TU.N Hits 20-Day Low Amid Market Volatility

Written by Emily J. Thompson, Senior Investment Analyst

Updated: May 16 2025

0mins

Should l Buy TU?

Source: Coinmarketcap

Shares of TU.N declined sharply today, hitting a 20-day low as investors reacted to ongoing market volatility. The stock's recent performance indicates a bearish trend, with technical indicators suggesting increased selling pressure. Analysts note that the breach of this key support level may trigger further declines if selling momentum continues.

Market participants are closely monitoring the situation, as external factors such as economic data releases and geopolitical tensions have contributed to the stock's downward trajectory. The combination of these elements has left investors cautious, prompting a reevaluation of their positions in TU.N.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TU?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TU

Wall Street analysts forecast TU stock price to rise

10 Analyst Rating

4 Buy

4 Hold

2 Sell

Hold

Current: 13.700

Low

13.71

Averages

14.96

High

18.04

Current: 13.700

Low

13.71

Averages

14.96

High

18.04

About TU

TELUS Corporation is a communications technology company serving customers through its suite of broadband services for consumers, businesses and the public sector. Its segments include TELUS technology solutions, TELUS digital experience and TELUS health. The TELUS technology solutions segment includes mobile technologies; data (which include Internet protocol; television; hosting, cloud-based services; and home and business security and automation); agriculture and consumer goods services (software, data management and data analytics-driven smart-food chain and consumer goods technologies); voice and other telecommunications services ; and equipment sales. The TELUS health segment includes healthcare services, software and technology solutions. The TELUS digital experience segment consists of digital customer experience and digital-enablement transformation solutions, including artificial intelligence and content management.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Partial Redemption Announcement: TELUS Corporation has announced a partial redemption of C$500 million of its 2.75% Notes due July 8, 2026, from the outstanding C$800 million, indicating proactive debt management strategies.

- Funding Source for Redemption: The redemption will be funded through proceeds from TELUS's Fixed-to-Fixed Rate Junior Subordinated Notes offerings completed in December 2025, reflecting strategic considerations in optimizing the company's capital structure.

- Global Operational Scale: Operating in over 45 countries, TELUS generates more than C$20 billion in annual revenue with over 21 million customer connections, showcasing its leadership and market influence in the global communications technology sector.

- Commitment to Social Responsibility: Since 2000, TELUS and its team members have contributed C$1.85 billion in cash and in-kind donations, underscoring the company's ongoing investments in education, health, and community well-being, further solidifying its reputation as the world's most giving company.

See More

- Partial Redemption Announcement: TELUS Corporation has announced a partial redemption of C$500 million of its 2.75% Notes, Series CZ, due July 8, 2026, from an outstanding total of C$800 million, reflecting the company's proactive debt management strategy.

- Redemption Method: The notes will be selected for redemption on a pro rata basis, with the redemption price calculated according to the applicable indenture, which helps maintain investor confidence and ensures market stability.

- Funding Source: The partial redemption will be funded using proceeds from TELUS' Fixed-to-Fixed Rate Junior Subordinated Notes offerings completed in December 2025, indicating the company's strategic planning in optimizing its capital structure.

- Company Background: TELUS operates in over 45 countries, generating more than C$20 billion in annual revenue and connecting over 21 million customers, demonstrating its leadership in the communications technology sector and commitment to societal advancement through advanced broadband services.

See More

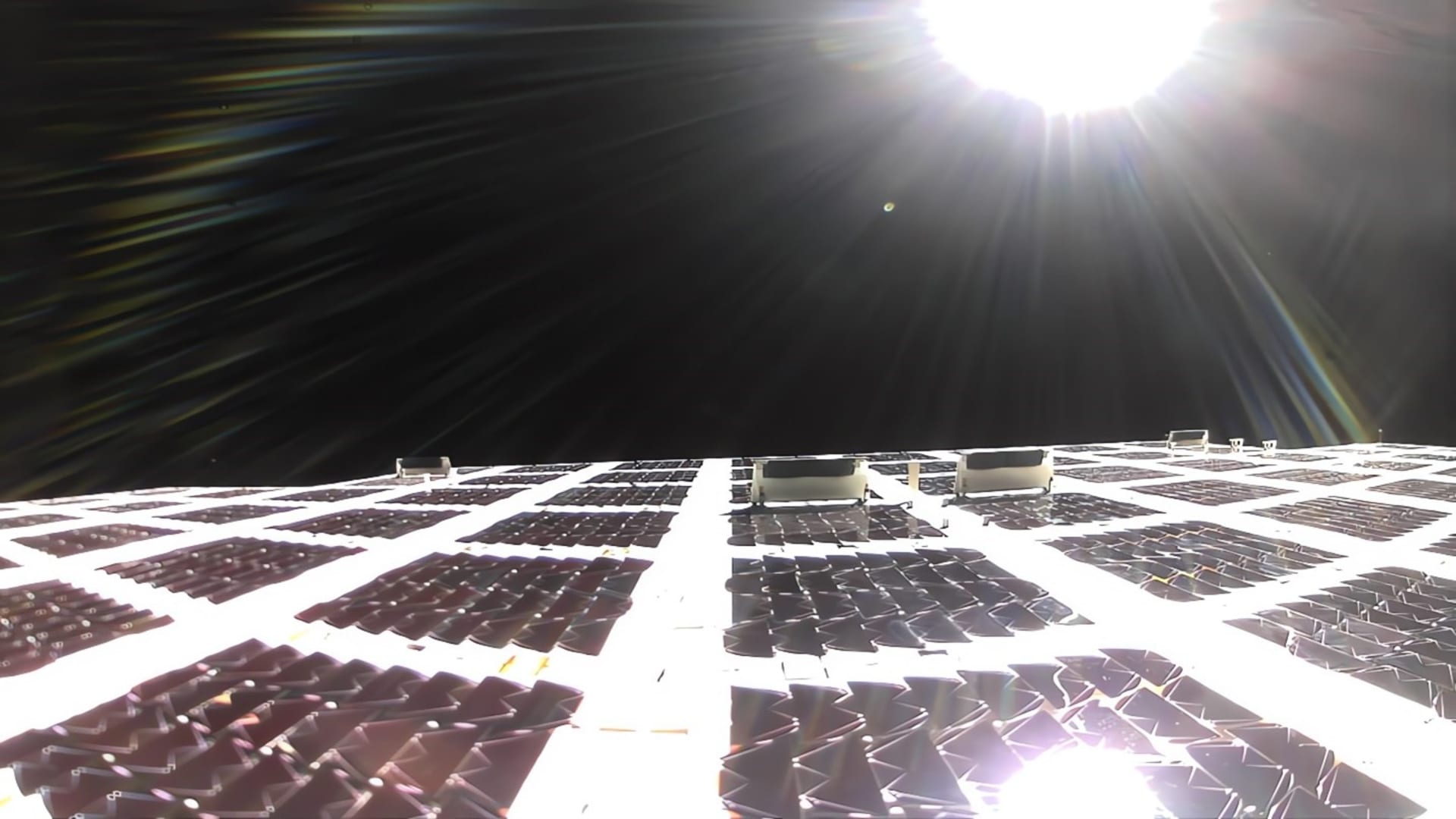

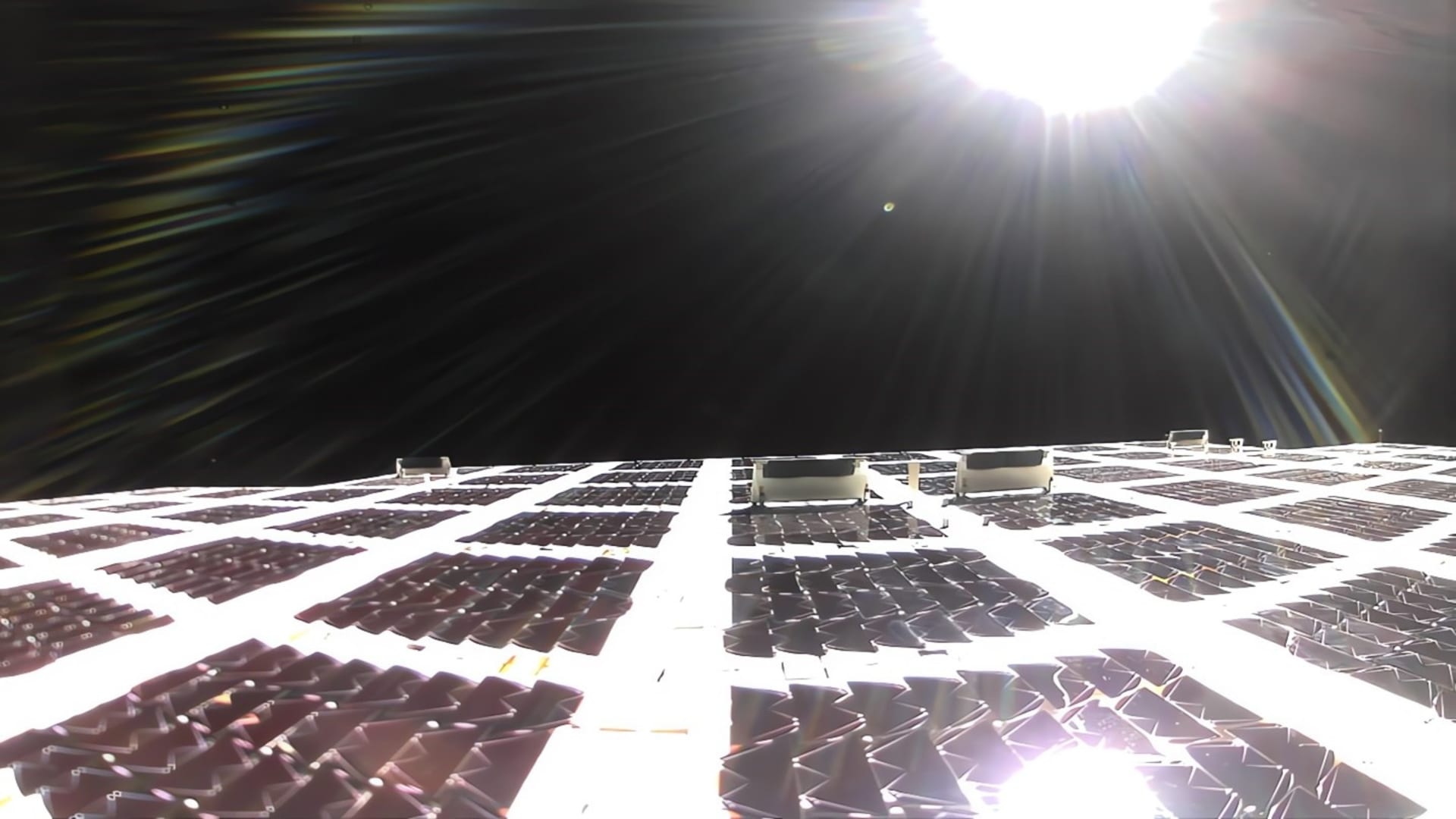

- Partnership Agreement: AST SpaceMobile has partnered with Canadian telecom company Telus, which will invest in ground-based satellite infrastructure and acquire equity in AST SpaceMobile, enhancing ASTS's competitive position in the market.

- Commercial Service Outlook: Once ASTS launches its commercial services, Telus customers will be able to send texts, make calls, and use data services in the most remote areas of Canada, significantly improving user experience and expanding market coverage.

- Price Target Increases: UBS analyst Christopher Schoell nearly doubled the price target for AST SpaceMobile from $43 to $85, reflecting optimistic market expectations for the company's future revenue growth, while Deutsche Bank raised its target to $139, implying a 34% upside.

- Positive Market Sentiment: Retail sentiment on Stocktwits regarding AST SpaceMobile trended in the 'extremely bullish' territory with high message volumes, indicating strong investor confidence in the company's future partnerships and market potential.

See More

- Partnership Announcement: AST SpaceMobile has signed a partnership with Canadian telecom giant Telus, which will invest in ground-based satellite infrastructure while AST provides BlueBird satellites, aiming to deliver satellite broadband to remote areas in Canada, thereby enhancing AST's competitive position in the market.

- Equity Stake: Telus will become an equity shareholder in AST SpaceMobile, reinforcing the long-term alignment between the two companies; however, it remains unconfirmed whether Telus will directly purchase AST shares, yet this equity relationship ensures Telus will entrust its direct-to-cell business to AST going forward.

- Market Reaction: Following the partnership announcement, AST's stock surged by 10%, indicating a positive investor response, although the direct-to-cell service is not expected to launch until late 2026, which may impact short-term profitability expectations.

- Profitability Outlook: Despite the optimistic partnership prospects, AST's service readiness in the U.S. or Canada remains uncertain, potentially disappointing investors who anticipated profitability next year, leading analysts to maintain a cautious stance on AST's stock.

See More

- Strong Earnings Report: Latham Group reported a fourth-quarter loss of 6 cents per share, outperforming analyst expectations of a 10-cent loss, indicating improvements in cost control and operational efficiency.

- Sales Exceed Expectations: The company achieved quarterly sales of $99.950 million, surpassing the analyst consensus estimate of $96.786 million, reflecting strong market demand and robust product performance, which bolstered investor confidence.

- Significant Stock Surge: Following the positive earnings report, Latham Group's shares jumped 25.7% to $8.10 on Wednesday, reflecting market optimism regarding the company's future growth potential.

- Positive Future Outlook: Latham Group issued FY26 sales guidance above estimates, further solidifying investor confidence in the company's long-term growth trajectory.

See More

- Commercial Agreement: TELUS has signed a commercial agreement with AST SpaceMobile to combine AST's low-Earth orbit satellite network with TELUS' wireless network, aiming to provide space-based cellular broadband to remote areas in Canada, which is expected to significantly enhance communication capabilities in these regions.

- Infrastructure Investment: As part of the deal, TELUS will invest in ground-based satellite infrastructure and take an equity stake in AST SpaceMobile, which not only strengthens TELUS's market position but also provides ASTS with financial support to accelerate its global satellite deployment.

- Service Launch Timeline: Starting in late 2026, TELUS customers are expected to send texts, make calls, and use data in areas where traditional cellular networks are unavailable, offering unprecedented connectivity opportunities for users in remote locations and enhancing user experience.

- Stock Price Reaction: ASTS shares rose by 2.6% following the announcement of the agreement, reflecting market optimism about the collaboration and indicating investor confidence in future revenue growth, especially as ASTS sets a revenue target of $150 million to $200 million for 2026.

See More