Tencent Music Entertainment Group Reports Q3 2024 Financial Results

Tencent Music Entertainment Group (TME), a leading online music and audio entertainment platform in China, announced its unaudited financial results for the third quarter ended September 30, 2024.

Key Financial Metrics

| Metric | Q3 2024 | Q3 2023 | YoY Change |

|---|---|---|---|

| Total Revenue | US$1.0 billion | US$935 million | +6.8% |

| Net Profit | US$244 million | US$180 million | +35.3% |

| Diluted EPS per ADS | US$0.14 | US$0.11 | +27.3% |

Interpretation: TME's financial results showed robust performance with total revenues increasing by 6.8% year-over-year, primarily driven by strong growth in online music services. The significant growth in net profit by 35.3% reflects the company's effective cost management and increased profitability.

Revenue by Segment

| Segment | Q3 2024 | Q3 2023 | YoY Change |

|---|---|---|---|

| Online Music Services | US$781 million | US$649 million | +20.4% |

| Social Entertainment Services | US$219 million | US$288 million | -23.9% |

Interpretation: TME experienced a healthy expansion in its online music services segment with a 20.4% year-over-year increase due to growing subscription revenues and advertising. However, social entertainment services faced a decline of 23.9% largely due to strategic adjustments and compliance implementations.

Key Developments and Operational Highlights

- Renewed partnerships with key record labels like YH Entertainment Group and Image Music Group, securing early access for new song releases.

- Formed a strategic alliance with Galaxy Corporation to enhance K-pop offerings.

- Successful execution of concerts such as TME's Zebra Music Festival and Yu Jiayun's live concert, drawing significant audience engagement.

- Enhanced SVIP memberships with additional privileges to improve conversion rates and subscriber loyalty.

- Boosted content offerings by integrating advanced recommendation algorithms and personalized features.

Management Commentary

Mr. Cussion Pang, Executive Chairman of TME, emphasized the platform's commitment to quality growth, noting the continued expansion of its music subscriber base and the synergies with its content ecosystem. Mr. Ross Liang, CEO, highlighted the strategic focus on premium memberships which has driven subscriber and ARPPU growth.

Share Repurchase Program

The company reported repurchase of 42.1 million ADSs for US$335.5 million as of the end of Q3 2024, under its US$500 million Share Repurchase Program.

Guidance and Stock Performance

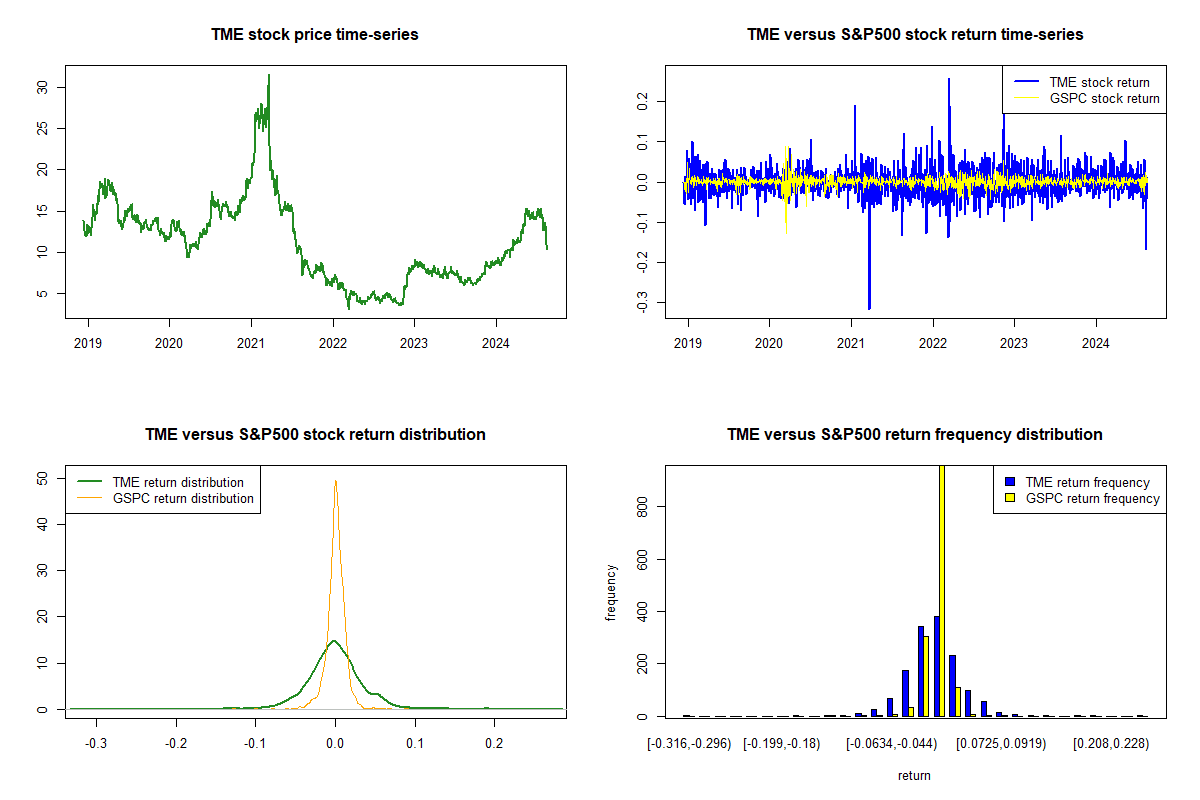

The earnings release did not include forward guidance. Following the release, TME's stock price experienced a 1.4% upward movement.

Overall, Tencent Music continues to demonstrate strong financial performance, underpinned by an expanding music subscription base and strategic partnerships.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.