Madrigal Pharmaceuticals recently released their annual financial report for 2024, revealing a landmark year for the company with the successful U.S. approval and commercialization of their premier drug, Rezdiffra. This pivotal moment not only marked their transition into a commercial-stage company but also set the stage for future growth and expansion. This report delves into the intricate details of Madrigal’s financial results, operational highlights, and outlook, providing investors with a comprehensive understanding of the company's current and future trajectory.

Madrigal Pharmaceuticals Inc Earnings

Madrigal Pharmaceuticals predominantly generates revenue from its newly approved product, Rezdiffra. In 2024, the company reported total product revenue of $180.1 million. This achievement represented a crucial turning point as the company capitalizes on its strategic focus on metabolic dysfunction-associated steatohepatitis (MASH), a significant unmet medical need.

Key Financial Metrics

Here's a detailed breakdown of Madrigal Pharmaceuticals' financial results for the years ending December 31, 2024 and 2023:

| Financial Metrics | 2024 (in millions) | 2023 (in millions) |

|---|---|---|

| Product Revenue, Net | $180.1 | N/A |

| Cost of Sales | $6.2 | N/A |

| Research and Development Expenses | $236.7 | $272.4 |

| Selling, General and Admin. Expenses | $435.1 | $108.1 |

| Interest Income | $46.7 | $19.6 |

| Interest Expense | $14.7 | $12.7 |

| Net Loss | $465.9 | (Not Provided) |

The company's strategic pivot towards commercialization incurs increased selling, general, and administrative expenses due primarily to establishing the necessary infrastructure to support Rezdiffra's market launch. The R&D expenses exhibit a decrease owing to the completion of several milestone clinical trials compared to previous years.

Revenue Breakdown

Rezdiffra's revenues are primarily generated through specialty pharmacies and distributors. The revenue performance highlights are evidenced by the strategic move to tap into emerging healthcare needs associated with MASH. The effective rollout and acceptance of Rezdiffra have been pivotal in cementing Madrigal's commercial presence in the industry.

Key revenue drivers include the successful marketing and education initiatives aimed at healthcare providers and patients about the benefits and application of Rezdiffra as a therapeutic intervention for MASH. This is part of an astutely managed commercialization strategy focusing on achieving broad acceptance and leveraging first-mover advantage in this nascent treatment market.

Key Developments

2024 was an inflection year for Madrigal with several notable developments:

-

FDA Approval : Rezdiffra received accelerated approval from the FDA in March 2024. This approval was based on 52-week data demonstrating significant efficacy in reducing MASH-related liver fibrosis, a condition with high unmet medical needs.

-

Commercial Launch in U.S. : Following the FDA approval, Rezdiffra was launched in the U.S. in April 2024, becoming the first approved product for MASH, consequently reinforcing Madrigal's leadership position in addressing this critical clinical need.

-

Expansion Strategy for Europe : Madrigal is keen on extending its market reach to Europe, with plans underway for regulatory approval via the European Medicines Agency and subsequent deployment of commercialization operations.

-

Infrastructure Expansion : To support these ambitious growth plans, the company has significantly invested in expanding its commercial team and operational infrastructure.

Comments from Company Officers

In his remarks, CEO William J. Sibold expressed optimism concerning the company's trajectory, highlighting the strategic significance of Rezdiffra's approval as a milestone that validates Madrigal's research and development efforts. Similarly, Chief Financial Officer Mardi Dier emphasized that the financial discipline alongside strategic investments positions the company well for sustainable growth.

Dividends and Share Repurchases

There have been no declared dividends, given the company’s reinvestment strategy focusing on capital outlays to support both current operations and future expansion into new geographies. Madrigal is prioritizing reinvestment in R&D and operational scaling over returning profits to shareholders at this early commercial stage.

Stock Forecast

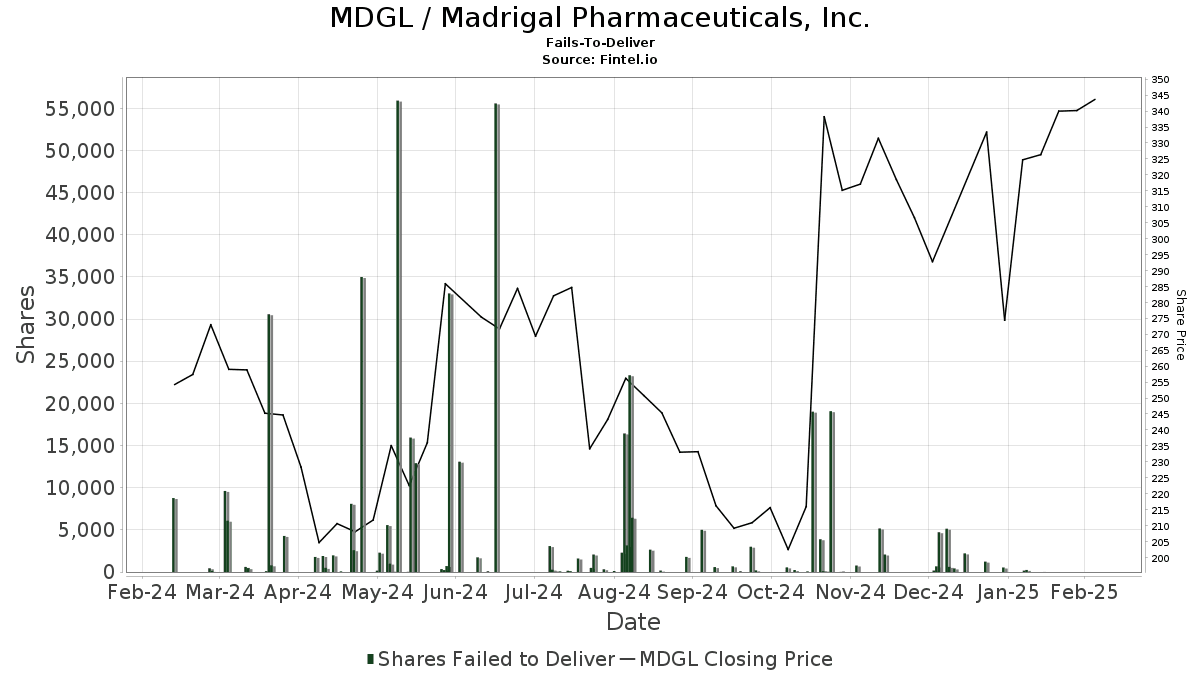

Madrigal’s stock outlook remains positive, driven by the growing market for MASH treatment and the successful commercialization of Rezdiffra. However, investors should anticipate volatility given the biopharma industry's inherent risks and operational scaling challenges. High-end projections could see substantial appreciation as the European market potentially opens up post-2025, while low-end projections consider generic competition and regulatory hurdles that might emerge over time.

Conclusion

Madrigal Pharmaceuticals is at a pivotal crossroads shaped by regulatory success in approving Rezdiffra and subsequent market introduction. This event marks a transformative phase in its operational history. While the company continues to manage elevated operational expenditures associated with the commercialization of Rezdiffra, the outlook for sustainable revenue growth remains robust, especially as Madrigal looks to expand into European markets. Future investors should closely monitor operational efficiencies and continued post-market obligations necessary for full FDA endorsement.