Lincoln Educational Services Corporation Reports Q3 2024 Financial Results

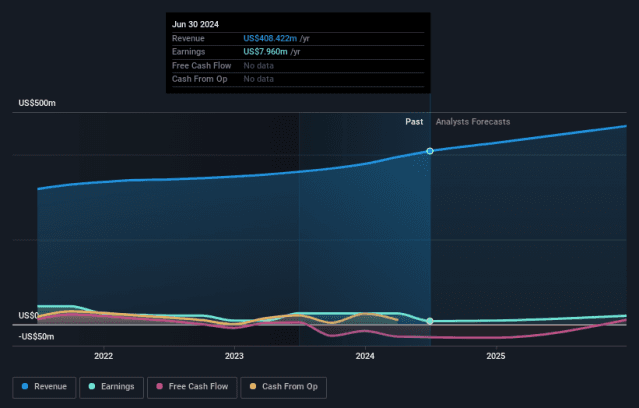

Lincoln Educational Services Corporation (NASDAQ: LINC), based in Parsippany, N.J., announced its financial results for the third quarter ending September 30, 2024. The company reported significant growth across several key financial metrics, underscoring its robust operational performance.

Consolidated Financial Metrics

| Metric | Q3 2024 | YoY Change (%) |

|---|---|---|

| Total Revenue | $114.4 million | +15.0% |

| Adjusted EBITDA | $10.2 million | +67% |

Interpretation : Lincoln Educational Services showcased a strong quarter, with total revenue rising by 15% year-over-year to $114.4 million. The adjusted EBITDA grew by 67%, signaling improved operational efficiency and profitability. These figures highlight the company's successful implementation of its growth strategies and ability to meet increasing demand for career-focused education programs.

Revenue Performance by Segment

| Segment | Q3 2024 Revenue | YoY Change (%) | Comparison to Guidance |

|---|---|---|---|

| Campus Operations | $114.4 million | +15.0% | Outperformed |

| Transitional Segment | $0.0 million | -100% | In line with expectation |

Interpretation : The Campus Operations segment saw robust growth driven by increased student starts and the successful launch of the East Point, Georgia campus, while the transitional segment's conclusion aligned with prior expectations. The segment performances reflect Lincoln's effective strategic focus on expanding and enhancing campus operations.

Key Developments and Operational Highlights

- Student starts increased by 21.1%, with a 13.3% rise in end-of-quarter student population.

- The new East Point campus is exceeding first-year operating targets, contributing $3.4 million in revenue for the quarter.

- Introduced a partnership with Hyundai and Genesis Motor America to provide complimentary training within automotive campuses.

- Launched three replication programs, with three more expected by year-end, each projected to generate an additional $1 million in EBITDA within three years.

- The Lincoln 10.0 hybrid teaching platform is planned to expand to encompass 80% of the student body by 2025, with future integration into nursing programs.

Executive Comments

Scott Shaw, CEO, emphasized the company's role in providing alternatives to four-year degrees and highlighted strong growth across several operational areas. Lincoln attributes this success to its hybrid teaching platform, effective new campus developments, and strategic corporate partnerships, positioning it well for continued expansion and increased financial performance.

Forward Guidance

Lincoln has raised its financial guidance for 2024, anticipating higher end-of-year revenues, adjusted EBITDA, and student starts than previously forecasted.

Stock Price Movement

Following the earnings announcement, Lincoln Educational Services Corporation saw its stock price increase by 8.65%, reflecting investor confidence in the company's strategic direction and financial health.

In summary, Lincoln Educational Services Corporation reported a successful third quarter, underscored by strong revenue growth, strategic educational program expansion, and bolstered guidance for 2024.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.