Arbe Robotics Ltd. Announces Third Quarter 2024 Financial Results

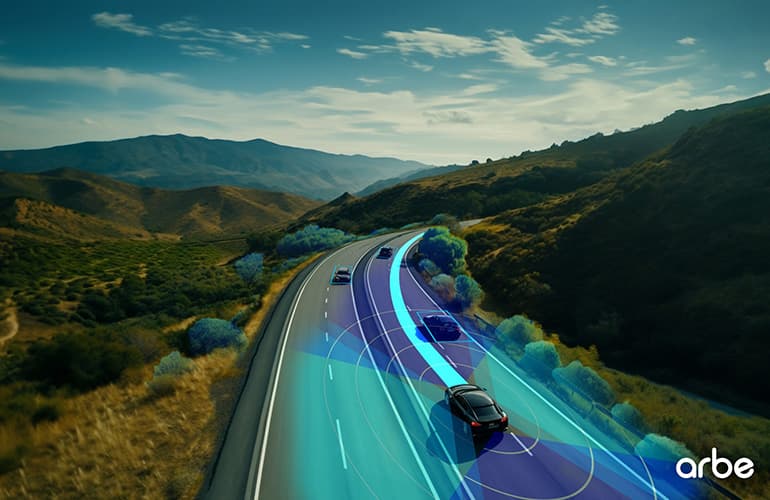

TEL AVIV, Israel, Nov. 27, 2024 – Arbe Robotics Ltd. (NASDAQ: ARBE), a leader in Perception Radar Solutions, reported its financial results for the third quarter, ended September 30, 2024.

Key Financial Metrics

| Metric | Q3 2024 | Q3 2023 | Year-over-Year |

|---|---|---|---|

| Revenue | $0.1 million | $0.5 million | -80% |

| Gross Profit | -$0.3 million | $0.1 million | N/A |

| Operating Expenses | $12.2 million | $11.7 million | 4.3% |

| Net Loss | $12.6 million | $11.7 million | N/A |

| Adjusted EBITDA | -$8.2 million | -$7.5 million | N/A |

Financial Performance Analysis: In the third quarter of 2024, Arbe's revenue decreased by 80% compared to the previous year, primarily due to lower-than-expected uptake and ongoing development cycles. Negative gross profit resulted from a fixed cost base amidst reduced revenue. Operating expenses increased slightly, reflecting higher investments in both outsourced and in-house resources. The company reported a widened net loss, signaling ongoing financial challenges.

Revenue Performance by Segment

A breakdown table is not available as segment-specific revenue data was not disclosed in the earnings release.

Segment Performance Analysis: Despite missing detailed segment-specific data, Arbe's recent strategic engagements with OEMs and Tier-1 collaborators, including deals with HiRain Technologies and Sensrad, suggest a focused push in the automotive radar technology space, positioning the firm for future growth.

Key Developments and Operational Highlights

- Significant growth in OEM engagements, including active processes with 16 OEMs and partnership advancement with 8 entering advanced phases.

- Collaborations with Tier-1s HiRain Technologies and Sensrad on radar technology adoption in ADAS systems and 4D imaging radars.

- Successful capital raise of up to $49 million to support production ramp-up plans for 2025.

- Increasing interest in radar technology from new verticals outside of automotive, reflected in burgeoning market opportunities.

Executive Commentary

Kobi Marenko, CEO, highlighted Arbe's progress in OEM testing and delivering critical milestones alongside Tier-1 partners. Despite elongated selection timelines, the company remains optimistic about achieving its design-in objectives. The successful capital raise underscores strong investor confidence, supporting Arbe's long-term vision.

Dividends or Share Repurchase Program

The earnings release did not mention any new dividends or share repurchase programs.

Forward Guidance

Arbe projects its 2024 annual revenues to align with 2023 levels, anticipating growth in 2025 as full production commences. The company emphasizes strategic focus on producing its radar chipset.

Stock Price Movement Post-Earnings Release

After the earnings announcement, Arbe's stock experienced a decline of approximately 1.04%.

Arbe continues to drive technological advancements within the radar solutions market, poised to expand its influence across the automotive and emerging sectors.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.