Airbus CEO: Building Europe's 'Digital Battlefield' Will Require a Decade

AI-Driven Battlefield Development: Airbus CEO Guillaume Faury stated that building Europe's AI-driven battlefield capabilities will take a decade, emphasizing the need for improved data-sharing protocols among European countries for effective military collaboration.

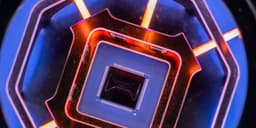

Combat Cloud Initiative: The "combat cloud" project aims to enhance information sharing between various military assets, including satellites and aircraft, as part of the Future Combat System, which also includes the development of a new fighter jet.

European Defense Collaboration: Faury highlighted the importance of creating large-scale defense players in Europe to compete with American and Chinese companies, expressing frustration over the slow progress in European defense initiatives since the Ukraine invasion.

Partnerships for Innovation: Airbus has partnered with Italy's Leonardo and France's Thales to combine space projects, aiming to establish a European leader in satellite technology and innovation, with plans for an AI-driven missile shield called the 'Michelangelo Dome.'

Trade with 70% Backtested Accuracy

Analyst Views on TSLA

About TSLA

About the author

- Steady Sales Performance: Tesla delivered 418,227 vehicles in Q4 2024, reflecting only a 15.6% year-over-year decline, significantly better than competitors' 88.6% drops, indicating strong customer demand despite a 3% overall revenue decrease.

- Margin Improvement: Tesla's gross margin increased from 15.4% in Q3 to 17.9% in Q4, despite launching lower-priced Model 3 and Model Y versions, showcasing successful cost management and product optimization that may enhance future profitability.

- Capital Expenditure Plans: Tesla anticipates capital expenditures exceeding $20 billion in 2026, a substantial increase from $8.5 billion in 2025, aimed at starting production at new factories and advancing technology development, reflecting the company's ambitious growth strategy.

- Market Competition Pressure: While Tesla experienced sales growth in the Asia-Pacific region, the company warned of potential margin compression across all business segments, indicating the need for continuous innovation to maintain its market leadership amid intense competition.

- Merger Scale: Musk's SpaceX and xAI have merged to form a new entity valued at $1.25 trillion, making SpaceX the largest single holding in the ARK fund at 11.23%, while xAI stands at 6.31%, together representing a significant 17.54% of the portfolio, enhancing the fund's market position.

- Market Impact: This merger breaks the global M&A record, with SpaceX acquiring xAI for approximately $1 trillion and xAI valued at around $250 billion, surpassing Vodafone's $203 billion acquisition of Mannesmann in 2000, marking Musk's strategic integration in space and AI.

- Portfolio Dominance: The combined entity dominates the ARK fund, significantly exceeding other holdings like Figure AI (4.24%) and Databricks (3.55%), providing investors with a stronger concentrated investment opportunity in the AI and aerospace sectors.

- Future IPO Outlook: SpaceX is reportedly preparing for a potential IPO later this year that could see its valuation exceed $1.5 trillion, and this merger consolidates high-conviction exposure for ARK investors, further solidifying its leadership in emerging markets.

- Policy Reversal: The EPA's decision to reverse its finding on greenhouse gas harms may boost sales of gas-guzzling vehicles but poses a significant threat to the electric vehicle market, particularly after the removal of federal tax credits, which led to a dramatic drop in EV sales in October.

- Market Reaction: According to Cox Automotive, EVs peaked at 10.3% of the new vehicle market in September, just before federal incentives ended, but sales plummeted afterward, indicating a direct impact of policy changes on consumer demand for electric vehicles.

- Industry Opposition: Automakers like Tesla oppose the EPA's decision, arguing that reversing the endangerment finding undermines the regulatory framework that supports investments in EVs, potentially harming consumer choice and economic benefits while affecting the integrated North American automotive sector.

- Future Outlook: Despite policy challenges, the market potential for EVs remains strong, as battery prices decline and the number of models increases, with experts suggesting that the commercial viability of EVs will continue to grow, albeit at a slower pace due to current regulatory headwinds.

- EPA Decision Reversal: The EPA's decision to no longer regulate greenhouse gases, based on its interpretation of the Clean Air Act, could pose significant challenges for the U.S. electric vehicle market, especially as global competition in EVs intensifies.

- Decline in EV Sales: Following the removal of federal tax credits, EV sales plummeted in October, dropping from 10.3% market share in September, highlighting a disconnect between consumer demand and policy support that may hinder future market growth.

- Automaker Responses: Ford has expressed support for a unified national standard, arguing that current emissions regulations do not align with consumer choices, reflecting the automotive industry's divisions over environmental policies, particularly between EVs and traditional vehicles.

- Tesla's Position: Tesla opposes the EPA's reconsideration of the endangerment finding, asserting that this regulatory framework has provided stability for its investments in product development, warning that abandoning fuel-efficiency goals could negatively impact consumer choice and economic benefits.

- Market Value Loss: On Thursday, Wall Street's tech sector saw over $500 billion wiped off market value across 10 major companies, indicating a sharp decline in investor confidence amid simultaneous pressures on both software and hardware sectors.

- Cisco Earnings Impact: Cisco's stock plummeted 11% despite reporting earnings of $1.04 per share, exceeding expectations, as the company’s gross margin guidance of 65.5%-66.5% fell short of the 68% consensus, highlighting the impact of rising hardware costs.

- Memory Shortage Risks: Lenovo confirmed mounting pressure on PC shipments, with CEO Yang Yuanqing stating that while unit pressures are expected, the company aims to maintain profitability, reflecting growing concerns over memory shortages in the industry.

- Software Sector Decline: The iShares Expanded Tech-Software Sector ETF dropped over 3% on Thursday, with the sector down over 20% year-to-date, illustrating the ongoing impact of fears surrounding AI disruption on software stock performance.

- AI Fears Impacting Stocks: Concerns about artificial intelligence are affecting tech-related stocks, indicating a shift in market sentiment.

- Sector's Future Uncertain: While the tech sector may still have potential, it appears it will need to share attention with other emerging trends.