Welcome to Earnings Trading on Intellectia! This powerful tool helps you make smarter investment decisions based on the latest earnings calls. Whether you're an experienced trader or just getting started, leveraging earnings data can give you an edge in the market. Let’s walk through the features of this tool and show you how to make the most of them.

Step one: Key stats - your data overview

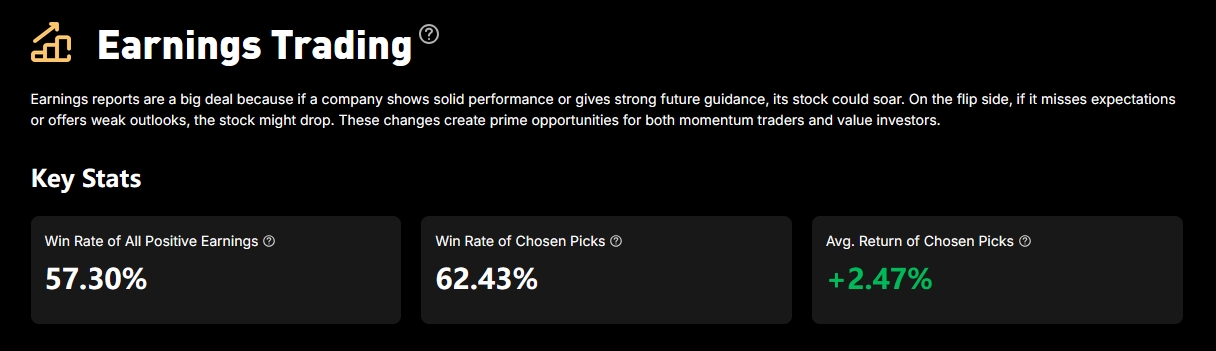

When you first access the Earnings Trading feature, you’ll be greeted with an overview of key statistics that give you insight into the effectiveness of the strategy. Here’s a breakdown of what each metric means:

Win Rate of All Positive Earnings: This metric shows the percentage of positive earnings reports that resulted in a price increase over the next 20 trading days. It gives you a quick way to evaluate how often positive earnings reports lead to price moves.

Win Rate of Chosen Picks: This represents the win rate of stocks identified by Intellectia’s AI as having strong investment potential following positive earnings events. It shows how often the stock price increases over the next 20 days based on AI’s recommendations.

Avg. Return of Chosen Picks: This metric tells you the average return of the AI-selected stocks in the 20 days following the earnings report. It helps you understand the potential rewards of following these picks.

These key stats provide you with a quick snapshot of how well the earnings trading strategy has worked historically, giving you confidence in the data behind the tool.

Step two: Intellectia’s chosen pick: AI-selected investment opportunities

Next, let’s explore Intellectia’s Chosen Pick, where the AI presents the best stock picks based on positive earnings calls. These selections are made using a combination of historical data, sentiment analysis, and real-time market reactions.

Why it matters: Our AI analyzes earnings calls and the surrounding sentiment to pick stocks that have a high likelihood of price increases. Based on backtesting data, these picks have shown a 70% probability of price gains in the 20 days after earnings reports.

How it works: When you click on a pick, you’ll be taken to a detailed analysis of that stock, with commentary from the AI explaining why it was chosen. You’ll also see a breakdown of the earnings call, giving you a clear understanding of the factors influencing the pick.

This feature allows you to capitalize on high-probability stock moves after earnings reports, providing you with actionable insights and saving you time by doing the heavy lifting for you.

Step three: Earnings summary list - filter and search for the best opportunities

The Earnings Summary List is where you can see a comprehensive list of earnings reports categorized by sentiment: Positive, Negative, or Neutral. Here’s how to use it effectively:

Filter: Use the filter option to sort earnings reports by their sentiment. Whether you’re looking for companies with positive earnings reports or focusing on neutral or negative reports, the filter helps you narrow down your choices.

Search: If you’re tracking a specific company, use the search bar to find the earnings summary for that stock. This ensures you never miss a relevant earnings call for the companies you’re interested in.

The Earnings Call Summary List helps you stay on top of the most recent earnings reports and quickly identify the best trading opportunities based on sentiment and market trends.

Conclusion

Intellectia’s Earnings Trading feature is a game-changer for investors looking to capitalize on earnings reports. By combining powerful AI analysis, performance metrics, and a comprehensive earnings call summary, you’ll have all the tools you need to make smarter, data-driven decisions.

Start by reviewing the key stats to understand how earnings events have performed historically.

Explore Intellectia’s Chosen Picks to identify high-probability trades based on earnings calls.

Use the Earnings Call Summary List to filter and search for the latest earnings reports and discover potential opportunities.

Now that you’re equipped with these tools, dive in and start trading smarter with Intellectia!