Biogen and Other Pharma Stocks Face February Challenges

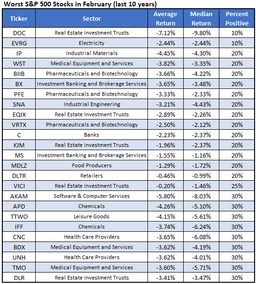

- February Underperformance: According to analyst Rocky White, Biogen Inc (NASDAQ:BIIB) has averaged a 4.2% loss in February over the past decade, finishing the month positively only twice, indicating its persistent weakness in the market.

- Revenue Impact from Increased Competition: Zacks Research highlights that Biogen's multiple sclerosis drugs are facing intensified competition, likely leading to a decline in revenue from these products, which raises concerns among investors regarding its future performance.

- Earnings Report Volatility Risk: Biogen is set to announce its fourth-quarter results on February 6, and historical data shows that the stock has dropped in five of its last eight post-earnings sessions, including a 4.3% gap down last February, prompting investors to be cautious of potential volatility.

- Options Market Anticipates Significant Moves: Options traders are pricing in a 7% move for Biogen's stock following the earnings announcement, a figure significantly higher than the average two-year move of 2.6%, reflecting the market's uncertainty about its future trajectory.

Trade with 70% Backtested Accuracy

Analyst Views on BIIB

About BIIB

About the author

- February Underperformance: According to analyst Rocky White, Biogen Inc (NASDAQ:BIIB) has averaged a 4.2% loss in February over the past decade, finishing the month positively only twice, indicating its persistent weakness in the market.

- Revenue Impact from Increased Competition: Zacks Research highlights that Biogen's multiple sclerosis drugs are facing intensified competition, likely leading to a decline in revenue from these products, which raises concerns among investors regarding its future performance.

- Earnings Report Volatility Risk: Biogen is set to announce its fourth-quarter results on February 6, and historical data shows that the stock has dropped in five of its last eight post-earnings sessions, including a 4.3% gap down last February, prompting investors to be cautious of potential volatility.

- Options Market Anticipates Significant Moves: Options traders are pricing in a 7% move for Biogen's stock following the earnings announcement, a figure significantly higher than the average two-year move of 2.6%, reflecting the market's uncertainty about its future trajectory.

- Stock Market Trends: Stock futures are declining as Wall Street experiences a selloff for a second consecutive day.

- Federal Reserve Leadership: The market reaction follows President Donald Trump's selection of Kevin Warsh as the next Federal Reserve chairman.

Market Volatility: Last week saw increased volatility in equities, with the S&P 500 ending slightly up and the Nasdaq Composite slightly down after a steady interest rate announcement by the Federal Open Market Committee.

Microsoft's Earnings Impact: Microsoft experienced a significant drop of 10% in its stock value, resulting in a loss of $357 billion in market capitalization following a disappointing earnings report.

Silver Market Collapse: The silver market faced a dramatic decline, falling 31% in a single day, attributed to the nomination of hawkish Kevin Warsh as the next Fed Chair and a prior 50% increase in value this year.

Overall Economic Sentiment: The combination of these events reflects a turbulent economic sentiment, with investors reacting to both corporate earnings and shifts in monetary policy.

- Earnings Outlook: Next week, earnings reports from tech giants Alphabet and Amazon are highly anticipated, especially after Microsoft's report led to a 10% stock drop despite beating expectations, indicating a shift in investor scrutiny towards profitability and growth metrics.

- Job Cuts and Efficiency: Amazon announced a restructuring that will eliminate 16,000 jobs, adding to the 14,000 cuts made in October, resulting in a 10% reduction in its corporate and tech workforce, with CEO Andy Jassy emphasizing that AI-driven efficiency gains will significantly impact operational costs moving forward.

- Labor Market Insights: A crucial jobs report is set to be released next Friday, alongside the Job Openings and Labor Turnover Survey (JOLTS), providing investors with insights into the labor market, particularly after the Fed indicated an improving economic outlook, which may alter interest rate expectations.

- Government Shutdown Risks: The market is also wary of a potential partial government shutdown, as a planned Senate vote on funding has stalled, despite a strong January performance; this uncertainty could lead to increased volatility, prompting investors to remain cautious in their strategies.

- Pharmaceutical Stocks Performance: Pharmaceutical stocks have recently reached new highs in the market.

- Earnings Potential: Upcoming earnings reports are expected to further boost the stock prices of pharmaceutical companies.

- FDA Breakthrough Therapy Designation: Biogen's litifilimab (BIIB059) has received FDA Breakthrough Therapy Designation for treating cutaneous lupus erythematosus (CLE), indicating the FDA's recognition of the drug's potential in addressing serious diseases and potentially expediting its market entry.

- Clinical Trial Data Support: Results from the Phase 2 LILAC study demonstrate that litifilimab significantly reduces skin disease activity in CLE patients compared to placebo, highlighting its potential to improve patient quality of life.

- Urgent Market Need: Current standard treatments for CLE include topical steroids and antimalarials, but there are no targeted therapies available, making litifilimab's development crucial to meet the urgent demand for effective treatments among patients.

- Future Research Plans: Biogen is advancing the AMETHYST Phase 3 study, with data readout expected in 2027, which, if successful, could provide a new therapeutic option for millions of CLE patients, further solidifying Biogen's leadership in the biopharmaceutical sector.