Hancock Whitney Earnings

Hancock Whitney Corporation reported robust financial results for the fourth quarter of 2024, showcasing significant strides in both earnings and fiscal health. This quarter's financial achievements contribute to an optimistic outlook for the company as it prepares to enter 2025 with strengthened capital positions and strategic advancements.

Financial Metrics Overview (in USD)

| Metric | Q4 2024 | Q3 2024 | Q4 2023 (Excl. Supplemental) | YoY Change | QoQ Change |

|---|---|---|---|---|---|

| Net Income | $122.1 million | $115.6 million | $50.6 million ($1.26 per share) | +141%* | +6% |

| EPS (Diluted) | $1.40 | $1.33 | $0.58 ($1.26 adjusted) | +141%* | +5% |

| Revenue | $276.3 million (net interest) | $274.5 million | Not provided | N/A | +1% |

(*) YoY change based on adjusted EPS figure from Q4 2023.

Hancock Whitney saw substantial improvement in net income and earnings per share (EPS) in Q4 2024 compared to the previous year. This substantial growth reflects effective management strategies leading to cost efficiencies and enhanced net interest margins.

Hancock Whitney Results

The corporation's significant growth in earnings as highlighted by the 141% year-over-year increase in both net income and EPS indicates a remarkable turnaround from the challenges of previous periods. The quarterly increment in revenue by 1% is indicative of steady performance augmented by strategic financial management.

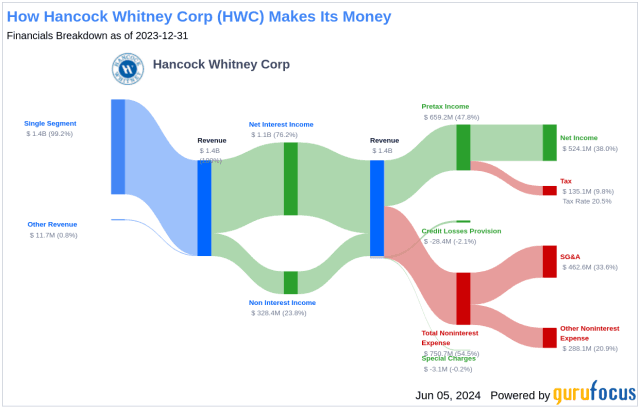

Revenue Breakdown

Segment Performance Overview

| Segment | Q4 2024 Revenue | QoQ Change |

|---|---|---|

| Loans | $23.3 billion (Total loans) | Decreased by 1% |

| Deposits | $29.5 billion (Total deposits) | Increased by 2% |

Despite a 1% decline in total loans compared to the prior quarter, deposits increased by a healthy 2%. This showcases Hancock Whitney's successful focus on enhancing its deposit base, both interest-bearing and noninterest-bearing, which will likely provide more robust financial footing moving forward.

Key Developments

Some of the significant developments during the quarter include: - The allowance for credit losses (ACL) stabilized, with coverage solidifying at 1.47%, showing a negligible increase of 1 basis point from the preceding quarter. - A slight rise in nonaccrual loans to $97.3 million, up from $82.9 million in Q3, was observed, yet it remains within manageable levels. - A buoyant common equity tier 1 (CET1) ratio stood at 14.14%, symbolizing a robust capital structure. - A notable achievement was the acquisition of Sabal Trust Company, aligning with strategic expansion goals.

Comments from Company Officers

John M. Hairston, Hancock Whitney's President & CEO, commented on the results: "The results for Q4 2024 mark a strong end to our 125th anniversary year. Our team has delivered impressive growth in ROA and regulatory capital ratios, and we are well-prepared to pursue further opportunities in 2025, including our strategic acquisition of Sabal Trust Company." This acquisition is poised to enhance Hancock Whitney's wealth management capabilities.

Dividends and Share Repurchases

The company finalized its previous share buyback program by repurchasing 150,000 shares at an average cost of $52.50 each. Further boosting shareholder value, Hancock Whitney has authorized a new share repurchase program, allowing up to 5% of outstanding common stock repurchases starting January 1, 2025. This move aims to optimize capital structure and reward shareholders consistently.

Hancock Whitney Stock Forecast

Following the positive earnings report, Hancock Whitney's stock experienced a commendable 2.71% uptick. With its current trajectory, the stock price, which last settled at $60.70, could see further gains. Utilizing a fundamental analysis that encapsulates the company's recent financial performance, acquisition strategies, stock price trends, and a market cap of $4,017,047,196, stock price projections range from a low of $62 to a high of $68 by the end of the fiscal year. These predictions consider continued operational improvements and effective management initiatives steering future growth.

In conclusion, Hancock Whitney Corporation concluded 2024 on a high note with substantial financial gains, strengthened reserves, and strategic acquisitions. As it enters its 126th year, the corporation is well-set for continued growth, supported by robust capital management and vigilant operational strategies.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.