Lantheus Holdings Inc Earnings Summary

Lantheus Holdings Inc., a leader in radiopharmaceutical solutions, recently announced its financial results for the second quarter of 2025. Despite the challenges posed by increased competition, Lantheus reported significant achievements and ongoing strategic initiatives to bolster its growth trajectory. The company recorded a worldwide revenue of $378 million, demonstrating its robust operational capacity in the face of market pressures.

Lantheus Holdings Inc Financial Results

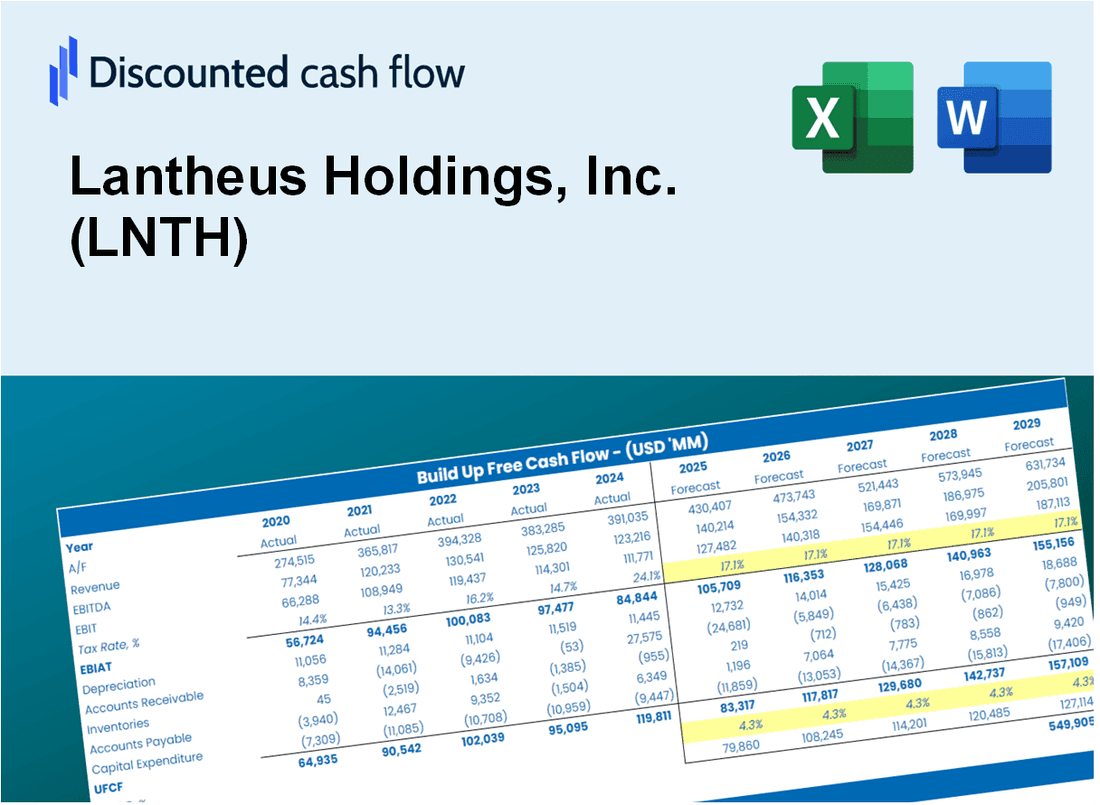

During the second quarter of 2025, Lantheus presented its key financial metrics, illustrating both progress and areas that need attention.

| Financial Metric | Q2 2025 | Q2 2024 | Year-over-Year Change |

|---|---|---|---|

| Total Revenue (in millions) | $378.0 | Not provided | - |

| GAAP Earnings Per Share (EPS) | $1.12 | $0.88 | +27.3% |

| Adjusted Earnings Per Share (EPS) | $1.57 | $1.80 | -12.8% |

| Free Cash Flow (in millions) | $79.1 | Not provided | - |

| Operating Income (in millions) | $88.0 | Not provided | -14.4% |

| Adjusted Operating Income (in millions) | $152.6 | Not provided | -10.8% |

The company's operating income decreased by 14.4% to $88 million, while adjusted operating income dropped by 10.8% to $152.6 million. Although adjusted earnings per share decreased by 12.8% from the prior year, GAAP EPS improved significantly by 27.3%, reflecting efficient financial management despite revenue pressures.

Revenue Breakdown

Lantheus' revenue performance spanned across several critical products, including PYLARIFY and DEFINITY.

| Product | Q2 2025 Sales (in millions) | Year-over-Year Change |

|---|---|---|

| PYLARIFY | $250.6 | -8.3% |

| DEFINITY | $83.9 | +7.5% |

Segment Performance Analysis

PYLARIFY: The sales of PYLARIFY decreased by 8.3%, a reflection of increased competition in the PSMA PET imaging arena. Despite this setback, Lantheus is actively reinforcing PYLARIFY's clinical differentiation to maintain its competitive edge.

DEFINITY: In contrast, DEFINITY's sales displayed a healthy growth, increasing by 7.5% over the same period in the previous year, demonstrating effective market penetration and sustained demand for this critical product.

Key Developments

Lantheus marked several notable accomplishments in the past quarter:

-

Strategic Acquisitions: The company completed acquisitions of Evergreen Theragnostics and Life Molecular Imaging. These strategic acquisitions are set to enhance Lantheus' commercial portfolio and growth potential, notably with the addition of Neuraceq, a radiodiagnostic for Alzheimer's disease.

-

Regulatory Approvals: The FDA accepted a New Drug Application (NDA) for a new formulation of the piflufolastat F 18 PSMA PET imaging agent, anticipated to significantly increase batch production and patient reach.

-

Portfolio Expansion: The expanded label for Neuraceq, approved in June, now supports its use in broader clinical scenarios, including monitoring Alzheimer's progression, enhancing its market utility.

Comments from Company Officers

Brian Markison, CEO of Lantheus, expressed confidence in the company's forward-looking strategy despite competitive challenges in the marketplace. "Our acquisitions of Evergreen and Life Molecular Imaging are key steps in our strategy to expand our capabilities across the radiopharmaceutical value chain," Markison noted. "The acceptance of our NDA and our ongoing commitment to clinical excellence represent our resolve to deliver continued value to patients and shareholders."

Dividends and Share Repurchases

Lantheus reinforced its commitment to shareholder value through a newly authorized $400 million stock repurchase program. This program replaces the previous 12-month initiative and signals confidence in the company's long-term growth trajectory.

Lantheus Holdings Inc Stock Forecast

Considering Lantheus' strategic expansions and growing product portfolio, the outlook for its stock appears promising. The company's global outreach with Neuraceq, coupled with innovative advancements in its imaging agents, is poised to stimulate long-term growth.

High Projection: Given robust financial management and successful integration of acquisitions, Lantheus' share price might exceed $2.00 within the next year, especially as new product formulations gain traction in the market.

Low Projection: However, if competitive pressures persist and regulatory hurdles delay product rollouts, the stock could find resistance around the $1.50 mark, where current market dynamics are priced in.

Overall, Lantheus Holdings Inc is positioning itself strategically through key acquisitions, product innovations, and an enriched pipeline to harness growth in the radiopharmaceutical field. Its robust financial fundamentals and leadership in imaging solutions underpin its capacity to overcome market obstacles and deliver shareholder value.