Daqo New Energy Corp. to Hold Annual General Meeting on December 12, 2025

Annual General Meeting Announcement: Daqo New Energy Corp. will hold its annual general meeting on December 12, 2025, at its Shanghai office, with eligible shareholders invited to attend.

Eligibility for Attendance: Shareholders of record as of November 28, 2025, will be entitled to attend the AGM in person, and they can request a hard copy of the annual report.

Company Overview: Daqo New Energy Corp. is a leading manufacturer of high-purity polysilicon for the solar PV industry, with a nameplate capacity of 305,000 metric tons and recognized as one of the lowest cost producers.

Contact Information: Shareholders can obtain more information or request documents through the company's website or by contacting the Investor Relations Department directly.

Trade with 70% Backtested Accuracy

Analyst Views on DQ

About DQ

About the author

- Earnings Release Schedule: Daqo New Energy plans to release its unaudited financial results for the fiscal year 2025 before U.S. markets open on February 26, 2026, demonstrating the company's commitment to transparency and aiming to bolster investor confidence.

- Conference Call Timing: The company has scheduled a conference call for 8:00 AM U.S. Eastern Time on February 26, 2026, which is expected to attract analysts and investors, further enhancing market focus on its performance.

- Dial-in Information: The dial-in details for the conference call have been provided, including U.S. and international numbers, ensuring global investors can easily participate, reflecting the company's emphasis on its international investor base.

- Replay Availability: A replay of the call will be available one hour after the conclusion of the conference, through March 5, 2026, enhancing information accessibility and allowing investors who could not attend live to stay informed about company developments.

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several companies, reflecting varying market perspectives that could influence investor decisions and market trends.

- Overview of Updates: The rating changes include upgrades, downgrades, and new initiations, showcasing analysts' keen responses to market dynamics, which may lead to short-term volatility in the affected stocks.

- Investor Considerations: Investors considering purchasing VERX stock should pay attention to the latest insights from analysts to make more informed investment decisions, especially amid increasing market uncertainties.

- Market Impact Analysis: The adjustments in analysts' ratings not only affect the performance of individual stocks but may also influence overall market sentiment, prompting investors to closely monitor these changes to seize investment opportunities.

- Net Loss Estimate: Daqo's subsidiary Xinjiang Daqo estimates a net loss of RMB 1.0 to 1.3 billion for FY2025, an improvement from the RMB 2.7 billion loss in FY2024, indicating gradual recovery amidst challenges.

- Shareholder Impact: The estimated net loss will directly affect approximately 72.8% of Daqo's equity interest in Xinjiang Daqo, highlighting ongoing concerns regarding the potential threat to the company's overall financial health despite the reduction in losses.

- Financial Reporting Discrepancy: Xinjiang Daqo's financial results are prepared under PRC GAAP, while Daqo's consolidated results are reported under U.S. GAAP, which may lead to investor misunderstandings regarding the company's overall financial condition.

- Investor Caution: The company advises investors to exercise caution regarding the preliminary loss estimate, as actual results may vary significantly from this estimate, underscoring the uncertainty and risks surrounding future financial performance.

- Net Loss Estimate: Daqo's subsidiary Xinjiang Daqo estimates a net loss of RMB 1.0 to 1.3 billion for FY2025, an improvement from the RMB 2.7 billion loss in FY2024, indicating gradual recovery amidst challenges.

- Equity Structure: Daqo New Energy owns approximately 72.8% of Xinjiang Daqo, highlighting the close relationship between its financial performance and that of its subsidiary, suggesting future profitability will be influenced by Xinjiang Daqo's results.

- Financial Reporting Differences: The loss estimate is prepared under PRC GAAP, while Daqo's consolidated results are reported under U.S. GAAP, illustrating the differences in financial transparency and reporting standards between the two.

- Investor Caution: The company advises investors to exercise caution regarding the preliminary loss estimate, as actual results may vary significantly, emphasizing the uncertainty and risks surrounding future financial performance.

- Market Underperformance: On Thursday, semiconductor stocks collectively fell by approximately 1.8%, with Applied Optoelectronics experiencing a significant drop of 15.5%, indicating pressure on the sector that could undermine investor confidence.

- Key Contributors to Decline: DAQO New Energy's shares also declined by about 10.2%, exacerbating the overall weakness in the semiconductor sector and reflecting market concerns regarding future growth prospects in this industry.

- Industry Trend Warning: The downturn in the semiconductor sector may signal a broader market correction, prompting investors to closely monitor the financial health of related companies and shifts in market demand to adjust their investment strategies accordingly.

- Investor Sentiment Fluctuation: Heightened negative sentiment towards the semiconductor industry could lead to short-term capital outflows, impacting the stock performance and financing capabilities of affected companies.

Market Overview: The stock market is experiencing turbulence, with the Nasdaq down 2.74% and a notable rotation into healthcare, which is currently the only sector showing strong opportunities. The crypto market is facing significant challenges, indicating a critical juncture ahead.

Dianthus Therapeutics: Dianthus Therapeutics (DNTH) is a clinical-stage biotech company focused on innovative therapies for autoimmune diseases, showing potential for a 95% return. Despite a high Price-to-Sales ratio, recent technical patterns suggest an upward momentum.

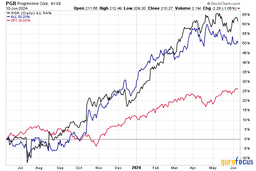

Daqo New Energy: Daqo New Energy (DQ), a leading polysilicon manufacturer for solar products, presents a 78% return potential. The company is well-positioned to benefit from the growing renewable energy sector, with strong operational resilience and strategic expansion plans.

Arcus Biosciences: Arcus Biosciences (RCUS) is developing advanced cancer therapies, with a 45% return potential. The company is backed by significant partnerships and funding, allowing it to aggressively pursue its pipeline while navigating the biotech landscape.