Eupraxia Pharmaceuticals Completes $80.5 Million Public Offering with Full Underwriter Option Exercised

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Sep 24 2025

0mins

Should l Buy EPRX?

Source: Newsfilter

Successful Public Offering: Eupraxia Pharmaceuticals closed a public offering of 14,636,363 common shares at $5.50 each, raising approximately $80.5 million to support the development of its drug EP-104GI and other clinical initiatives.

Use of Proceeds: The funds will primarily be used for advancing the product pipeline, including clinical trials, regulatory submissions, and expanding the company's intellectual property portfolio, with a focus on addressing significant unmet medical needs.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy EPRX?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on EPRX

Wall Street analysts forecast EPRX stock price to rise

4 Analyst Rating

4 Buy

0 Hold

0 Sell

Strong Buy

Current: 8.050

Low

11.02

Averages

13.02

High

16.03

Current: 8.050

Low

11.02

Averages

13.02

High

16.03

About EPRX

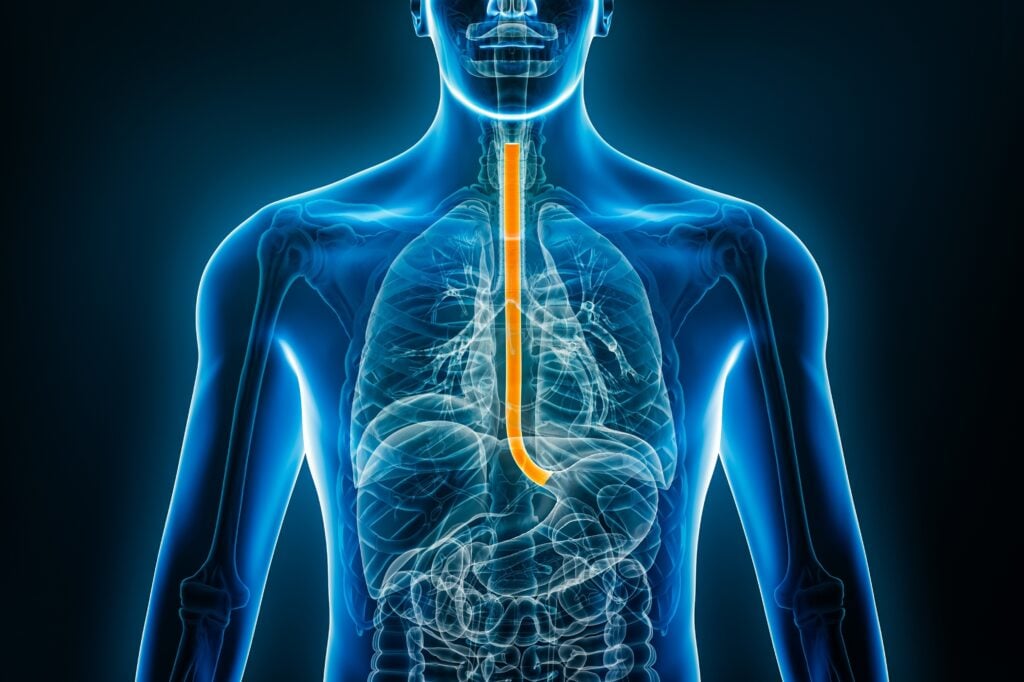

Eupraxia Pharmaceuticals Inc. is a clinical-stage biotechnology company. The Company is focused on the development of locally delivered, extended-release products that have the potential to address therapeutic areas with high unmet medical need. DiffuSphere, a proprietary, polymer-based micro-sphere technology, is designed to facilitate targeted drug delivery of both existing and novel drugs. The Company’s EP-104GI is in a Phase Ib/IIa trial, the RESOLVE trial, for the treatment of eosinophilic esophagitis (EoE). EP-104GI is administered as an injection into the esophageal wall, providing local delivery of drug. The Company also completed a Phase IIb clinical trial (SPRINGBOARD) of EP-104IAR for the treatment of pain due to knee osteoarthritis. In addition, the Company is developing a pipeline of later and earlier-stage long-acting formulations. Its potential pipeline indications include candidates for other inflammatory joint indications and oncology.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Successful Financing: Eupraxia Pharmaceuticals has successfully closed a public offering of 7.6 million common shares, raising approximately $63.2 million, which will significantly enhance its research capabilities for EP-104GI targeting eosinophilic esophagitis and facilitate the achievement of multiple development milestones.

- Clear Use of Proceeds: The company intends to allocate the funds primarily towards clinical trials for EP-104GI, including ongoing Phase 2 trials and preparations for a Phase 3 trial, thereby accelerating the product's market readiness to meet demand.

- Market Expansion Plans: Eupraxia will also use a portion of the proceeds to expedite clinical studies in additional gastrointestinal indications, such as esophageal strictures and fibrostenotic Crohn's disease, further broadening its product pipeline and enhancing market competitiveness.

- Strategic Investment: This fundraising not only supports the advancement of existing projects but also funds the development of new pipeline candidates and strengthens corporate infrastructure, ensuring sustainable growth and demonstrating the company's long-term commitment to the biotechnology sector.

See More

- Offering Pricing: Eupraxia Pharmaceuticals has priced its public offering at $7.00 per share for 6.43 million common shares and 1.43 million pre-funded warrants, aiming for gross proceeds of approximately $55 million before expenses, indicating the company's ability to raise capital in the market.

- Market Reaction: Following the announcement of the public offering, Eupraxia's shares fell by 9.3% to $7.40 in premarket trading, reflecting a negative market response and investor concerns regarding the company's future prospects.

- Underwriter Team: Cantor and LifeSci Capital are acting as joint book-running managers for the offering, with Bloom Burton and Craig-Hallum serving as co-managers, demonstrating the support from multiple parties in the financing process.

- Use of Proceeds: The funds raised from this offering are intended to support Eupraxia's research and development as well as operational needs, aiming to advance its product pipeline, although the negative market reaction highlights the challenges the company faces in executing its long-term growth strategy.

See More

- Offering Size: Eupraxia Pharmaceuticals has priced a public offering at $55 million, expected to close around February 20, 2026, with proceeds aimed at advancing key programs and expanding its proprietary Diffusphere technology.

- Program Development: The company plans to utilize the funds to advance its lead programs, including EP-104GI, currently in Phase 1b/2 RESOLVE trial, with topline data from the Phase 2b expected in Q3 2026.

- Financial Position: As of September 30, 2025, Eupraxia reported $89 million in cash, and with the new offering, it projects a funding runway into the first half of 2028, supporting multiple late-stage programs and pipeline expansion.

- Stock Performance: EPRX has traded between $2.68 and $9.32 over the past year, closing at $8.16, down 0.85%, and showing a pre-market decline of over 9% to $7.40, indicating cautious market sentiment regarding the offering.

See More

- Offering Size: Eupraxia Pharmaceuticals announced the pricing of 6,428,574 common shares at $7.00 each, expecting gross proceeds of approximately $55 million, indicating strong market demand and investor confidence in the company.

- Pre-Funded Warrant Structure: The company is also offering pre-funded warrants to purchase 1,428,571 common shares at $6.99999, enhancing investor participation and providing flexible financing options for the company.

- Use of Proceeds: The funds will primarily support the advancement of EP-104GI for Eosinophilic Esophagitis, including ongoing preclinical studies and Phase 2 trials, demonstrating the company's commitment to drug development.

- Market Expansion Strategy: Eupraxia plans to use part of the proceeds to accelerate clinical studies in multiple gastrointestinal indications, showcasing its innovative potential and strategic intent for market expansion in the biotechnology sector.

See More

- Public Offering Announcement: Eupraxia Pharmaceuticals filed a preliminary prospectus supplement on Wednesday for a proposed public offering of common shares or pre-funded warrants, with underwriters expected to receive a 30-day option to purchase up to 15% of the offered securities.

- Clear Use of Proceeds: The proceeds from this offering are primarily intended to advance EP-104GI for Eosinophilic Esophagitis, including ongoing preclinical studies and Phase 2 trials, as well as preparations for a Phase 3 trial, indicating the company's commitment to product development.

- Market Reaction: Following the announcement, EPRX's stock price fell by 1.96% in after-hours trading to $8.0, reflecting a cautious market sentiment regarding the offering, which may impact investor confidence.

- Future Growth Potential: Although the size and pricing of the offering have yet to be determined, Eupraxia's strategic investment is expected to support its long-term growth in the biopharmaceutical sector, particularly in the market for Eosinophilic Esophagitis treatments.

See More

- Significant Efficacy: In the RESOLVE trial, patients receiving the highest dose (8 mg/site) showed nearly complete normalization of esophageal tissue at 12 weeks, indicating the drug's potential in treating eosinophilic esophagitis (EoE).

- Improved Remission Rates: At 12 weeks (n=19), 58% of patients achieved clinical remission, while 79% maintained remission at 24 weeks (n=14), demonstrating the sustained effectiveness of the treatment.

- Good Safety Profile: To date, over 200 patient-months of follow-up have been reported in 31 patients, with no serious adverse events or cases of oral candidiasis, indicating that EP-104GI is well tolerated at all dose levels.

- Long-term Tracking Data: At 52 weeks (n=6), 67% of patients maintained clinical remission, further validating the drug's long-term efficacy and safety, which may lay the groundwork for future market promotion.

See More