Descartes Systems Group Inc Earnings

Descartes Systems Group Inc., a leader in software-as-a-service solutions for logistics-intensive businesses, recently announced its impressive financial results for the fiscal 2025 fourth quarter (Q4FY25) and the full year ended January 31, 2025. The company demonstrated significant growth across various financial metrics and continued to expand its global logistics network, meeting and exceeding industry expectations despite macroeconomic challenges.

Descartes Systems Group Inc Results

To provide a clear overview of Descartes' financial performance, key metrics from FY25 and Q4FY25 compared to the previous fiscal period are tabulated below.

| Metric | FY25 | FY24 | % Change YoY | Q4FY25 | Q4FY24 | % Change QoQ |

|---|---|---|---|---|---|---|

| Revenues (in millions) | $651.0 | $572.9 | +14% | $167.5 | $148.2 | +13% |

| Income from Operations (in millions) | $181.1 | $142.8 | +27% | $47.1 | $37.0 | +27% |

| Net Income (in millions) | $143.3 | $115.9 | +24% | $37.4 | $31.8 | +18% |

| Earnings Per Share (EPS) Diluted | $1.64 | $1.34 | +22% | $0.43 | $0.37 | +16% |

| Adjusted EBITDA (in millions) | $284.7 | $247.5 | +15% | $75.0 | $65.7 | +14% |

Descartes finished FY25 with overall revenues of $651.0 million, a robust 14% increase from the $572.9 million recorded in FY24. In Q4FY25 alone, they garnered $167.5 million in revenue, showing a quarter-over-quarter increase, underscoring their consistent growth trajectory.

Revenue Breakdown

The breakdown of revenue across Descartes' key segments reveals valuable insights into the company's performance for FY25:

| Revenue Segment | FY25 (in millions) | FY24 (in millions) | % Change YoY |

|---|---|---|---|

| Services Revenues | $590.2 | $520.9 | +13% |

| Professional Services & Other | $55.1 | Non-Specified | Not Provided |

| License Revenues | $5.7 | Non-Specified | Not Provided |

Analysis

Service revenues, which comprise the bulk of Descartes' income, were particularly strong, improving by 13% year-over-year. This performance reflects the successful integration and enhancement of Descartes’ Global Logistics Network—a cornerstone of its growth strategy. The augmentation of complementary services allowed the company to better cater to the diverse needs of shippers, carriers, and logistics providers in an increasingly complex global trade environment. On the professional services and license fronts, while specifics aren't drawn in comparison, these categories collectively contribute critical components to revenue, indicative of a diversified revenue model that can weather market changes.

Key Developments

FY25 witnessed Descartes achieving significant milestones. Notably, the company's efforts to broaden its Global Logistics Network paid off, enabling them to better navigate global trade uncertainties. The introduction of new services aligned well with customer needs for handling tariffs, sanctions, and supply chain complexities. Furthermore, the robust development of digital trade services positioned Descartes as a pivotal player in transportation invoice management and the streamlining of global trade data.

Consistent investments over the year not only expanded their service capability but also bolstered their position as a leader in logistics-based software solutions, evident from the rise in both market cap and operational efficiency.

Comments from Company Officers

Edward J. Ryan, CEO of Descartes, accentuated, "Fiscal 2025 was another year of growth, highlighted by the addition of numerous complementary services to the Global Logistics Network. We believe these investments can help shippers, carriers, and logistics services providers manage the increased uncertainty and complexity introduced to the global trade environment." Ryan's commentary boiled down to a pivotal strategy of leveraging expansive connectivity with global trade partners to ensure Descartes remains at the forefront of a dynamically evolving market landscape.

Dividends and Share Repurchases

Descartes did not report any specific dividend policy changes or active share buyback programs in the latest financial statements, suggesting potential reinvestments into business expansion or strategic acquisitions could be a focus moving forward.

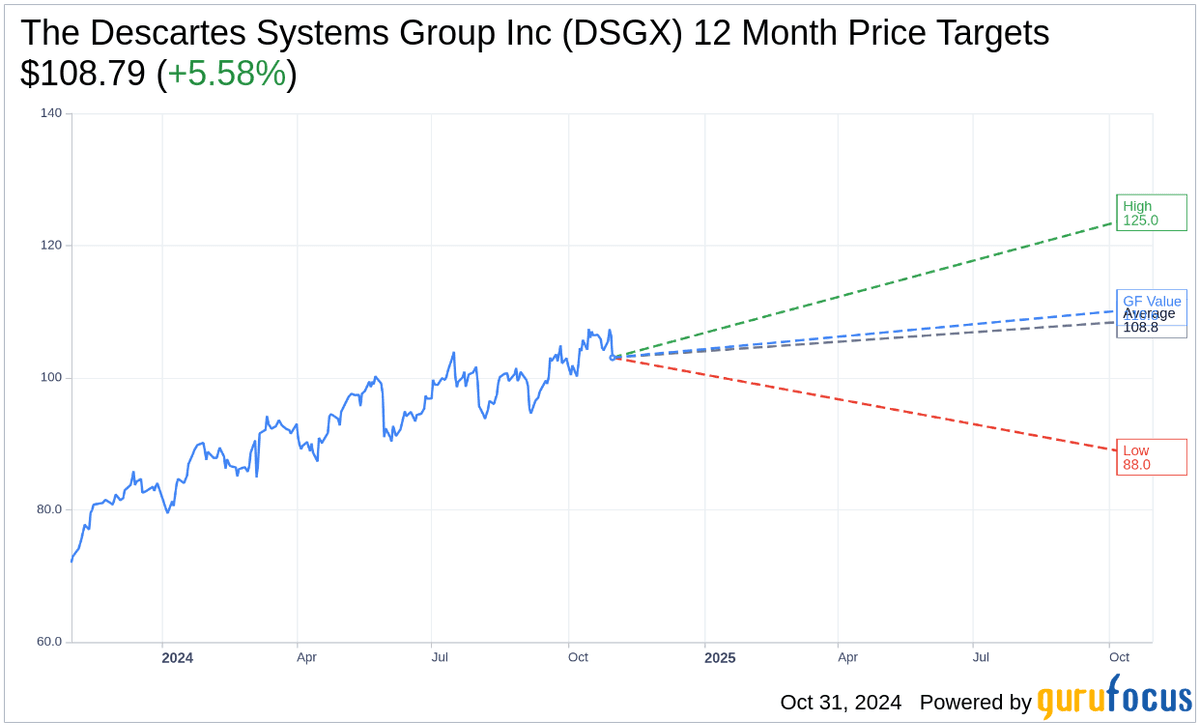

Descartes Systems Group Inc Stock Forecast

Based on Descartes' impressive revenue growth, strategic expansions, and continued strong earnings performance, projections for the stock's trajectory look promising. The company's market capitalization stands at approximately $8.3 billion, reflecting investor confidence in its ongoing strategy. While short-term market variables could introduce some volatility, a bullish high projection for Descartes' stock price could reach upwards of $2.05 in the coming fiscal period. Conversely, given potential regional and global trade challenges, a conservative forecast might set the lower limit around $1.80. These projections assume continued strong performance and market conditions aligned with present trends.

In conclusion, Descartes Systems Group Inc. continues to flourish, driven by strategic enhancements and a robust service portfolio. Their financial results underscore a well-executed strategy in adapting to, and thriving amidst, a complex global trade environment. With key initiatives in place, the company stands poised to capture future growth opportunities, solidifying its reputation as a leader in the global logistics solutions sphere.