Nexxen International Ltd. Announces Q3 2024 Financial Results

Nexxen International Ltd. (AIM/NASDAQ:NEXN), a leader in advertising technology, reported its third quarter financial results for 2024, showcasing significant growth and investment in its platform.

Key Financial Metrics

| Metric | Q3 2024 | Q3 2023 | YoY Growth |

|---|---|---|---|

| Contribution ex-TAC | $85.5M | - | 12% |

| Programmatic Revenue | $81.6M | - | 10% |

| CTV Revenue | $29.7M | - | 52% |

| Adjusted EBITDA | $31.6M | - | 49% |

| Adjusted EBITDA Margin | 37% | 28% | - |

Nexxen's Q3 performance was bolstered by robust growth across key revenue streams, notably in the Connected TV (CTV) revenue which surged by 52% year-over-year, indicating strong demand in this segment.

Revenue Segmentation

| Revenue Segment | Q3 2024 | YoY Comparison |

|---|---|---|

| Programmatic | 90% of Revenue | Down from 93% |

| Video | 71% of Programmatic | Up from 66% |

The company saw a positive shift in its revenue mix, with CTV representing a larger portion of programmatic revenue. This aligns with the strategic emphasis on CTV and video, which are gaining traction across the digital advertising landscape.

Key Developments and Operational Highlights

- Strategic ACR Data Partnership: Formed a data partnership with The Trade Desk to enhance revenue opportunities.

- New Partnerships: Selected as a preferred data platform for Kinective Media by United Airlines.

- Product Launches: Rolled out solutions targeting political advertisers.

- Market Expansion: Onboarded new advertisers and supply partners across various verticals.

Executive Commentary

CEO Ofer Druker noted, 'Nexxen's fully integrated platform continues to provide critical AdTech solutions, driving significant gains in both our revenue and EBITDA margins. Our technological edge positions us well for future growth, as we deepen our push into generative AI and data integration.'

Share Repurchase Program

Nexxen repurchased over 5 million shares in Q3, investing £14.1 million ($18.3 million). A new $50 million repurchase program is set to launch on November 19, 2024.

Forward Guidance

The company reaffirmed its 2024 Contribution ex-TAC guidance between $340-$345 million and increased its Adjusted EBITDA outlook to approximately $107 million.

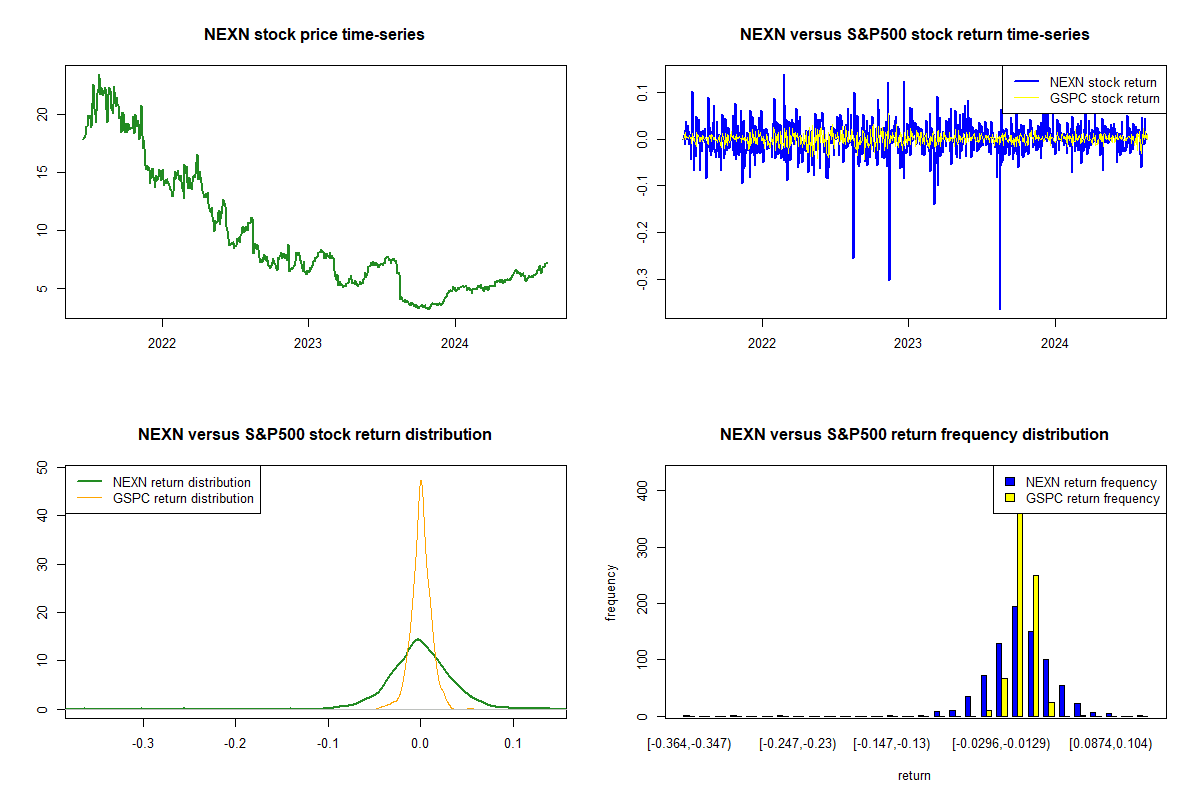

Stock Movement

Following the release, Nexxen's stock saw a positive uptick, with shares increasing by approximately 1.86%.

Nexxen's strategic initiatives and focus on expanding its technological capabilities underscore its commitment to sustained growth and market leadership.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.