RLX Technology Reports Q3 2024 Financial Results

RLX Technology Inc. (NYSE: RLX), a leading global branded e-vapor company, announced its unaudited financial results for the third quarter ended September 30, 2024.

Key Financial Metrics

| Metric | Q3 2024 | Q3 2023 | YoY Change |

|---|---|---|---|

| Revenue | $107.8M | RMB498.9M | +51.6% |

| U.S. GAAP Net Income | $24.1M | RMB176.6M | - |

| Non-GAAP Net Income | $37.3M | RMB201.4M | - |

| EPS | $0.019 | RMB0.133 | - |

The company reported a strong year-over-year growth, with net revenues rising by 51.6% to US$107.8 million, supported by its international expansion efforts. RLX Technology's performance demonstrated robust operational leverage as its gross margin improved by 3.1 percentage points to 27.2%.

Key Developments and Operational Highlights

- Gross margin increased to 27.2% from 24.1% year-over-year, attributed to a favorable shift in revenue mix and cost optimization.

- Operating expenses rose primarily due to an increase in share-based compensation expenses.

- RLX maintained stable non-GAAP operating expenses while achieving rapid revenue growth, highlighting its operational leverage.

- The announcement of a cash dividend of US$0.01 per ordinary share, illustrating commitment to shareholder returns.

- Execution of a share repurchase program.

Comments from Company Officers

Ms. Ying (Kate) Wang, Co-founder, Chairperson, and CEO of RLX Technology, emphasized the company's resilience amidst evolving market trends and regulations, attributing success to its localization strategies and strong product-market alignment. CFO Mr. Chao Lu reflected on the internationalization efforts driving revenue growth and emphasized their focus on sustainable growth and enhancing shareholder returns.

Dividend and Share Repurchase Program

RLX Technology declared a cash dividend of US$0.01 per ordinary share, further emphasizing its dedication to returning value to shareholders. Also, the company continued its share repurchase program, showcasing confidence in its long-term growth strategy.

Forward Guidance

There was no specific mention of forward guidance in the report, aside from the general commitment to pursue sustainable profit growth opportunities.

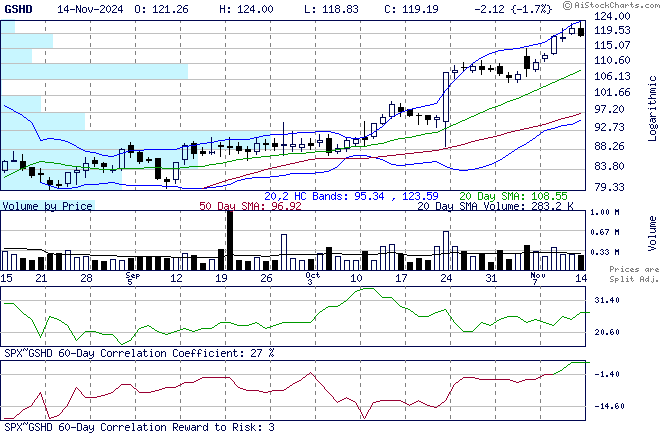

Stock Price Movement

Following the earnings release, RLX Technology’s stock experienced a positive movement, with a post-earnings release change of approximately +1.24%.

Overall, RLX Technology has shown strong financial health and strategic growth initiatives, underpinning its position as a leading global e-vapor company.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.