Alibaba Group's Third-Quarter Financial Results for 2024

Overview:

Alibaba Group Holding Limited (NYSE: BABA) announced its financial results for the quarter ending September 30, 2024.

Key Financial Metrics:

| Financial Metric | Current Quarter | YoY Change |

|---|---|---|

| Total Revenue (USD) | $33.7 billion | +5% |

| Diluted EPS (USD) | $2.59 ADS | +74% |

| Non-GAAP Diluted EPS (USD) | $2.15 ADS | -4% |

| Net Income Attributable (USD) | $6.25 billion | +63% |

Interpretation: Alibaba's revenue grew by 5% year-over-year to $33.7 billion, driven by higher monetization rates on its Taobao and Tmall platforms. Net income showed a significant increase by 63% largely because of favorable mark-to-market changes in equity investments. However, non-GAAP net income decreased by 9%, reflecting increased investments in e-commerce.

Revenue Performance by Segment:

| Segment | Revenue (USD) | YoY Change |

|---|---|---|

| China Commerce Retail | $13.25 billion | +0.5% |

| Cloud Intelligence Group | $4.22 billion | +7% |

| International Commerce | $3.65 billion | +35% |

| Cainiao Smart Logistics | $3.51 billion | +8% |

| Local Services | $2.53 billion | +14% |

| Digital Media and Entertainment | $0.81 billion | -1% |

Interpretation: The cloud segment continued its positive trajectory with a 7% increase, driven largely by its strong AI-offerings performance. The international commerce business showed vigorous growth, supported by the expansion of AliExpress and Trendyol. Despite a minor decline, the digital media division reported better operational efficiency with reduced losses.

Key Operational Developments:

- Taobao and Tmall Enhancements: Introduction of software service fees based on GMV to boost monetization, alongside strategic initiatives for improved user experience.

- Cloud Intelligence Recognition: Alibaba Cloud named leader in AI and public cloud platforms by industry reports.

- 11.11 Global Shopping Festival: Achieved robust GMV growth and a record number of purchasers.

- Share Buyback Program: Repurchased $4.1 billion in shares, reducing total shares outstanding by 2.1%.

Executive Commentary:

CEO Eddie Wu emphasized continued investment in cloud infrastructure and AI technologies. The expectation is that collaborations in logistics will accelerate growth. CFO Toby Xu highlighted the successful reduction in outstanding shares contributing to earnings accretion.

Dividends and Share Repurchase Program:

- Share Repurchase: Total of $4.1 billion in share buybacks in the quarter ended September 30, 2024.

- Remaining Authorization: $22 billion in the share repurchase program, effective through March 2027.

Forward Guidance:

No specific forward guidance provided. However, reiteration of commitment to growth-driven investments in core business segments and continuation of strategic buybacks and technological advancements.

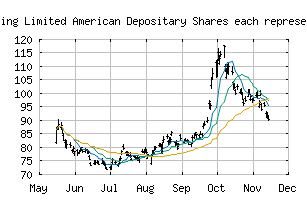

Stock Price Movement Post-Release:

- After the earnings release, Alibaba shares saw a decline of approximately 1.54%.

This concise earnings summary reflects Alibaba's overall strategic positioning towards sustained growth in its diverse business segments, supported by vital technological investments and strategic measures to enhance shareholder value.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.