Comtech Telecommunications Earnings

Comtech Telecommunications Corp., recognized globally for its communications technology proficiency, has released its first fiscal quarter results for 2025. The company navigated through a challenging quarter, marked by a decline in revenue, amidst the backdrop of a changing communication industry landscape. Key financial figures depict significant challenges but also highlight potential for growth in certain segments.

| Financial Metric | Q1 2025 | Q1 2024 (YoY Change) |

|---|---|---|

| Total Revenue | $115.8 million | (23.8)% |

| Operating Income (Loss) | ($129.2 million) | N/A |

| Net Loss | ($148.4 million) | N/A |

| Adjusted EBITDA (Loss) | ($19.4 million) | N/A |

| Funded Backlog | $811.0 million | N/A |

Comtech Telecommunications Results

In the first quarter of 2025, Comtech reported a total revenue of $115.8 million, indicating a 23.8% year-over-year decline. The company's operating loss stood at $129.2 million, with a net loss amounting to $148.4 million. Notably, the company did not provide earnings per share data, but the figures reflect substantial headwinds, notably in their Satellite & Space Communications segment. A key highlight, however, is the company's funded backlog, which stood strong at $811.0 million, signaling potential future revenue streams.

Revenue Breakdown

Comtech's revenue performance varied across its major business segments:

| Segment | Revenue | YoY Change |

|---|---|---|

| Satellite & Space Communications (S&S) | $58.9 mln | (42.5)% |

| Terrestrial & Wireless Networks (T&W) | $56.9 mln | 14.9% |

-

Satellite & Space Communications (S&S) : The S&S segment faced significant challenges with a 42.5% revenue decline due to reduced sales and strategic divestitures. Despite this setback, the segment secured impactful new contracts, such as a $50 million deal with the U.S. Navy, indicative of its capability to rebound strongly.

-

Terrestrial & Wireless Networks (T&W) : The T&W segment displayed resilience with a revenue growth of 14.9%, driven by new contract acquisitions and existing contract renewals. A noteworthy achievement was a $30 million contract for 911 call routing services, underscoring the segment's potential for sustained growth.

Key Developments

The first fiscal quarter of 2025 was pivotal for Comtech due to several strategic initiatives and developments:

-

Leadership Transition : Ken Traub assumed the role of President and CEO while maintaining his duties as Chairman, reinforcing stability in leadership.

-

Strategic Contracts : Comtech secured high-value contracts, including a noteworthy $50 million award from the U.S. Navy, which is expected to bolster future revenue prospects.

-

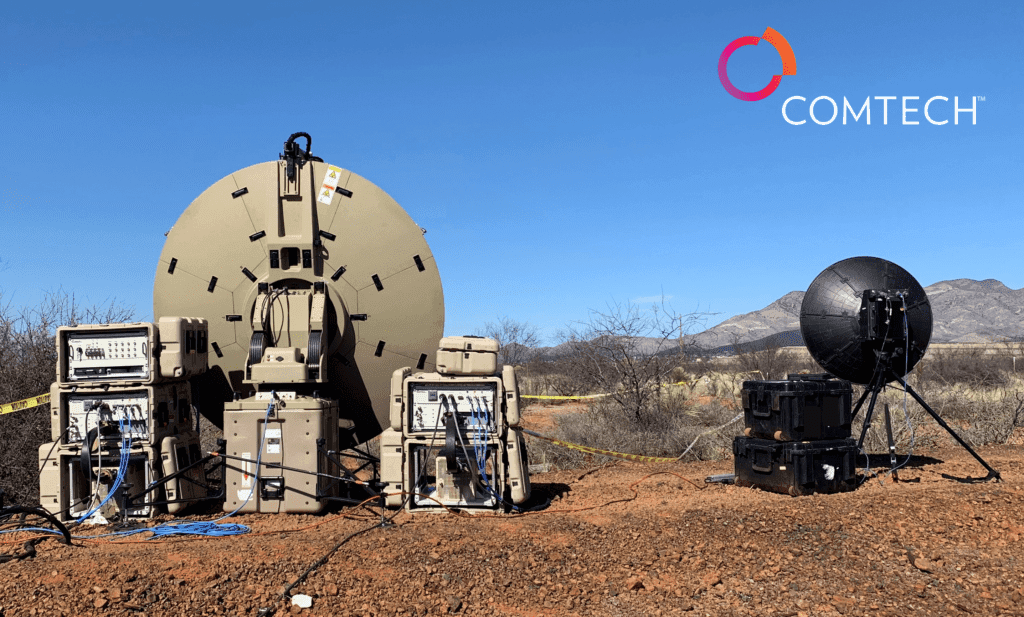

Innovation Launch : Introduction of the Digital Common Ground (DCG) modem platform, targeting both U.S. government and commercial sectors, signifies Comtech's commitment to technological innovation and market expansion.

-

Strategic Alternatives Review : The commencement of a comprehensive review to explore strategic alternatives aimed at bolstering financial performance and enhancing market competitiveness.

Comments from Company Officers

In the latest earnings announcement, newly appointed President and CEO Ken Traub shared insights into the company's strategic direction. He emphasized Comtech's strong technological foundations and influential industry relationships. Traub's strategic vision includes enhancing operational discipline, optimizing processes, and evaluating strategic alternatives to fortify Comtech's financial and market standing.

Dividends and Share Repurchases

No announcements regarding dividend distribution or share repurchase programs have been made for this quarter. This may suggest a focused effort on reinvesting in growth opportunities and strategic initiatives.

Comtech Telecommunications Stock Forecast

Following the earnings release, Comtech's stock price experienced a positive movement with an approximate increase of 6.17%. The company’s performance in securing substantial contracts and launching innovative platforms leaves room for positive stock performance. Looking ahead, with an existing market cap of $88,898,619 and a last stock price of $4.13, projections for Comtech's stock price remain cautiously optimistic:

- High Projection : Based on potential contract fulfillment and successful strategic realignment, the stock could see an upside, reaching approximately $5.00.

- Low Projection : Should external challenges persist and dampen performance recovery, the stock might stabilize around $3.50.

Overall, Comtech Telecommunications remains committed to navigating through current challenges by leveraging its robust product portfolio, strategic partnerships, and forward-thinking leadership direction to drive sustainable growth and shareholder value enhancement in the long term.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.