Key Takeaways

- Fusion energy stocks are capturing the attention of investors eager to tap into a technology that could redefine how we power the world.

- These fusion energy stocks include companies funding or partnering with private fusion innovators like TAE Technologies, Helion, CFS, and General Fusion.

- With Intellectia.AI, investors can analyze and compare top fusion energy stocks—including Alphabet (GOOG), Cameco (CCJ), Cenovus (CVE), Microsoft (MSFT), and Eni (E)—with real-time AI-driven insights.

Introduction

Have you ever wondered how we can meet soaring global energy demands while protecting the planet? The answer may lie in fusion energy, a groundbreaking technology promising clean, abundant power with minimal environmental impact. Fusion energy stocks offer a way to invest in this potential revolution, but navigating this emerging field can be complex. Many companies are pouring resources into fusion research, creating opportunities for savvy investors.

What Are Fusion Energy Stocks?

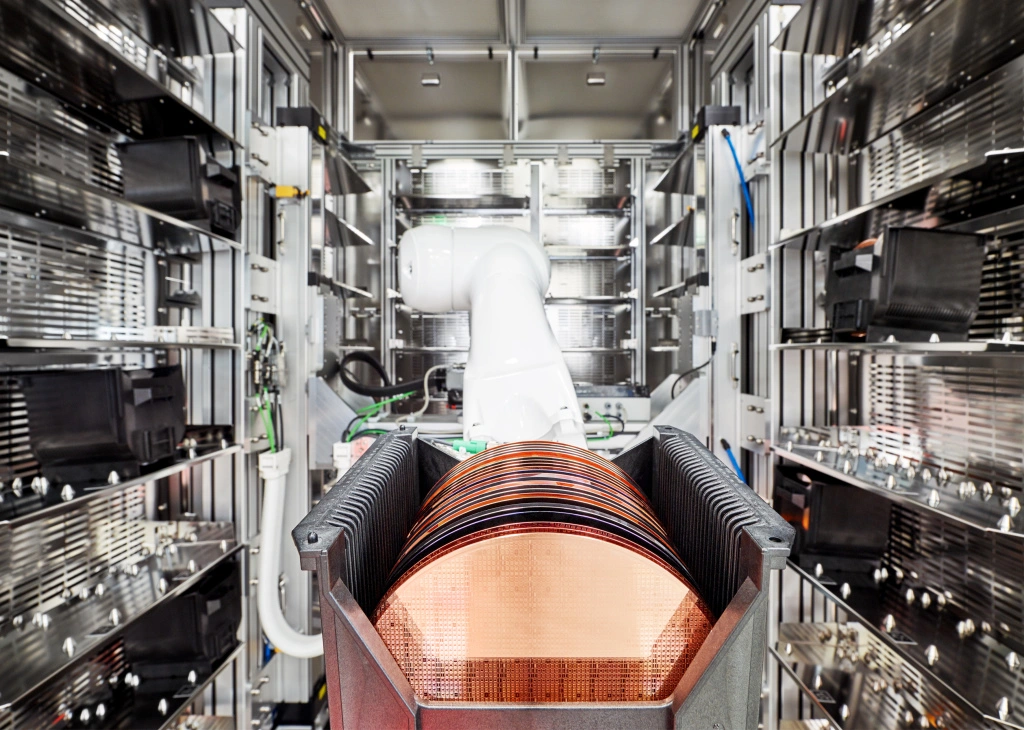

Fusion energy stocks are shares in companies actively involved in developing or supporting fusion energy technology. Fusion energy is produced by fusing atomic nuclei, typically hydrogen isotopes like deuterium and tritium, to release massive amounts of energy. Unlike nuclear fission, which splits atoms and produces long-lived radioactive waste, fusion generates minimal waste and no carbon emissions, making it a sustainable alternative to fossil fuels. Fusion differs from fission in its safety profile, with no risk of meltdowns and an abundant fuel supply derived from water and lithium. Companies in this space range from tech giants leveraging AI to energy firms diversifying into clean tech, all aiming to bring fusion to commercial reality.

Why Invest in Fusion Energy Stocks?

Investing in fusion energy stocks offers compelling reasons, though it comes with risks due to the technology’s early stage. Here’s why you might consider them:

- Market Potential: If fusion becomes commercially viable, it could disrupt the multi-trillion-dollar global energy market, offering significant returns for early investors.

- Sustainability: Fusion produces no greenhouse gases and minimal radioactive waste, aligning with global climate goals and increasing demand for clean energy.

- Technological Leadership: Companies involved in fusion are pioneers, potentially leading to innovations in related fields like AI and materials science.

- Long-term Growth: While commercialization may be a decade away, early investments could yield substantial rewards as fusion matures.

However, the speculative nature of fusion energy means timelines are uncertain, and not all companies will succeed.

Criteria for Selecting Best Fusion Energy Stocks

Choosing the best fusion energy stocks requires careful evaluation. Here are key criteria to guide your decisions:

- Investment in Fusion Technology: Prioritize companies with significant stakes in fusion startups or in-house research programs.

- Technological Approach: Understand the fusion technologies (e.g., tokamak, Z-pinch, magnetized target fusion) and the company’s role in advancing them.

- Financial Backing: Strong financials ensure a company can sustain long-term research and development.

- Strategic Partnerships: Collaborations with governments, universities, or other firms enhance credibility and resources.

Top 5 Fusion Energy Stocks

The following table compares five leading fusion energy stocks based on their market presence and involvement in fusion technology:

| Company Name | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Alphabet Inc. | GOOG | Technology | $2T | AI expertise, large resources |

| Cameco Corp | CCJ | Energy | $37.55B | Energy sector leader, diversified investments |

| Cenovus Energy Inc. | CVE | Energy | $21B | Canadian oil company, investment in General Fusion |

| Microsoft Corporation | MSFT | Technology | $3.2T | Tech leader, commitment to clean energy |

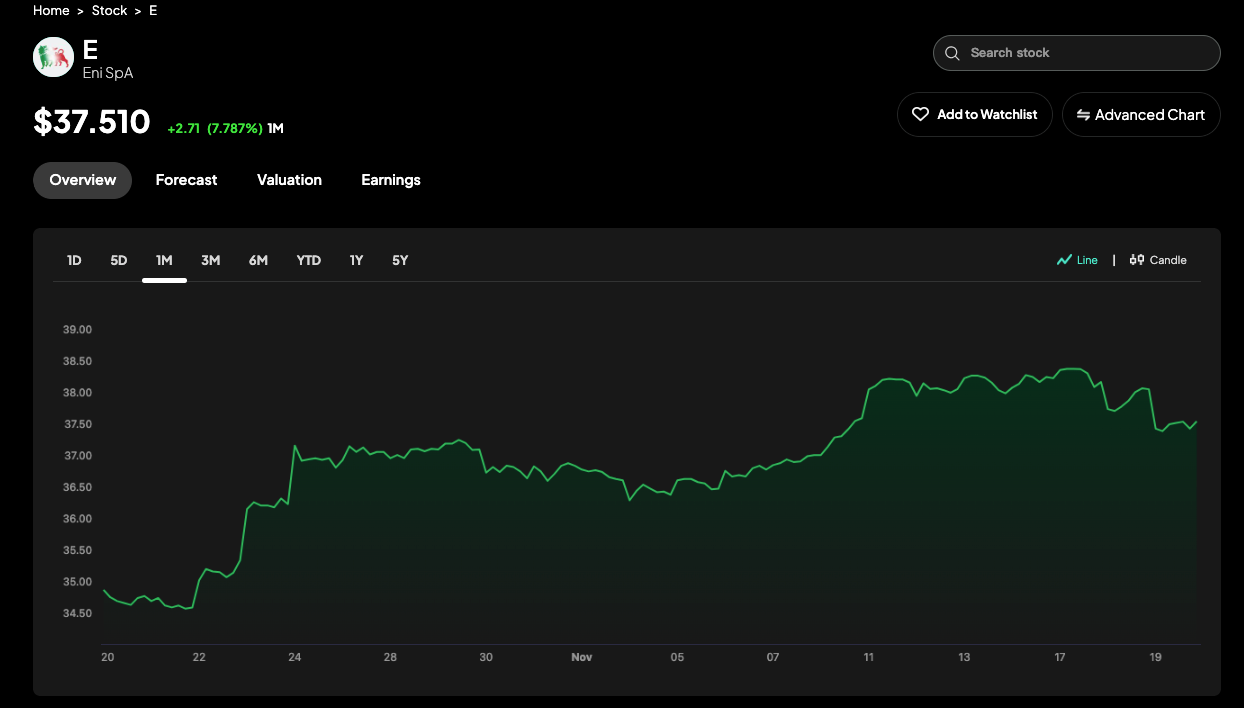

| Eni S.p.A. | E | Energy | $42B | European energy company, investment in CFS |

Alphabet Inc. (GOOG)

Alphabet, Google’s parent, dominates in search, cloud computing, and AI. Its innovative culture drives investments in cutting-edge technologies like fusion energy. Alphabet has partnered with TAE Technologies since 2014, providing AI and computational support. In 2022, it invested $250 million in TAE’s $1.2 billion funding round. In April 2025, TAE announced a breakthrough in plasma formation, reducing costs and accelerating commercialization.

For Q1 2025, Alphabet reported revenue of $90.23 billion (+12.04% YoY), net income of $34.54 billion (+34.07% YoY), and EPS of $2.81 (+48.68% YoY). Its diverse revenue streams ensure stability for high-risk investments like fusion. With 16 Buy and 1 Hold ratings, analysts set an average 1-year price target of $204.07, suggesting upside from the current $165.20. Alphabet’s AI expertise enhances fusion research, and its financial strength supports long-term bets. If you value innovation and stability, GOOG is a strong pick.

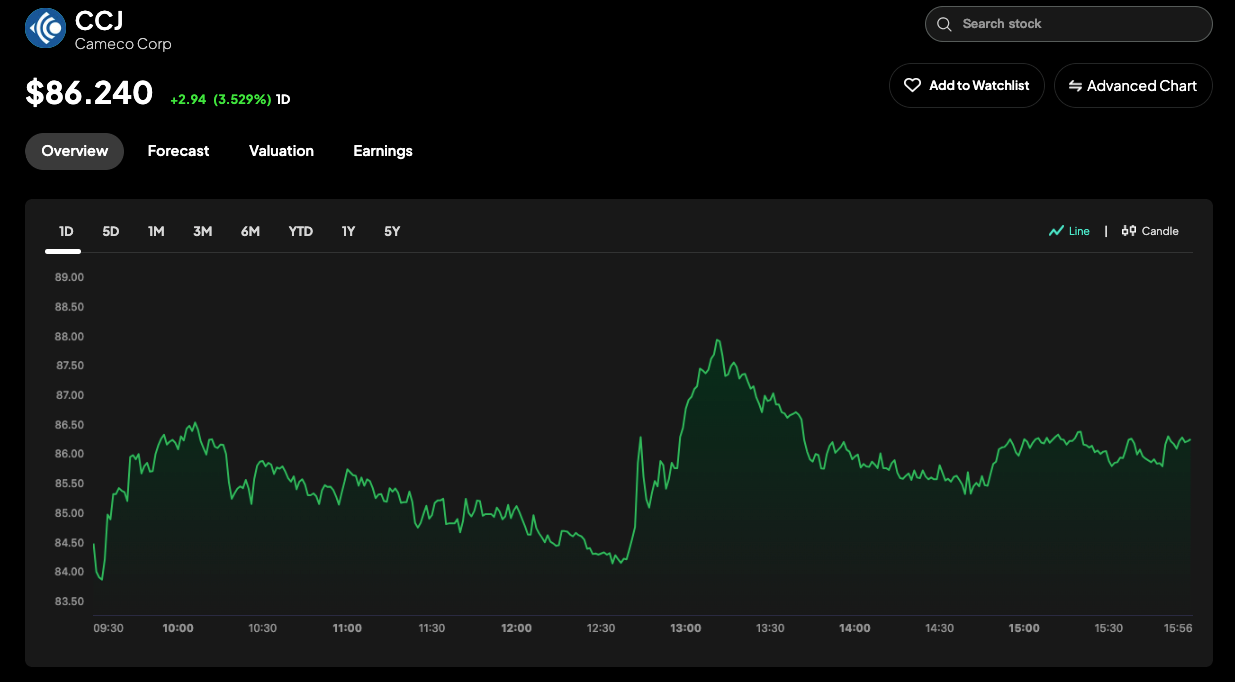

Cameco Corporation (CCJ)

Cameco is one of the world’s leading uranium producers and a key player in the global nuclear fuel supply chain. For Q1 2025, Cameco reported higher revenue and earnings driven by strong uranium markets and growing utility contracting. Its strategic partnership in acquiring Westinghouse expands its role across the nuclear ecosystem, from fuel production to reactor services.

Analysts maintain a bullish outlook, citing tightening uranium supply and increasing investment in advanced nuclear technologies. With solid fundamentals and exposure to long-term energy transitions, CCJ offers an attractive option for investors seeking clean energy growth.

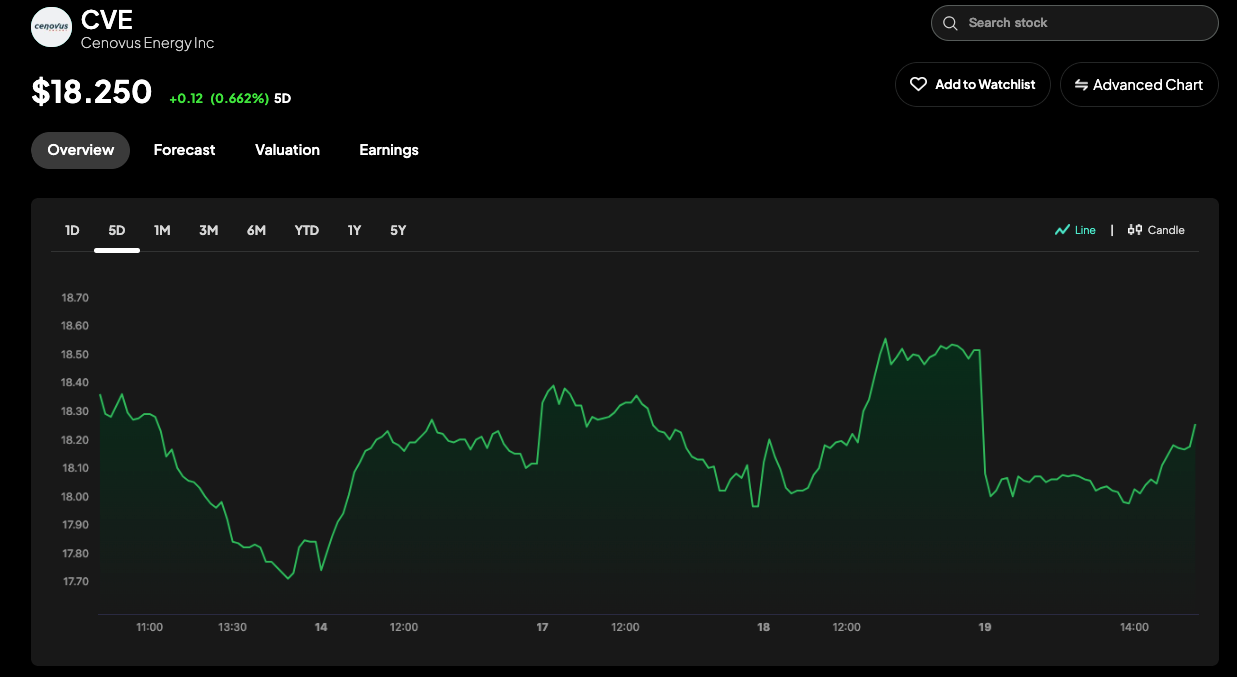

Cenovus Energy Inc. (CVE)

Cenovus, a Canadian oil and gas producer, is transitioning toward sustainable energy solutions. Cenovus has supported General Fusion since 2011, with a $4 million investment in 2021. General Fusion is building its Lawson Machine 26, targeting fusion conditions by 2025 and breakeven by 2026

For Q4 2024, Cenovus reported revenue of $11.75 billion (-10.57% YoY), net income of $146 million (-80.35% YoY), and EPS of $0.07 (-82.05% YoY). Upward revisions in 2026 estimates suggest recovery potential.

With 9 Buy and 1 Hold ratings, the average price target is $19.19, implying a 62.08% upside. Cenovus’s early investment in General Fusion offers exposure to fusion’s potential, ideal if you’re bullish on Canadian energy and clean tech.

Microsoft Corporation (MSFT)

Microsoft, a tech leader in software and cloud services, is committed to carbon negativity by 2030. In 2023, Microsoft signed a power purchase agreement with Helion Energy to buy 50 megawatts of fusion power by 2028. In January 2025, Helion raised $425 million to scale commercialization.

For Q3 2025, Microsoft reported revenue of $70.07 billion (+13.27% YoY), net income of $25.82 billion (+17.71% YoY), and EPS of $3.46 (+17.69% YoY). Strong growth supports its clean energy bets.

With 26 Buy and 3 Hold ratings, the average price target is $477.75, suggesting a 10.26% upside from $433.31. Microsoft’s direct commitment to fusion power enhances its sustainability profile, making it a top choice if you prioritize tech and environmental leadership.

Eni S.p.A. (E)

Eni, an Italian energy company, operates globally and is investing in renewables and fusion. Eni invested $50 million in Commonwealth Fusion Systems (CFS) in 2018. CFS is building its SPARC reactor, aiming for first plasma by 2026 and commercial power in the 2030s. For Q1 2025, Eni reported an adjusted net profit of €1.4 billion. Its 2025-2028 plan focuses on disciplined investments.

Price targets range from $31.60 to $37.67, indicating upside from ~$28.74. Eni’s early stake in CFS positions it as a European leader in fusion, ideal if you focus on global energy transitions.

How to Invest in Fusion Energy Stocks Today

Direct investment in fusion energy companies is challenging, as most, like TAE Technologies, Zap Energy, General Fusion, Helion Energy, and CFS, are privately held. However, you can gain indirect exposure by investing in public companies with stakes in these startups:

- Public Companies: Alphabet, Chevron, Cenovus Energy, Microsoft, and Eni S.p.A. provide a way to invest in fusion through their partnerships and investments.

- ETFs: Clean energy ETFs, such as the Invesco WilderHill Clean Energy ETF (PBW) or First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN), may include these companies, though specific fusion-focused ETFs are rare.

- Intellectia.AI Tools: Use Intellectia.AI’s AI stock picker and trading signals to analyze these stocks, monitor market trends, and develop personalized strategies.

Accredited investors may consider pre-IPO shares in fusion startups, but these carry higher risks. Intellectia.AI’s stock monitor can keep you updated on market movements.

Conclusion

Fusion energy holds immense promise as a clean, abundant power source, and investing in fusion energy stocks allows you to participate in this potential revolution. Companies like Alphabet, Chevron, Cenovus Energy, Microsoft, and Eni S.p.A. are leading the charge by supporting innovative fusion startups. While the technology is still developing, early investments could yield significant returns if fusion becomes commercially viable. To navigate this speculative yet exciting market, leverage Intellectia.AI’s advanced tools for real-time analysis and informed decision-making.