Interactive Brokers Group Inc Earnings

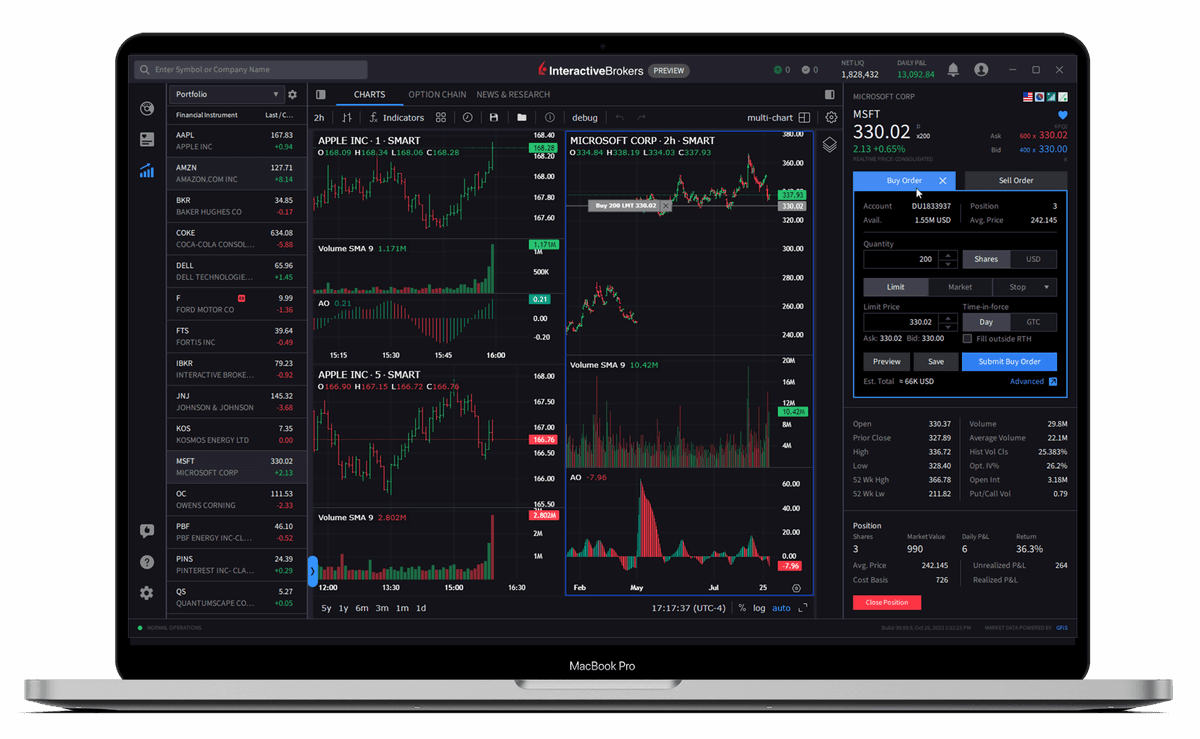

Interactive Brokers Group Inc. (NASDAQ: IBKR), a leader in electronic brokerage, has reported impressive financial results for the quarter ending March 31, 2025. The company showcased robust growth across its financial metrics, reinforcing its position in the competitive online brokerage market.

Interactive Brokers Group Inc Results

Below is a table summarizing key financial metrics for the current quarter compared to the year-ago quarter:

| Metric | Current Quarter | Year-Ago Quarter | % Change |

|---|---|---|---|

| GAAP Net Revenues | $1,427 million | $1,203 million | +18.6% |

| Adjusted Net Revenues | $1,396 million | $1,216 million | +14.8% |

| GAAP Diluted EPS | $1.94 | $1.61 | +20.5% |

| Adjusted Diluted EPS | $1.88 | $1.64 | +14.6% |

| Income Before Income Taxes | $1,055 million | $866 million | +21.8% |

| Adjusted Income Before Taxes | $1,024 million | $879 million | +16.5% |

| Pretax Profit Margin (Reported) | 74% | 72% | +2% |

The company achieved a GAAP diluted earnings per share (EPS) of $1.94, with adjusted EPS at $1.88, demonstrating significant growth from the respective $1.61 and $1.64 EPS figures in the year-ago quarter.

Revenue Breakdown

Interactive Brokers' revenue performance is highlighted in the following table, showcasing growth across major segments compared to the prior year:

| Revenue Segment | Current Quarter Revenue | % Change |

|---|---|---|

| Commission Revenue | $514 million | +36% |

| Net Interest Income | $770 million | +3% |

| Other Fees and Services | $78 million | +32% |

| Execution, Clearing, & Distribution Fees | $121 million | +20% |

Analysis : The brokerage saw a remarkable 36% increase in commission revenue, driven by an impressive increase in customer trading volumes—47% in stocks, 25% in options, and 16% in futures. Net interest income also rose modestly by 3%, benefitting from higher average customer margin loans and credit balances. Additionally, fees from other services jumped by 32%, propelled by a surge in risk exposure fees and payments from exchange-mandated programs.

Execution, clearing, and distribution fees saw a 20% increase, reflecting a higher SEC fee rate and the introduction of a new FINRA Consolidated Audit Trail fee.

Key Developments

A significant development for Interactive Brokers in Q1 2025 was the announcement of a four-for-one forward stock split of its common stock, aimed at making stock ownership more accessible to investors. This move reflects the company's confidence in its continued growth and stability. The split will occur in mid-June, with trading on a split-adjusted basis beginning on June 18, 2025.

Additionally, Interactive Brokers' currency diversification strategy bolstered earnings by $127 million this quarter, thanks to changes in the U.S. dollar value relative to a basket of global currencies.

Comments from Company Officers

In a statement, Interactive Brokers' CEO lauded the team's performance and commitment to enhancing client experiences through technological advancements. The CEO emphasized the company's dedication to maintaining its leadership position in the electronic brokerage field while expanding access and convenience for all investors.

Dividends and Share Repurchases

Demonstrating its solid financial health and commitment to providing shareholder returns, the Board of Directors declared an increase in the quarterly cash dividend from $0.25 per share to $0.32 per share. This increased dividend is payable on June 13, 2025. The company did not announce any share repurchase program for this quarter.

Interactive Brokers Group Inc Stock Forecast

Considering the strong financial results, significant operational developments, and enhanced dividend, Interactive Brokers appears poised for further growth. Analysts project the stock price to range between $90 and $110 in the coming months, with a high-end forecast factoring in continued market expansion and efficiency gains from technological investments. A more conservative projection might account for potential market volatility and regulatory challenges.

Interactive Brokers' consistent performance and strategic initiatives make it a compelling investment opportunity for both retail and institutional investors looking to capitalize on advancements in electronic trading platforms. As always, investors should conduct their due diligence and consider market conditions when assessing stock potential.