Key Takeaways

Nvidia's path to a potential $500 price target by 2026 is driven by AI dominance, strategic partnerships, and massive infrastructure spending, though significant risks remain.

• Analysts overwhelmingly bullish: 44 of 48 analysts rate NVDA "Strong Buy" with average target of $264.97, representing 43% upside potential from current levels.

• AI market dominance creates moat: Nvidia controls 80-95% of AI GPU market with CUDA ecosystem lock-in affecting 4 million developers worldwide.

• Massive revenue pipeline ahead: Data center revenue projected to reach $51.2B by FY2026, with $500B in Blackwell/Rubin demand visibility through 2026.

• China re-entry catalyst: Potential $54B revenue opportunity from 2+ million H200 chip orders, despite regulatory complexities and revenue-sharing requirements.

• Significant downside risks exist: AI bubble concerns, geopolitical tensions, and Fear & Greed Index at 39 signal caution despite strong fundamentals.

The $3-4 trillion AI infrastructure spending forecast by 2030 provides enormous long-term opportunity, but investors must weigh exceptional growth potential against mounting market skepticism and regulatory headwinds.

NVDA stock prediction remains a hot topic for investors after the company's mind-boggling 1,100% share price growth in the last three years. The AI boom has propelled Nvidia's revenue through new product launches and major partnership deals.

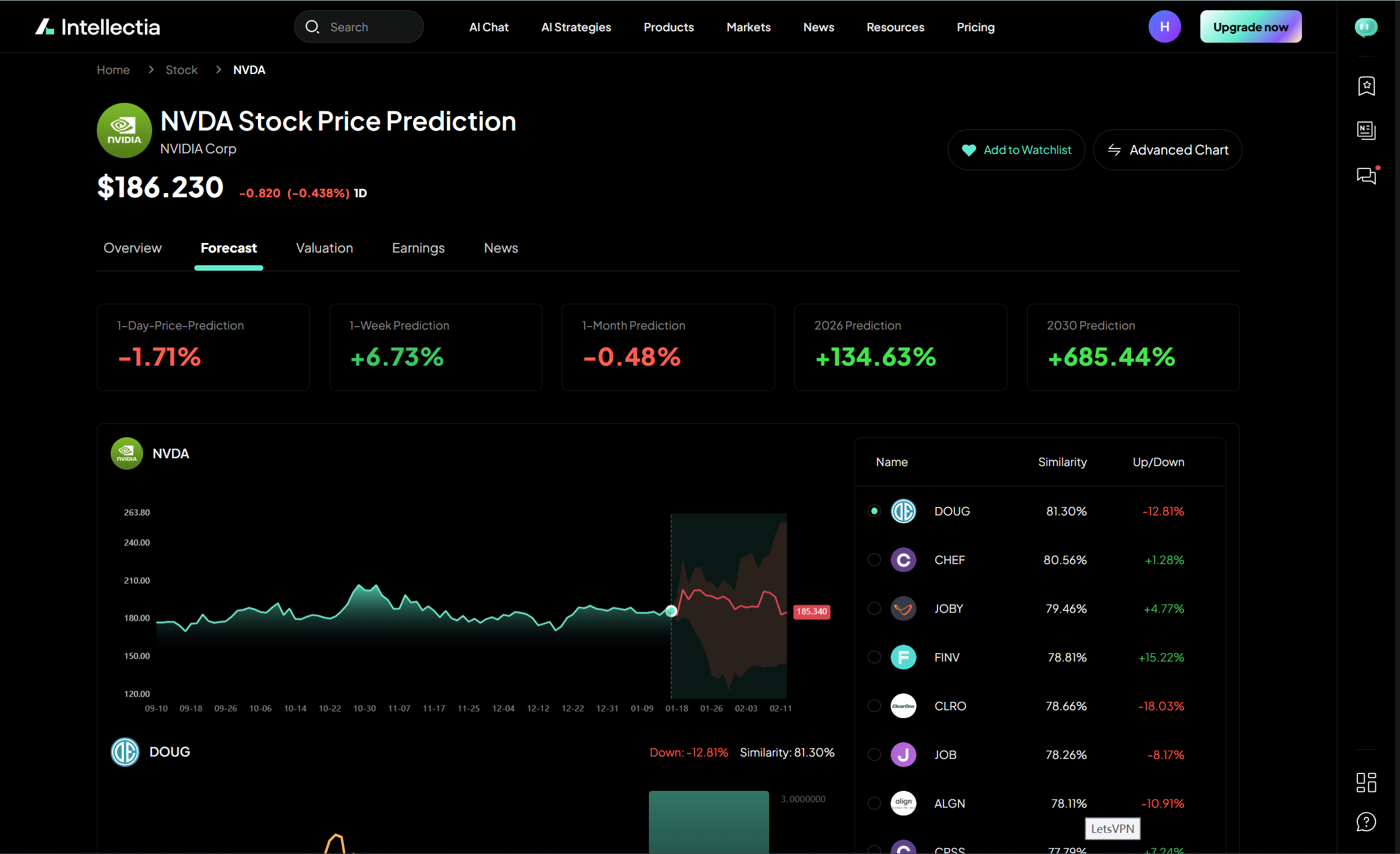

Recent analyst forecasts put the average NVDA price target at $264.97. The estimates range from $200.00 on the low end to $352.00 at the high end. This target suggests a 43.27% potential upside from the last price of $184.94. Nvidia stock ended last year with a 38% gain. The Nvidia stock forecast 2026 points to more growth ahead, with predictions of trading between $175.48 and $271.72.

You'll find out why several analysts have set an ambitious $500 price target for 2026. The factors driving these optimistic NVDA price targets and the potential risks that could impact this AI semiconductor leader's remarkable growth trajectory deserve a closer look.

Nvidia’s Position in the AI and Semiconductor Market

Nvidia rules the AI chip market with an 80-95% share of AI GPU needs. The company has become the life-blood of the AI development. This market leadership gives a resilient foundation to nvda stock prediction models through 2026 and beyond.

Data Center Revenue Growth: $51.2B in FY2026

The data center segment has grown into Nvidia's main revenue source and has overtaken its gaming business. Analysts expect the data center revenue to hit $51.2B by FY2026, which would make up about 65% of Nvidia's total revenue. AI solutions are spreading fast among enterprise and cloud service providers, driving this growth.

Cloud giants like AWS, Google Cloud, and Microsoft Azure are fighting to get their hands on H100 and upcoming Blackwell chips. These data center GPUs sell at premium prices—sometimes over $25,000 per unit—and bring in gross margins close to 70%. Such strong pricing power shapes the nvda price target projections, as these high margins could boost profits substantially through 2026.

On top of that, Nvidia's DGX systems and AI-specialized hardware fit into the company's vertical integration strategy. This helps Nvidia capture more value across the AI infrastructure stack and strengthens the nvidia stock forecast 2026 outlooks.

CUDA Ecosystem Lock-in and Developer Adoption

Nvidia's biggest edge might be its CUDA ecosystem. This proprietary parallel computing platform and programming model has become the go-to standard for AI development. Then, developers and companies face huge costs if they want to switch away from Nvidia's architecture.

Network effects power the CUDA ecosystem—more developers using CUDA means more AI frameworks and libraries optimized for Nvidia hardware. This software advantage helps protect against competition from AMD, Intel, and custom AI chip designers.

Nvidia's developer community has grown to over 4 million developers worldwide. These developers keep building new applications and optimizations for Nvidia hardware. This creates a cycle that makes the nvda stock prediction case stronger for long-term investors.

The developer ecosystem has:

TensorRT and CUDA-X AI libraries that optimize AI workloads

Support for every major AI framework including PyTorch, TensorFlow, and JAX

Enterprise-grade software stacks for vertical applications in healthcare, automotive, and finance

AI Infrastructure Spending Forecast: $3–4 Trillion by 2030

The nvidia stock price prediction 2030 makes more sense when you look at the massive AI infrastructure spending ahead. Industry analysts think global AI infrastructure spending will reach $3–4 trillion by 2030, creating a huge market to tap into.

This spending covers not just chips but complete AI systems, networking equipment, and specialized cooling solutions—areas where Nvidia sells products. The company now offers networking solutions through its Mellanox purchase, letting it grab more value from each AI infrastructure dollar spent.

The inference market offers another growth path. While smaller than the training market now, inference will grow as AI applications spread across industries. Nvidia has positioned itself well to serve this market with specialized hardware and software optimizations.

This huge infrastructure spending outlook supports many bullish nvidia stock price prediction 2030 models. It points to strong growth potential well past 2026.

Why Analysts Are Bullish on NVDA Stock Forecast

Wall Street analysts remain upbeat about Nvidia stock and see exceptional growth potential through 2026. Their positive outlook comes from several factors: AI demand shows no signs of slowing, product cycles keep succeeding, and new market opportunities continue to emerge.

Average Analyst Price Target: $264.97

Wall Street analysts who track Nvidia have set a consensus price target of $264.97. This suggests a possible 43.20% upside from current trading levels near $185.04. The target comes from 41 analysts who've shared their 12-month price forecasts in the last quarter. Most analysts expect the stock to hit $250.00, pointing to a 33% jump in the coming year. These numbers show their confidence in Nvidia's leadership in AI chips and its ability to grow its market share.

Top Analyst Target: $352.00 by 2026

Evercore ISI leads the pack with the highest forecast - a bold $352.00 price target for Nvidia by late 2026. This target suggests the stock could jump 86% from where it trades now. Analyst Mark Lipacis just raised his target from $261.00. He believes Nvidia's revenue could surge by 79% by mid-2026. Other big names share this optimism. Bank of America says "buy" with a $275.00 target, and Cantor Fitzgerald picks Nvidia as their top choice with a $300.00 target. Dan Ives at Wedbush, a five-star analyst who gets it right 56% of the time, sees $250.00 as his base case.

Strong Buy Consensus: 44 of 48 Analysts

Analysts show rare agreement about Nvidia's future. Right now, all but four of the 48 analysts covering the stock say it's a "Strong Buy". Here's how the ratings break down:

44 analysts say "Strong Buy" (92%)

2 analysts pick "Moderate Buy" (4%)

1 analyst suggests "Hold" (2%)

1 analyst warns "Strong Sell" (2%)

Tech stocks rarely see such strong agreement among analysts. StockAnalysis.com tells a similar story - out of 39 analysts, 22 rate it "Strong Buy," 15 say "Buy," 1 suggests "Hold," and 1 picks "Strong Sell". This overwhelming support shows how much faith analysts have in Nvidia's growth path.

China Market Re-entry with H200 Chips

Nvidia's possible return to the Chinese market with H200 AI chips has analysts excited. Chinese tech companies have ordered more than 2 million H200 chips, each costing around $27,000. This could bring in $54 billion from China alone. Nvidia has found ways to alleviate regulatory risks by asking Chinese customers to pay everything upfront.

Chinese officials might approve some H200 imports early in 2026's first quarter. Nvidia's CEO Jensen Huang says customers really want these H200 chips and they've ramped up their supply chain to make more. The first H200 chips should arrive before mid-February 2026. New rules mean Nvidia must give 25% of its China revenue to the U.S. government, but analysts think the company could still make over $40 billion from this market.

This potential comeback to China makes analysts even more certain that Nvidia will keep growing beyond current expectations. Their bullish stock predictions through 2026 reflect this confidence.

Key Drivers Behind the $500 NVDA Price Target

The bullish $500 nvda price target stems from several tech breakthroughs and mutually beneficial alliances. These developments are the foundations of Nvidia's long-term growth path through 2026 and beyond.

Blackwell Ultra and Rubin Platform Rollout

Nvidia's AI capabilities have taken a huge leap forward with the next-generation Rubin platform. The platform has six new chips that work together as "one incredible AI supercomputer": the NVIDIA Vera CPU, NVIDIA Rubin GPU, NVIDIA NVLink 6 Switch, NVIDIA ConnectX-9 SuperNIC, NVIDIA BlueField-4 DPU, and NVIDIA Spectrum-6 Ethernet Switch. The platform trains Mixture-of-Experts (MoE) models with 4x fewer GPUs, which speeds up AI adoption rates.

Jensen Huang revealed in his October keynote that they can see "visibility into a half a trillion dollars of cumulative Blackwell and early ramps of Rubin through 2026". This is a big deal as it means that the projected demand of $500 billion over five quarters is 2.4 times the data center revenue from the last quarter.

The core tech companies that will use the Rubin platform are:

Cloud providers: AWS, Google, Microsoft, CoreWeave, Nebius, Oracle

AI leaders: OpenAI, Anthropic, Mistral AI, xAI

Enterprise tech: Dell, Lenovo, Supermicro

AI Partnerships with Oracle, Meta, and Google

Mutually beneficial alliances with tech giants have boosted Nvidia's market position. Oracle's CEO Clay Magouyrk pointed out that "together with NVIDIA, we're redefining the limits of what customers can build and scale with AI". Google's Sundar Pichai also highlighted their "deep and long-standing relationship" and plans to bring "the impressive capabilities of the Rubin platform" to customers.

Nvidia has moved into healthcare with a $1 billion AI drug discovery initiative with Eli Lilly. This alliance targets the $105 billion drug discovery market, which should grow by nearly 10% each year. The company has also started working with Palantir, T-Mobile, and Uber to vary its revenue through AI-powered applications in different industries.

Inference Acceleration via Groq Acquisition

Nvidia made its biggest purchase ever by acquiring Groq's assets for $20 billion. This move targets the growing inference market where AI models see real-life use. Groq's Language Processing Unit (LPU) technology can do 10x the work at one-tenth the cost of commercial GPUs when running GPT-4.

Jensen Huang told employees in an email that Nvidia will "merge Groq's low-latency processors into the NVIDIA AI factory architecture to serve more AI inference and real-time workloads". This purchase helps optimize inference, which becomes more crucial as AI applications expand.

Networking Growth: 162% YoY via NVLink and Spectrum-X

The networking business has become Nvidia's growth engine, with revenues jumping 162% year-over-year to $8.19 billion in Q3 FY2026. This rapid growth shows how essential high-speed interconnects are for larger and more complex AI models.

The company's Spectrum-X Ethernet technology showed "double-digit sequential and year-over-year growth, with annualized revenue exceeding $10 billion". Combined with NVLink and InfiniBand solutions, these networking products are vital for data centers building large AI clusters. Data centers now use more networking components as clusters grow bigger, which helps Nvidia's profit margins.

Valuation Metrics and Technical Indicators

Image Source: Chartmill

Let's take a closer look at Nvidia's financial metrics to get vital context about the nvda stock prediction landscape beyond what analysts say. Technical indicators show a mixed but largely positive outlook for investors who track the nvidia stock forecast 2026.

Forward P/E Ratio: 41.09 vs Sector Average

Nvidia trades at a forward P/E ratio of 41.09. This shows how much investors will pay for predicted future earnings growth. The ratio sits above the semiconductor industry average of 42x. The stock trades at a slight premium. The company's dominant AI position justifies this valuation. Nvidia's forward P/E should drop to about 22.9x in the next five fiscal years. This is a big deal as it means that current valuations could become more attractive for long-term investors who watch nvda stock prediction trends.

PEG Ratio: 1.03x Indicates Growth Justification

The Price/Earnings to Growth (PEG) ratio stands at 1.03x. This ratio suggests Nvidia stock has reasonable value compared to its growth potential. The number looks even better when compared to competitors. Microsoft and Meta have higher PEG ratios of 2.276 and 2.376. A PEG ratio near 1.0 usually means fair value—not expensive despite the high P/E ratio. This metric supports the bullish nvidia stock forecast 2026 since current prices match growth expectations well.

MACD and RSI Trends: Bullish but Stabilizing

Nvidia's technical indicators show a stabilizing pattern now. The RSI reads 51.52, right in the neutral zone—neither overbought nor oversold. The MACD shows 0.845, which bulls like to see. But some conflicting data puts MACD at -0.0573, which hints at bearish momentum in the short term.

The Intellectia.ai AI Screener helps analyze this market behavior. You can filter the entire market instantly to find companies that might benefit from the Gemini 3 trend. Look for Google's suppliers or competitors that buy more chips.

SMA/EMA Signals: 50-Day and 200-Day Support Levels

Technical charts show the 50-day moving average at $183.10 beats the 200-day average of $180.00. Traders call this a "golden cross". This pattern often signals bullish momentum. Nvidia now trades above its rising SMA(20), declining SMA(50), and rising SMA(200). These support levels build a foundation for nvda price target projections as the stock tests these key technical levels.

Risks and Market Sentiment for 2026

Several warning signs point to potential headwinds for NVDA stock prediction, despite bullish projections. The market's attitude has become more cautious as AI investments face growing scrutiny.

AI Bubble Concerns and Valuation Compression

Tech executives are raising red flags about market excess. Google CEO Sundar Pichai pointed out "elements of irrationality" in AI markets. OpenAI CEO Sam Altman acknowledged that investors are "overexcited about AI". A survey showed that 45% of fund managers saw an AI bubble as the market's biggest tail risk. Tech billionaire Peter Thiel sold his $100 million Nvidia stake, which suggests smart money might be leaving before a correction.

Geopolitical Risks: China Export Controls

The Chinese government has set new limits on H200 chip purchases. They now require approval under "special circumstances" such as university research. This vague policy creates uncertainty for nvidia stock forecast 2026. U.S. senators have proposed laws to stop advanced AI chip exports to China. Nvidia now faces pressure from both sides of this regulatory battle.

Investor Rotation into Other AI Stocks

Small investors are moving away from Nvidia toward smaller AI companies. The [AI Stock Picker](https://intellectia.ai/features/ai-stock-picker) offers evidence-based, applicable information for daily recommendations. Investors have reduced their purchases of leveraged Nvidia ETFs to a one-year low as they move their money to companies like Applied Digital and CoreWeave.

Volatility Index and Fear & Greed Score: 39 (Fear)

Market anxiety has reached levels not seen since April. The Fear & Greed Index dropped to 39, landing firmly in the "Fear" zone. The VIX climbed near 25, reaching its highest point since May.

Conclusion

Nvidia's journey to a $500 price target by 2026 looks promising with several compelling factors backing it up. The company holds a commanding 80-95% market share in AI GPUs, which sets a strong foundation for future growth. Their data center revenue is expected to reach $51.2 billion by FY2026, showing the remarkable scale of their expansion.

The market sentiment remains highly positive. A striking 44 out of 48 analysts have given Nvidia a "Strong Buy" rating, with an average price target of $264.97. This target suggests a 43% upside from current levels. The $500 target shows even more optimism, driven by breakthroughs like the Rubin platform and mutually beneficial alliances with Oracle, Meta, and Google.

Notwithstanding that, investors should consider some risk factors carefully. China export controls and geopolitical tensions could restrict access to a crucial market worth potentially $54 billion. The growing worry about an AI bubble might squeeze valuations across the sector. Market confidence has turned cautious, as shown by the Fear & Greed Index dropping to 39.

The valuation story has multiple layers. Nvidia's premium forward P/E of 41.09 might seem high, but its PEG ratio of 1.03x suggests this premium aligns with expected growth rates. Technical indicators send mixed messages yet broadly support continued strength, with key moving averages acting as price support.

Success for Nvidia hinges on balancing massive AI infrastructure spending forecasts against increasing regulatory pressures and market doubts. They must deliver perfectly on their Blackwell Ultra and Rubin platform while adapting to shifting investor views. Investors eyeing that ambitious $500 target should watch these growth drivers and potential obstacles closely through 2026.