Webster Financial Corporation has released its fourth-quarter earnings for the fiscal year 2024, showcasing a strategic balance between adapting to financial pressures and preparing for long-term growth. While facing reduced income and earnings per share, adjusted earnings indicate the company's robust approach in managing financial dynamics effectively.

Webster Financial Corporation Earnings

In this quarter, Webster Financial Corporation reported a total revenue of $661.0 million, reflecting a steady growth of 1.1% from the previous quarter. However, there was a decline in both net income and basic earnings per share, which fell by 4.2% and 3.8%, respectively, compared to the same period last year. The adjusted earnings per share also saw a slight drop of 2.0%, from $1.46 in Q4 2023 to $1.431 in Q4 2024. Despite these declines, the bank's deliberate decisions around securities repositioning and deferred tax adjustments were pivotal during the quarter. Below is a table summarizing these key financial metrics:

| Metric | Q4 2024 | Q4 2023 | QoQ Change | YoY Change |

|---|---|---|---|---|

| Total Revenue | $661.0 million | Not provided | +1.1% | Not provided |

| Net Income | $173.6 million | $181.2 million | -4.2% | -4.2% |

| Earnings per Share (EPS) | $1.01 | $1.05 | -3.8% | -3.8% |

| Adjusted EPS | $1.431 | $1.46 | -2.0% | -2.0% |

Webster Financial Corporation Results

On delving into the results, we notice that Webster Financial Corporation continues to exhibit a degree of stability in its financial operations despite a backdrop of financial pressures. Key facets like securities repositioning were highlighted, with pre-tax losses amounting to $56.9 million. Critical adjustments to the deferred tax asset valuation also played a significant role, showing a $29.4 million impact. These figures underscore the company's resilient approach in navigating fiscal challenges.

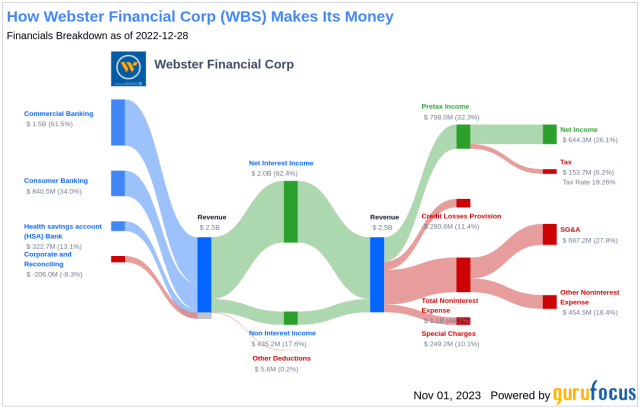

Revenue Breakdown

A closer examination of the segment-specific performance reveals varied outcomes:

| Segment | Revenue (Q4 2024) | Revenue (Q4 2023) | Change |

|---|---|---|---|

| Commercial Banking | $264.7 million | $287.4 million | -7.9% |

| Healthcare Financial Services | $63.7 million | Not provided | Not calculable |

| Consumer Banking | $110.0 million | $124.9 million | -12.0% |

The Commercial Banking segment experienced a revenue dip of 7.9%, driven by tightening loan yields. As for the Consumer Banking division, the 12% decline was primarily due to higher deposit rates impacting yields negatively. However, the Healthcare Financial Services segment marked an upsurge, significantly benefiting from the strategic acquisition of Ametros, which augmented its revenue stream.

Key Developments

Webster Financial Corporation's strategic initiatives include: - Securities Repositioning : Losses attributed to this reconfiguration totaled $56.9 million pre-tax. - Deferred Tax Adjustments : The valuation for deferred tax assets stood at $29.4 million. - Growth in Assets : The total assets under administration saw appreciable growth thanks to the integration of Ametros, following its acquisition.

Comments from Company Officers

Chairman and CEO John R. Ciulla spoke on the company’s consistent strength in maintaining resilience amidst challenges, underscoring how strategic investments are paving the way for future growth. Chief Financial Officer Neal Holland highlighted proactive enhancements in capital and liquidity, driven by groundbreaking funding strategies and technology investments.

Dividends and Share Repurchases

The company's report did not provide specific updates regarding dividends and share repurchase programs during this fiscal quarter.

Webster Financial Corporation Stock Forecast

In light of Webster's strategic initiatives and fiscal results, the company's stock price experienced a modest decrease of 0.378% following the earnings report due to market correction responses. With a last recorded stock price of $57.94 and a market capitalization of $7.1 billion, Webster Financial Corporation’s stock is poised for potential growth. Short-term high projections could reach around $60, factoring in continued successful execution of strategic investments and full integration of Ametros. Conversely, in a low projection scenario, persistent market pressures could see stock consolidation closer to $55.

Through resilient fiscal management and operational strides, Webster Financial Corporation positions itself well for potential upward trajectories in stock performance, affirming the company's stronghold amidst economic ebbs and flows.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.