Key Takeaways

- SHEIN is not yet a publicly traded company. This implies that no official SHEIN stock ticker or SHEIN stock price can be bought on any large exchange.

- The company is actively working on an Initial Public Offering (IPO), though the timeline is not definite and may change, mainly due to complex regulatory hurdles, the most notable being the requirement that the company be approved by the Chinese securities regulator.

- SHEIN has shifted its primary focus away from the US. The London Stock Exchange (LSE) and, as an alternative possibility, the Hong Kong Stock Exchange (HKEX) are the most probable listing venues under consideration.

- You’re not able to buy SHEIN yet, but you can gain exposure to the fast-fashion and e-commerce segment through publicly traded competitors such as PDD Holdings (parent of Temu), Amazon (AMZN), and Inditex (parent of Zara).

- Intellectia.ai’s AI stock analysis tools allow investors to track market sentiment, competitor performance, and market indicators as the IPO process progresses.

Introduction

You might be looking for SHEIN stock or the SHEIN IPO date, since you have heard about the company's huge global expansion and are now considering investing in the next big disruptor. Nonetheless, the path to SHEIN's public listing is complex and evolving. All this uncertainty — plus the rumors that the listing might not happen — has understandably left investors scratching their heads. We have used the latest market intelligence to deconstruct everything you need to know about SHEIN's IPO status, including the most up-to-date timeline and the major regulatory obstacles.

In this article, I’m going to break it all down for you — what SHEIN is, why people keep talking about its IPO, where things currently stand, and how you can use Intellectia’s AI tools to stay ahead. Keep reading to get the definitive answer on the SHEIN stock price and discover the best publicly traded alternatives you can confidently invest in right now.

What Is SHEIN and Why Are Investors Searching for “SHEIN Stock”?

SHEIN is the undisputed digital ultra-fast fashion giant. That’s because the company constructed its multi-billion-dollar empire based on a distinctive, data-driven model that transformed retail. SHEIN, unlike more conventional rivals, has advanced algorithms that monitor real-time fashion trends and social media buzz, enabling it to design, produce, and deliver new products within days rather than months. This agility, along with massive scale, enables the firm to offer consumers around the world incredibly low prices.

SHEIN has experienced aggressive, high-double-digit revenue growth and has secured significant market share, especially among younger, more digital consumers. You are seeking a stock that is fundamentally disruptive to the traditional retail industry, and SHEIN is the poster child of such disruption. This is precisely why the search for a SHEIN stock ticker and SHEIN stock price continues to dominate financial news and investor queries.

Does SHEIN Have a Stock? Current IPO Status Explained

If you're wondering, the simple answer is no—SHEIN is not publicly traded yet.

Since the company is still privately held, there is no official SHEIN stock ticker or SHEIN stock price available for trading on any major exchange, such as the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE). Because of this private status, any "price" information you may see online is likely derived from internal private funding rounds, highly illiquid secondary-market indications, or simply outdated speculation.

Is SHEIN Publicly Traded Right Now?

To be perfectly clear, not yet. You won't find an official SHEIN stock ticker because the company has not yet completed its Initial Public Offering (IPO). This means that no broker can currently offer you shares of SHEIN. The company remains dedicated to its international development as it navigates the complex process of becoming a publicly traded company.

SHEIN IPO Timeline — What We Know So Far (2025 DecemberUpdates)

SHEIN has had a long, winding road to the IPO. The most recent changes as of 2025 indicate that the center of interest has now been decisively taken out of the United States.

- US IPO Attempts Stalled: Its first efforts to list in the US were reportedly halted due to severe political and regulatory scrutiny, particularly regarding its supply chain and data practices.

- The UK Pivot: The company has since changed its main focus to the London Stock Exchange (LSE) as a listing venue of choice. The move is an opportunity to gain a higher valuation and less political heat than the US market.

- The Hong Kong Backup: SHEIN has also privately registered an IPO in Hong Kong (HKEX) to keep its options open and exert pressure on regulators. This will provide the company with an alternative listing option in case the London path encounters unexpected delays.

- The Key Hurdle: If you're tracking the news, the main thing holding up the official listing is getting the regulatory approvals. More importantly, the firm must seek authorization from the China Securities Regulatory Commission (CSRC) for any foreign listing, and this process has been lengthy and painstaking.

The timing depends on an ongoing valuation dispute (the valuation of SHEIN has ranged from 66 billion to as low as 30 billion in private markets), the tension in US-China trade relations, and questions about the company's supply chain ethics. For investors, a definitive listing date remains a moving target, but reports suggest a potential target window in the second half of 2025.

How to Buy SHEIN Stock Alternatives Today

If you think you want exposure to the lucrative ultra-fast fashion and global e-commerce sector right now, you don't have to wait. You can gain immediate market exposure by looking at the major publicly traded competitors. These companies are already listed and have tickers you can trade today.

| Company | Ticker | Why It's a Good SHEIN Alternative | Key Strengths |

|---|---|---|---|

| PDD Holdings (Temu’s Parent) | PDD | Very direct exposure to low-cost, cross-border e-commerce. | Massive platform, supply-chain efficiency, very aggressive growth. |

| Amazon | AMZN | E-commerce titan. While it isn’t “fast fashion only,” it’s a retail powerhouse with logistics muscle. | Huge reach, infrastructure, strong margins & upside in global expansion. |

| Inditex (ZARA) | ZARA | Traditional fashion, but very scalable and globally known. | Proven supply chain, desirable brand, strong fashion credibility. |

| H&M Group | H&M | A legacy fast-fashion brand navigating the online transition. | ESG focus, large physical + online presence, established customer base. |

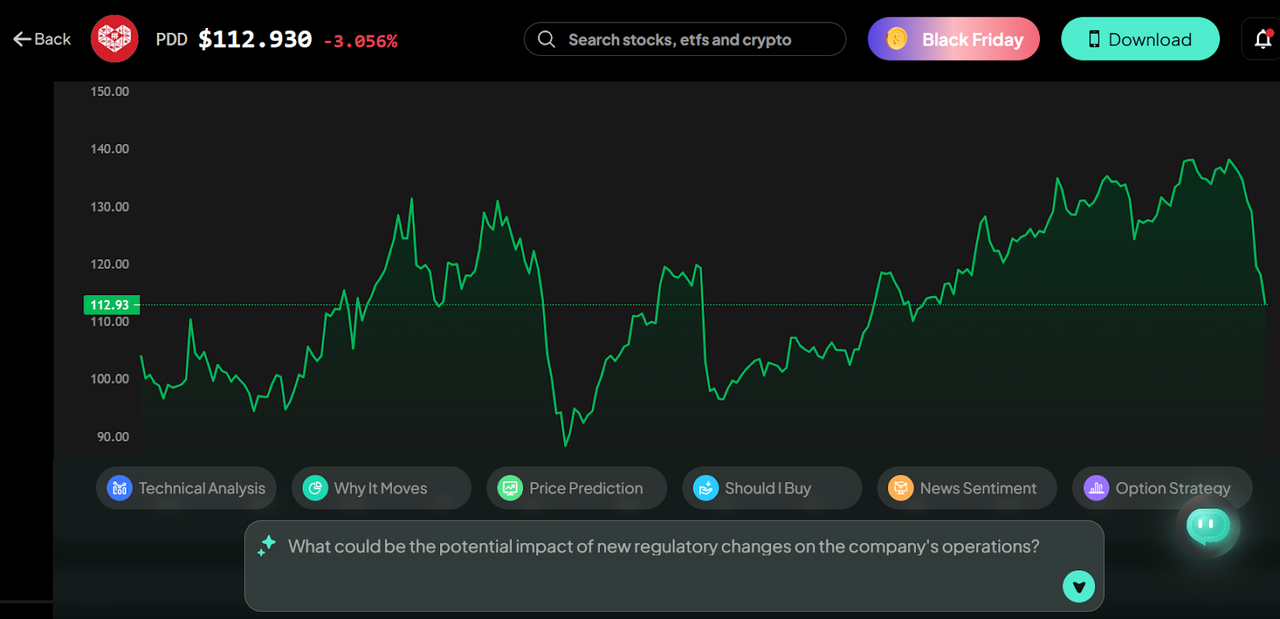

PDD Holdings (PDD)

PDD Holdings is the parent company of both Pinduoduo and, more importantly for US and global investors, Temu. Temu is SHEIN's fiercest direct competitor in the ultra-low-cost, rapid-delivery e-commerce space. If you believe that the "bargain hunting" trend is the future of online retail, PDD offers immediate exposure to the segment.

Recent Q3 2025 reports showed PDD's adjusted net profit rising 17% year over year, a very strong sign of efficient management. However, revenue narrowly missed expectations, and the stock tumbled by about 4.2% on the news. This shows that while their profitability is solid, market volatility is high, especially given the ongoing uncertainties in the international environment and trade policies that affect their supply chain.

If you're focused on high growth, PDD is where you'll find the most intense competitive friction with SHEIN. Analysts currently have mixed ratings, but many remain bullish on the long-term growth of the Temu platform.

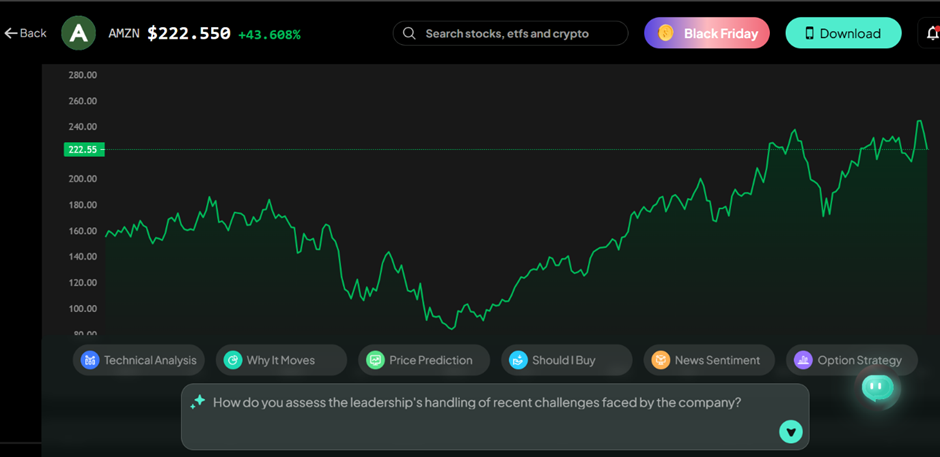

Amazon.com, Inc. (AMZN)

Amazon is perhaps the most diversified stock on this list, as it’s a gigantic retail marketplace that rivals SHEIN in terms of volume and convenience. If you think of Amazon as more than just a place to buy books and gadgets, you’re right—it’s a big player in the business of apparel and fast-moving consumer goods.

The two major pillars driving Amazon's performance are its extremely lucrative Amazon Web Services (AWS) cloud division and its rapidly growing advertising business. However, the stock price has been fluctuating over the last few days, dropping by 2-3% on a trading day in November 2025, as certain market segments feared a potential unwinding of the larger Magnificent Seven trade. This volatility underscores that they generally have strong business fundamentals (as evidenced by their Q3 2025 performance), but that the stock price is very sensitive to the overall sentiment in the tech market and to interest rate news.

If you’re looking for stability combined with retail exposure, Amazon offers a far more diversified and highly profitable venture supported by cloud computing, which is hard to replicate.

Inditex, S.A. (ITX)

Inditex, the parent company of Zara, is the original master of fast fashion. Zara is known for its incredible "turnaround time," moving fashion designs from the sketchpad to the store floor in a matter of weeks. This efficiency is their competitive edge against the digitally native SHEIN.

Inditex generally exhibits lower price volatility than high-growth tech stocks, with a beta below 1.0. The company is oriented towards stable growth, estimating roughly 5% annual gross space growth through 2026 and investing heavily in enhancing store layouts and online platforms. The stock performed well year to date but has recorded some declines, trading below its 50-day moving average towards mid-November 2025.

If you’re a value-focused investor looking at apparel retail fundamentals and a consistent dividend yield (around 3.56%), Inditex offers a solid alternative to the riskier high-growth names.

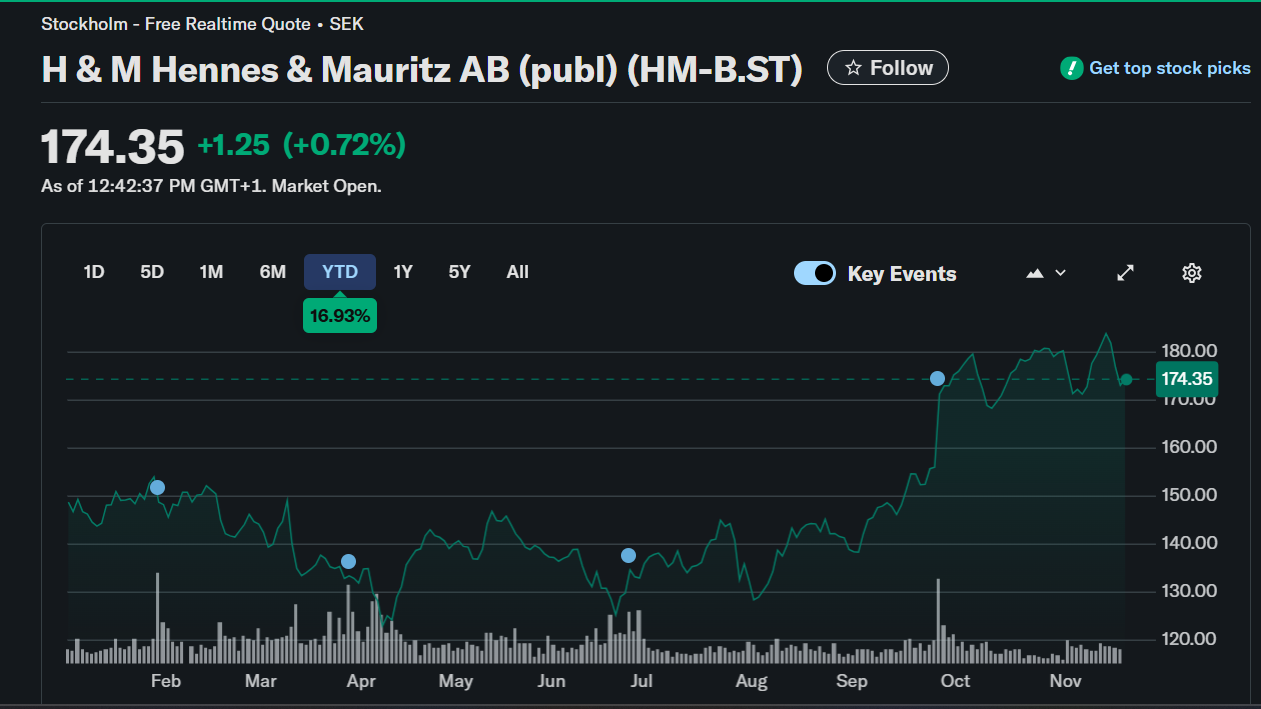

H&M Hennes & Mauritz AB (HMB)

H&M is a global apparel brand that has struggled to keep up with the speed of SHEIN and Zara, but it’s fighting back hard. The company has closed physical stores but seen its profits and stock rebound strongly thanks to a massive digital expansion effort and a strategic focus on efficiency and sustainability initiatives. The stock has performed very well over the past year, significantly outperforming the broader Swedish market. This suggests that the turnaround strategy is gaining traction.

H&M is also a good choice if you are interested in investing in a company actively restructuring and focusing on its digital channel and brand collaborations (such as its recent Perfect Moment partnership). With a trailing Price-to-Earnings (P/E) ratio around 27 and a fair dividend yield (around 3.91%), it presents a slightly different profile than the tech giants—more of a retail recovery play with value potential.

Using AI Stock Analysis Tools to Track SHEIN-Related Stocks

Waiting for the eventual IPO can feel tedious, but you can use this time strategically. With innovative AI technology, you can gain a significant advantage by tracking the performance and market sentiment of SHEIN's nearest competitors.

Investors can use the superior AI capabilities of Intellectia.ai to remain ahead of the curve since SHEIN stock is not public yet:

- Monitor Fast-Fashion and E-commerce Competitor Stocks: Our AI Screener lets you take a deep dive into companies like PDD and AMZN, giving you an idea of the health and mood of the industry in which SHEIN operates.

- Track Sentiment and Market Signals: Our AI Agent is efficient at searching news, social media, and regulatory filings to track market signals in the run-up to a prospective IPO. If you're concerned about political or ethical risks, the AI can filter and analyze such headlines on your behalf.

- Compare Fundamentals and Growth: In case you’re day trading or simply looking for the best long-term investment while you wait, our AI Stock Picker can help you filter the market for the best-performing e-commerce stocks likely to benefit from the same trends driving SHEIN's success. You can compare fundamentals, growth projections, and supply-chain-related risks among the alternatives using our Stock Technical Analysis to identify where to put your money.

Conclusion

You've done the smart thing by thoroughly researching SHEIN's IPO status. The key takeaway remains that there is no official ticker yet, and the 2026 timeline is fluid, contingent on crucial regulatory approvals in London and Hong Kong. If you believe in the long-term growth trajectory of ultra-fast fashion, investing in strong alternatives like PDD Holdings and Amazon can give you market exposure today while you wait. Don't leave your analysis to guesswork or old rumors. Be prepared for the eventual IPO by tracking the sector and its major players now. Sign up and subscribe to Intellectia.ai today for real-time alerts, daily AI stock picks, AI trading signals, and comprehensive market analysis that can give you the definitive edge in the dynamic e-commerce world.