PennantPark Floating Rate Capital Ltd. Reports Fourth Quarter and Fiscal Year 2024 Financial Results

PennantPark Floating Rate Capital Ltd. (NYSE: PFLT) announced its financial results for the fourth quarter and fiscal year ended September 30, 2024.

Key Financial Metrics:

| Metric | Q4 2024 | YoY Change | QoQ Change | Consensus Estimates |

|---|---|---|---|---|

| Revenue | $55.5M | +55.5% | +55.5% | $52.05M |

| Earnings per Share (EPS) | $0.24 | -25% | -25% | $0.32 |

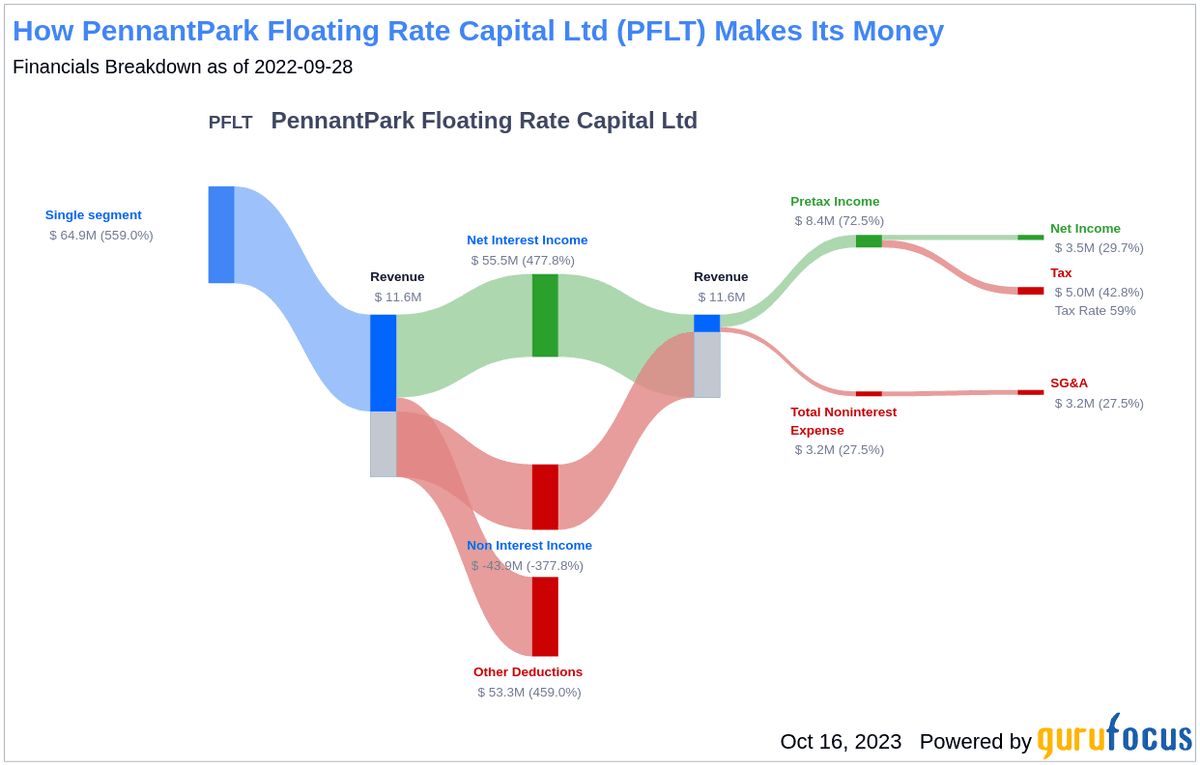

For the fiscal year, PennantPark reported total revenue of $186.4 million, significantly up from $139.3 million in the previous year, primarily driven by the expansion of its debt portfolio. While revenue exceeded consensus estimates, earnings per share fell short. Net investment income for the year was $77.7 million, translating to $1.18 per share, marking an increase from the previous year's $67.5 million or $1.33 per share.

Segment Performance:

| Revenue Source | FY 2024 | Previous Year |

|---|---|---|

| First Lien Secured Debt | $164.3M | $120.0M |

| Other Investments | $22.1M | $19.3M |

Revenue from first lien secured debt saw a significant increase, reflecting successful investments in the core middle market, emphasizing low leverage and attractive spreads.

Key Developments and Highlights:

- Portfolio closed at $1,983.5 million, with substantial first lien secured debt investments.

- Two portfolio companies were on non-accrual, minimal impact on overall portfolio valuation.

- Combined sales and repayments for the fiscal year reached $514.1 million.

Management Commentary:

Art Penn, Chairman and CEO, highlighted the continued investment in a strong vintage of loans and emphasized the company’s focus on middle-market debt with sound covenants and attractive yields.

Dividends:

- Total dividends declared during the fiscal year amounted to $1.23 per share.

Forward Guidance:

The company did not provide specific forward guidance in the release.

Stock Price Movement:

Following the earnings release, shares of PennantPark Floating Rate Capital Ltd. experienced a slight decline of 0.50%.

Overall, PennantPark demonstrated solid revenue growth and strategic portfolio expansion, even though it missed EPS estimates, signaling robust operational execution amid varying market conditions.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.