Lucid Group Faces Deepening Financial Crisis

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy LCID?

Source: Fool

- Weak Revenue Growth: Lucid Group reported $337 million in revenue for Q3 2025, a 68.5% increase from Q3 2024, but new vehicle deliveries only rose by 47% year-over-year, indicating insufficient market demand to sustain growth.

- Cash Flow Crisis: The company burned through nearly half of its cash reserves in 2025, starting the year with over $5 billion and dropping to $2.9 billion by September 30, coupled with $2.8 billion in debt, raising concerns about future operations.

- Out-of-Control Costs: Despite a $136 million revenue increase, costs surged by $257.7 million, leading to only a slight reduction in net losses from $992.5 million in Q3 2024 to $978.4 million in Q3 2025, highlighting ongoing profitability issues.

- Competitive Market Pressure: Lucid's Gravity SUV is priced higher than the Tesla Model Y, and the lack of a competitor to the Model 3 diminishes its appeal to price-sensitive consumers, resulting in a bleak outlook for future sales.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LCID?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LCID

Wall Street analysts forecast LCID stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for LCID is 16.73 USD with a low forecast of 10.00 USD and a high forecast of 30.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

12 Analyst Rating

1 Buy

8 Hold

3 Sell

Hold

Current: 10.290

Low

10.00

Averages

16.73

High

30.00

Current: 10.290

Low

10.00

Averages

16.73

High

30.00

About LCID

Lucid Group, Inc. is a technology company, which designs, engineers, and manufactures electric vehicles (EVs), EV powertrains, and battery systems in-house using its own equipment and factories. It sells vehicles directly to consumers through its retail sales network and through direct online sales. Its vehicles include Lucid Air and Lucid Gravity. Lucid Air is an advanced car, featuring powertrain technology. It offers 420 miles of the United States Environmental Protection Agency (EPA)-estimated range, with an 84-kWh battery pack. The Lucid Air Sapphire is the highest-performance version of the Lucid Air, boasting 1,234 horsepower from three motors, 427 miles of an EPA-estimated range (when equipped with standard wheel covers). The Lucid Gravity provides the interior space and practicality of a full-size SUV within the exterior footprint of a mid-size SUV. It provides space for up to seven adults. It has engineered the Lucid Gravity to deliver up to 450 miles of EPA-estimated range.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Winter Test Victory: The Lucid Air Grand Touring achieved a remarkable 520 kilometers in the 2026 Norges Automobil-Forbund Winter Test, outperforming its closest competitor by nearly 100 kilometers, reinforcing its technological leadership even in extreme conditions and showcasing its strong performance in the EV market.

- Investor Day Scheduled: Lucid has confirmed an Investor Day on March 12, where it will provide a comprehensive update on its strategic roadmap, including the upcoming midsize vehicle program and software advancements, aimed at improving financial performance and previewing next-generation vehicle architecture, indicating future growth potential.

- Stock Price Analysis: Lucid shares are currently priced at $10.78, trading 4.83% below the 20-day simple moving average, indicating a bearish trend, with a 62.09% decline over the past 12 months, positioning the stock closer to its 52-week lows, reflecting market concerns about its future performance.

- Earnings Expectations: Lucid is expected to release its earnings report on February 24, with an estimated EPS of -$2.57 and revenue of $468.45 million, showing significant year-over-year growth, although the overall hold rating and price target of $25.70 suggest a cautious market outlook regarding its future.

See More

- Weak Revenue Growth: Lucid Group reported $337 million in revenue for Q3 2025, a 68.5% increase from Q3 2024, but new vehicle deliveries only rose by 47% year-over-year, indicating insufficient market demand to sustain growth.

- Cash Flow Crisis: The company burned through nearly half of its cash reserves in 2025, starting the year with over $5 billion and dropping to $2.9 billion by September 30, coupled with $2.8 billion in debt, raising concerns about future operations.

- Out-of-Control Costs: Despite a $136 million revenue increase, costs surged by $257.7 million, leading to only a slight reduction in net losses from $992.5 million in Q3 2024 to $978.4 million in Q3 2025, highlighting ongoing profitability issues.

- Competitive Market Pressure: Lucid's Gravity SUV is priced higher than the Tesla Model Y, and the lack of a competitor to the Model 3 diminishes its appeal to price-sensitive consumers, resulting in a bleak outlook for future sales.

See More

- Weak Revenue Growth: In Q3 2025, Lucid Group reported revenue of $337 million, a 68.5% increase year-over-year; however, rising costs of $257.7 million offset this growth, indicating ongoing deterioration in profitability.

- Cash Flow Crisis: As of September 30, 2025, Lucid's cash reserves plummeted from over $5 billion at the start of the year to $2.9 billion, nearly halving, while total debt reached $2.8 billion, highlighting severe liquidity risks.

- Deepening Losses: Although Lucid's net loss decreased from $992.5 million in Q3 2024 to $978.4 million in Q3 2025, its free cash flow losses worsened from -$622.5 million to -$955.5 million, demonstrating the company's inability to control costs effectively.

- Competitive Market Pressure: Lucid's Gravity SUV is priced higher than Tesla's Model Y, and while the Air is cheaper than the Model S, it lacks a competitor to the Model 3, leading to decreased consumer interest and exacerbating sales challenges.

See More

- Attraction of Shorted Stocks: Investors maintain high short interest in overvalued stocks, indicating significant perceived risks such as poor earnings or industry headwinds that could drive prices down, impacting market sentiment and investment strategies.

- Bear vs. Bull Dynamics: Short sellers meticulously identify companies they view as ticking time bombs, while retail traders see high short interest as a potential springboard for price rebounds, where rising stock prices can trigger short squeezes, affecting market liquidity.

- Understanding Short Squeeze Mechanics: A short squeeze creates a volatile feedback loop initiated by unexpected price increases, forcing short sellers to buy back shares to cover positions, which spikes demand and further elevates prices, trapping more short sellers and potentially leading to outsized returns.

- Current Market Landscape: As of February 2, the most shorted stocks include those with market caps above $2 billion and free floats exceeding 5 million shares, ranked by short interest, highlighting the market's focus on these stocks and their associated risks.

See More

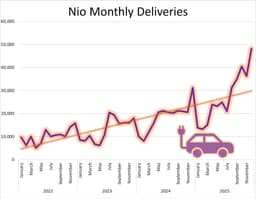

- Delivery Growth Momentum: Nio set a new delivery record in December with a 54.6% year-over-year increase to 48,135 vehicles, and a 71.7% year-over-year growth in Q4 to 124,807 vehicles, indicating strong market demand and brand influence.

- Profitability Improvement: Nio's vehicle margins and gross profits significantly increased in Q3, suggesting that the company is enhancing its profitability alongside rapid growth, with a target to achieve breakeven in 2026, which would be a significant milestone for the EV industry.

- Lucid's Production Acceleration: Lucid produced 8,412 vehicles in Q4, a 116% increase year-over-year, delivering 5,345 vehicles, up 31% from the previous year, marking eight consecutive quarters of record deliveries, indicating a gradual recovery in production capacity.

- Market Outlook Comparison: While both Nio and Lucid show strong delivery performance, Lucid faces cash flow pressures and widening EBITDA losses, whereas Nio's net losses are narrowing, prompting investors to be cautious in their investment choices.

See More

- Significant Delivery Growth: Nio set a new delivery record in December with a 54.6% year-over-year increase to 48,135 vehicles, and a 71.7% increase in Q4 deliveries to 124,807 vehicles, indicating strong market demand and brand influence.

- Improved Profitability: Nio's vehicle margins and gross profits saw a significant rise in Q3, indicating that the company is enhancing its profitability alongside rapid growth, with a target to achieve breakeven in 2026, which is crucial for the entire EV industry.

- Lucid Production Acceleration: Lucid produced 8,412 vehicles in Q4, a 116% year-over-year increase, and delivered 5,345 vehicles, a 31% increase, marking eight consecutive quarters of record deliveries, demonstrating its gradual overcoming of supply chain bottlenecks for the new Gravity SUV.

- Market Outlook Comparison: While both Nio and Lucid show strong delivery performance, Lucid faces cash flow issues and widening adjusted EBITDA losses, whereas Nio's net losses are narrowing, highlighting significant differences in market performance and financial health between the two companies.

See More