Bilibili Inc. Reports Financial Results for Q3 2024

Overview Bilibili Inc., a leading Chinese video community, has announced its unaudited financial results for the third quarter ending September 30, 2024.

Key Financial Metrics

| Metric | Q3 2024 | Q3 2023 (YoY) | Consensus Estimates | Variance from Estimates |

|---|---|---|---|---|

| Total Revenue (USD) | $1,041.0 million | +26% | $1,079 million | -3.52% |

| Earnings Per Share (EPS, USD) | ($0.03) | +94% | $0.91 | Below Expectations |

| Gross Profit (USD) | $363.0 million | +76% | - | - |

| Net Loss (USD) | $11.4 million | -94% | - | - |

Financial Performance Interpretation Despite missing revenue and EPS consensus estimates, Bilibili has significantly reduced its net loss by 94% year-over-year and achieved its first non-GAAP net profit. A substantial increase in gross profit and margin reflects improved commercialization efficiency and a strong performance from high-margin segments.

Revenue Performance by Segment

| Segment | Q3 2024 Revenue (USD) | Q3 2023 (YoY) |

|---|---|---|

| Mobile Games | $259.7 million | +84% |

| Advertising | $298.5 million | +28% |

| Value-Added Services (VAS) | $402.0 million | +9% |

| IP Derivatives and Others | $80.8 million | -2% |

Segment Performance Interpretation Mobile games posted the most robust growth at 84% year-over-year, driven by a successful game title. Advertising revenues also increased appreciably due to enhancements in product offerings. The segment diversification highlights Bilibili's strength in monetizing its digital content efficiently.

Key Developments and Operational Highlights - Achieved first non-GAAP net profit. - Daily active users (DAUs) reached 107 million, while monthly active users (MAUs) hit 348 million. - Users’ average daily time spent increased to 106 minutes.

Comments from Company Officers Rui Chen, Chairman and CEO, emphasized strong community metrics and commercial growth potential, highlighting DAUs and MAUs records. The focus will proceed toward long-term value creation through enhancing commercial capabilities and reinforcing community empowerment. CFO Sam Fan noted significant revenue growth from high-margin segments and the subsequent margin expansion, pointing to the business model's elasticity.

Dividends and Share Repurchase Program Bilibili announced a US$200 million share repurchase program authorized by its board, with plans for funding from its existing cash reserves.

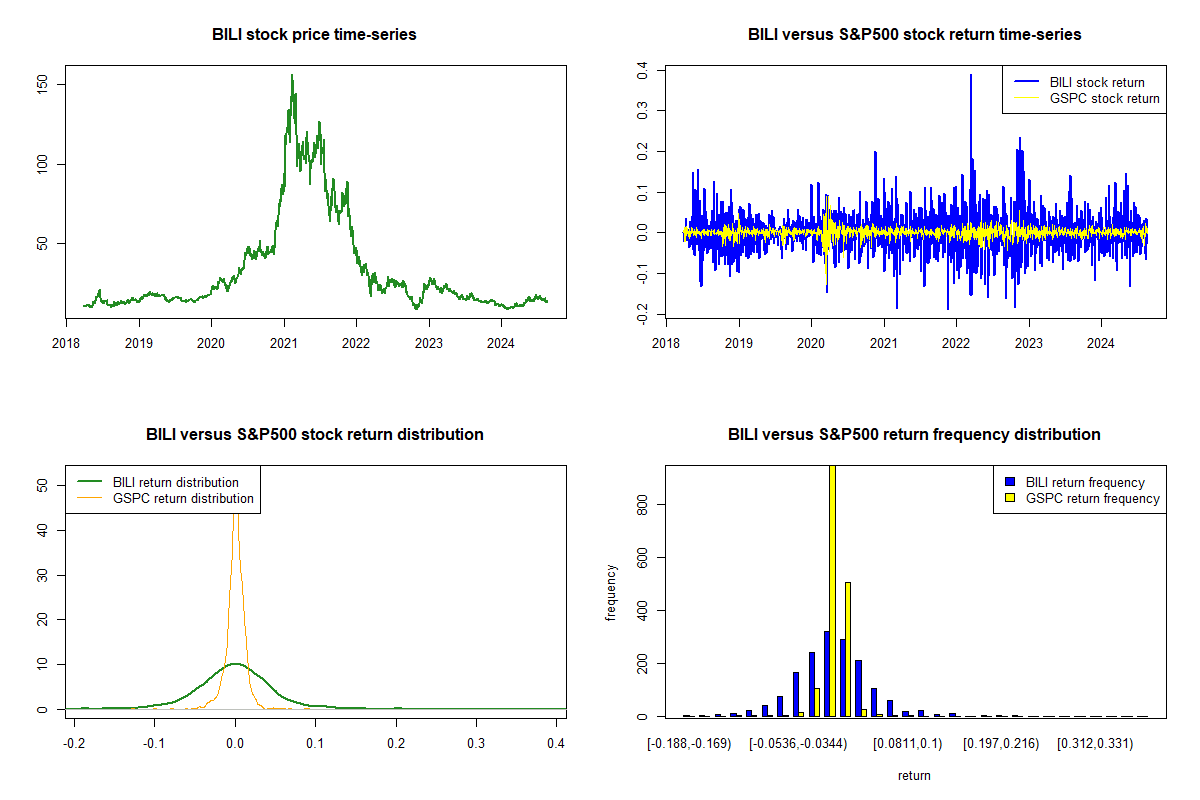

Forward Guidance and Stock Price Movement The company did not provide forward guidance in the release. Following the earnings announcement, Bilibili’s stock experienced a slight increase of approximately 0.90%.

These results signify Bilibili’s strategic progression in operational efficiency and community engagement, painting an optimistic future scenario despite missing some financial estimates.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.