As the pioneer in robotic-assisted surgery, Intuitive Surgical, Inc. (NASDAQ: ISRG) recently released its financial results for the first quarter ending March 31, 2025. The figures revealed a significant upward trajectory in both revenue and procedure volume, reasserting its role as an industry leader in minimally invasive care.

Intuitive Surgical Inc Earnings

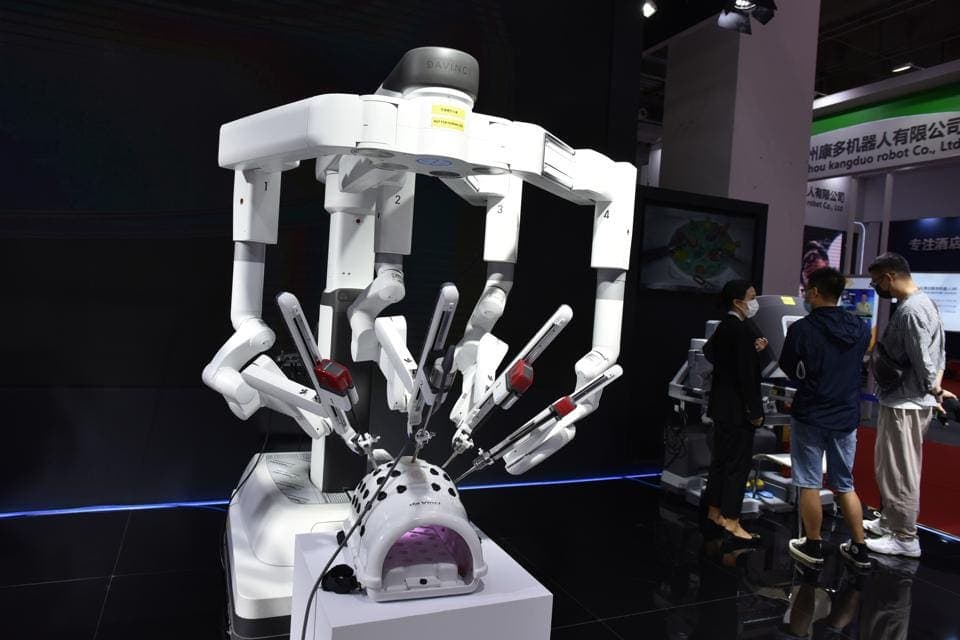

For the first quarter of 2025, Intuitive Surgical reported commendable financial results. The company saw a total revenue increase of 19%, reaching $2.25 billion compared with $1.89 billion in the same period the previous year. The growth was primarily driven by the increased adoption of the da Vinci surgical systems, a core product offering of Intuitive.

Moreover, the company's net income attributable to Intuitive on a GAAP basis rose to $698 million, or $1.92 per diluted share, compared with $545 million, or $1.51 per diluted share, in the first quarter of 2024. On a non-GAAP basis, the net income was $662 million, translating to $1.81 per diluted share.

Intuitive Surgical Inc Results

Below is a consolidation of key financial metrics for the quarter:

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Total Revenue (USD) | $2.25 billion | $1.89 billion | +19% |

| GAAP Net Income (USD) | $698 million | $545 million | +28.1% |

| Non-GAAP Net Income (USD) | $662 million | $541 million | +22.3% |

| Earnings Per Share (GAAP) | $1.92 | $1.51 | +27.2% |

| Earnings Per Share (Non-GAAP) | $1.81 | $1.50 | +20.7% |

The above results showcase a strong performance across all major financial parameters, highlighting robust growth in revenue and profitability.

Revenue Breakdown

The growth in revenue is further elucidated in the breakdown of key segments:

| Segment | Q1 2025 Revenue | Q1 2024 Revenue | YoY Growth |

|---|---|---|---|

| Instruments and Accessories Revenue | $1.37 billion | $1.16 billion | +18% |

| Systems Revenue | $523 million | $418 million | +25.1% |

Analysis of these figures indicates a strong performance across both instruments and systems revenue, with the latter witnessing a remarkable increase of over 25%. This surge can be largely attributed to the increased placements of the company's flagship product, the da Vinci surgical system, which grew by approximately 17% in terms of worldwide procedures and a noteworthy 58% growth in Ion procedure volume.

Key Developments

A key highlight from the quarter was the robust placement of 367 da Vinci surgical systems, up from 313 in the previous year. Notably, the introduction and expansion of the da Vinci 5 system have witnessed significant adoption, with 147 units placed compared to just 8 in the prior year.

Intuitive's installed base of da Vinci systems saw a 15% year-over-year increase, to 10,189 systems. This expansion underlines the widespread acceptance and demand for specialized robotic-assisted surgery platforms in the medical community.

Comments from Company Officers

Reflecting on the results, Gary Guthart, CEO of Intuitive, remarked, "Core measures of our business were healthy this quarter, and we are pleased by continued customer adoption of our platforms, including da Vinci 5. As we look ahead, we remain focused on enabling our customers to deliver on their goals: better patient outcomes, improved patient and care team experiences, lower total cost to treat, and increased access to care."

Dividends and Share Repurchases

There was no specific mention of dividends or share repurchase programs in the financial release. Typically, such actions are considered based on excess free cash flow and longer-term capital allocation strategies. The company ended the quarter with a robust cash position of $9.10 billion, signifying a healthy runway for potential future distributions or strategic reinvestments.

Intuitive Surgical Inc Stock Forecast

With a last-reported stock price around $2.227 and a formidable market cap of approximately $157.88 billion, Intuitive Surgical is well-positioned for continued growth. Given the robust financial performance, expanding product adoption, and favorable market conditions, stock projections are optimistic.

High Projection

The accelerated adoption rates and consistent revenue growth could push Intuitive's stock price toward higher valuations. Assuming favorable economic conditions and sustained company performance, a high-end stock price projection could reach upwards of $3.00. This would represent continued confidence in Intuitive's strategic initiatives and sustained market leadership in robotic-assisted surgical tools.

Low Projection

On the flip side, challenges such as geopolitical tensions, regulatory repercussions, or potential disruptions in supply chains could somewhat mitigate growth. A conservative low-end price could linger around $2.00, capturing possible market volatilities or unexpected economic downturns.

Conclusion

Intuitive Surgical Inc. has showcased remarkable performance in the first quarter of 2025, driven by innovation, strategic expansions, and strong demand for their cutting-edge robotic-assisted surgical systems. As the company navigates through the rest of the fiscal year, it remains poised to fortify its market position, offering investors potential for attractive returns in a dynamic healthcare landscape.