, with over 72% of free cash flow returned to shareholders through buybacks and dividends over the past three years, underscoring its commitment to shareholders and financial health.

- Optimistic Market Outlook: Management raised the growth outlook for Enterprise Data from a range of 30%-40% to a floor of 50%, expecting to maintain strong trends in enterprise data, communications, and automotive sectors into 2026, reflecting confidence in future market demand.

- Ongoing Product Innovation: The company launched new solutions for 48-volt and zonal architectures in the automotive sector and began sampling its 800-volt power solutions, further solidifying its competitive edge across diversified markets.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy MPWR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on MPWR

Wall Street analysts forecast MPWR stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for MPWR is 1200 USD with a low forecast of 950.00 USD and a high forecast of 1375 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

11 Analyst Rating

9 Buy

2 Hold

0 Sell

Strong Buy

Current: 1136.830

Low

950.00

Averages

1200

High

1375

Current: 1136.830

Low

950.00

Averages

1200

High

1375

About MPWR

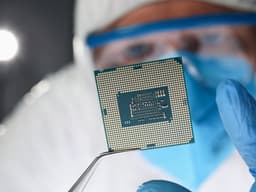

Monolithic Power Systems, Inc. is a fabless company, which provides semiconductor-based power electronic solutions. The Company design and develop its products for the enterprise data, storage and computing, automotive, communications, consumer, and industrial end markets. Direct Current (DC) to DC, Alternating Current (AC) to DC, driver metal-oxide-semiconductor field-effect transistor, power management integrated circuit (IC), current limit switch and lighting control products. Its DC to DC ICs are used to convert and control voltages within a range of electronic systems, such as cloud-based central processing unit (CPU) servers, server artificial intelligence (AI) applications, storage applications, commercial notebooks, digital cockpit, power sources, home appliances, fourth generation (4G) and fifth generation (5G) infrastructure and satellite communications applications. The Company have sales offices in various locations in Asia, Europe and the United States.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Strong Financial Performance: In 2025, Monolithic Power Systems achieved full-year revenue of $2.8 billion, reflecting a 26.4% increase, with Q4 revenue hitting a record $751.2 million, representing a 1.9% sequential rise and a 20.8% year-over-year growth, indicating robust market performance and sustained growth potential.

- Increased Shareholder Returns: The company announced a 28% increase in its quarterly dividend to $2 per share, with over 72% of free cash flow returned to shareholders through buybacks and dividends over the past three years, underscoring its commitment to shareholders and financial health.

- Optimistic Market Outlook: Management raised the growth outlook for Enterprise Data from a range of 30%-40% to a floor of 50%, expecting to maintain strong trends in enterprise data, communications, and automotive sectors into 2026, reflecting confidence in future market demand.

- Ongoing Product Innovation: The company launched new solutions for 48-volt and zonal architectures in the automotive sector and began sampling its 800-volt power solutions, further solidifying its competitive edge across diversified markets.

See More

- Market Volatility: Futures markets pared losses after the stock market broke key levels, indicating investor concerns about future economic prospects, which could lead to short-term market instability.

- Amazon's Capital Spending: Amazon's stock fell due to significant capital expenditures, reflecting the company's aggressive strategy in expansion and infrastructure investment, which may impact its short-term profitability.

- Bitcoin Bounce: Despite overall market pressure, Bitcoin saw a slight bounce, indicating a demand for digital assets as a safe haven in uncertain market conditions, potentially attracting more investor interest.

- Investor Sentiment: The market's strong reaction to Amazon's spending may lead investors to reassess the risk and return of tech stocks, influencing overall investment strategies.

See More

- Market Decline: The stock market experienced a significant sell-off on Thursday, with major indices declining broadly, reflecting investor concerns about the economic outlook amid high inflation and rising interest rates, which have dampened market confidence.

- Bitcoin Crash: Bitcoin prices fell sharply, driven by a bearish market sentiment as investors rushed to sell off crypto assets, likely due to concerns over increased regulation in the crypto market and a general rise in risk aversion.

- Amazon Earnings Miss: Amazon's stock price dropped following its earnings report, primarily due to concerns over its massive capital spending plans, which raised investor apprehensions about future profitability, highlighting the tension between expansion and earnings.

- Capital Expenditure Impact: While Amazon's capital expenditure plans aim to drive long-term growth, they may negatively affect cash flow and shareholder returns in the short term, leading to lowered market expectations for its future performance.

See More

- Market Decline: The stock market experienced a significant sell-off on Thursday, with major indices declining broadly, reflecting investor concerns about the economic outlook, which may dampen market confidence and influence short-term investment decisions.

- Bitcoin Crash: Bitcoin prices fell sharply, contributing to a gloomy market sentiment, as investor confidence in cryptocurrencies wanes, potentially leading to further capital outflows from this asset class and affecting the stock performance of related companies.

- Amazon's Disappointing Earnings: Amazon's stock dropped following its earnings report, primarily due to concerns over its massive capital spending plans, which may prompt a reassessment of its long-term growth potential by the market.

- Impact of Capital Expenditure: While Amazon's capital expenditure plans aim to expand its business, they may exert pressure on cash flow in the short term, thereby affecting its stock performance and investor confidence.

See More

- Stock Purchase Overview: On January 5, 2026, Mullin disclosed purchases of 10 stocks, each ranging from $15,000 to $50,000, indicating his ongoing interest in small and mid-cap stocks, with most having market capitalizations below $20 billion.

- Small-Cap Characteristics: Notably, two of these stocks have market caps under $5 billion, reinforcing Mullin's preference for smaller stocks, which could influence his decisions on the Armed Services Committee, particularly regarding future government contracts.

- Historical Trade Review: Prior to this, on December 29, 2025, Mullin bought six of the Magnificent Seven stocks, investing at least $50,000, highlighting his preference for tech stocks, with Microsoft Corp (MSFT) being the largest investment.

- Potential Conflict of Interest: Given Mullin's role on the Armed Services Committee, Benzinga will closely monitor his future stock trades, especially concerning potential conflicts arising from military actions in countries like Venezuela.

See More

- Earnings Highlights: Monolithic Power Systems (MPWR) reported a Q4 non-GAAP EPS of $4.79, beating expectations by $0.05, with revenue of $751.2 million reflecting a 20.8% year-over-year increase, surpassing market expectations by $9.51 million, indicating robust financial performance.

- Future Guidance: The company anticipates Q1 2026 revenue between $770 million and $790 million, exceeding the consensus estimate of $738.38 million, demonstrating confidence in future growth prospects.

- Margin Expectations: GAAP gross margin is projected to be between 54.9% and 55.5%, while non-GAAP gross margin is expected to range from 55.2% to 55.8%, reflecting efforts to control costs and enhance profitability.

- Shareholder Returns: The company aims for a non-GAAP tax rate of 15.0% for 2026, with fully diluted shares outstanding expected to be between 49.0 million and 49.4 million, and an 8% increase in share price, showcasing market optimism regarding its future performance.

See More