FuelCell Energy Earnings

FuelCell Energy, Inc. has released its financial results for the fourth quarter of its fiscal year 2024, which ended on October 31, 2024. Despite facing financial challenges, the company showcases significant revenue growth, strengthened by its strategic restructuring and robust demand for its products.

Key Financial Metrics

| Metric | Q4 2024 | Q4 2023 | Year-over-Year Change |

|---|---|---|---|

| Total Revenue | $49.3 million | $22.5 million | +120% |

| Gross Loss | $(10.9) million | $(1.5) million | N/A |

| Loss from Operations | $(41.0) million | $(36.4) million | N/A |

| Net Loss per Share | $(2.21) | $(2.07) | N/A |

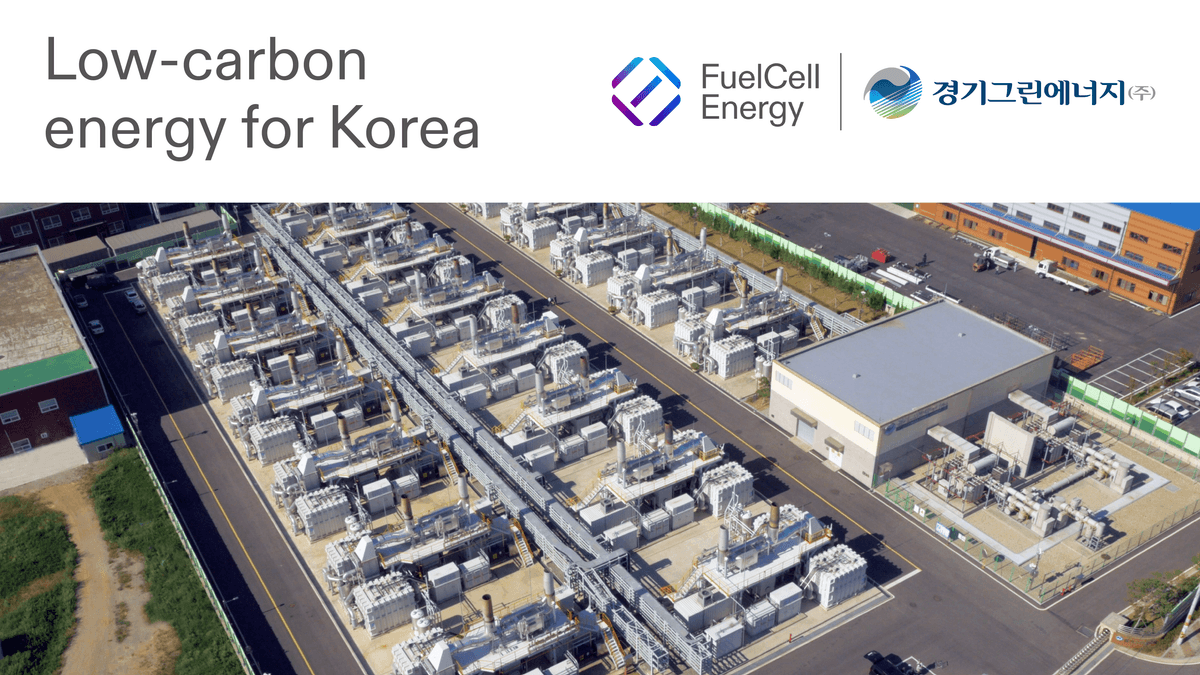

With total revenue increasing by 120% year-over-year, predominantly due to sales to Gyeonggi Green Energy Co., Ltd., FuelCell Energy has shown capacity for growth. However, the quarter was marred by increased operational losses and a raised net loss per share compared to the same period last year, emphasizing the financial challenges the company still faces.

FuelCell Energy Results

FuelCell Energy's earnings reflect mixed progress as the company achieved considerable revenue growth while grappling with expanding operational losses. Despite these challenges, the company remains focused on seizing opportunities to solidify its market position.

- Total Revenue: Total revenue for the quarter was reported at $49.3 million, a notable increase from $22.5 million in the previous year, showcasing robust business development, largely propelled by sales activities with Gyeonggi Green Energy Co., Ltd.

- Earnings Per Share (EPS): The company reported a net loss per share of $(2.21), indicating deteriorating profitability compared to $(2.07) in Q4 2023.

Although the company reported a significant revenue increase, its gross loss margins and operations losses highlight the ongoing financial difficulties. Addressing these issues will be crucial for establishing financial stability in the upcoming fiscal years.

Revenue Breakdown

Revenue performance across major segments has demonstrated substantial growth in the fourth quarter under review. The following is a detailed breakdown by segment:

| Segment | Q4 2024 | Q4 2023 | Change (%) |

|---|---|---|---|

| Product Revenues | $25.4 million | $10.5 million | +141% |

| Service Agreements | $5.6 million | $(0.8) million | N/A |

| Generation Revenues | $12.0 million | $8.5 million | +40.3% |

| Advanced Tech Contract Rev. | $6.4 million | $4.3 million | +48.8% |

The Product Revenues segment notably jumped 141%, largely fueled by agreements with Gyeonggi Green Energy Co., Ltd. Additionally, Service Agreements turned positive against a negative figure in Q4 2023, marking a notable shift in operational effectiveness and client demand. The positive trajectory across all segments reflects FuelCell Energy's continuous improvement and growth strategies.

Key Developments

This quarter's results accompany significant developments within FuelCell Energy's operations:

- Restructuring Announcement: A global restructuring plan was unveiled to strategically reduce operational costs and streamline resource allocation towards core technologies.

- Workforce Optimization: The workforce saw a reduction of around 13%, aimed at optimizing operations while taking advantage of existing opportunities and fostering innovation.

- Strengthened Financial Partnerships: The company expanded relationships with notable financial organizations, such as the Export-Import Bank of the United States, fortifying its future financing capabilities.

- Backlog Increase: The company's backlog increased by 13.1% to reach $1.16 billion, indicative of substantial contractual agreements that promise steady future revenue streams.

Comments from Company Officers

Jason Few, FuelCell Energy's President and CEO, expressed optimism amidst current financial challenges. He stated, "Despite financial hurdles, we believe our global restructuring will stabilize FuelCell Energy's financial platform, enabling us to capitalize on strong international energy demand. Our focus remains on enhancing distributed power generation technologies to drive substantial revenue growth in fiscal year 2025 and beyond."

Dividends and Share Repurchases

FuelCell Energy has not declared any dividends or engaged in a share repurchase program, directing capital toward operational improvements and growth initiatives instead.

FuelCell Energy Stock Forecast

Given the current financial performance, key contracts, and strategic restructuring, we present the following projections for FuelCell Energy's stock:

- High Projection: Based on anticipated revenue from contracted drivers and improved operational efficacy post-restructuring, the high projection for the stock price could reach approximately $12.50.

- Low Projection: Accounting for potential financial hurdles amidst strategic adjustments, the low projection could see the stock price descend to approximately $9.00.

The company's shares have recently been trading at $10.38, with an after-event price change of -7.16%. These projections are contingent on successful implementation of operational improvements and continued demand fulfillment. As the company enhances its foundational strategies, potential for improved stock performance in the coming fiscal year remains a viable prospect.