HYT Fund Yields 10.6%, Hedging Against AI Bubble Risks

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 15 2026

0mins

Should l Buy GOOGL?

Source: NASDAQ.COM

- Stable Bond Market: According to Coatue Management, the growth in debt issuances for the tech, media, and telecom sectors from 2023 to 2025 is only 0%, 3%, and 9%, indicating that fears of an AI bubble may be overstated, thus providing investors with relatively safe bond investment opportunities.

- Strong HYT Performance: The BlackRock Corporate High Yield Fund (HYT) currently yields 10.6% and has raised its payouts by approximately 11% over the past decade, outperforming the SPDR Bloomberg High Yield Bond ETF (JNK), highlighting its attractiveness in the current market.

- Market Opportunity Emerges: HYT's discount to net asset value has dropped to levels not seen since 2022 and 2023, indicating a potential for price recovery in the short term, allowing investors to capitalize on this value investment opportunity.

- Fading AI Bubble Concerns: As fears of an AI bubble diminish, the reduced demand for corporate bonds has made funds like HYT relatively cheap, enabling investors to position themselves ahead of future market volatility that could drive demand for these bonds.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GOOGL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GOOGL

Wall Street analysts forecast GOOGL stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for GOOGL is 338.25 USD with a low forecast of 279.00 USD and a high forecast of 390.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

34 Analyst Rating

27 Buy

7 Hold

0 Sell

Strong Buy

Current: 322.860

Low

279.00

Averages

338.25

High

390.00

Current: 322.860

Low

279.00

Averages

338.25

High

390.00

About GOOGL

Alphabet Inc. is a holding company. The Company's segments include Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment includes infrastructure and platform services, collaboration tools, and other services for enterprise customers. Its Other Bets segment is engaged in the sale of healthcare-related services and Internet services. Its Google Cloud provides enterprise-ready cloud services, including Google Cloud Platform and Google Workspace. Google Cloud Platform provides access to solutions such as artificial intelligence (AI) offerings, including its AI infrastructure, Vertex AI platform, and Gemini for Google Cloud; cybersecurity, and data and analytics. Google Workspace includes cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Micron's Remarkable Growth: Micron Technology's stock surged 317% over the past year, with a modest dividend yield of 0.12%, yet its $42.3 billion revenue and improving fundamentals make it a focal point for investors, especially as it plays a crucial role in the AI revolution's data center buildout.

- Alphabet's Strong Performance: Alphabet's revenue rose 15% in 2025, marking its largest increase in four years, with a net income margin reaching 33%; despite a 0.3% dividend yield, the 69% stock price increase underscores its robust market performance and competitiveness in the AI sector.

- Alibaba's Potential: Alibaba leads with a 0.65% dividend yield among these stocks, and while its earnings multiple is high, its position as an e-commerce giant in China and potential AI chip supplier could enhance its appeal, especially amid ongoing U.S.-China trade restrictions.

- Investor Confidence: Despite the lackluster dividend performance of these three companies, their capital appreciation potential and market leadership position them as attractive investment opportunities, particularly against the backdrop of rapid advancements in technology and AI.

See More

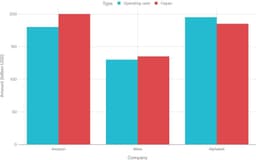

- Funding Shortages: Amazon expects to generate about $180 billion in operating cash this year against a capital spending plan of $200 billion, resulting in a $20 billion shortfall, marking the company's first entry into deficit territory which could impact future investment capabilities.

- Meta's Cash Flow Crisis: Meta anticipates operating cash flow of approximately $130 billion, while its capital spending guidance peaks at $135 billion, indicating significant financial pressure in building AI systems that may lead to depletion of cash reserves.

- Increased Debt Financing: Oracle raised $25 billion in bonds to support a $300 billion infrastructure deal with OpenAI, while Meta raised $30 billion last year, with tech companies expected to issue $337 billion in investment-grade bonds this year, reflecting the industry's urgent need for funding.

- Infrastructure Investment Risks: Big Tech firms are heavily investing in data centers and power facilities, yet the irreversibility of these infrastructures poses substantial financial risks, especially if AI demand does not grow as anticipated, potentially leading to massive depreciation and debt burdens.

See More

- Funding Initiative: Alphabet announced its intention to raise funds through the bond market to support its artificial intelligence expansion, with Bloomberg reporting an expected raise of approximately $15 billion, which will provide essential capital for future tech investments.

- Increased Capital Expenditure: The company plans to allocate between $175 billion and $185 billion for capital spending in 2026, demonstrating a strong commitment to AI investments aimed at enhancing its overall technological competitiveness.

- Market Reaction: Alphabet's shares dipped slightly in premarket trading, reflecting investor concerns over the high capital expenditure plans, which may impact shareholder confidence in the short term.

- Industry Impact: As Alphabet ramps up its AI investments, it is expected to have a profound effect on the entire industry, particularly in its competition with rivals like Nvidia, potentially reshaping the market landscape.

See More

- Market Surge: The Dow Jones Industrial Average surged over 1,200 points on Friday, surpassing the 50,000 mark for the first time, closing the week up 2.5%, indicating a strong recovery in market sentiment despite earlier tech stock sell-offs.

- Bitcoin Rebound: Bitcoin rebounded above $70,000 on Friday, recovering from a sharp drop that nearly brought it below $60,000, reflecting a renewed confidence in the cryptocurrency market, although it remains over 50% off its all-time high.

- Super Bowl Advertising Boom: During the Super Bowl, NBC's average price for a 30-second ad reached $8 million, with some slots exceeding $10 million, highlighting strong demand in the advertising market, particularly from AI companies.

- Legal Battle Between Hims and Novo: Novo Nordisk is suing Hims & Hers over alleged copycat versions of its Wegovy obesity drug, leading Hims to announce the withdrawal of its product, which caused its shares to drop over 20% before the market opened.

See More

- User Growth Resurgence: OpenAI CEO Sam Altman revealed in an internal message that ChatGPT's monthly growth rate has exceeded 10%, indicating a recovery in user demand that is expected to further drive the company's market share and revenue growth.

- New Model Launch: Altman stated that OpenAI plans to launch an updated ChatGPT model this week, which will enhance its product competitiveness, especially in the face of pressure from rivals like Anthropic.

- Strong Codex Performance: OpenAI's coding product Codex grew approximately 50% over the past week, demonstrating increased market acceptance and potentially eroding market share from competitors like Claude Code.

- Ad Testing Initiation: OpenAI will begin testing ads within ChatGPT on Monday; although ad revenue is expected to account for less than half of total revenue in the long term, this initiative could provide new revenue streams and enhance the company's financial stability.

See More

- Market Surge: The Dow Jones Industrial Average soared over 1,200 points on Friday, surpassing the 50,000 mark for the first time, closing the week up 2.5%, indicating strong investor confidence despite a slight dip in futures trading this morning.

- Super Bowl Advertising Boom: NBC's 30-second ad spots averaged $8 million, with some exceeding $10 million, showcasing fierce competition in the advertising market as AI companies heavily invested in the event, highlighting the importance of brand visibility.

- Legal Action Intensifies: Novo Nordisk is suing Hims & Hers over its copycat weight-loss pills, leading Hims to announce the withdrawal of its product, resulting in a pre-market stock drop of over 20%, reflecting market sensitivity to legal risks.

- Meta Faces Major Trials: Meta is set to face two significant lawsuits in New Mexico and Los Angeles regarding the protection of child users and the mental health impacts on young users, which could have profound implications for its business and the social media industry.

See More