Key Takeaways

- Waymo does not currently have a standalone stock ticker; it is a subsidiary of Alphabet Inc. (GOOG/GOOGL).

- The most direct way to invest in Waymo today is by purchasing shares of its parent company, Alphabet.

- You can gain exposure to the autonomous driving sector through competitors like Tesla and Mobileye.

- AI-powered tools are essential for tracking volatility and sentiment surrounding autonomous vehicle stocks.

Introduction

Have you noticed the increasing number of driverless cars navigating city streets and wondered how you can capitalize on this technological shift? You are not alone. Many investors see autonomous driving as the next frontier in transportation, with Waymo leading the charge in reliability and commercial deployment. However, when you search for a ticker symbol to place a trade, you likely hit a dead end.

This confusion stems from the complex corporate structure behind these innovations. You might be ready to invest your capital into the future of mobility, but the market doesn't offer a direct path to Waymo just yet. This creates a problem for investors who want pure-play exposure to self-driving technology without the baggage of a massive conglomerate.

By analyzing the corporate hierarchy and the broader market sentiment, you can find strategic ways to gain exposure to this sector. This article will clarify exactly who owns Waymo, explain why you cannot buy shares directly, and provide you with the best actionable alternatives to position your portfolio for the autonomous revolution.

Who Owns Waymo?

To understand how to invest in Waymo, you must first understand its corporate lineage. Waymo is not an independent entity in the public markets; it is a subsidiary.

Alphabet’s Ownership of Waymo

Waymo began life in 2009 as the Google Self-Driving Car Project. It was one of the company's most ambitious "moonshots"—projects with high risk but massive potential reward. In 2016, it was spun out as a standalone subsidiary under Alphabet Inc. (NASDAQ: GOOG, GOOGL).

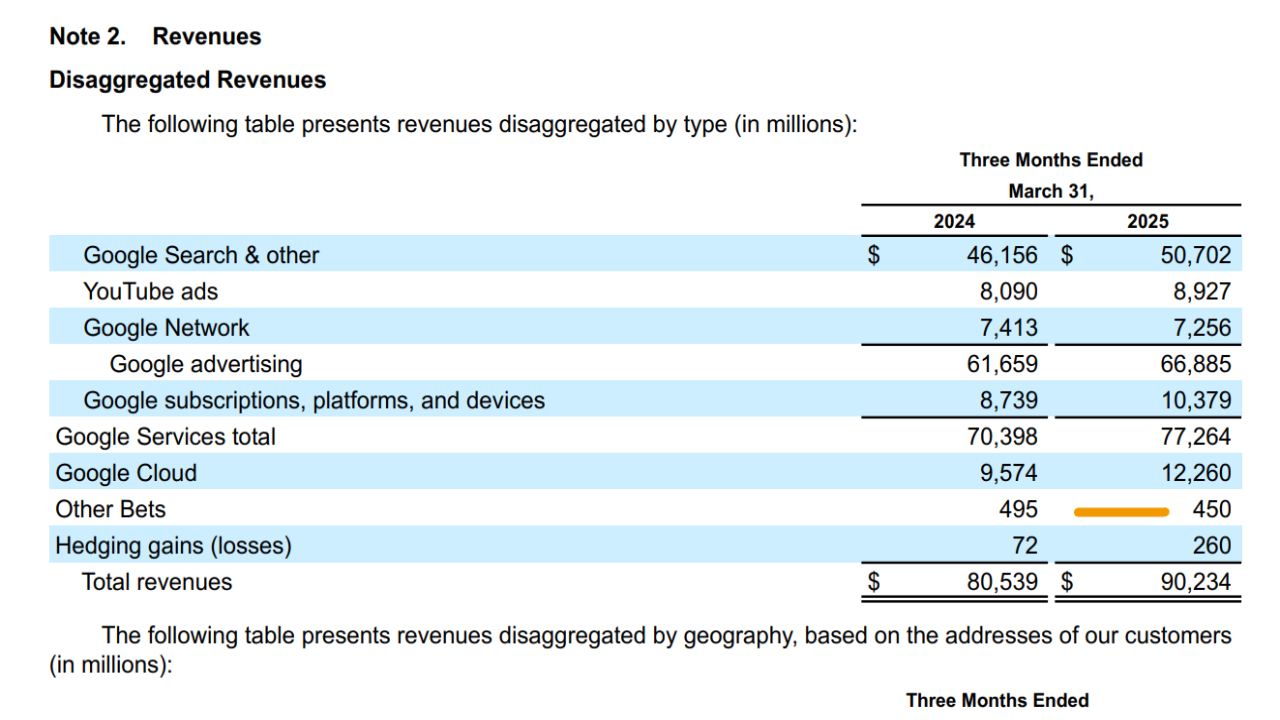

Alphabet serves as the holding company for Google and several "Other Bets," which includes Waymo, Verily (life sciences), and Wing (drone delivery). Because Alphabet retains full ownership, the financial performance of Waymo is rolled into Alphabet’s financial statements. When you look at Alphabet's filings, such as the recent 10-K for the fiscal year ended December 31, 2024, Waymo's revenues are categorized under "Other Bets."

This structure allows Waymo to benefit from Google's immense computational resources, data infrastructure, and cash reserves without the immediate pressure to turn a quarterly profit that independent public companies face.

Stakeholders & Major Investors

While Alphabet is the parent company, it is important to note that Waymo has accepted outside funding to validate its valuation and fuel expansion. In recent years, Waymo raised billions of dollars from external investors, including Silver Lake, Andreessen Horowitz, and AutoNation.

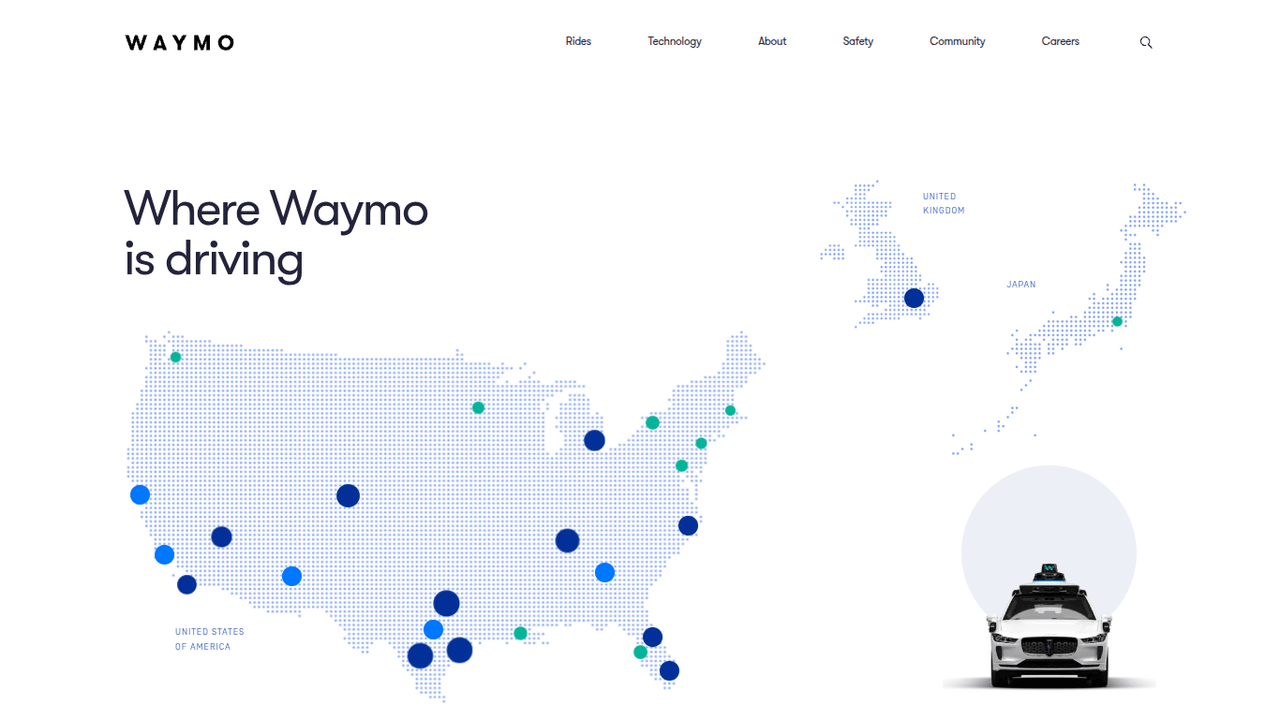

However, these are private equity investments. Alphabet remains the controlling stakeholder. As of late 2025, reports indicate that Alphabet continues to pour billions into the subsidiary to expand its "Waymo One" ride-hailing service in cities like Phoenix, San Francisco, Los Angeles, and Austin. The Q3 2025 earnings calls highlighted that while Waymo is generating revenue (contributing to the $1.6 billion in Other Bets revenue), it still operates at a loss as it scales infrastructure. For you as a retail investor, this means the only door in is through the parent company.

Does Waymo Have a Stock?

The short answer is no. As of late 2025, Waymo does not have a stock ticker symbol. You cannot log into your brokerage account and buy "Waymo" shares directly.

Understanding the "Other Bets" Structure

Waymo remains a private subsidiary of a public company. This distinction is crucial. When a company like Alphabet reports earnings, they separate their core business (Google Services and Google Cloud) from "Other Bets." Waymo falls into this latter category.

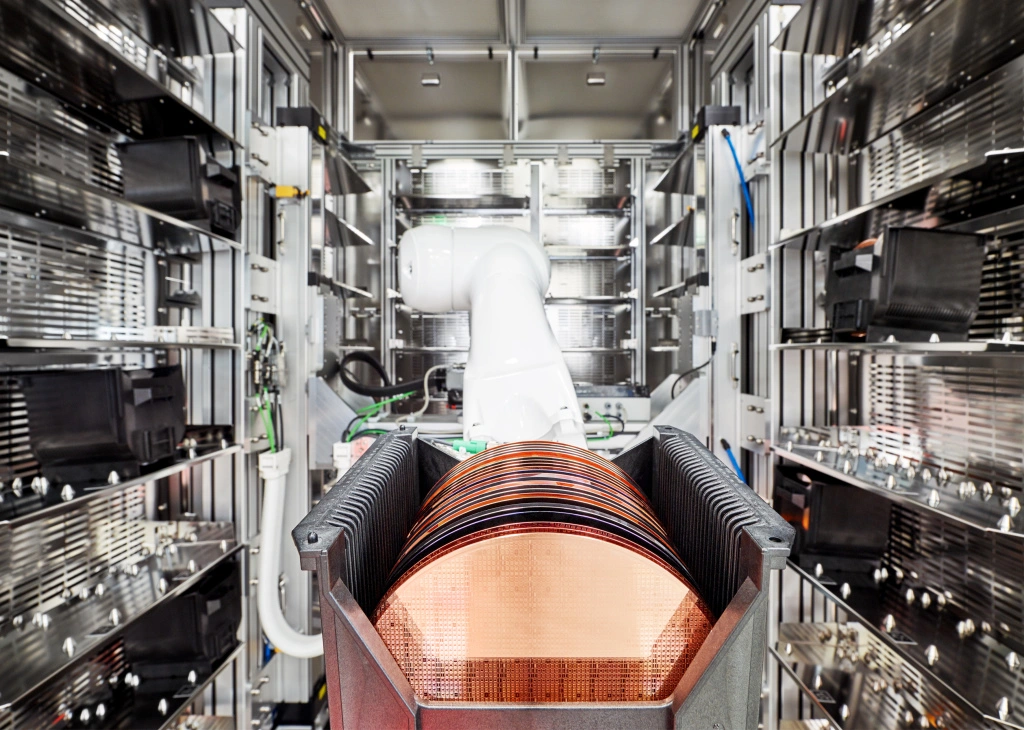

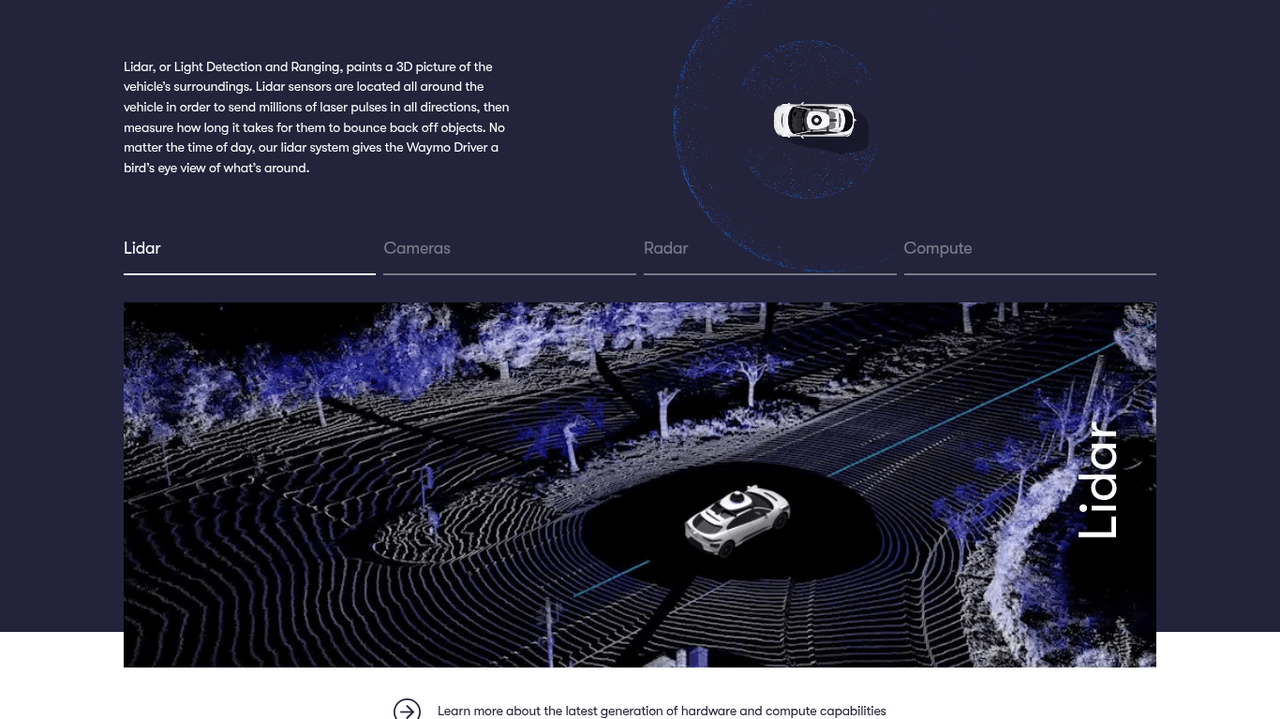

In the Q3 2025 earnings report, Alphabet reported an operating loss for Other Bets, despite revenue growth. This highlights why Waymo is not yet public. Autonomous driving is capital-intensive. It requires massive spending on hardware (LiDAR, cameras), software (AI training), and operations (fleet management). By keeping Waymo under the Alphabet umbrella, the company can sustain these losses using the massive profits generated by Google Search and Cloud.

The IPO Rumor Mill

There is constant speculation about a potential Waymo stock IPO. An Initial Public Offering (IPO) would spin Waymo off into its own publicly traded entity. Analysts often argue that Waymo might be worth more as a standalone company than it is currently valued within Alphabet.

However, an IPO usually occurs when a company has a clear path to profitability or needs to raise capital that the parent company cannot provide. Given Alphabet’s $100 billion+ quarterly revenue (as seen in Q3 2025), they have ample cash to fund Waymo internally. Until Alphabet decides to spin it off, the "Waymo stock price" is essentially a theoretical portion of Alphabet's stock price.

How to Buy Waymo Stock — The Only Real Ways to Invest Today

Since you cannot purchase Waymo directly, you must use indirect strategies. Here are the three most effective methods to gain exposure to Waymo and the autonomous driving theme.

Comparative Overview of Autonomous Driving Stocks

| Company Name | Ticker | Sector | Market Cap Focus | Key Strength |

|---|---|---|---|---|

| Alphabet Inc. | GOOGL | Comm. Services | Parent Company | 100% owner of Waymo; Leader in AI & Data. |

| Tesla Inc. | TSLA | Consumer Discretionary | Competitor | Massive fleet data; "Robotaxi" ambition. |

| Mobileye Global | MBLY | Technology | Supplier | ADAS technology supplier to major auto OEMs. |

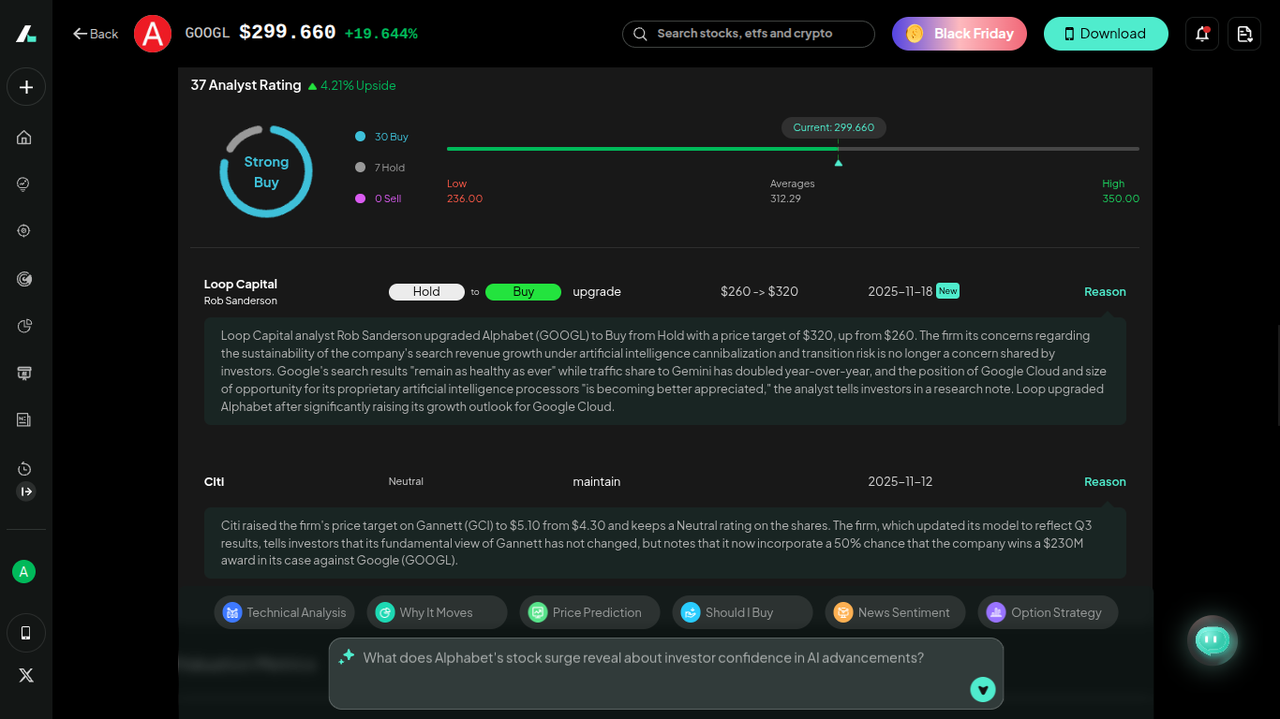

Method 1 — Invest in Alphabet (GOOGL), The Parent Company

The most direct way to own a piece of Waymo is to buy stock in Alphabet Inc. (NASDAQ: GOOGL or GOOG). By owning Alphabet, you technically own the asset that is Waymo.

Why this works:

Alphabet's recent performance has been stellar. In Q3 2025, they delivered their first-ever $100 billion revenue quarter. The growth isn't just from ads; it is driven by AI and Cloud. Waymo utilizes Google’s deep AI capabilities—specifically the tensor processing units (TPUs) and Gemini models—to train its driving software.

The Trade-off:

When you buy GOOGL, you are primarily buying an advertising and cloud computing business. Waymo represents a small fraction of the total enterprise value. However, if Waymo succeeds in monopolizing the robotaxi market, that value will eventually be reflected in Alphabet's stock price. This is the "safest" play because even if Waymo struggles, Google’s core business provides a massive safety net.

Method 2 — Invest in Waymo Competitors

If you want to bet on the technology of self-driving cars rather than just Waymo specifically, you should look at its fiercest rivals.

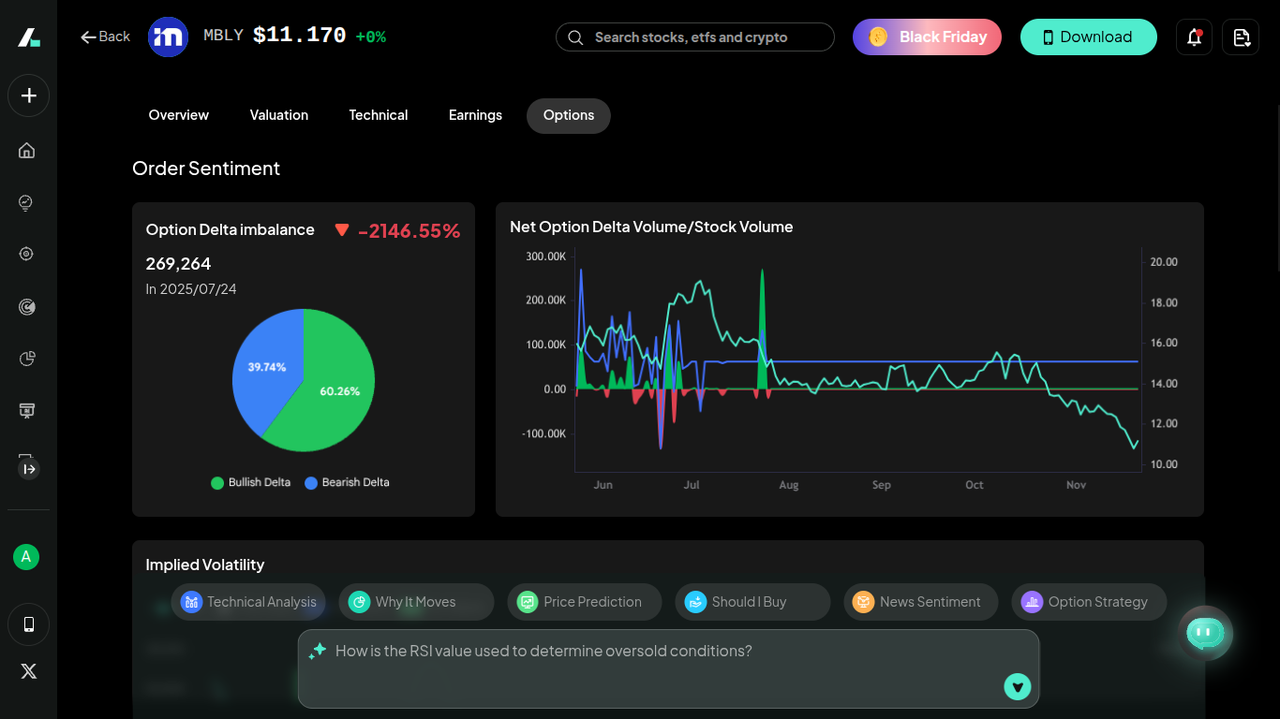

Mobileye Global (MBLY)

Mobileye takes a different approach. Rather than building a robotaxi fleet from scratch, they supply the computer vision and driver-assist technology (ADAS) to traditional automakers like Volkswagen and Porsche. In Q3 2025, Mobileye reported strong cash flows and highlighted their "Chauffeur" and "SuperVision" products, which aim to bridge the gap between driver-assist and full autonomy.

Investing in Mobileye is a bet that legacy automakers will eventually solve autonomy by partnering with a tech supplier, rather than Waymo taking over the world with its own fleet.

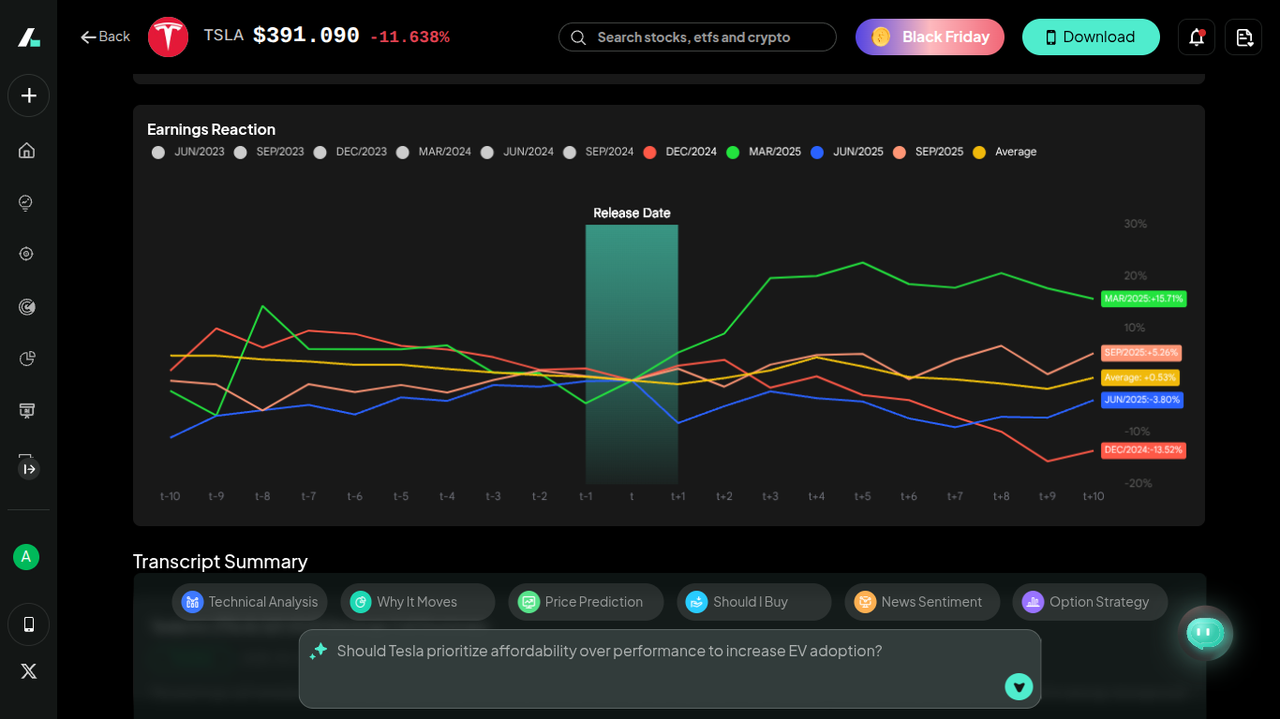

Tesla (TSLA)

You cannot talk about Waymo without mentioning Tesla. While Waymo uses LiDAR and detailed maps, Tesla relies on cameras and "end-to-end" neural networks trained on data from millions of customer cars. In their Q3 2025 earnings, Tesla emphasized their push toward a dedicated "Cybercab" and unsupervised Full Self-Driving (FSD).

Tesla is the high-risk, high-reward alternative. If they solve generalized autonomy, their massive fleet gives them a scale advantage Waymo might struggle to match. However, Waymo currently leads in actual driverless commercial miles driven.

Method 3 — Pre-IPO Shares (But With High Risk)

If you are an accredited investor (meeting specific income or net worth requirements), you might be able to buy Waymo stock before it goes public.

Secondary marketplaces like EquityZen, Forge Global, or Hiive allow employees of private companies to sell their vested stock options to outside investors.

Pros: You get direct exposure to Waymo shares (not Alphabet).

Cons: High minimum investments (often $10k+), very low liquidity (you can't sell easily), and fees are high. This is speculative and not available to the general public.

Using AI Stock Analysis Tools to Track Waymo-Related Stocks

The autonomous driving sector is incredibly volatile. News about regulatory approvals, safety recalls, or technological breakthroughs can send stocks like Tesla or Mobileye soaring or crashing in minutes. To navigate this, you cannot rely on outdated quarterly reports alone.

Why Waymo-Related Stocks Require Real-Time AI Analysis

Waymo, Tesla, and Mobileye are all fighting an "AI Arms Race." The winner is determined by who has the best data and the most efficient compute. Traditional fundamental analysis often misses the nuances of technological leads. For example, Alphabet's increased CapEx in 2025 (projected at $90B+) is largely for AI infrastructure that benefits Waymo. A standard screener might see high spending as a negative, but an AI tool recognizes it as a strategic moat.

How Intellectia.ai Helps Investors Analyze Waymo Exposure

Intellectia.ai provides the edge you need to track these complex movements.

AI-Powered Stock Signals: You can receive alerts when technical indicators align for Alphabet or its competitors. If Tesla breaks a key resistance level on robotaxi news, the Swing Trading feature will flag it.

Real-Time News Sentiment: Waymo often moves based on headlines—new city expansions or safety reports. Intellectia’s Stock Monitor tracks sentiment across thousands of news sources to tell you if the market reaction is bullish or bearish.

Autonomous Driving Industry Watchlist: You can create a dedicated watchlist using the AI Stock Picker to monitor not just GOOGL, TSLA, and MBLY, but also the semiconductor stocks powering them (like Nvidia) and the sensor manufacturers.

Deep Fundamental + Technical Analysis: Use the Stock Technical Analysis feature to overlay Waymo's expansion news against Alphabet's price action to see if the "Other Bets" valuation is finally being priced in.

Conclusion

While you cannot add "Waymo" to your portfolio today with a specific ticker, you are not locked out of the opportunity. Waymo is the crown jewel of Alphabet’s "Other Bets," and buying GOOGL remains the smartest way to invest in its future while enjoying the safety of Google’s search and cloud dominance. For those with a higher risk tolerance, competitors like Tesla and Mobileye offer different angles on the same autonomous future.

The race for self-driving dominance is evolving daily. To stay ahead of market moves, regulatory changes, and tech breakthroughs, you need tools that move as fast as the market.

Sign up for Intellectia.AI today to get AI-driven alerts, daily stock picks, and deep market analysis that will help you time your investments in the autonomous driving revolution. Don't just watch the future of transportation drive by—invest in it with precision.