Investment Opportunities in AI Computing Sector

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 2h ago

0mins

Source: NASDAQ.COM

- TSMC's Market Dominance: As the world's largest chip foundry, TSMC anticipates AI chip revenue to grow at nearly a 60% CAGR from 2024 to 2029, showcasing strong market demand and technological superiority, further solidifying its leadership in the AI computing sector.

- Nvidia's Growth Potential: Nvidia is projected to achieve a 52% revenue growth in FY 2027, driven by global data center capital expenditures expected to reach $3 trillion to $4 trillion by 2030, indicating robust demand and sustained growth in the AI hardware market.

- Broadcom's Innovative Strategy: By partnering with AI hyperscalers to design application-specific integrated circuits (ASICs), Broadcom expects its AI semiconductor revenue to double in Q1 2026, demonstrating rapid growth and market adaptability in the AI computing space.

- Diversity in Investment Recommendations: While TSMC is seen as a key player in AI investments, it was not included in the analyst team's list of the 10 best stocks, suggesting investors should also consider other high-return opportunities, reflecting market diversity and uncertainty.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TSM?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TSM

Wall Street analysts forecast TSM stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for TSM is 313.46 USD with a low forecast of 63.24 USD and a high forecast of 390.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

8 Analyst Rating

7 Buy

1 Hold

0 Sell

Strong Buy

Current: 339.550

Low

63.24

Averages

313.46

High

390.00

Current: 339.550

Low

63.24

Averages

313.46

High

390.00

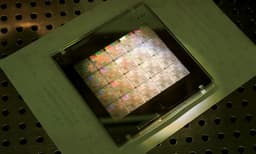

About TSM

Taiwan Semiconductor Manufacturing Co Ltd is a Taiwan-based integrated circuit foundry service provider. The Company is primarily engaged in integrated circuit manufacturing services. It offers advanced process technologies, specialised process solutions, advanced photomask and silicon stacking, and packaging-related technologies, while supporting a comprehensive design ecosystem. The Company's products serve diverse electronic sectors including artificial intelligence, high-performance computing, wired and wireless communications, automotive and industrial equipment, personal computing, information applications, consumer electronics, smart internet of things, and wearable devices.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

AI Growth Forecast Positions TSMC as a Key Player

- Market Forecast: Renowned investor Cathie Wood's Ark Invest predicts that AI data center spending will triple from $500 billion to $1.4 trillion by 2030, creating substantial market opportunities for companies like TSMC.

- Technological Edge: TSMC, as a leading chip manufacturer, maintains close relationships with top AI chip designers like Nvidia and Broadcom, ensuring a dual advantage in both GPU and AI ASIC markets, positioning itself favorably in the rapidly growing AI sector.

- Enhanced Pricing Power: With a near monopoly in advanced chip manufacturing, TSMC has laid out a four-year price hike schedule for customers, which not only boosts its gross margin but also strengthens its pricing power, further solidifying its market leadership.

- Increased Capital Expenditure: TSMC plans to raise its capital expenditure budget from $41 billion in 2025 to between $52 billion and $56 billion, reflecting strong confidence in AI revenue growth at a mid- to high-50% compound annual growth rate (CAGR), indicating an optimistic outlook on long-term market trends.

Continue Reading

2026 Investment Opportunities: Semiconductors and Ad Platforms

- TSMC Earnings Outlook: Taiwan Semiconductor Manufacturing (TSM) reported outstanding Q4 2025 earnings, with management forecasting nearly 30% revenue growth in 2026 and a projected 60% compound annual growth rate for AI chip revenue from 2024 to 2029, highlighting its pivotal role in the AI infrastructure spending boom.

- Ad Platform Recovery Potential: The Trade Desk (TTD) has seen its stock price plummet 75% from its all-time high; however, it still achieved an 18% revenue growth in Q3, with Wall Street analysts expecting a 16% growth in 2026, indicating strong market demand, and its current price represents a bargain at 15 times expected forward earnings.

- Nebius Growth Prospects: Nebius (NBIS), a lesser-known company, focuses on data centers and cutting-edge GPU applications, with management forecasting a revenue surge from $551 million to between $7 billion and $9 billion by 2026, positioning it as one of the most attractive growth stocks in the market right now.

- Market Investment Timing: As the earnings season for 2026 approaches, investors should pay attention to these companies' performances, particularly in the AI and advertising technology sectors, which are expected to yield substantial returns for investors in the coming years.

Continue Reading