Vaxcyte, Inc. (NASDAQ: PCVX) recently announced its financial results for the fourth quarter and full year ended December 31, 2024. As a clinical-stage vaccine innovation company, Vaxcyte is dedicated to developing high-fidelity vaccines aimed at tackling bacterial diseases. Let’s delve into their financial performance and strategic initiatives that suggest significant growth prospects in the coming years.

Vaxcyte Inc Earnings

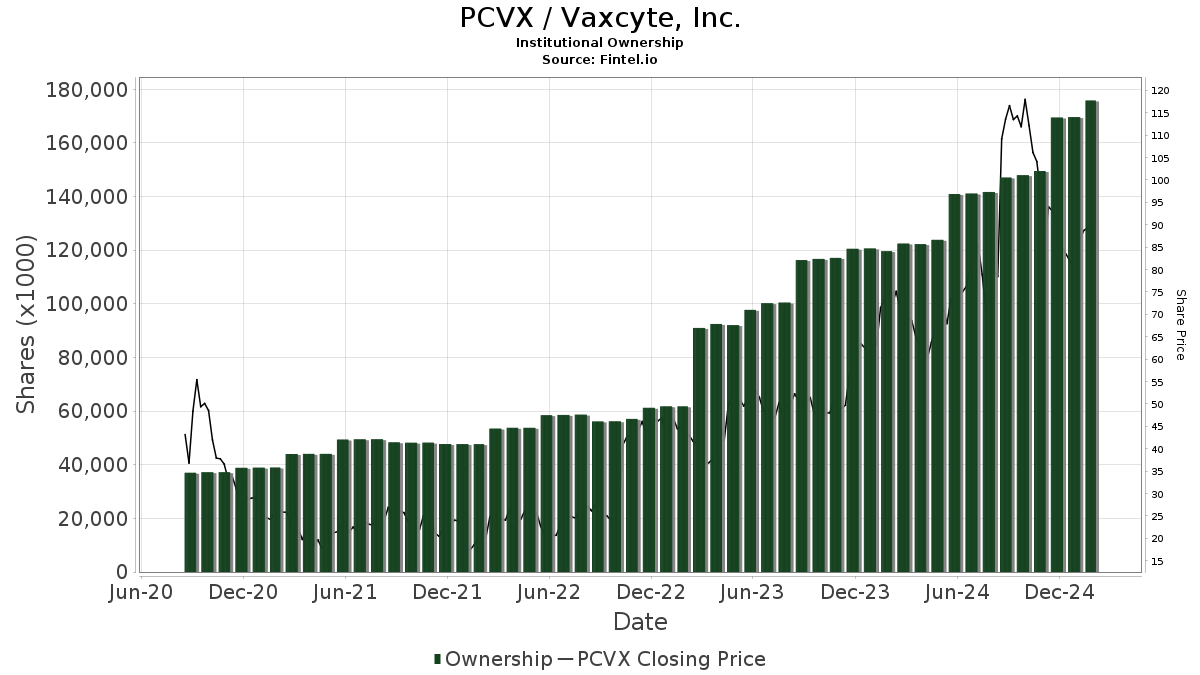

Vaxcyte demonstrated substantial financial moves in 2024, notably with two successful follow-on equity offerings that netted approximately $2.2 billion, reinforcing the company's capital foundation. This capital boost ensures that Vaxcyte is equipped to advance its vaccine development programs, notably VAX-31 and VAX-24, for both adults and infants.

Vaxcyte Inc Results

Below is a summary of key financial performance metrics for Vaxcyte, Inc.:

| Metric | Q4 2024 | Q4 2023 | FY 2024 | FY 2023 |

|---|---|---|---|---|

| Cash, Cash Equivalents, and Investments | $3.135 billion | $1.243 billion | ||

| R&D Expenses | $133.6 million | $104.1 million | $476.6 million | $332.3 million |

| G&A Expenses | $28.5 million | $17.5 million | $92.9 million | $60.7 million |

| Net Loss | $137.1 million | $180.8 million | $463.9 million | $402.3 million |

In 2024, Vaxcyte prioritized scaling operations, which is evident from the substantial increase in both R&D and G&A expenses, reflecting enhanced development and manufacturing activities. Their financial loss, though notable, can be partially attributed to these strategic investments in their vaccine pipeline.

Revenue Breakdown

As Vaxcyte is still a clinical-stage company, traditional revenue streams from commercial sales are absent. However, significant funding through equity raises and cash from investments facilitates continued research and development activities. Their financial strategy is a testament to investor confidence and sets the stage for future revenue generation through commercializing vaccines currently in development.

Key Developments

Several significant developments mark Vaxcyte’s strategic progress:

-

VAX-31 Advancements : Vaxcyte is on track with the VAX-31 program for adults. Having completed successful Phase 2 trials, it aims for a Phase 3 pivotal study by mid-2025 with data expected in 2026.

-

VAX-24 for Infants : Vaxcyte plans to announce topline data for the VAX-24 infant Phase 2 study by Q1 2025, with booster data by year's end. The goal is to improve pneumococcal disease prevention in one of the most vulnerable age groups.

-

Expanded Leadership Team : Strategic appointments in leadership positions highlight Vaxcyte’s focus on scaling its operations. New hires bring decades of experience crucial for driving commercial readiness.

-

Manufacturing Investments : Continued investments aimed at global manufacturing capacity underscore Vaxcyte’s commitment to future commercialization efforts.

Comments from Company Officers

Grant Pickering, Chief Executive Officer and Co-Founder, emphasized, "We believe our carrier-sparing platform has the potential to set a new standard in disease coverage.” This affirms the company's belief in its innovative approach, particularly given the positive outcomes from their adult and infant clinical programs.

Andrew Guggenhime, President and Chief Financial Officer, noted, "The strength of our balance sheet enables continued momentum in several areas,” underlining the strategic financial planning that allows Vaxcyte to focus on its ambitious vaccine initiatives.

Dividends and Share Repurchases

As of this report, Vaxcyte has not declared any dividends or initiated share repurchase programs. The focus remains on reinvestment and scaling operations as part of their growth strategy.

Vaxcyte Inc Stock Forecast

Given Vaxcyte’s innovative pipeline, reinforced by a $3.1 billion cash reserve, let's explore potential stock price projections:

-

High Projection : Should Vaxcyte meet its key milestones and transition VAX-31 and VAX-24 towards market readiness successfully, its stock could see a substantial upswing. In such a scenario, a high target price could range from $120 to $130, influenced by increased market confidence and prospective revenues from a successful product launch.

-

Low Projection : Conversely, delays in clinical trial milestones or regulatory hurdles could temper investor enthusiasm, potentially bringing the stock down to a range of $70 to $80.

These projections depend on Vaxcyte’s execution of strategic objectives and further financial disclosures as they progress in their clinical developments.

In summary, while Vaxcyte remains in an investment-heavy phase, its strategic positioning, substantial cash reserves, and constructive clinical advancements suggest a promising outlook for long-term investors.