Bunge Global SA Earnings

Bunge Global SA (NYSE:BG) has released its financial results for the fourth quarter of 2024, showcasing a blend of resilience and strategic advancement despite encountering external headwinds. The company demonstrated a robust performance with its GAAP Diluted Earnings Per Share (EPS) enhancing year-over-year, although adjusted figures showed a decline due to market dynamics.

Key Financial Metrics

| Metric | Q4 2024 | Q4 2023 | YoY Change |

|---|---|---|---|

| GAAP Diluted EPS | $4.36 | $4.18 | +4.3% |

| Adjusted Diluted EPS | $2.13 | $3.70 | -42.4% |

| Full-Year GAAP Diluted EPS | $7.99 | $14.87 | -46.3% |

| Full-Year Adjusted Diluted EPS | $9.19 | $13.66 | -32.7% |

The full-year financial performance highlights a notable decrease in both GAAP and adjusted EPS figures, painting a picture of 2024 as a year filled with operational adjustments and strategic maneuvers in response to shifting market conditions.

Bunge Global SA Results

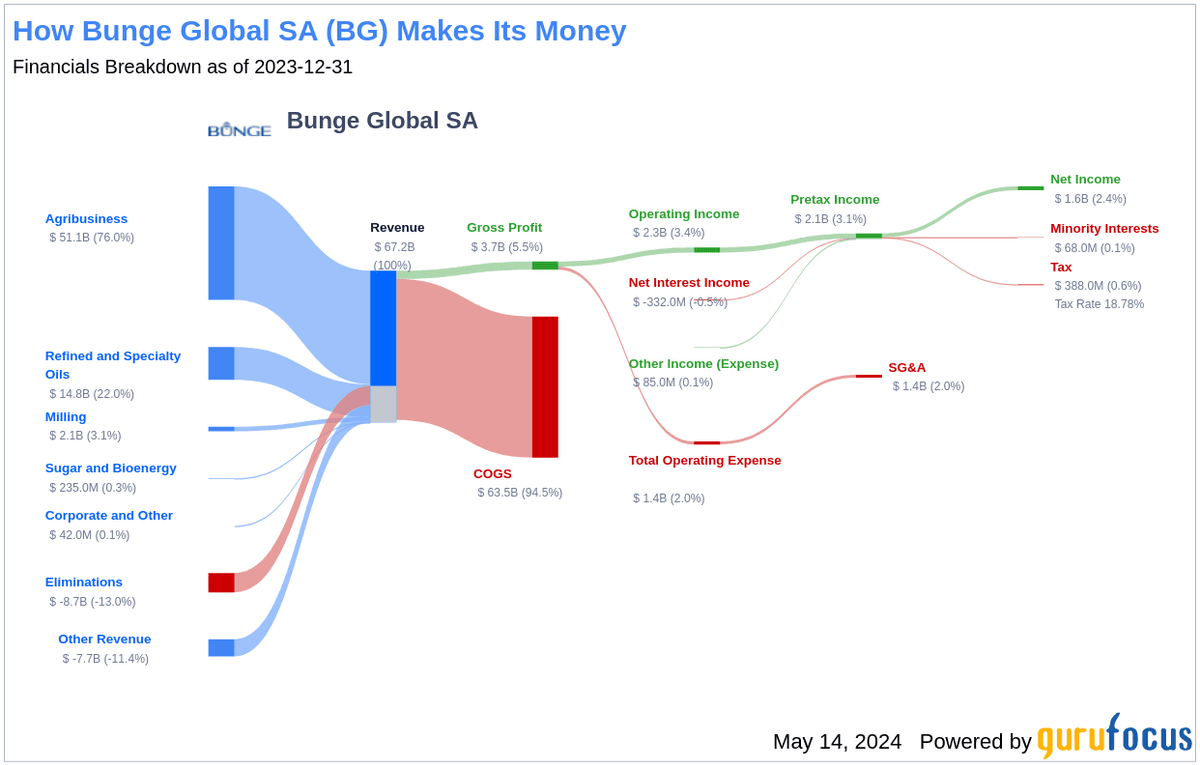

Revenue Breakdown

Bunge's diverse portfolio saw mixed returns across its various segments, with noteworthy performances meriting discussion:

| Segment | Q4 2024 Performance | Previous Guidance |

|---|---|---|

| Agribusiness - Processing | Lower in North & South America | Met internal forecasts |

| Agribusiness - Merchandising | Higher | Surpassed expectations |

| Refined & Specialty Oils | Lower in North America | Lagged behind expectations |

| Milling | Higher in North America | Exceeded expectations |

Analysis : - Agribusiness : While there was a decline in processing, the merchandising arm delivered robust results, driven largely by strong dynamics in global grains and ocean freight sectors. - Refined & Specialty Oils : This segment faced pressure due to a more balanced supply-demand equilibrium in North America, reflecting in its subdued performance. - Milling : Exhibited strong results particularly in North America, which partially offset softer outcomes elsewhere, marking it as a segment of growth and opportunity for Bunge.

Key Developments

Bunge's strategic objectives and operational focus demonstrate significant advancements. Notable achievements of the quarter include:

- The completion of 100% traceability and monitoring goals within its Brazilian sustainability initiatives, underscoring the company's environmental commitment.

- Progress in forming strategic alliances and divesting its sugar and bioenergy joint venture, indicating a clear focus on core competencies and future growth segments.

- A substantial share repurchase program with $500 million in shares repurchased during Q4 alone, summing to a total of $1.1 billion for the year.

Comments from Company Officers

Greg Heckman, CEO of Bunge, provided insights into the quarter's results. He stressed the progress in integrating plans for the impending merger with Viterra, which remains subject to regulatory approvals. His commentary also spotlighted the company's dedication to sustainability goals and productivity enhancements amid uncertain geopolitical landscapes affecting long-term forecasts.

Dividends and Share Repurchases

While no specific dividend declaration was highlighted in the report, Bunge continued its proactive share repurchase strategy by allocating $500 million towards share buybacks in Q4. This approach underscores the company's strategy to return capital to shareholders, indicative of management's confidence in Bunge's intrinsic value.

Bunge Global SA Stock Forecast

Given the financial outcomes and strategic efforts discussed, Bunge Global SA's share price is projected to navigate the $72 to $80 range. This forecast aligns with recent financial performances and growth strategies, offering a conservative yet optimistic outlook on future stock valuation. The company's market capitalization, currently standing at $15.24 billion, reflects a solid foundation underscoring its operational capabilities and strategic potential.

In conclusion, Bunge Global SA's Q4 2024 financial results highlight a year of tactical resilience, characterized by both challenges and achievements in equal measure. As the company progresses into 2025, it remains positioned to capitalize on growth opportunities while carefully navigating external uncertainties that shape its market environment.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.