Key Takeaways

- The acronym for Big Tech has shifted from FAANG to the more descriptive MAMAA (Meta, Apple, Microsoft, Amazon, Alphabet) due to significant shifts in market dominance.

- Most of these companies now rely on their Cloud Computing units and aggressive investments in AI as the main engine of their growth.

- To invest in MAMAA, you must have a diversification strategy and remain on constant alert to mitigate risks, such as antitrust investigations and severe competition.

- You can use Intellectia.ai’s AI tools (such as the AI stock picker, trading signals, and daytrading tools) to have an unmatched advantage in analyzing and timing trades in these complex mega-cap stocks.

Introduction

The phrase "FAANG stock" used to be shorthand for the entire tech market. If you were talking about investment or growth, chances are you were talking about the big five: Facebook, Amazon, Apple, Netflix, and Google. But let’s be honest, the investment market moves faster than a day trader on caffeine. Relying on an outdated grouping is a considerable risk if you believe the market’s focus is shifting.

These mega-cap companies still have an outsized influence—they account for a massive portion of the S&P 500's overall performance. So, what happens when the names and the players change? We’ll jump into the shift of FAANG to the new MAMAA giants, breaking down what has shifted and why it is relevant to your portfolio today.

You’ll walk away with the knowledge to navigate this evolving landscape and know how to employ smart, data-driven investing to keep your portfolio at the forefront, particularly with the applications provided by Intellectia.ai.

FAANG versus MAMAA tech shift in the AI era.

What Is a FAANG Stock?

The FAANG stock acronym has been the uncontested leader in the technology investment market over the years. It was coined to capture the spirit of an enormous tech-driven frenzy, representing creation, fierce expansion, and control across industries such as social media, e-commerce, and streaming.

The Original FANG and the Addition of Apple

The acronym FANG was initially developed in 2013 by CNBC host Jim Cramer. It was initially an acronym of Facebook, Amazon, Netflix, and Google. These four firms were the high-growth, disruptor stocks of the time.

This group was later expanded to FAANG to include Apple. Although Apple was older and might not have been as pure a disruptor as the others, its enormous market valuation, iconic product range, and ecosystem made it impossible for any serious investor to overlook. The five firms were bundled together as they were seen as invincible, market-making powers.

From FAANG to MAMAA: Why the Term Changed

So, why did we move on? Simply put, the companies themselves changed, and a new player became too dominant to exclude.

First, Facebook underwent a massive rebranding as Meta Platforms (M) to pivot toward the Metaverse. Second, Google restructured under its parent company Alphabet (A). These are minor name swaps, but they reflected huge shifts in corporate focus.

The biggest shakeup, however, involved Microsoft (M). Microsoft's stock performance and, crucially, its leadership in two key areas—Cloud Computing (Azure) and the burgeoning field of Artificial Intelligence (through its investment in OpenAI)—catapulted its market value past some of its very largest competitors. As a result, many analysts dropped Netflix (N), which, while still a major player, has a comparatively lower market capitalization and a more specialized business model.

The new acronym, MAMAA, now stands for Meta, Apple, Microsoft, Amazon, and Alphabet. It's considered a more accurate representation of the five largest, most influential, and highly diversified tech giants driving the market today.

Complete List of MAMAA Companies (Comparative Overview)

Understanding the MAMAA companies requires looking beyond their old nicknames and focusing on their current strengths, where the real value lies for your portfolio. Here is a snapshot of the current giants.

| Company Name | Ticker Symbol | Sector | Market Cap (Current) | Key Strengths |

|---|---|---|---|---|

| Meta Platforms (formerly Facebook) | META | Communication Services | $1.50 Trillion | Social media dominance, Metaverse focus, Ad revenue across FB/Insta/WhatsApp |

| Apple | AAPL | Technology/Consumer Elec. | $4.01 Trillion | Ecosystem lock-in, High-margin Services growth, Global hardware sales |

| Microsoft | MSFT | Technology | $3.51 Trillion | Cloud Computing (Azure), Enterprise Software, AI lead via OpenAI integration |

| Amazon | AMZN | Consumer Discretionary | $2.36 Trillion | E-commerce dominance, Cloud (AWS) market leader, Logistics scale |

| Alphabet (formerly Google) | GOOGL/GOOG | Communication Services | $3.62 Trillion | Search dominance, YouTube advertising, AI research (DeepMind/Gemini) |

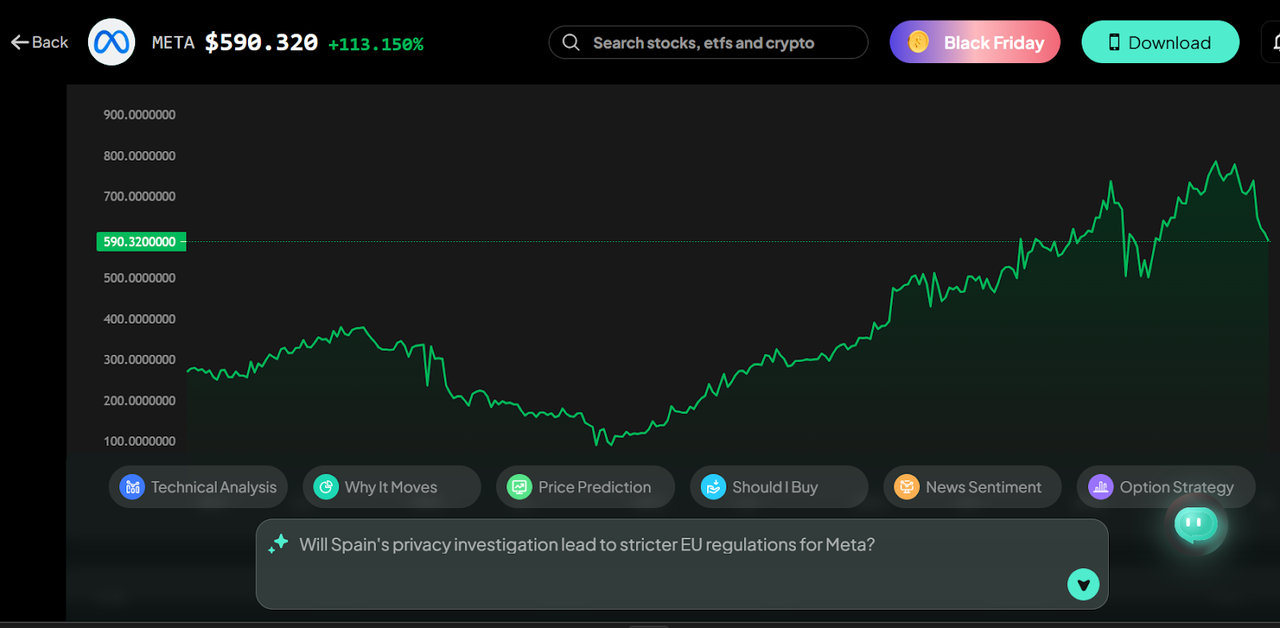

Meta (formerly Facebook)

Meta's focus has expanded well beyond just Facebook. While its core advertising business on Instagram and WhatsApp is a massive cash cow, the company is pouring billions into the Metaverse. If you believe the long-term vision for augmented and virtual reality will pay off, Meta represents a high-risk, high-reward proposition. You can track their activity here: Meta Stock Analysis.

Apple

Apple is unique because it's both a hardware company and, increasingly, a services company. Once you own an iPhone or a Mac, you are often locked into the Apple ecosystem, which drives massive revenue from the App Store, Apple Music, and iCloud. Its high margins and resilient customer base make it a cornerstone investment. Find real-time data here: Apple Stock Analysis.

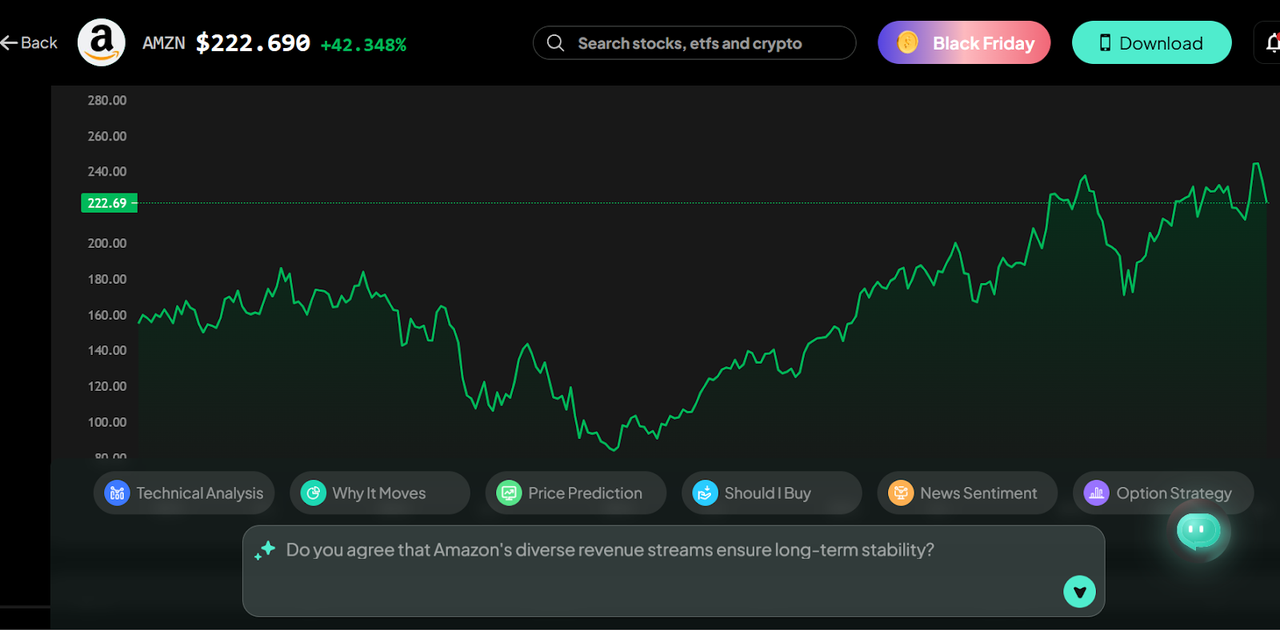

Amazon

When most people think of Amazon, they think of fast delivery, but its true powerhouse is Amazon Web Services (AWS). AWS is the leading cloud provider globally and its profitability often props up the lower-margin e-commerce segment. If you think cloud infrastructure will continue its exponential growth, Amazon remains a must-watch stock. See their page: Amazon Stock Analysis.

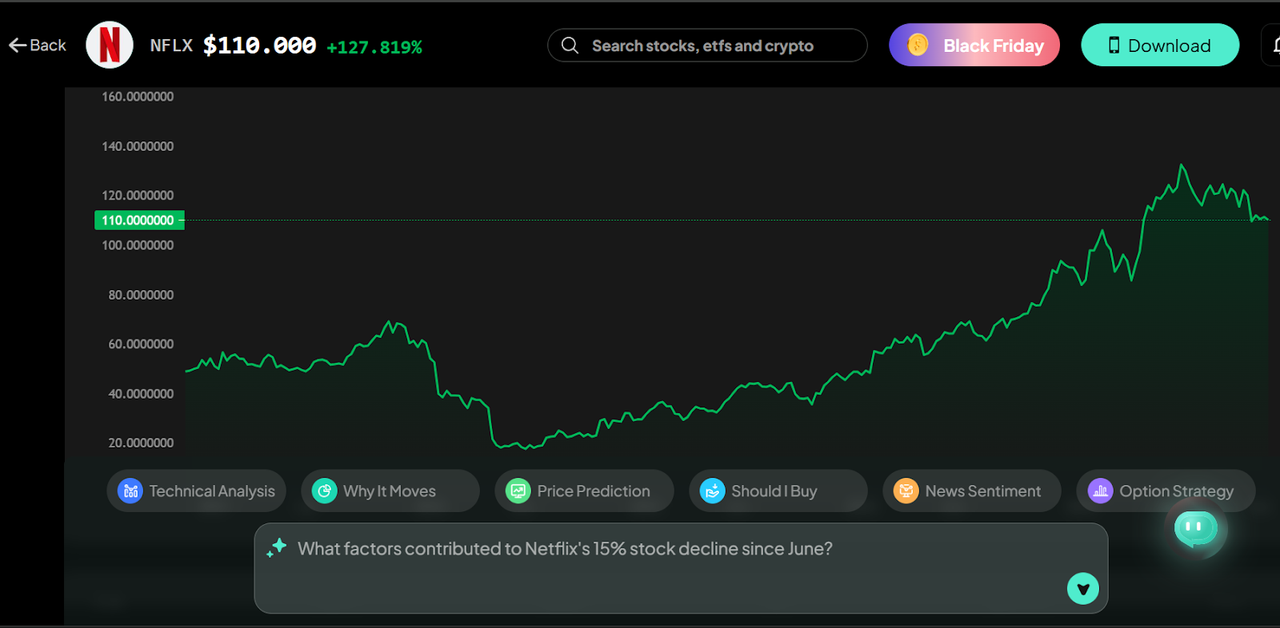

Netflix (The FAANG Member Often Replaced)

Netflix (NFLX) is a global streaming leader, but it’s often left out of the MAMAA acronym. Why? While it is profitable, its market capitalization and diversification don't quite match those of the other four. It operates in a fiercely competitive, specific vertical (streaming), whereas the others are spread across cloud, enterprise, and advertising. For a dedicated deep dive: Netflix Stock Analysis.

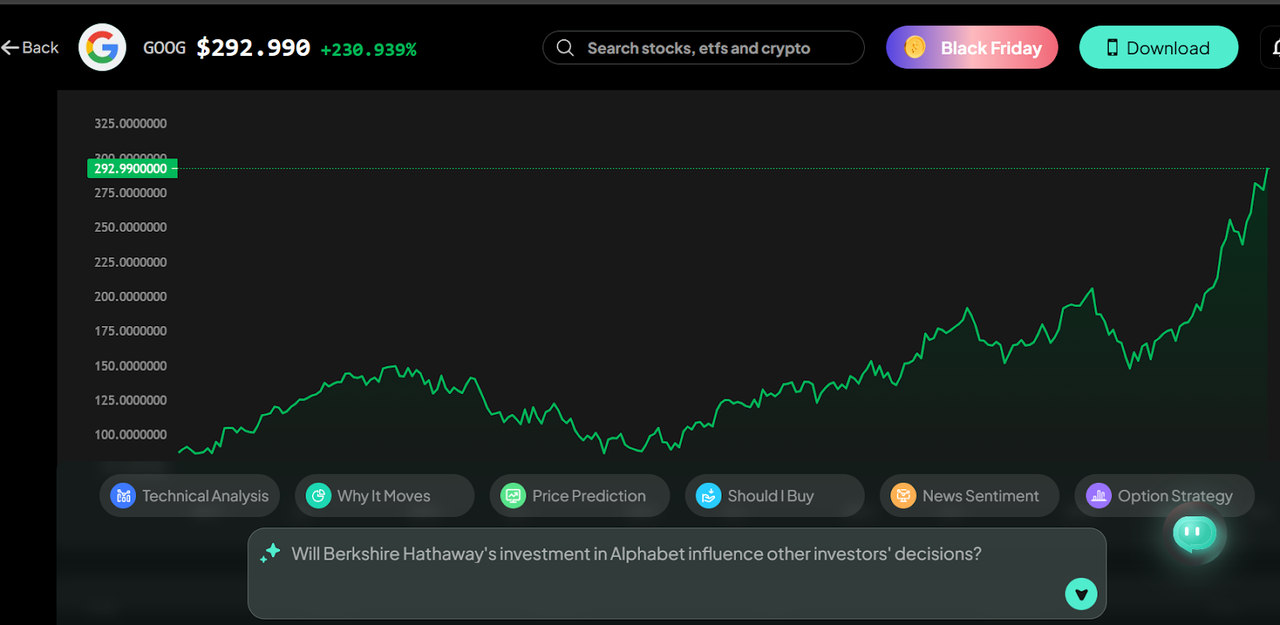

Alphabet (Google)

Alphabet is still dominated by Google Search and YouTube advertising, two of the most powerful digital platforms ever created. However, the company is also a titan in AI research and development, particularly with DeepMind and its cutting-edge Gemini models. In case you are concerned about Google's regulatory risk, remember the vast diversification provided by its "Other Bets" and cloud division. Stay updated here: Alphabet Stock Analysis.

MAMAA Performance Analysis and Outlook (2024–2026)

Looking ahead, analyzing the MAMAA stocks isn't just about reading a balance sheet; it's about predicting where the next trillion dollars of value will be created.

Revenue, Growth Rates, and Valuation Trends

Consistency has been rewarded greatly in the market over the past few years. Firms with consistent cash flows and service expansion, such as Apple and Microsoft, usually have a premium valuation. Conversely, the valuation of stocks such as Amazon and Alphabet is usually directly related to the growth rates of their core businesses: Cloud and Search/Ads, respectively. When looking at your portfolio, you must compare their P/E ratios and future growth forecasts to determine where value currently lies. The story now is less about explosive, unpredictable growth and more about massive, durable profitability.

Which MAMAA Company Has the Highest Upside?

The highest near-term upside is almost certainly tied to the massive investments each company is making in Artificial Intelligence.

If you think the current market is under-appreciating one company’s foundational AI bets, that stock might be your high-upside pick. For example, some analysts point to Meta’s open-source Llama models and its efficiency gains as a major catalyst.

Others argue that Microsoft has the greatest advantage, given its tight integration of OpenAI technologies into its enterprise software suite. Ultimately, the highest upside will come from the company that can commercialize AI fastest and most effectively.

Risks Investors Should Know About (Regulation, AI Competition)

Investing in giants means dealing with giant risks:

Regulatory Risk: Antitrust and Data privacy regulations are constant risks. These companies are being targeted by lawmakers worldwide due to their monopoly-like domination of major markets.

AI Competition: The race to dominate Generative AI is a winner-take-most scenario. Microsoft (OpenAI) vs. Google (Gemini) vs. Meta (Llama) is a high-stakes competition that could dramatically shift market caps in the coming years. If you're concerned about competitive risks, seek firms with extremely balanced revenue bases that can sustain losses in one sector.

Investment Strategies for Big Tech Stocks

To be a successful investor in MAMAA stocks, you need a disciplined approach that balances both stability and high-growth bets.

Diversifying Across Tech Leaders

It is critical not to go "all-in" on a single stock or even a single acronym. These stocks are volatile, and market favor can shift quickly. Consider a hybrid approach: maintain exposure to the core MAMAA group through an ETF tracking the technology or by purchasing a fraction of shares in all five. This will enable you to benefit from sector-wide growth without excessive exposure to the failure of a single company.

For a broader approach, many investors also look at the Magnificent Seven or just diversify in other high-growth tech giants such as Nvidia and Tesla.

Long-Term vs. Short-Term Strategy

Long-Term: These titans should default to a long-term approach, with Dollar-Cost Averaging (DCA) and holding during volatility, focusing on core business strength. The aim is to capture the compounding growth over a number of years.

Short-Term: Short-term trading plans, such as swing trading, can be a good fit if you believe the market will respond well to an impending earnings announcement or a significant news story.

Leveraging AI for Big Tech Stock Analysis

The amount of data produced by MAMAA stocks, including quarterly reports and analyst ratings, as well as social media sentiment, is overwhelming to a human investor. This is where Artificial Intelligence offers an outstanding advantage.

If you're looking for data-driven insights that go beyond simple charts, our AI stock and crypto analysis can easily digest the complex financial data and technical indicators of these mega-caps and provide some insight you would not have otherwise. Our Stock Technical Analysis feature may prove invaluable here.

In case you need a clear exit or entry point based on short-term market momentum, our AI trading signals can help you cut through the noise of market sentiment and media hype. Check out our Swing Trading or Day Trading Center features for more information.

Finally, our AI Stock Picker and AI Screener allow you to filter the MAMAA stocks and other tech companies based on your specific criteria—whether you're looking for value, growth, or a mix of both.

Conclusion

So the days of FAANG stock dominance are long gone, yet the tech giants themselves have not disappeared; they have just renamed themselves and re-equipped to take on the next generation of growth. The emergence of MAMAA underscores the essential role of cloud computing and AI in the investment world. If you think that the tech industry will keep on driving market expansion, then you must learn the intricacies of the MAMAA group to achieve success.

That’s why you need tools that can process the mountains of data these companies generate. Sign up and subscribe to Intellectia AI for real-time market analysis, daily AI stock picks, and exclusive AI trading signals and strategies to help you navigate this high-stakes, evolving market.