Roivant (NASDAQ:ROIV) has announced its financial results for the second quarter ending September 30, 2024. The company's performance is detailed below, alongside significant developments and strategic updates.

Key Financial Metrics

| Financial Metric | Q2 2024 | Q2 2023 | YoY Change |

|---|---|---|---|

| Research & Development Expenses | $143.1M | $114.8M | +24.7% |

| General & Administrative Expenses | $202.9M | $88.6M | +129% |

| Loss from Continuing Operations (Net of Tax) | $236.8M | $244.6M | -3.2% |

| Cash and Marketable Securities | $5.4B | - | - |

Interpretation : The increase in R&D expenses highlights expanded and costly program-specific initiatives, while the surge in G&A reflects retention awards for key executives. Despite these expenses, Roivant managed a slight reduction in operational losses year-over-year.

Key Developments and Operational Highlights

- Brepocitinib : Positive 52-week data in non-infectious uveitis with enrollment for Phase 3 program initiated.

- IMVT-1402 : Cleared for five IND applications, with a focus on rheumatoid arthritis potential trial by March 31, 2025.

- Batoclimab : Demonstrated promising data in Graves' disease and potential for further trials by year-end.

- Mosliciguat : Phase 2 initiated with significant efficacy in pulmonary vascular resistance reduction.

- Dermavant Transaction : Completed sale of Dermavant to Organon, receiving $184M cash.

Comments from Company Officers

Matt Gline, CEO, stated, “I am pleased with our clinical executions, underscoring significant advances in Graves' Disease and the clearance of multiple INDs at Immunovant.” He stressed optimism for major data releases in 2025 from Immunovant and Priovant, alongside ongoing program executions.

Share Repurchase Program

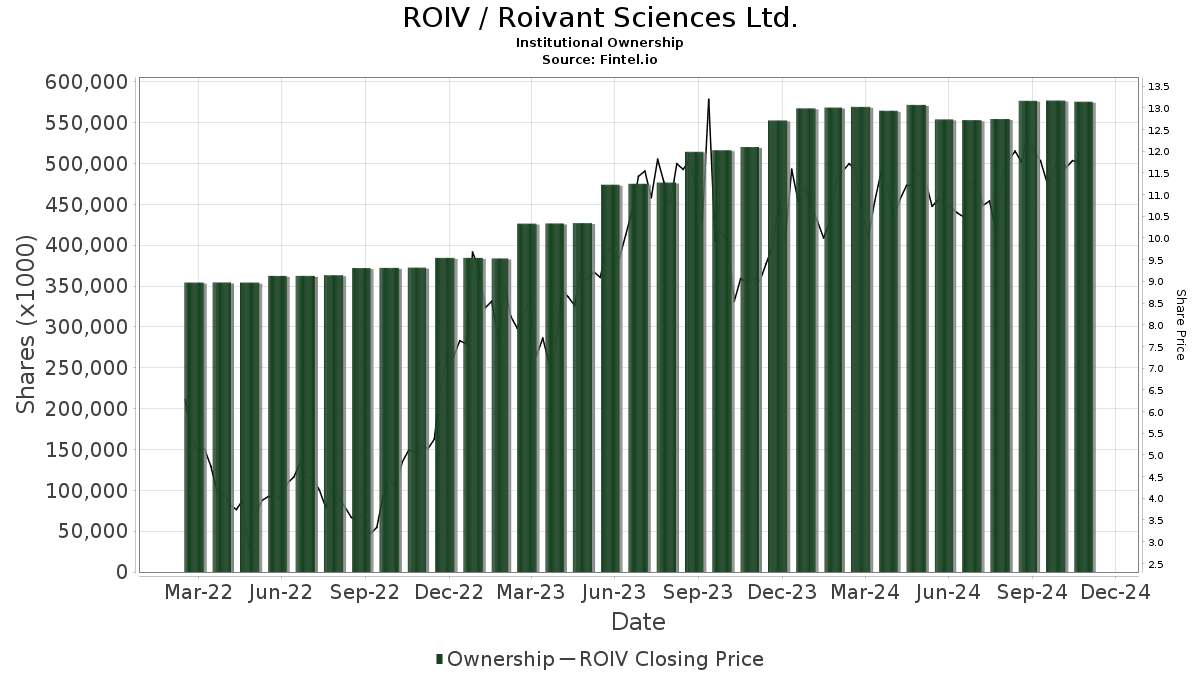

Roivant enhanced shareholder value through a share repurchase initiative, totaling $106M in Q2, summing up to a cumulative $754M in purchases to date.

Forward Guidance and Stock Movement

The earnings release did not divulge forward guidance specifics, nor detailed stock price movements post-announcement. However, a post-event stock decrease of approximately 0.5% was noted.

By focusing strategically on innovations and disciplined financial management, Roivant continues to fortify its pipeline and operational framework, positioning itself for prospective milestones in the ensuing quarters.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.