Key Takeaways

- Nancy Pelosi’s trading record continues to inspire investors in 2025.

- Her investments are typically aligned with major market trends, particularly in the fields of AI and technology.

- AI-powered tools like Intellectia’s Whale Tracker now make it easier to monitor and learn from Pelosi’s portfolio.

- Some of Pelosi’s top-performing stocks include Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOG), and Broadcom (AVGO).

- Nancy Pelosi is estimated to have more than $270 million in net worth as of 2025, which is primarily driven by these extremely successful stock and options trades.

- Following her portfolio means understanding the logic behind market timing and political capital.

Introduction

Let’s be real — sometimes the stock market feels like it has two sets of rules: one for the everyday investor, and another for those who already know what’s coming next.

That’s exactly why people started following Nancy Pelosi’s trades. Whether you admire her political career or not, there’s no denying that when Pelosi or her husband makes a move, it often pays off big.

But what if I told you there’s a way to watch the market's biggest players—people with unique insight into the industries that Congress legislates? You see, Nancy Pelosi’s trading record is public, and her portfolio has consistently outperformed the S&P 500 index for years.

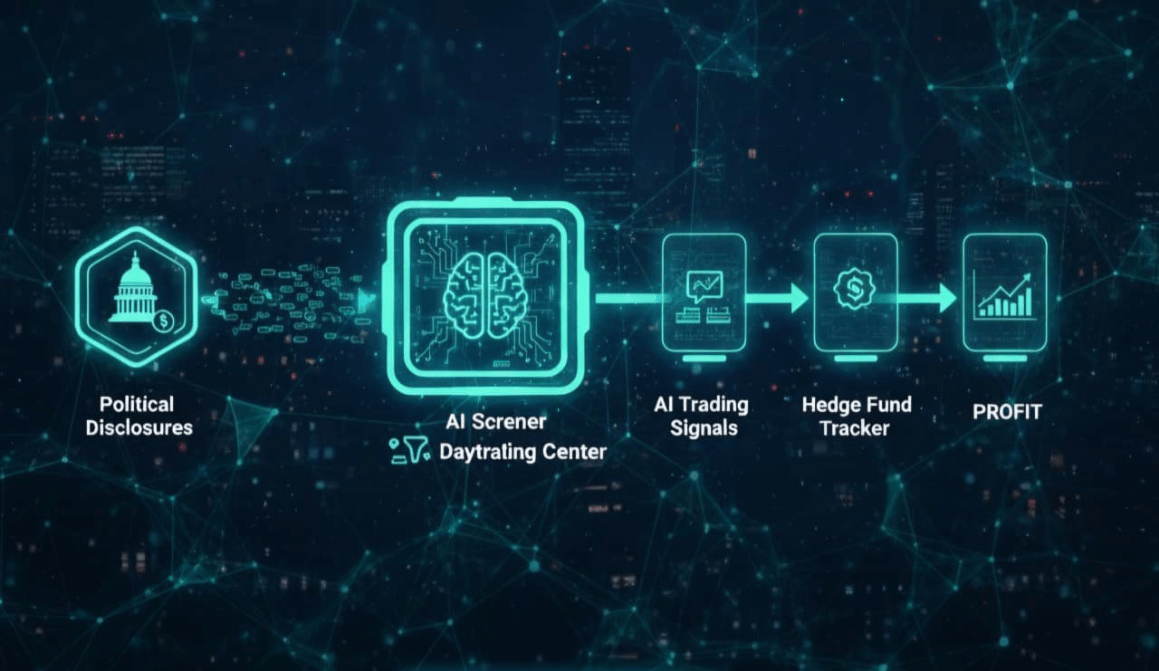

2026 will definitely not be like the early days of manually tracking congressional trades. And as experts in AI stock & crypto analysis, we understand how to turn public government filings into powerful, actionable trading signals. We’ve compiled the definitive guide to the tracker in 2026, showing you the top apps and the exact tech stocks to consider adding to your portfolio today.

Why Everyone Follows the Nancy Pelosi Stock Tracker

Here’s the thing: Nancy Pelosi’s trades have almost become a market indicator of their own.

In 2021 and 2022, Reddit threads would light up every time she or her husband, Paul, filed a new stock disclosure. “The Queen of Stocks” and “The Oracle of Congress” became some of her popular nicknames — but behind the memes, something serious was happening. People realized her trades weren’t random.

For example, when Paul Pelosi purchased call options on Nvidia (NVDA) months before key semiconductor legislation was introduced, investors noted the perfect timing. The stock later surged. That single trade became a topic of discussion among analysts on CNBC, Bloomberg, and social media.

By 2025, the “Pelosi Tracker” is no longer just a meme. Political transparency laws require members of Congress to file reports of their stock trades. That’s where the Nancy Pelosi Stock Tracker comes in — a collection of apps and AI-powered platforms that automatically collect and organize those filings so you can see what’s happening before it hits the headlines. So, if you’ve ever wondered how some traders know when the next big move is about to happen, this is part of the answer.

Today, tools like Intellectia’s Whale Tracker take that even further. They don’t just list Pelosi’s trades — they analyze them in context, compare them to hedge fund behavior, and utilize AI to identify trading patterns that may give signs of the next big opportunity. That’s the difference between manually checking filings and using an AI assistant.

Top Nancy Pelosi Stock Tracker Apps in 2026

If you’re serious about following Pelosi’s moves (and other political portfolios), you’ve got several solid options in 2026. Let’s go through the best ones — and why they matter.

Intellectia Whale Tracker

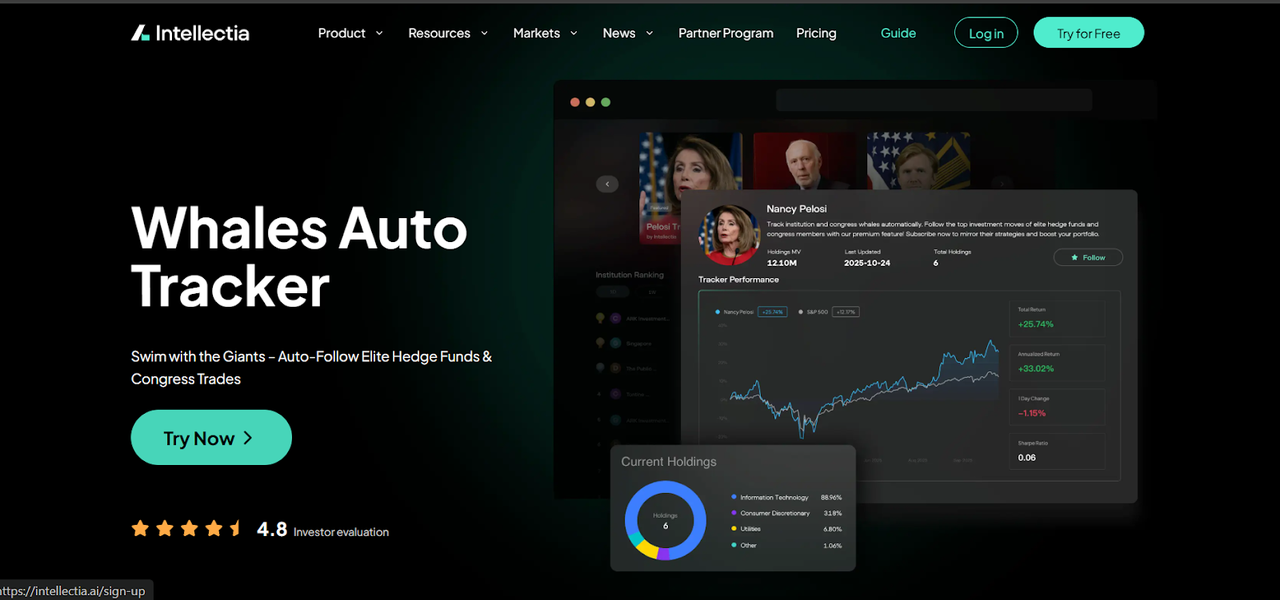

Now, if you’re looking for more than just raw data — if you want AI-powered insights, not just a spreadsheet — then Intellectia’s Whale Tracker is where things get even more profound.

Whales Auto Tracker uses artificial intelligence to not only track Pelosi’s public filings but also interpret them. It connects dots across:

- Timing patterns (how often she trades before legislative cycles)

- Sector concentration (AI, tech, energy, etc.)

- Hedge fund parallels (which funds made similar trades around the same time)

- Predictive modelling (what similar trade patterns have led to in the past)

Unlike basic trackers, Intellectia’s platform automatically syncs with your portfolio. That means it can notify you if Pelosi makes a trade in a stock that matches your watchlist.

What’s even more impressive is the AI Forecast Engine. It uses historical trade outcomes to assign a probability score — essentially, the likelihood that a trade will outperform the market over the next 3, 6, or 12 months.

Imagine knowing not just what Pelosi traded, but why it might matter next quarter. That’s what makes Intellectia.ai the next evolution in political trade tracking.

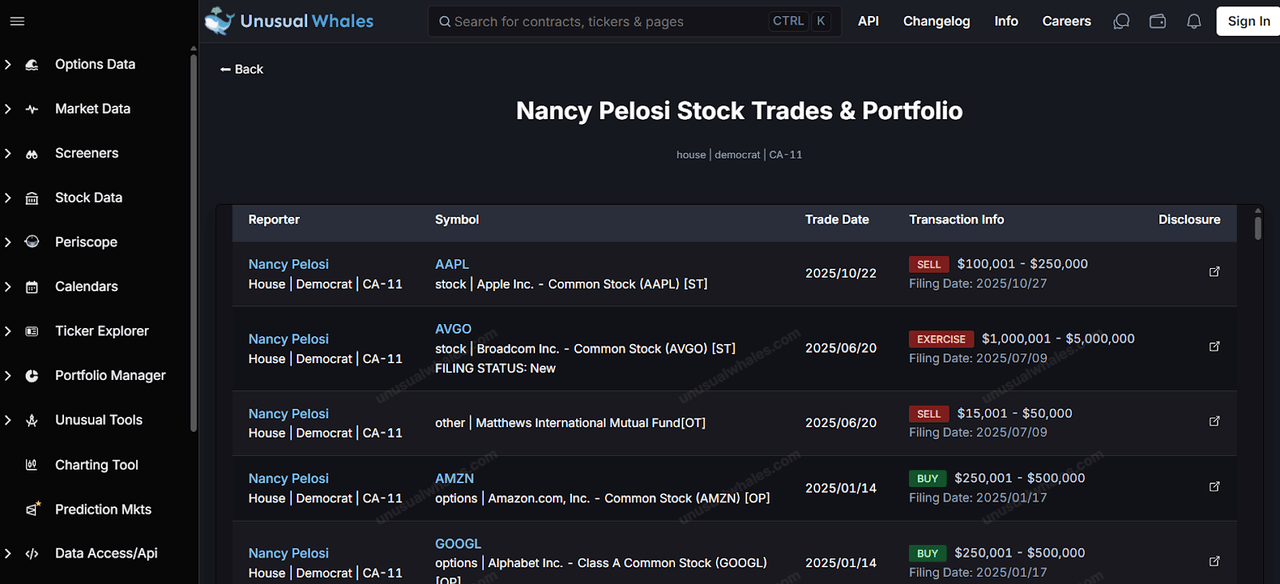

Unusual Whales

Unusual Whales takes things to another level by combining political trading data with options flow analysis.

In plain language, it doesn’t just show you Pelosi’s trades; it shows you how institutional traders are reacting around the same time.

This tool visualizes when trades are made, which sectors are targeted, and how legislative calendars might influence market movement. It’s the favorite among retail traders who like data-driven decisions but still want an intuitive interface.

Unusual Whales also offers real-time alerts, so you’ll know the minute a new Pelosi disclosure hits the system.

If you’re into correlation tracking — say, how Pelosi’s trades overlap with major hedge funds — Unusual Whales delivers that, too.

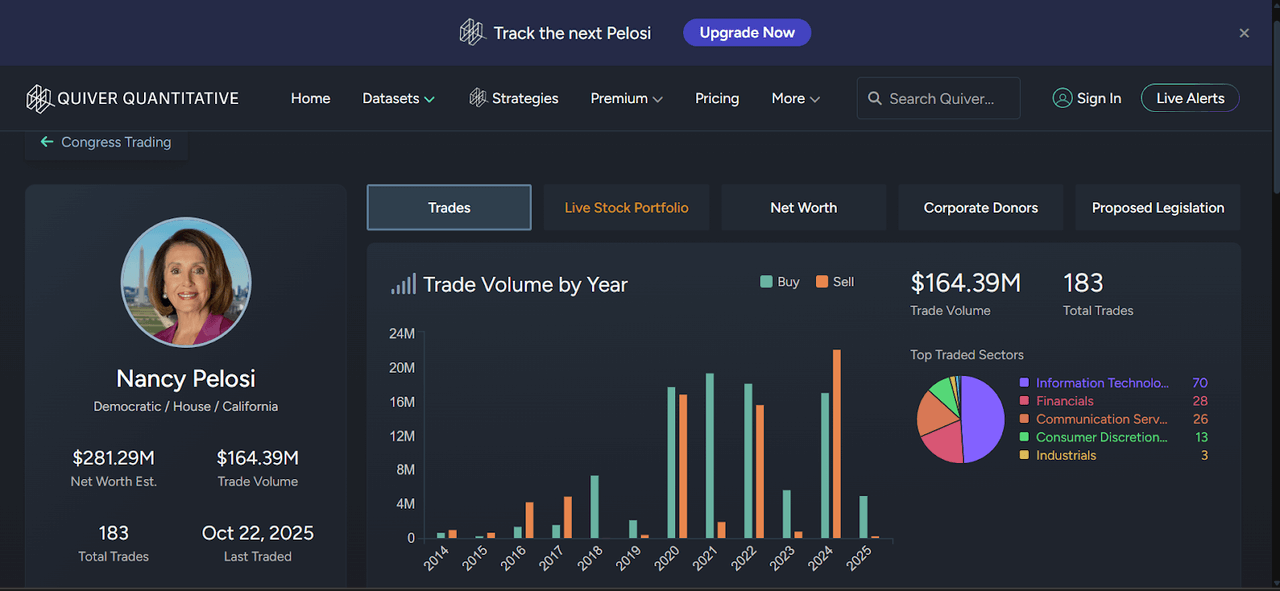

QuiverQuant

If you’ve ever searched “Pelosi tracker” online, chances are you’ve stumbled upon QuiverQuant. It’s one of the original tools that brought congressional trading into the spotlight. The platform scrapes public data directly from the U.S. House of Representatives and Senate financial disclosures, updating it daily.

What’s cool about QuiverQuant is its visual dashboards. You can see Pelosi’s entire trading history, broken down by sector, gain/loss percentages, and comparison charts versus the S&P 500.

It’s fully transparent — no AI predictions or interpretations, just raw data. Perfect for those who prefer to see the numbers themselves before drawing a conclusion.

Top Nancy Pelosi Stocks to Buy in 2026

Let’s talk about what everyone really wants to know — which stocks Pelosi owns that are worth keeping an eye on in 2026.

These include stocks that Pelosi has traded or held in previous filings, and many remain her core positions as she enters the next year.

Here’s a quick overview before we break them down one by one:

| Company Name | Ticker Symbol | Sector | Focus & Key Strength | Strategic Rationale |

|---|---|---|---|---|

| NVIDIA Corp. | NVDA | Semiconductors / AI | Undisputed AI Chip Leader: Dominates data center and generative AI infrastructure. | A core high-growth holding for mirroring the long-term AI hardware trend. |

| Microsoft Corp. | MSFT | Software / Cloud | Enterprise & Cloud Dominance: Azure cloud platform and AI integration via Copilot. | Offers defensive growth and exposure to corporate adoption of AI (SaaS). |

| Alphabet Inc. | GOOG | Internet Content / Tech | Diversified Tech Giant: Leading position in search, advertising, and cutting-edge Google DeepMind AI research. | Stable large-cap with exposure to future AI breakthroughs and digital ad revenue. |

| Broadcom Inc. | AVGO | Semiconductors / Software | Infrastructure & Networking: Supplies essential hardware and software for major data centers and networking. | Represents the backbone infrastructure necessary to power the entire AI and Cloud ecosystem. |

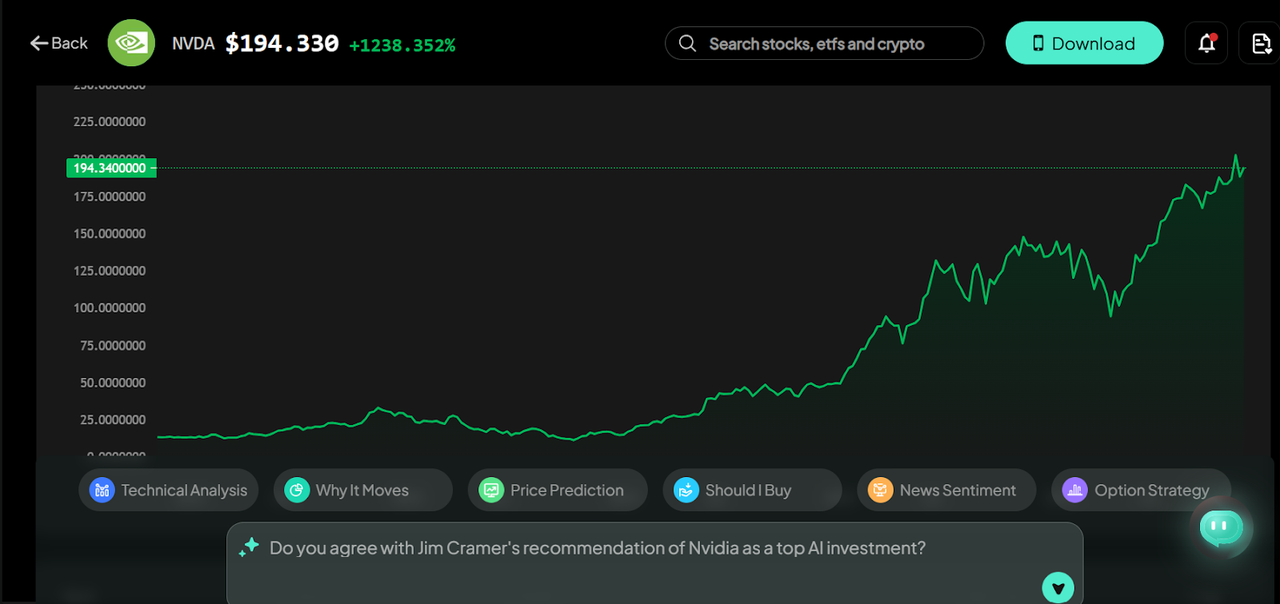

Nvidia (NVDA)

Let’s start with the golden child of AI — Nvidia. When Pelosi (through her husband) reportedly bought Nvidia options back in the early 2020s, the internet exploded. People mocked it at first, but the result was a massive profit when Nvidia's stock skyrocketed with the AI boom.

Fast forward to 2025 — Nvidia is no longer just a graphics card company. It’s the engine behind almost every major AI development on the planet. From ChatGPT-like models to autonomous vehicles, Nvidia’s chips are the backbone. This is why it continues to dominate Pelosi’s public holdings.

If you’re a long-term investor, Nvidia still has significant growth potential as the global AI arms race intensifies.

Alphabet (GOOG)

Next up is Alphabet, Google’s parent company. The story of Alphabet in the past decade is one of enormous change, not only as a search giant but also as an ecosystem builder based on AI. Its Gemini AI models are now competing head-to-head with OpenAI and Anthropic, and its cloud business is growing worldwide.

Pelosi’s holdings here reflect a bet on powerful data centers, advanced artificial intelligence, and automated advertising that are deeply embedded in the online ecosystem. For investors like you, Alphabet represents a blend of growth and stability.

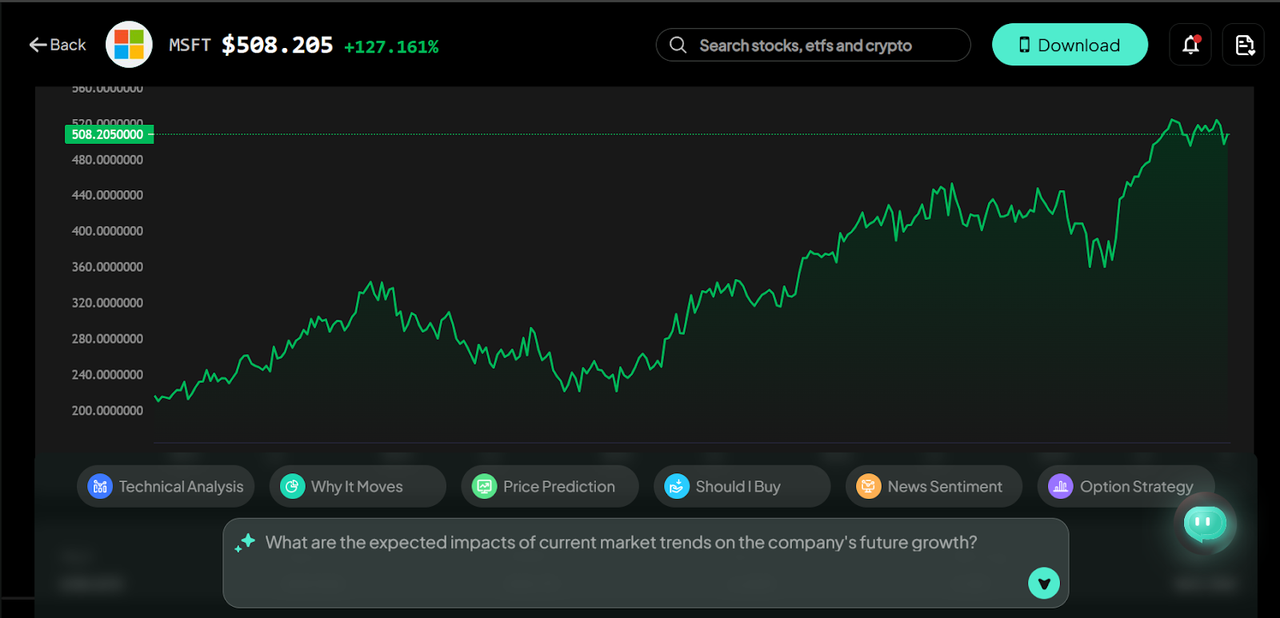

Microsoft (MSFT)

If Nvidia builds the chips and Alphabet builds the ecosystem, Microsoft builds the tools that everyone actually uses. Since its partnership with OpenAI, Microsoft has infused AI into everything — from Office 365 to Azure and Windows Copilot. Pelosi’s interest in MSFT makes sense: it’s one of the few trillion-dollar companies that continues to innovate like a startup.

By 2030, Microsoft plans to expand into AI-driven cybersecurity and enterprise automation — two sectors projected to grow faster than the broader technology market.

So, if you’re building a portfolio inspired by Pelosi’s holdings, Microsoft is your “safe innovation” play.

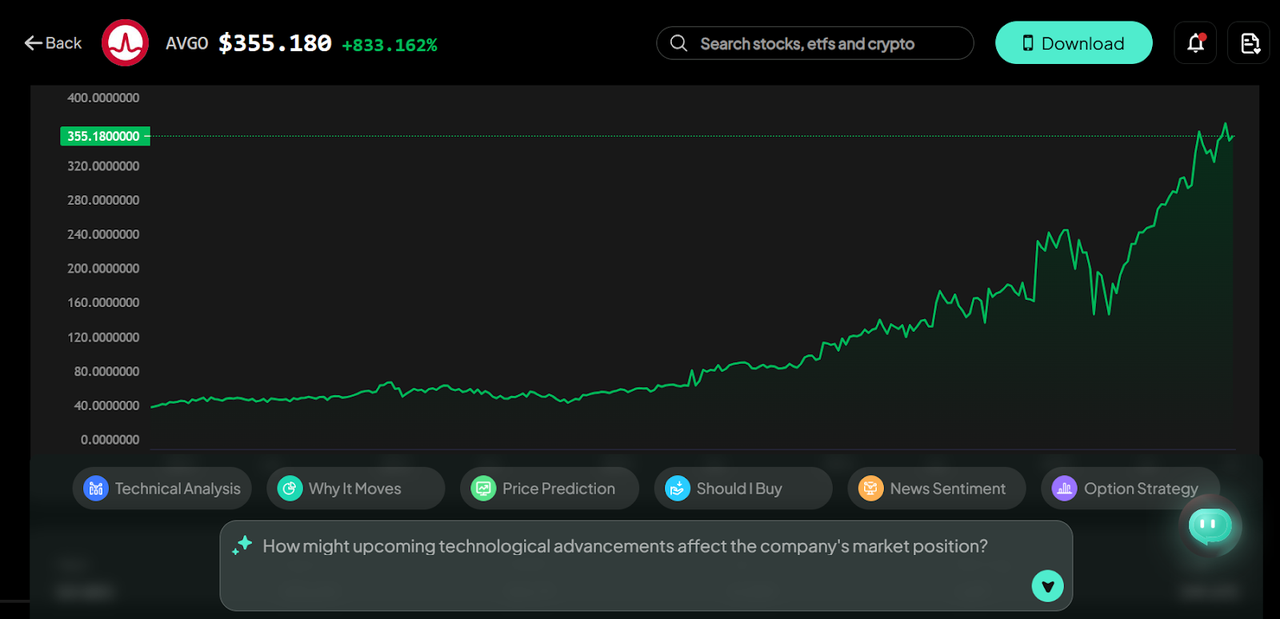

Broadcom (AVGO)

Last but not least, Broadcom. It doesn’t make headlines like Nvidia or Microsoft, but it’s a low-key giant. Broadcom supplies semiconductors and networking tech essential to 5G, AI servers, and data transmission — the unseen infrastructure that makes the modern tech world possible.

Pelosi’s filings indicate consistent exposure to Broadcom, likely due to its strong dividends and defensive positioning in the semiconductor sector.

In a volatile market, Broadcom provides the kind of balance that long-term investors crave.

Conclusion

At the end of the day, following Nancy Pelosi’s trades isn’t about politics — it’s the timing pattern. Her track record shows that political power and market timing often intersect, and understanding that can give you a real advantage. But instead of trawling through rumors, or having to sift through disclosures made by Congress, you can now have artificial intelligence-powered tools to do the hard work.

Platforms like Intellectia.ai make it possible not only to see what Pelosi trades, but also to understand why it matters — connecting political signals, stock data, and predictive analytics into one place.

If you’re serious about upgrading how you trade and invest, don’t wait until after the next disclosure drops. Sign up now on Intellectia.ai to get daily AI stock picks, real-time trade alerts, and automated tracking of political and institutional portfolios that could shape the markets in the coming years.