Alarum Technologies Ltd. Reports Third Quarter 2024 Financial Results

Alarum Technologies Ltd. (Nasdaq, TASE: ALAR), a global provider of internet access and web data collection solutions, released its financial results for the third quarter ended September 30, 2024.

Key Financial Metrics

| Metric | Q3 2024 | Q3 2023 | YoY Change | Consensus |

|---|---|---|---|---|

| Total Revenue | $7.2M | $6.7M | +7% | $7M |

| Earnings per Share (EPS) | $0.04 | N/A | N/A | $0.04 |

Alarum's financial performance for the third quarter showcases a solid revenue achievement, with figures at the high-end of its guidance. The revenue growth was primarily driven by its enterprise internet access business, NetNut. Earnings per share met Wall Street consensus, reflecting Alarum's ability to maintain profitability.

Revenue Performance by Segment

| Segment | Q3 2024 | Q3 2023 | YoY Change |

|---|---|---|---|

| NetNut | $7.0M | $6.1M | +14.8% |

| Other Revenues | $0.2M | $0.6M | -66.7% |

NetNut continued to be a significant driver of Alarum's growth, registering a 14.8% year-over-year revenue increase. The company’s strategic decision to focus on this segment has yielded positive results, offsetting a decline in other revenue streams.

Key Developments and Operational Highlights

- Enhanced IP Proxy Network infrastructure, coverage, and endpoints.

- Launched a user-friendly dashboard receiving positive customer feedback.

- Achieved a strategic cross-sell with the Website Unblocker product.

- Net Retention Rate (NRR) reached 1.42 as of September 30, 2024.

Comments from Company Officers

CEO Shachar Daniel emphasized the importance of the strategic shift to focus on the NetNut segment, which is integral to Alarum's profitable business model and long-term growth plan. He noted the successful expansion of the company's offerings and an extensive evaluation by a Fortune 200 company, leading to the rapid adoption of the new Website Unblocker product.

Forward Guidance

Alarum projects revenues for the fourth quarter of 2024 to be in the range of $7.5 million, with an Adjusted EBITDA expected between $1.3 million and $1.7 million. The company remains focused on leveraging strong cash generation to invest in long-term growth opportunities.

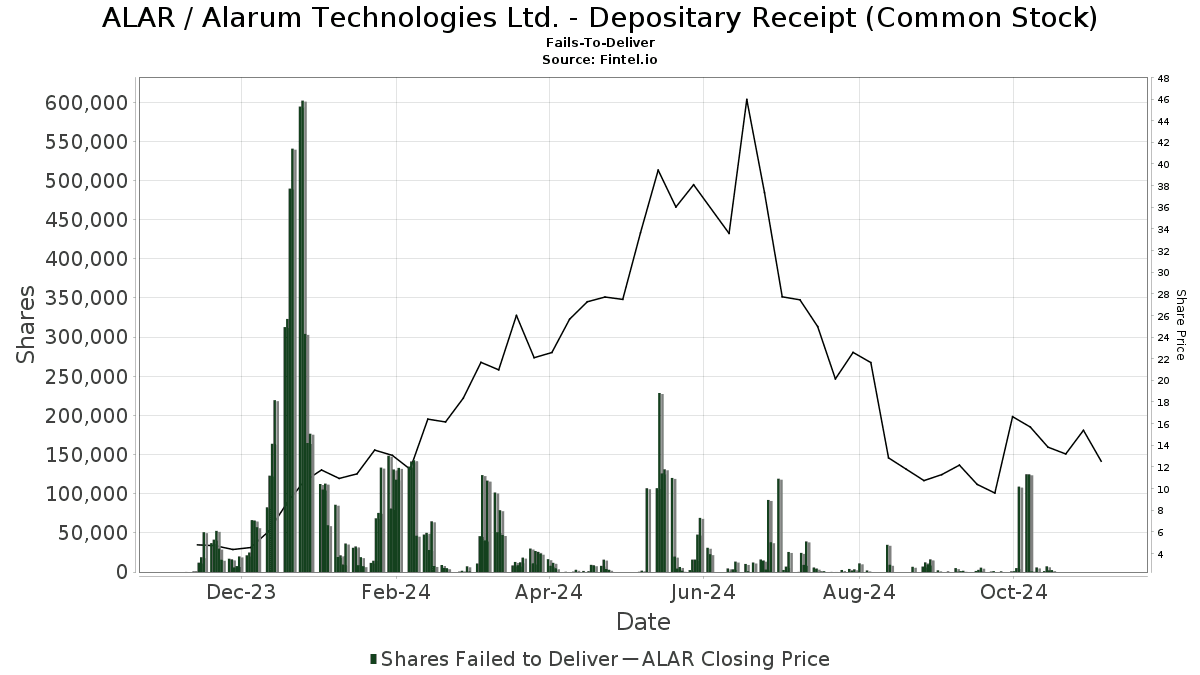

Stock Price Movement

Following the earnings release, Alarum's stock price experienced a significant increase, moving up by approximately 14.37%.

Alarum Technologies Ltd. continues to demonstrate robust performance through strategic focus and innovation, taking pivotal strides in its market segments and setting a strong foundation for sustained future growth.

For more in-depth analysis and insights, stay tuned with our platform to stay ahead of the market.