Key Takeaways

- NVIDIA's growth is overwhelmingly driven by its dominance in the AI and data center markets, with its Blackwell platform and upcoming Rubin architecture being critical to future success.

- Analysts offer a wide range of predictions for 2026, with price targets varying from the low $200s to bullish projections exceeding $400, contingent on market conditions.

- AI-powered predictive models, like those from Intellectia AI, suggest even higher potential, with bullish scenarios placing the stock in the $650-$750 range.

- Key risks to NVIDIA's growth include increased competition from rivals like AMD and Intel, geopolitical tensions impacting sales to China, and overall high valuation metrics.

- The overall market for AI infrastructure is projected to reach $3 to $4 trillion by the end of the decade, presenting a massive opportunity if NVIDIA can maintain its leadership.

Introduction

Have you been watching NVIDIA's incredible stock performance and wondering where it's headed by 2026? With the AI revolution in full swing, it’s a question on every investor’s mind. Many are trying to determine if this meteoric rise can continue or if the high valuation and growing competition signal a coming slowdown.

By diving deep into recent financial reports, executive commentary, and expert forecasts, a clearer picture of NVIDIA's potential emerges. This analysis breaks down the key factors that will steer NVIDIA's stock, from its powerful technology pipeline to the geopolitical risks that lie ahead.

This article will provide a comprehensive NVIDIA stock price prediction for 2026, drawing on insights from top analysts and Intellectia.ai’s advanced AI-powered models to help you navigate the opportunities and risks.

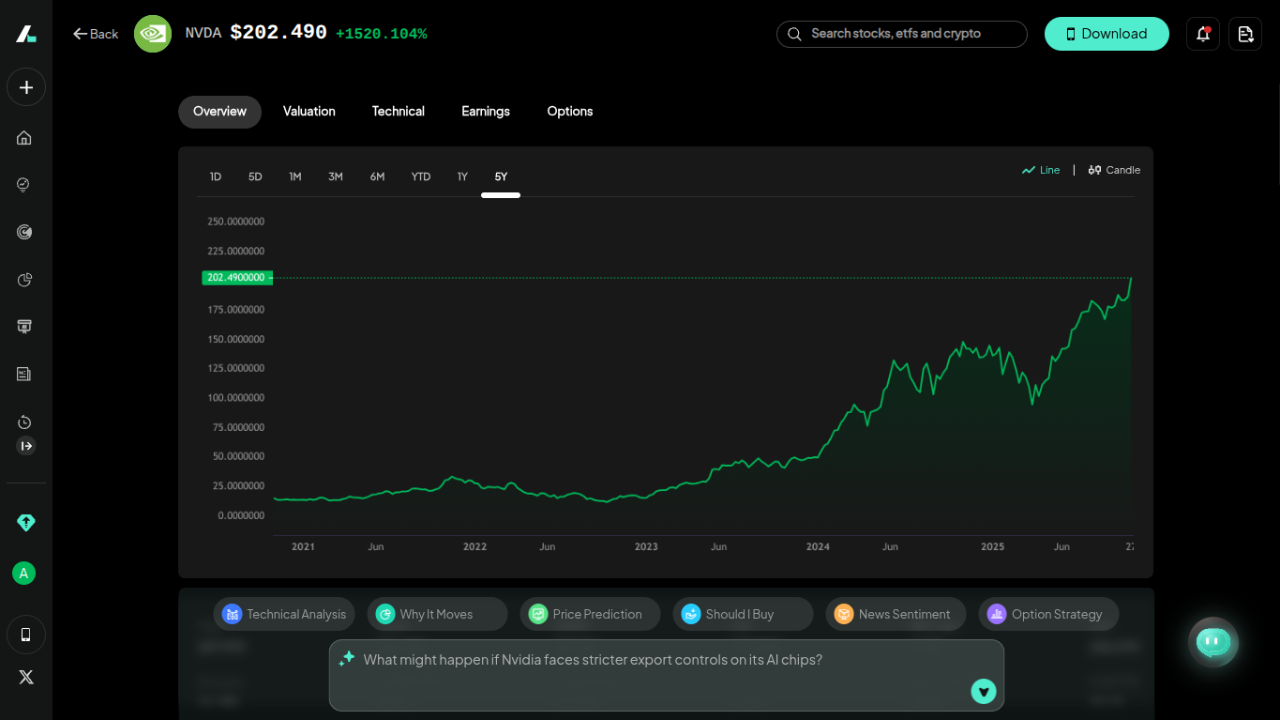

Current Overview of NVIDIA Stock Performance

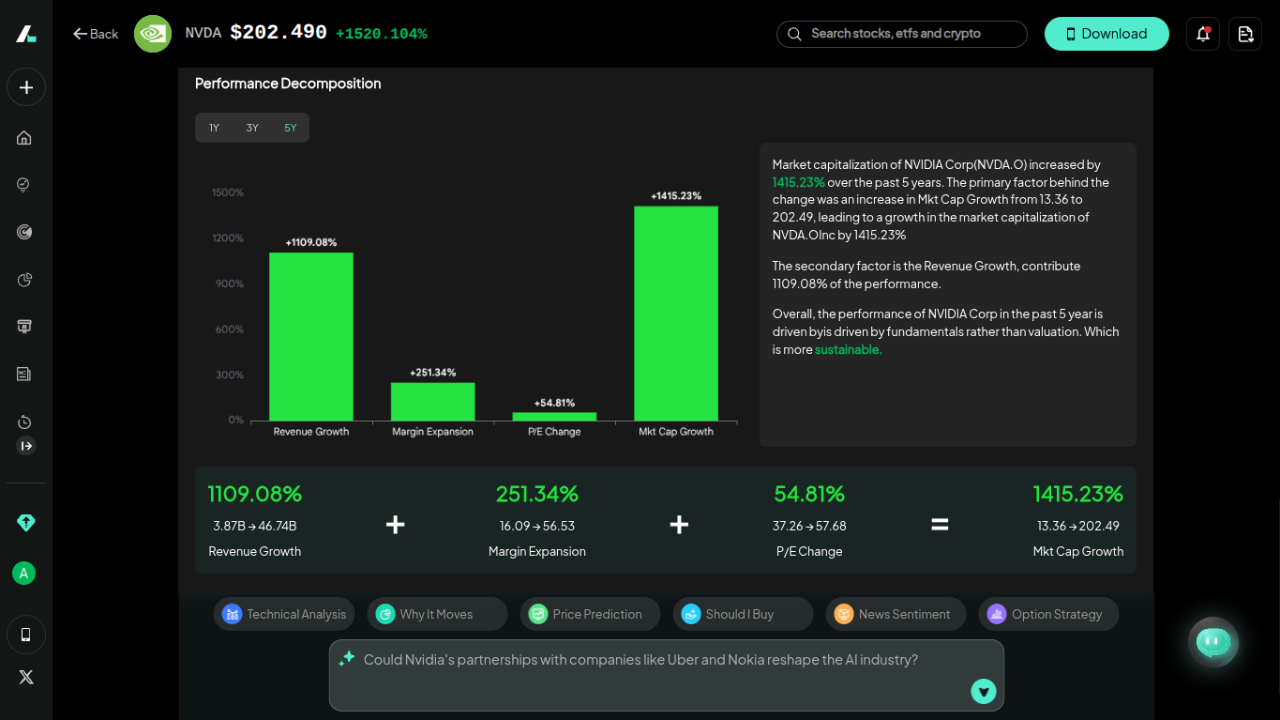

NVIDIA's performance over the last few years has been nothing short of spectacular, cementing its position as a leader in the tech industry. The company's market capitalization has soared past an incredible $4.9 trillion, leaving competitors in its wake. Over the long-term NVDA stock has delivered a price return of over 1500% based on the bullish momentum in the AI-era (post-ChatGPT).

Looking at the one-year price return, NVIDIA has delivered an impressive 52.52%. While strong, this is set against a backdrop of fierce competition, with competitors like AMD and Micron Technology showing returns of 77.77% and 124.56%, respectively, over the same period, highlighting the dynamic nature of the semiconductor industry.

Key Financial Highlights and Growth Drivers

NVIDIA's financial strength is anchored by its unparalleled dominance in the data center and AI sectors. In its Q2 2026 earnings report, the company announced a staggering total revenue of $46.7 billion, a 56% year-over-year increase. This growth was largely fueled by the ramp-up of its next-generation Blackwell platform.

Beyond AI, NVIDIA continues to see strong performance in its other key segments. The gaming division posted record revenue of $4.3 billion, while the automotive segment grew 69% year-on-year to $586 million, showcasing the company's expanding influence across multiple high-growth industries.

Factors Influencing NVIDIA’s 2026 Stock Price

While past performance is impressive, NVIDIA's future stock price will depend on its ability to navigate several key factors, from market demand and competition to its own innovation pipeline.

Market Demand for AI Chips and GPUs

The demand for AI computation is exploding. NVIDIA's CEO, Jensen Huang, refers to this shift as a new "industrial revolution." He emphasizes the move toward "reasoning agentic AI," a more advanced form of AI that requires anywhere from 100 to 1,000 times more computational power than previous models.

This insatiable demand is at the core of NVIDIA's growth strategy. The company projects the AI infrastructure market could be worth between $3 to $4 trillion by the end of the decade. As the primary enabler of this build-out, NVIDIA is positioned to capture a significant portion of this expanding market.

Competitor Landscape & Supply Chain Dynamics

NVIDIA doesn't operate in a vacuum. Key competitors are making significant strides. AMD has emerged as a credible challenger, with its MI300 and new MI350 accelerators gaining traction. The company recently announced a major partnership with OpenAI to deploy its Instinct GPUs, signaling its growing competitiveness in the AI space.

Intel is also re-entering the ring with a renewed focus on its AI accelerator strategy and foundry services. In a landmark move, Intel and NVIDIA have announced a collaboration to connect Intel CPUs with NVIDIA's architecture via NVLink, a partnership that could reshape the data center landscape.

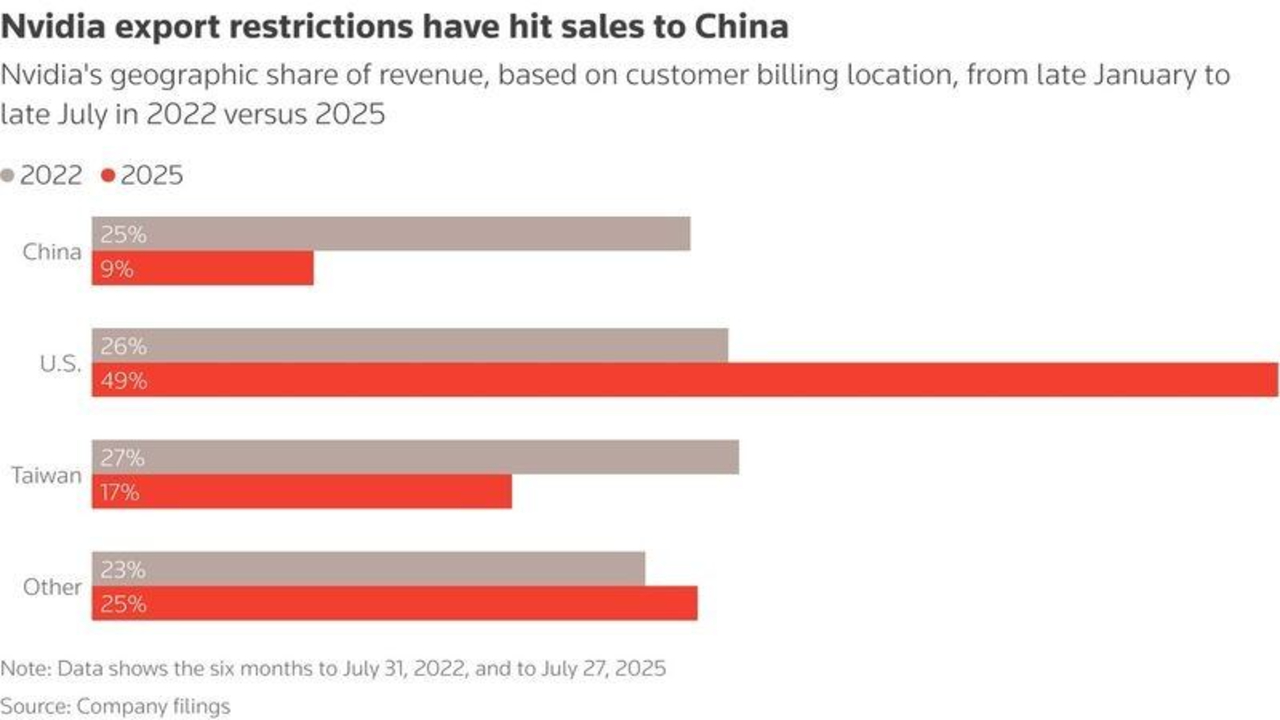

Geopolitical and Tech Regulation Risks

Geopolitical tensions, particularly with China, remain a significant headwind. NVIDIA's recent earnings call highlighted a $4 billion decline in revenue from its China-specific H20 chips. While the company has received licenses to potentially resume some sales, the situation remains highly uncertain.

CEO Jensen Huang has repeatedly stated the importance of the China market, which is the second-largest computing market in the world. Any long-term restrictions could impact NVIDIA's growth trajectory and open the door for domestic Chinese competitors.

NVIDIA’s R&D and Innovation Pipeline

NVIDIA’s primary competitive advantage is its relentless pace of innovation. The company has successfully established a one-year product cadence, a feat that keeps it ahead of the competition. The transition from the Hopper architecture to the current Blackwell platform has been a key driver of recent revenue growth.

Looking ahead, the next-generation Rubin platform is already in development and is expected to launch in 2026. This rapid innovation, combined with its proprietary networking technology like NVLink, creates a powerful and defensible ecosystem that is difficult for competitors to replicate.

NVIDIA Stock Forecast 2026

Analysts are overwhelmingly bullish on NVIDIA's prospects, though their price targets for 2026 vary based on different assumptions for growth and risk.

Expert Analyst NVIDIA Stock Price Target for 2026

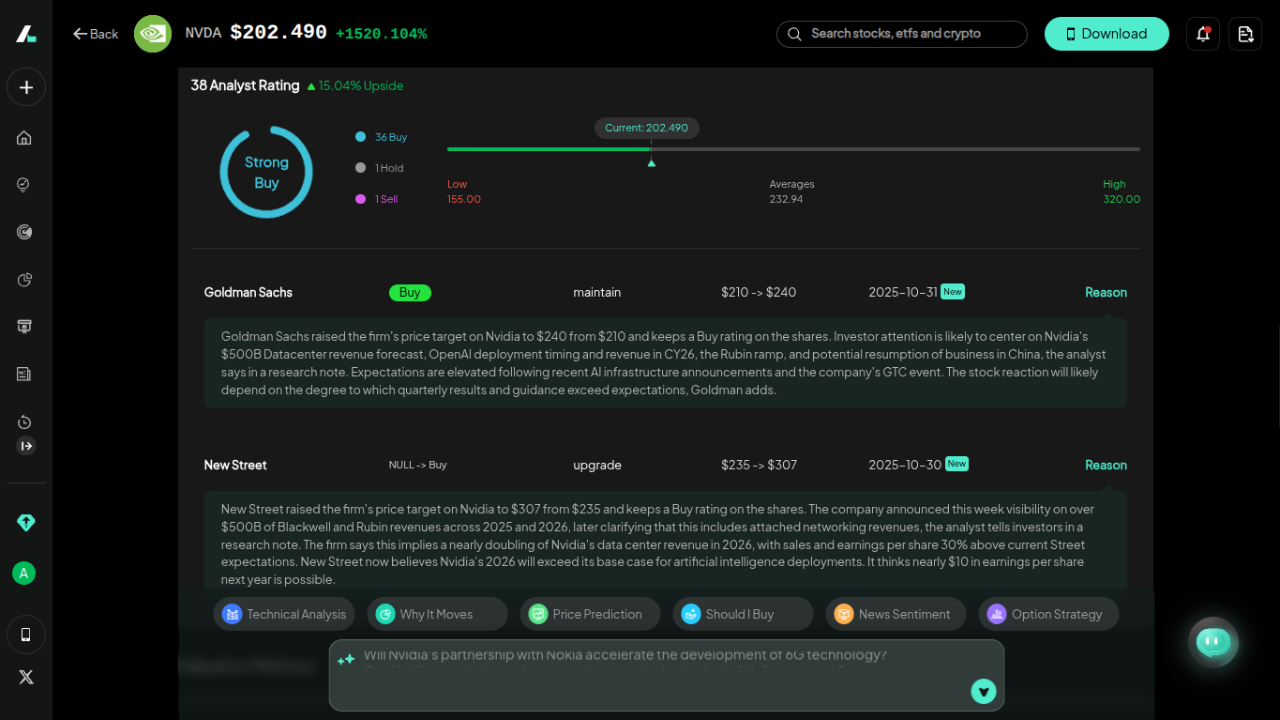

Several major banks have weighed in with their NVIDIA stock price forecasts for 2026:

- Goldman Sachs set a price target of $240, citing powerful AI-driven revenue and the potential for sales to resume in China.

- DA Davidson raised its target to $250, pointing to NVIDIA's expansion into new sectors like quantum computing.

- Mizuho has a target of $235, emphasizing the company's clear leadership in the ongoing AI race.

- New Street offered one of the most bullish targets at $307, highlighting the company's visibility on $500 billion in AI-related revenue by 2026.

- HSBC recently increased its target to $320, expecting the AI market to continue expanding and drive earnings growth.

Bullish Scenario

In a bullish scenario, NVIDIA's stock could reach between $307 and $428. This outlook assumes several key factors:

- AI adoption continues to accelerate at its current rapid pace.

- NVIDIA successfully launches its Rubin architecture and maintains its technological lead over competitors.

- Geopolitical tensions with China ease, allowing NVIDIA to resume high-margin sales in the region.

- Data center revenues continue to double, and earnings per share (EPS) exceed $10.

Bearish Scenario

A more bearish scenario would see the price target landing between $200 and $235. This could be triggered by:

- Stricter-than-expected regulatory restrictions on chip exports to China.

- Increased competition from AMD, Intel, and other emerging AI hardware players, leading to margin compression.

- A broader macroeconomic downturn that slows enterprise spending on AI adoption.

What Does Intellectia's AI Say About NVidia Stock in 2026?

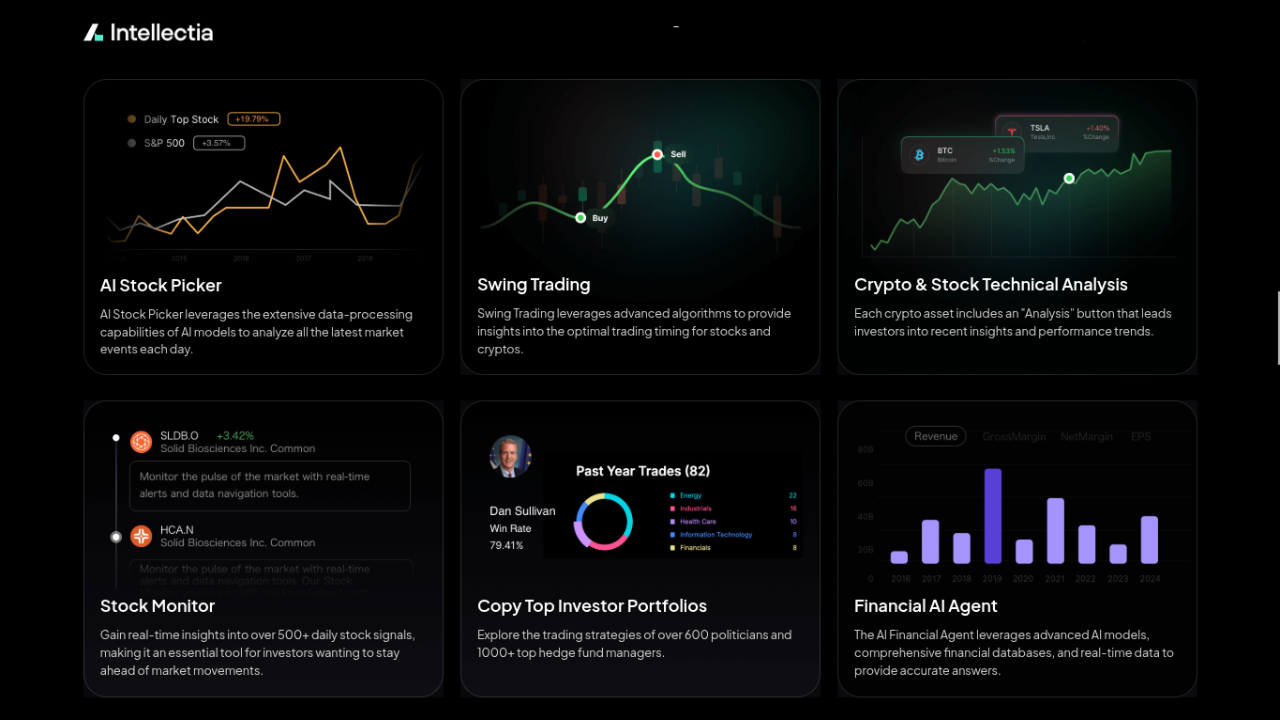

To get another perspective, you can turn to AI-powered predictive modeling. Intellectia AI utilizes advanced machine learning algorithms to forecast stock price movements by analyzing historical data, earnings performance (EPS), and market signals. The model incorporates everything from price trends and earnings growth to market sentiment and macroeconomic factors.

Intellectia AI's 2026 Projections

Based on its comprehensive analysis, Intellectia AI has generated several potential scenarios for NVIDIA's stock in 2026, with price ranges that are notably more bullish than many Wall Street analysts. Revenue growth is a major financial factor that derived NVDA stock’s price performance.

- Bullish Case: In this scenario, Intellectia's model projects a price range of $650–$750. This is driven by NVIDIA's continued dominance in AI and data center markets and successful expansion into new verticals like automotive AI.

- Neutral Case: A neutral outlook places the stock in the $500–$600 range. This assumes stable growth continues without significant new catalysts or unexpected headwinds.

- Bearish Case: If the market faces challenges, the model projects a price range of $400–$500. This scenario considers the risks of slower-than-expected AI adoption, increased competition, or macroeconomic pressures impacting tech valuations.

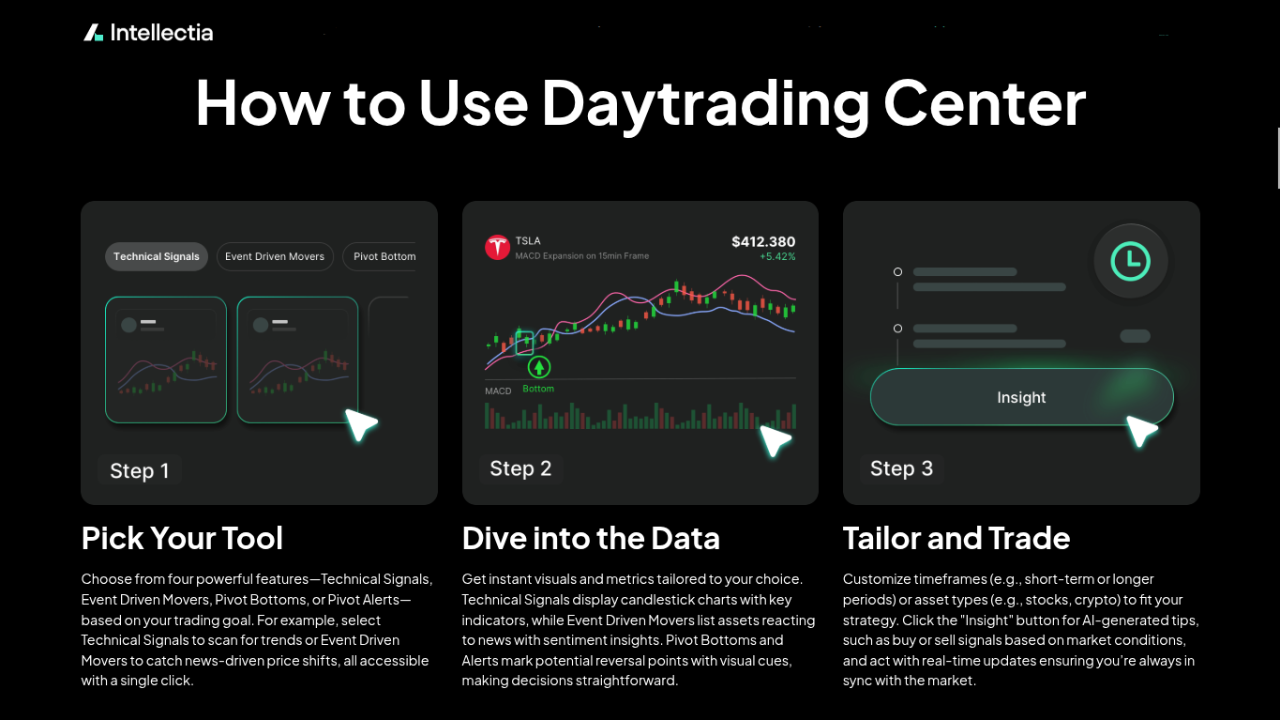

These projections highlight the significant upside potential that AI-driven analysis sees in NVIDIA, even when compared to optimistic human analysts. For traders and investors looking for data-driven insights, tools like an AI Agent, Daytrading Center, and AI swing trading signals can offer a unique edge.

Conclusion

NVIDIA's trajectory for 2026 and beyond is inextricably linked to the broader AI revolution. Its leadership in GPUs and a relentless, one-year innovation cycle with the Blackwell and Rubin platforms position it as a primary beneficiary of this technological shift.

However, the path forward is not without challenges. A high valuation, significant geopolitical risks centered on China, and strengthening competition from AMD and Intel are all factors that you must consider. While the long-term growth story remains compelling, these risks suggest a degree of caution is warranted.

For the latest AI-driven analysis, real-time trading signals, and market insights on NVIDIA, you can sign up for Intellectia AI to stay ahead of the curve.