Interactive Brokers Group Inc. (NASDAQ: IBKR), a leading automated global electronic broker, continues to demonstrate its growth capabilities with its latest quarterly earnings report for the period ending September 30, 2025. The company showcased robust financial health, marked improvements across key metrics, and strategic initiatives that further strengthen its position in the competitive brokerage industry. Despite a slight dip in stock price post-announcement, Interactive Brokers' results reveal a promising trajectory.

Interactive Brokers Group Inc Earnings Summary

Interactive Brokers reported a measured performance with both GAAP and adjusted metrics displaying growth compared to the previous year. The firm achieved a GAAP diluted earnings per share (EPS) of $0.59 and an adjusted EPS of $0.57.

In terms of net revenues, Interactive Brokers posted GAAP net revenues of $1,655 million, with adjusted net revenues amounting to $1,610 million, signifying an increase from the $1,365 million in GAAP revenues recorded in the year-ago quarter.

Interactive Brokers Group Inc Results

The table below outlines the key financial metrics and their respective comparisons:

| Financial Metrics | Q3 2025 (GAAP) | Q3 2025 (Adjusted) | Q3 2024 (GAAP) | Q3 2024 (Adjusted) | YoY Change (GAAP) |

|---|---|---|---|---|---|

| Net Revenues (Millions) | $1,655 | $1,610 | $1,365 | $1,327 | +21.3% |

| Earnings Per Share (EPS) | $0.59 | $0.57 | $0.42 | $0.40 | +40.5% |

| Income Before Taxes (Millions) | $1,312 | $1,267 | $909 | $871 | +44.3% |

The above figures illustrate strong year-over-year growth in both net revenues and earnings per share. Income before taxes also showed a significant increase, indicating effective cost management and operational efficiency.

Revenue Breakdown

An analysis of revenue streams reveals key areas contributing to Interactive Brokers' growth:

| Revenue Segments | Q3 2025 Revenue (Millions) | YoY Change (%) |

|---|---|---|

| Commission Revenue | $537 | +23% |

| Net Interest Income | $967 | +21% |

| Other Fees and Services | $66 | -8% |

| Execution, Clearing, Distribution Fees | $92 | -21% |

Segment Analysis

-

Commission Revenue experienced a healthy growth of 23%, driven by increased trading activities. Specifically, customer trading volume surged in stocks and options by 67% and 27% respectively, although futures volumes saw a decline.

-

Net Interest Income recorded a 21% increase, reflecting strong securities lending activity and higher average customer margin loans, reflecting the organization's ability to capitalize on favorable financing conditions to enhance profitability.

-

Other Fees and Services saw an 8% decrease primarily due to lower risk exposure fees, partially offset by an increase in FDIC sweep fees.

-

Execution, Clearing, and Distribution Fees experienced a 21% decline because of lower regulatory fees after the reduction of the SEC Section 31 transaction fee rate and improved liquidity rebate capture due to increased stock and options trading.

Key Developments

Interactive Brokers continues to witness substantial growth in customer accounts and assets under management:

- Customer Accounts : Increased by 32% to 4.13 million, highlighting a growing customer base and market penetration.

- Customer Equity : Rose by 40% to $757.5 billion, demonstrating higher customer engagement and investment activity.

- Daily Average Revenue Trades (DARTs) : Gained a 34% increase to 3.62 million, indicative of higher trading volume and customer activity.

Comments from Company Officers

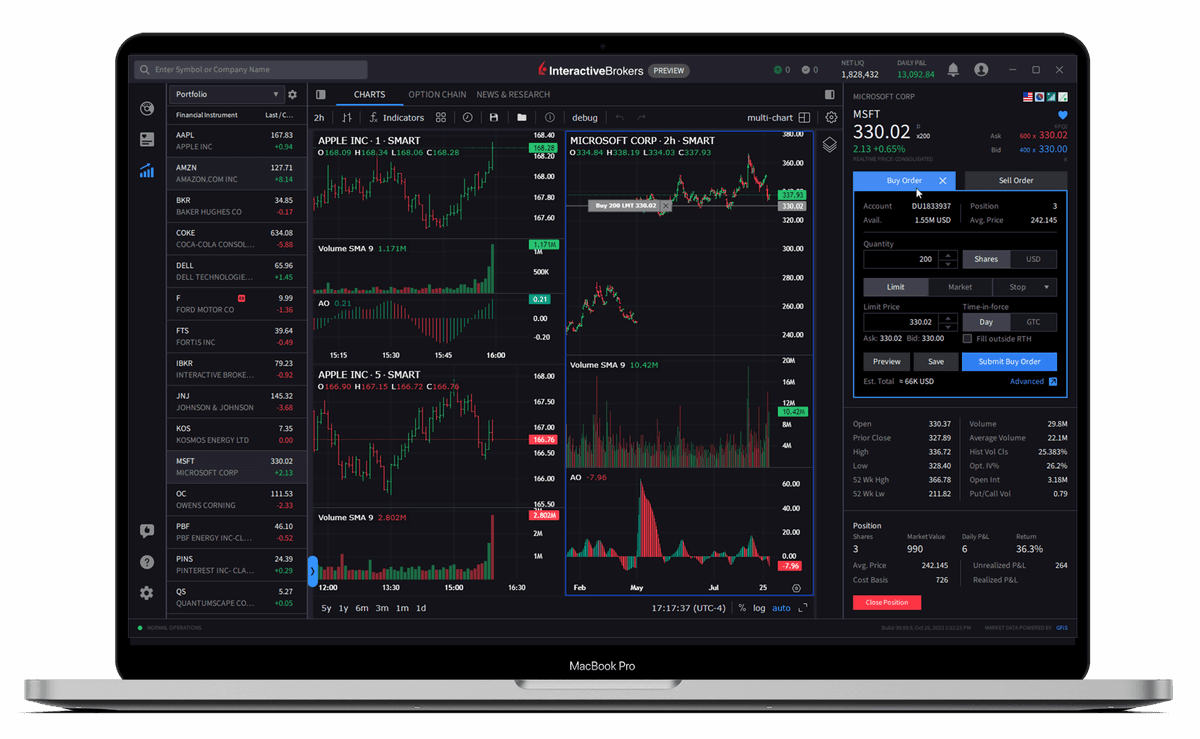

Company executives underscored their strategic focus on enhancing customer experience and expanding technological capabilities to maintain competitive advantage. The financial improvements are a testament to Interactive Brokers' commitment to advancing its comprehensive trading platform while managing operational costs effectively.

Dividends and Share Repurchases

The Board of Directors declared a quarterly cash dividend of $0.08 per share, payable on December 12, 2025, to shareholders of record as of December 1, 2025. This reflects Interactive Broker's strategy to return capital to shareholders while maintaining robust financial stability and reinvesting for growth.

Interactive Brokers Group Inc Stock Forecast

Based on the latest financial performance and market conditions, Interactive Brokers showcases potential for further growth momentum. Analysts project high and low stock price scenarios based on:

- Continuing strong customer account expansion and engagement.

- Sustained growth in trading volumes and interest income in favorable market conditions.

- Potential volatility from regulatory changes and currency diversification strategy.

High Projection estimates suggest the stock could climb to around $100, considering sustained growth and robust market conditions. Conversely, a Low Projection places the stock at approximately $85, factoring in possible economic slowdown impacts. The current market cap stands at approximately $13.17 billion, signaling investor confidence despite the slightly reduced last trading price.

In conclusion, Interactive Brokers Group Inc's recent earnings underscore a solid financial performance coupled with strategic initiatives aimed at growth and expansion. While market challenges persist, the company remains poised for continued success, driven by its comprehensive technological platform and expanding customer base.