Key Takeaways

- Gold remains a leading safe-haven and inflation hedge in 2026 as recession risks rise.

- Investors can buy gold through physical gold, ETFs, gold stocks, futures, digital gold, and more.

- AI tools like Intellectia.ai help analyze trends, screen gold stocks, and time entries.

- Analysts expect gold to trade between $3,350–$3,620/oz in 2026 depending on rate cuts and global demand.

- Align your gold investment with your financial goals, risk tolerance, and market conditions to maximize success.

Introduction

Wondering whether gold is still a smart investment in 2026? With recession risks rising, inflation sticky at around 2.8%, and global uncertainties increasing, many investors are once again turning to gold—the world’s most trusted safe-haven asset.

Gold has historically protected wealth during every major downturn, and 2026 is no exception. Prices have remained strong above $3,350 per ounce, and analysts expect continued strength as central banks increase reserves and demand remains high.

Whether you’re a beginner or an experienced investor, this guide breaks down the best ways to invest in gold in 2026, how to pick gold stocks, and which platforms offer the best value. If you’re looking for stability, diversification, and long-term protection, gold is still one of the smartest assets you can own.

Why Invest in Gold?

Gold has captivated investors for centuries, and in 2026, its allure is stronger than ever. Here’s why adding gold to your portfolio makes sense: As of May 2025, gold trades at approximately $3,270 per ounce, with analysts predicting a rise to $3,357 by year-end, and some even forecasting $3,720 . With U.S. inflation at 3%, gold’s value tends to hold steady or appreciate, unlike cash or bonds.

Gold’s low correlation with stocks and bonds makes it a powerful diversification tool, reducing portfolio volatility during market downturns . Unlike digital assets, gold is tangible, offering a sense of security with its intrinsic value. Central banks, which have boosted gold reserves since 2022, continue to drive demand, supporting price growth.

A weaker dollar, pressured by economic policies, further enhances gold’s appeal, as it becomes more affordable for global buyers. Gold’s consistent performance, with only two negative return years since 2000, makes it a reliable choice for 2026’s uncertain landscape.

Factors to Consider Before Investing in Gold

Before you invest in gold, take time to evaluate these critical factors to ensure it fits your financial plan: Your investment goals shape your approach. Are you aiming to preserve wealth, diversify, or chase short-term gains? Wealth preservation might lead you to physical gold, while growth seekers may prefer gold stocks.

Costs vary by method: physical gold requires storage and insurance, ETFs charge management fees (around 0.5%-0.6%), and CFDs involve spreads. Tax implications, like capital gains tax on gold sales, also affect returns, so consult a tax advisor.

Your investment horizon—short-term trading or long-term holding—will influence your choice. For example, long-term investors might opt for Sovereign Gold Bonds, while traders may choose CFDs. By weighing these factors, you’ll align your gold investment with your financial strategy and 2025’s economic realities.

How to Invest in Gold: Different Ways

You have multiple ways to invest in gold, each tailored to different needs. Here’s a detailed look:

Physical Gold: This includes bars, coins (like American Eagles), and jewelry. It offers direct ownership and no counterparty risk, making it ideal for those who value tangibility. However, you’ll face storage costs, insurance fees, and potential theft risks. Large bars are less liquid, requiring specialized buyers.

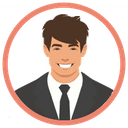

Gold Stocks: Investing in Agnico Eagle Mines (AEM) offers exposure to one of the world’s most reliable gold producers. As a low-cost miner with geographically stable operations, AEM provides leveraged upside to rising gold prices while maintaining strong operational discipline. Though its performance can diverge from gold’s spot price due to production costs and project risks, its consistent output and history of shareholder returns make it a solid option for investors seeking quality within the gold mining sector.

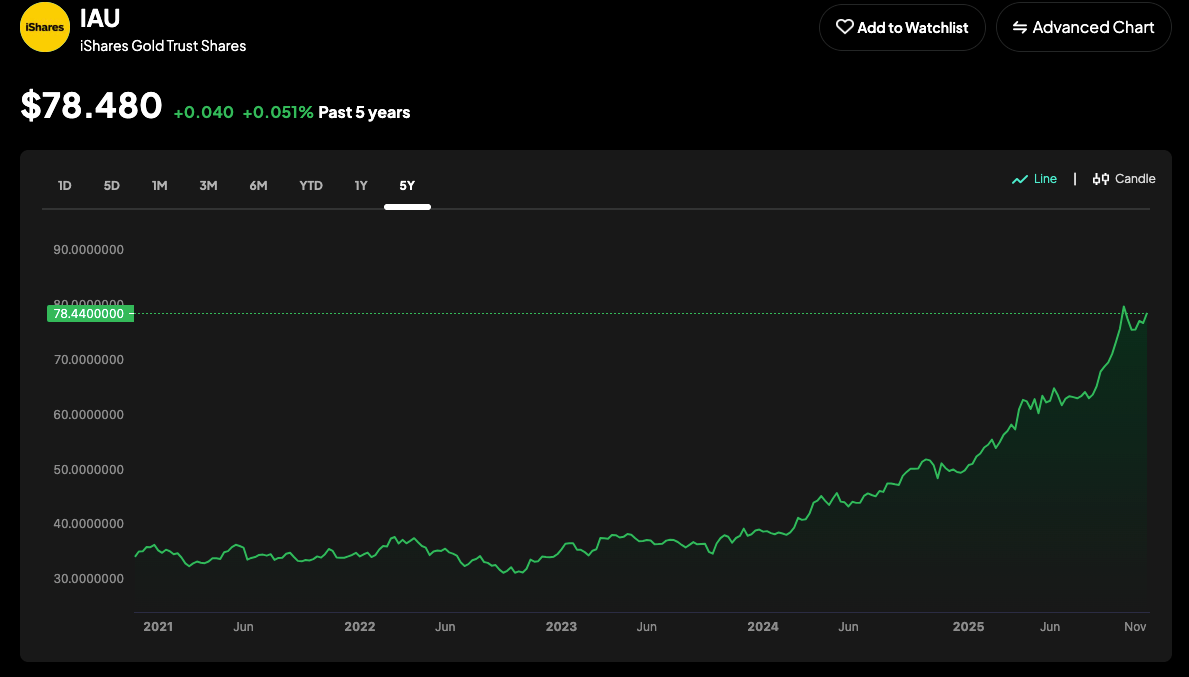

Gold ETFs: These funds, like SPDR Gold Shares, track gold prices and trade like stocks. They’re cost-effective (expense ratios as low as 0.09%) and don’t require storage, but you won’t own physical gold, and fees apply.

Gold Mutual Funds: These invest in gold-related companies or bullion, offering diversification. Professional management is a plus, but higher fees and exposure to other commodities may dilute returns.

Gold Futures and Options: These derivatives allow you to bet on future gold prices with high leverage, promising big gains but also significant losses. They’re complex and best for experienced traders.

Gold CFDs: Contracts for Difference let you speculate on price movements without owning gold. They offer flexibility to go long or short, but leverage amplifies risks, making them unsuitable for beginners.

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Physical Gold | Tangible, no counterparty risk | Storage costs, less liquid | Long-term wealth preservation |

| Gold Stocks | High return potential, dividends | Company risks, research needed | Growth-oriented investors |

| Gold ETFs | Easy to trade, low cost | Fees, no physical ownership | Beginners, traders |

| Gold Mutual Funds | Diversified, managed | Higher fees, mixed assets | Diversification seekers |

| Gold Futures | High leverage, big gains | High risk, complex | Experienced traders |

| Gold CFDs | Flexible, no storage | High risk, leveraged | Short-term speculators |

| Digital Gold | Convenient, fractional ownership | Platform risk, fees | Tech-savvy, small investors |

| SGBs | Interest, tax benefits | Long lock-in, region-specific | Long-term investors |

How to Invest in Gold: Step-by-Step Guide for Beginners

Step 1: Choose the Right Investment Method

Take a moment to think about what you want from your gold investment. Are you looking for something tangible you can hold, like physical gold bars or coins? Or do you prefer the ease of trading gold ETFs or digital gold on an exchange? If you’re okay with a bit more risk, gold stocks or CFDs might appeal to you for their growth potential.

Each method has its own risks and benefits, so research thoroughly. For example, physical gold offers security but requires storage, while ETFs are liquid but lack the tangible feel. Align your choice with your financial goals, risk tolerance, and whether you want direct ownership or market outlook.

Source: lbma.org

Step 2: Select a Reputable Broker or Dealer

Finding a trustworthy provider is crucial for a smooth investment experience. If you’re buying physical gold, look for dealers accredited by the London Bullion Market Association (LBMA) with strong customer reviews.

For ETFs, stocks, or CFDs, choose a regulated brokerage like Fidelity, Schwab, or Interactive Brokers. Check their licensing, read user feedback on platforms like Trustpilot, and ensure they have a solid reputation for security and transparency.

Step 3: Understand the Costs Involved

Every gold investment comes with costs you need to know upfront. Physical gold involves premiums over the spot price, plus storage and insurance fees—vault storage can cost $100-$300 annually. Gold ETFs typically have management fees, averaging 0.50%-0.60%, while CFDs come with spreads and overnight financing charges.

If you’re using a broker, check for trading fees or commissions as well. After choosing your provider, you’ll need to verify your account with ID documents and fund it, usually via bank transfer, credit card, or e-wallet, depending on the platform. Always compare costs across providers to maximize your returns.

Step 4: Execute Your Purchase

Now it’s time to make your investment. For physical gold, place your order with a dealer and arrange secure storage, either at home in a safe or in a professional vault. If you’re investing in ETFs or gold stocks, log into your brokerage account, search for your chosen fund—like SPDR Gold Shares (GLD)—and buy shares during market hours.

For CFDs or futures, open a position through a trading platform, specifying your trade size and leverage if applicable. Double-check all details, like quantity and price, before confirming your order to avoid mistakes. Keep records of your purchase for future reference.

Step 5: Develop a Clear Investment Strategy

A solid strategy keeps your investment on track. Are you aiming for long-term wealth preservation, or are you trading for short-term gains? Set a clear time horizon—holding physical gold for years versus trading ETFs monthly, for example. Decide how much of your portfolio to allocate to gold; experts often suggest 5-10% for diversification.

Use risk management tools like stop-loss orders, especially for volatile investments like CFDs. Regularly monitor your investment using tools like Intellectia.ai’s Stock Monitor to stay updated on price movements, and adjust your strategy as market conditions change.

Tips for Successful Gold Investing with Intellectia.AI

One can maximize gold investments potency with these detailed tips:

Diversify Your Gold Investments: Spread your capital across physical gold, ETFs, and stocks to mitigate risk. For example, allocate 50% to ETFs for liquidity, 30% to physical gold for security, and 20% to stocks for growth .

Set Clear Investment Goals and Time Horizons: Decide if you’re holding for decades or trading monthly. Long-term investors might choose physical gold, while traders may prefer ETFs. Clear goals guide your strategy .

Understand Costs and Fees: Compare storage costs for physical gold, ETF fees (0.61%), and CFD spreads to protect profits. Transparent cost analysis ensures better returns .

Leverage AI Tools for Better Decisions: Use Intellectia.ai’s AI Stock Picker to find promising gold stocks or Swing Trading to time ETF trades. These tools analyze market patterns, helping you seize opportunities. Start using Intellectia.ai to elevate your gold investing strategy today.

Conclusion

Investing in gold in 2026 offers a robust way to safeguard and grow your wealth amid economic turbulence. With prices potentially hitting $3,357 per ounce by year-end, gold’s role as a safe haven is undeniable . From physical gold to ETFs and stocks, each method caters to different goals and risk levels.

By following this guide’s steps and tips, you can invest with confidence. Platforms like Intellectia.ai boost your strategy with AI-driven insights, helping you navigate market complexities.