Key Takeaways

- DeepSeek is a private AI research lab and is not a publicly traded company, meaning you cannot currently buy DeepSeek AI stocks directly on any stock exchange.

- While there is speculation about a future IPO, no official date has been announced, making it a risky waiting game for potential investors.

- You can gain indirect investment exposure to DeepSeek's growth by investing in the public companies that provide the essential "picks and shovels" for its operations.

- Key publicly traded companies in DeepSeek's ecosystem include hardware providers like NVIDIA (NVDA), Super Micro Computer (SMCI), network specialists like Arista Networks (ANET), foundries like TSMC (TSM), and major cloud platforms such as Microsoft (MSFT).

- Using AI-powered trading tools can help you analyze these related stocks, identify market trends, and make more informed investment decisions in the booming AI sector.

Investing in the Next Wave of AI: Your Guide to DeepSeek-Related Stocks

Have you been following the incredible breakthroughs from AI labs like DeepSeek and wondered how you can get in on the action? It can be frustrating to see a revolutionary technology emerge, knowing its potential, but being unable to find a simple way to invest. You search for a "DeepSeek AI stocks price" but come up empty, feeling like you might be missing out on the next big winner in the artificial intelligence space.

Many investors face this exact problem with the most promising private companies. The secret isn't always about waiting for a blockbuster IPO; it's about understanding the entire ecosystem that fuels innovation. By analyzing the public companies that provide the critical infrastructure—the digital "picks and shovels" of the AI gold rush—you can position your portfolio to benefit from their growth.

This article will show you exactly how to do that. You'll explore why you can't buy DeepSeek stock directly, discuss its potential future, and, most importantly, reveal a list of publicly traded AI stocks that are essential to DeepSeek's operations and the broader AI industry.

Is DeepSeek a Publicly Traded Company?

No, DeepSeek is currently a private company (owned by the Chinese hedge fund, High-Flyer). This means you cannot buy its shares on public stock exchanges like the NASDAQ or the New York Stock Exchange (NYSE). There is no DeepSeek stock ticker, and any search for its stock price will come up empty.

Founded in 2023, DeepSeek is a China-based AI research lab that has quickly gained a global reputation for its powerful and open-source large language models (LLMs). Its models, particularly the DeepSeek Coder and Llama 3-V2, have become strong competitors to those from industry giants like Meta and OpenAI, demonstrating remarkable capabilities in coding, reasoning, and multilingual understanding.

As a private entity, DeepSeek is funded by venture capital and other private investors. This structure allows the company to focus on research and development without the pressures of public market expectations. While this is great for innovation, it means direct investment is off-limits for the average retail investor for now.

When Will DeepSeek IPO?

With the company's rapid rise and technological prowess, the natural question is: when will DeepSeek have its Initial Public Offering (IPO)?

Currently, there has been no official announcement or confirmed timeline for a DeepSeek IPO. The path to going public is complex and depends on many factors, including market conditions, the company's financial maturity, the need for a massive capital injection, and the desire to provide liquidity for early investors and employees.

Given the intense capital requirements for training next-generation AI models, an IPO could be a logical step for DeepSeek in the future. However, it's a speculative bet. The timeline could be years away, and geopolitical considerations surrounding a China-based AI leader could add further complexity.

Instead of waiting for a potential IPO, a more effective strategy is to invest in the public companies that are already benefiting from DeepSeek’s success today.

DeepSeek AI Stocks List — Companies Benefiting from DeepSeek’s Growth

The best way to invest in a gold rush is to sell the picks and shovels. In the AI revolution, the "gold" is the groundbreaking models developed by labs like DeepSeek. The "picks and shovels" are the GPUs, servers, networking gear, and cloud infrastructure they need to operate. As DeepSeek and other AI labs scale, these supplier companies see a massive surge in demand.

Here are five of the top AI stocks that form the backbone of the AI industry and are poised to grow alongside DeepSeek.

| Company Name | Ticker Symbol | Sector | Key Strengths |

|---|---|---|---|

| NVIDIA Corporation | NVDA | Semiconductors | Dominant provider of AI GPUs (the "brains" of AI) |

| Microsoft Corporation | MSFT | Software & Cloud | Leading hyperscale cloud provider (Azure) for AI workloads |

| Arista Networks Inc | ANET | Network Hardware | High-speed networking switches for AI data centers |

| Super Micro Computer, Inc. | SMCI | Computer Hardware | High-performance servers and rack-scale AI solutions |

| TSMC | TSM | Semiconductors | World's leading foundry, manufacturing advanced AI chips |

NVIDIA (NVDA)

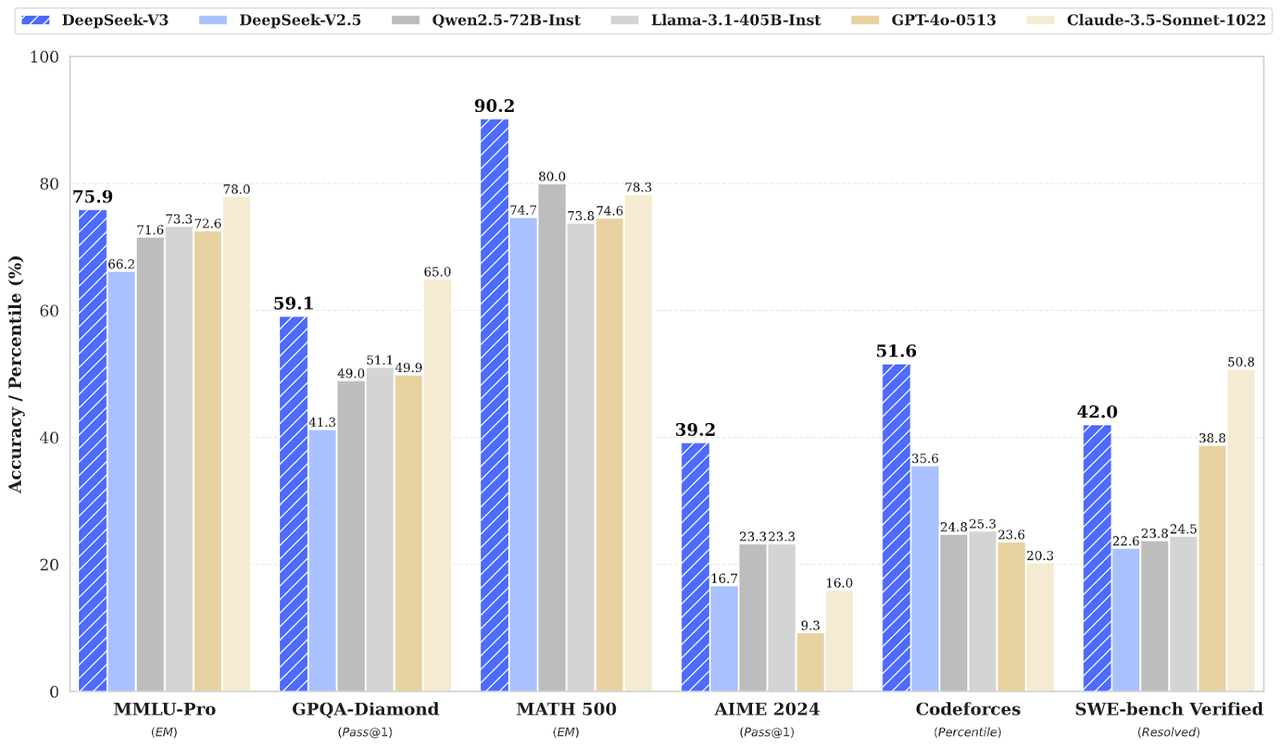

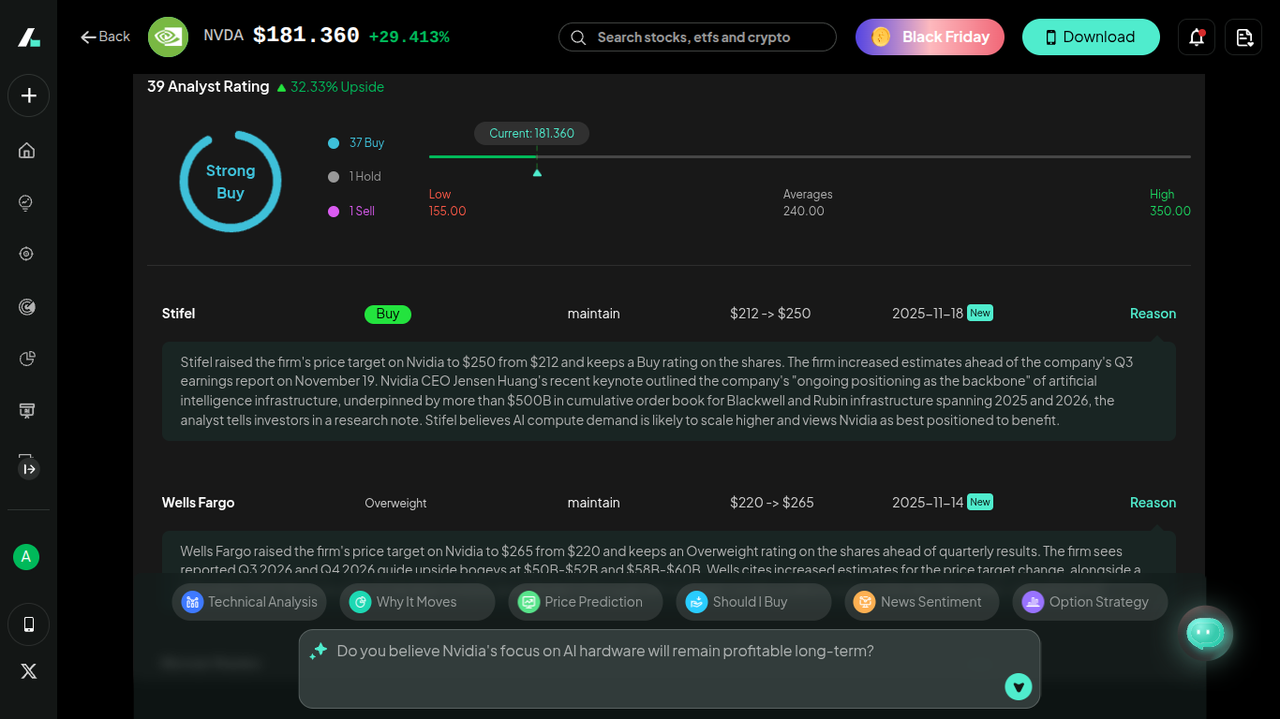

NVIDIA is the undisputed leader in designing and manufacturing graphics processing units (GPUs). Originally for gaming, its GPUs have become the essential hardware for training and running complex AI models, giving it a dominant position in the AI infrastructure market.

Research has confirmed that DeepSeek utilized NVIDIA's A100 and H800 GPUs to train its groundbreaking models. This direct link highlights a simple truth: as AI labs push the boundaries of what's possible, they need more of NVIDIA's powerful hardware. NVIDIA’s recent earnings calls underscore this, with CEO Jensen Huang describing the current environment as a new "industrial revolution" and projecting a $3 trillion to $4 trillion AI infrastructure opportunity by the end of the decade.

NVIDIA is the most direct "picks and shovels" play for the growth of any AI company, including DeepSeek. Its full-stack approach, combining hardware with its CUDA software platform, creates a deep competitive moat that is difficult for rivals to overcome.

Microsoft (MSFT)

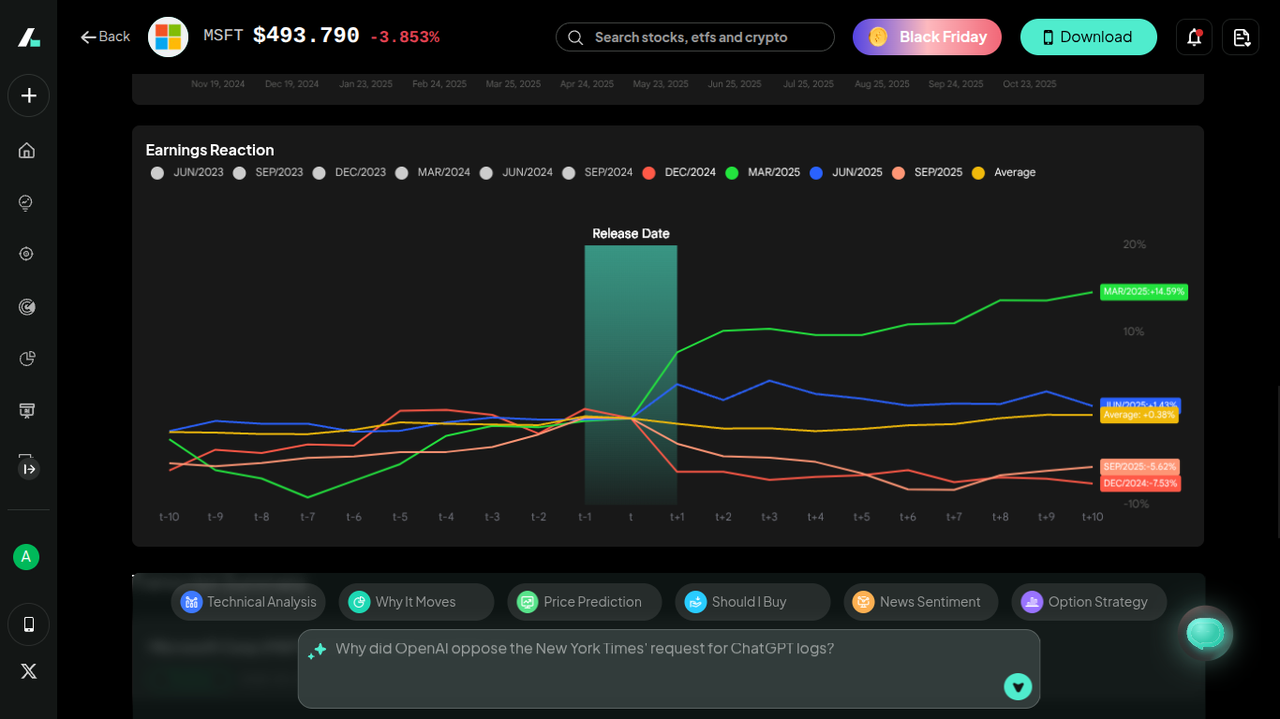

Microsoft is a global technology giant, but its relevance to AI comes from its Azure cloud platform. Azure is one of the top three hyperscale cloud providers, offering the massive, on-demand computing power that AI companies need for training and inference without building their own data centers.

Microsoft is aggressively expanding its AI infrastructure, recently announcing plans to increase its total AI capacity by over 80% and deploy the latest NVIDIA GB300 clusters. While not a direct supplier to DeepSeek, Microsoft's massive investment in AI-ready infrastructure reflects the tidal wave of demand from the entire AI ecosystem. As more businesses adopt models from developers like DeepSeek, the need for robust, scalable cloud hosting from providers like Azure will only grow.

Microsoft offers a way to invest in the broad adoption of AI services. Its deep integration with OpenAI also gives it unique insights into the AI market, positioning Azure as a go-to platform for enterprises looking to deploy AI solutions.

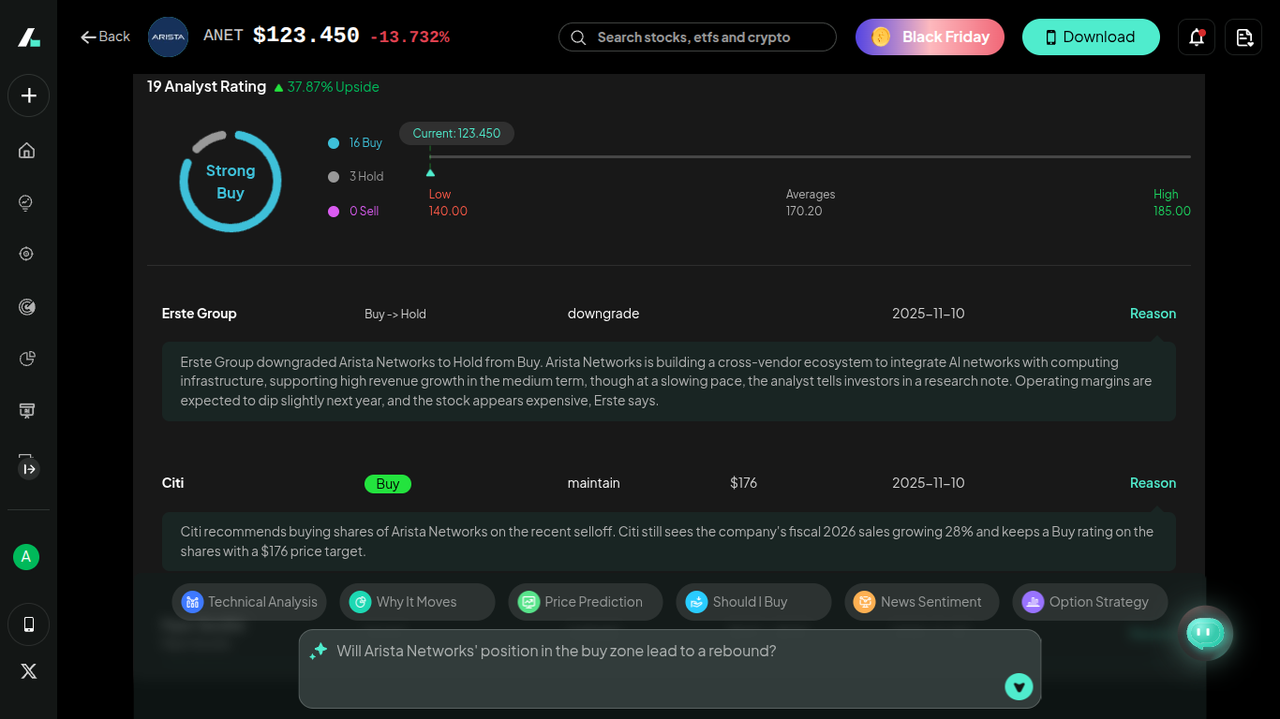

Arista Networks (ANET)

Arista Networks specializes in high-speed, low-latency networking switches, which are the traffic cops of the data center. For AI workloads, where thousands of GPUs must communicate seamlessly, Arista's technology is critical for maximizing performance and efficiency.

Arista's leadership consistently emphasizes its focus on "networking for AI," designed to "dramatically improve compute and GPU utilization." The company has reported significant progress with its major cloud and AI customers, with some of its back-end networking pilots now connecting clusters of over 100,000 GPUs. This is precisely the scale that advanced AI labs operate at.

While NVIDIA provides the compute power, Arista provides the essential connectivity that makes large-scale AI possible. It is a pure-play on the need for faster, more powerful data center networks, a trend that directly benefits from the growth of companies like DeepSeek.

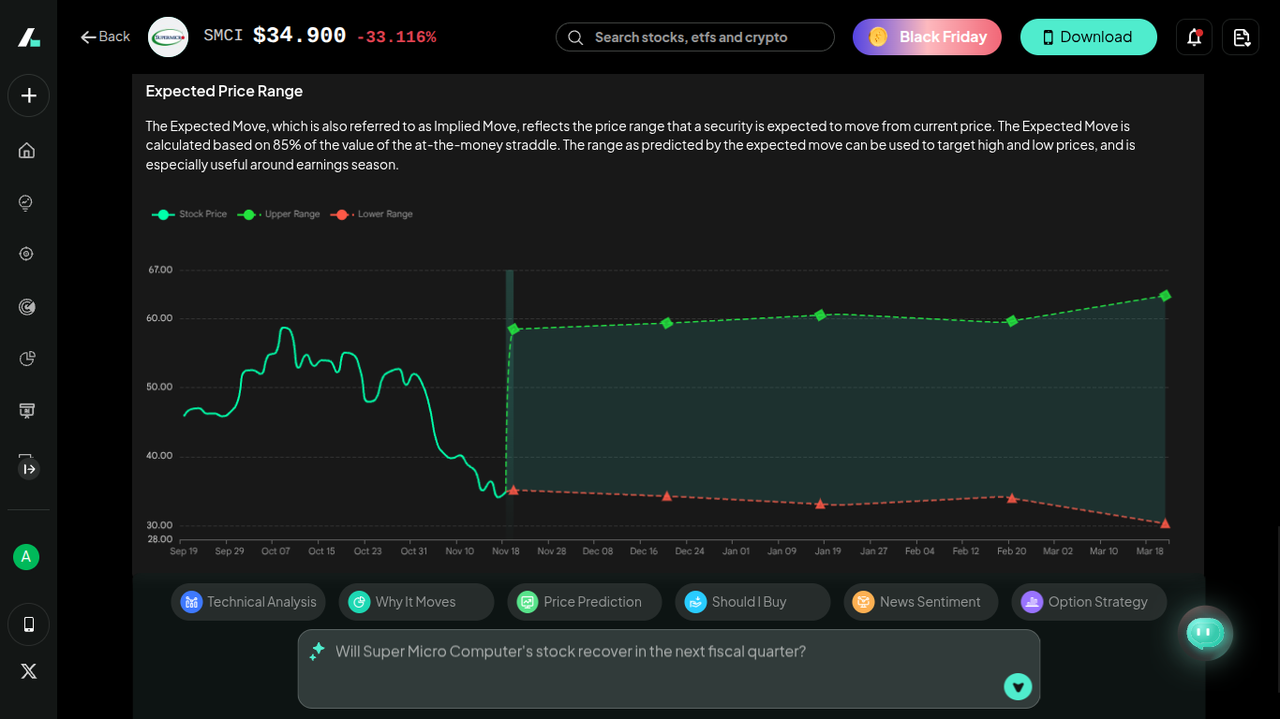

Super Micro Computer (SMCI)

Super Micro Computer is a leader in high-performance servers and storage systems. It specializes in building optimized, rack-scale solutions that integrate cutting-edge components, particularly NVIDIA GPUs, into ready-to-deploy systems for data centers.

Super Micro has seen a massive surge in demand, reporting a backlog of over $13 billion for its NVIDIA Blackwell-based platforms. The company works closely with AI leaders to provide complete, liquid-cooled, plug-and-play server racks that are the building blocks of modern AI factories. This close partnership allows them to deliver highly-optimized systems faster than competitors.

Super Micro is a direct beneficiary of AI infrastructure build-outs. As companies race to deploy more GPUs, they need the specialized server systems that SMCI provides, making it an essential link in the AI supply chain.

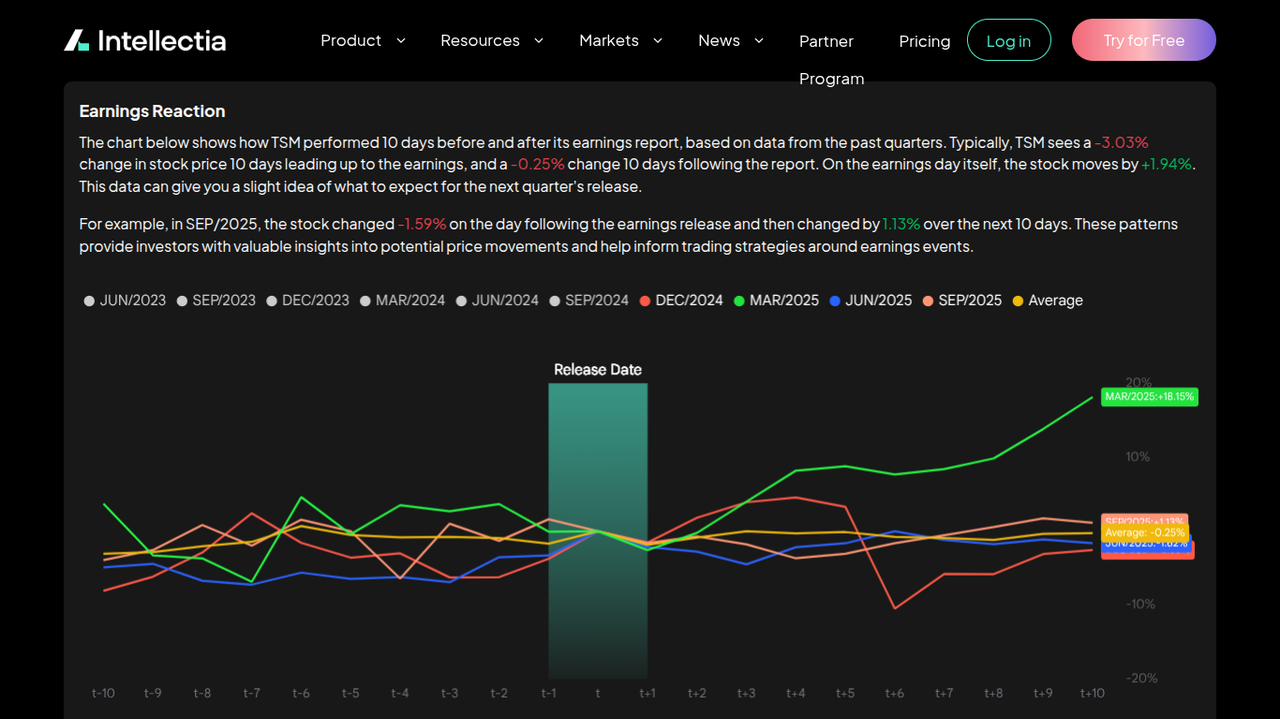

TSMC (TSM)

Taiwan Semiconductor Manufacturing Company, or TSMC, is the world's largest and most advanced independent semiconductor foundry. It doesn't design its own chips but manufactures them for fabless companies like NVIDIA, Apple, and AMD.

The demand for AI has created what TSMC calls an "AI megatrend," driving unprecedented demand for its most advanced manufacturing processes. NVIDIA's Jensen Huang has publicly stated his reliance on and need for more capacity from TSMC to meet the world's insatiable demand for GPUs. Without TSMC's cutting-edge fabrication, the AI revolution would not be possible.

TSM is the ultimate foundational player in the AI hardware ecosystem. An investment in TSM is a bet on the continued growth of the entire advanced semiconductor industry, which is being supercharged by the demand from AI labs like DeepSeek and the hardware companies that supply them.

How to Invest in DeepSeek AI Stocks Indirectly

Besides buying individual stocks, you can also use other strategies to gain exposure to the growth of AI and companies in DeepSeek's orbit.

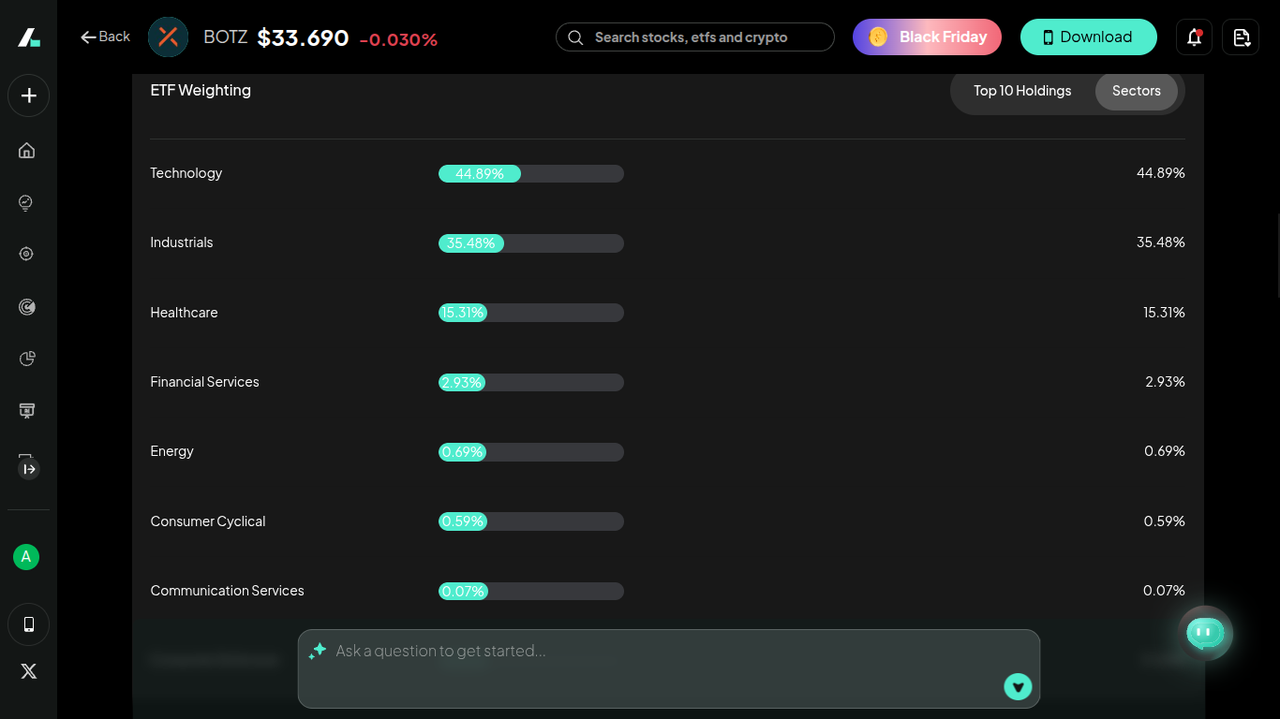

AI ETFs Holding DeepSeek-Related Companies

If you prefer a more diversified approach rather than picking individual stocks, you can invest in Exchange-Traded Funds (ETFs) that focus on the AI, robotics, and semiconductor industries. These funds hold a basket of stocks, spreading your risk while still capturing the theme's overall growth potential.

ETFs like the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the ARK Autonomous Technology & Robotics ETF (ARKQ) hold significant positions in companies like NVIDIA and other key players in the AI hardware and software space. Investing in these ETFs gives you broad exposure to the "picks and shovels" companies powering the AI revolution.

Use AI Trading Tools for Stock Analysis

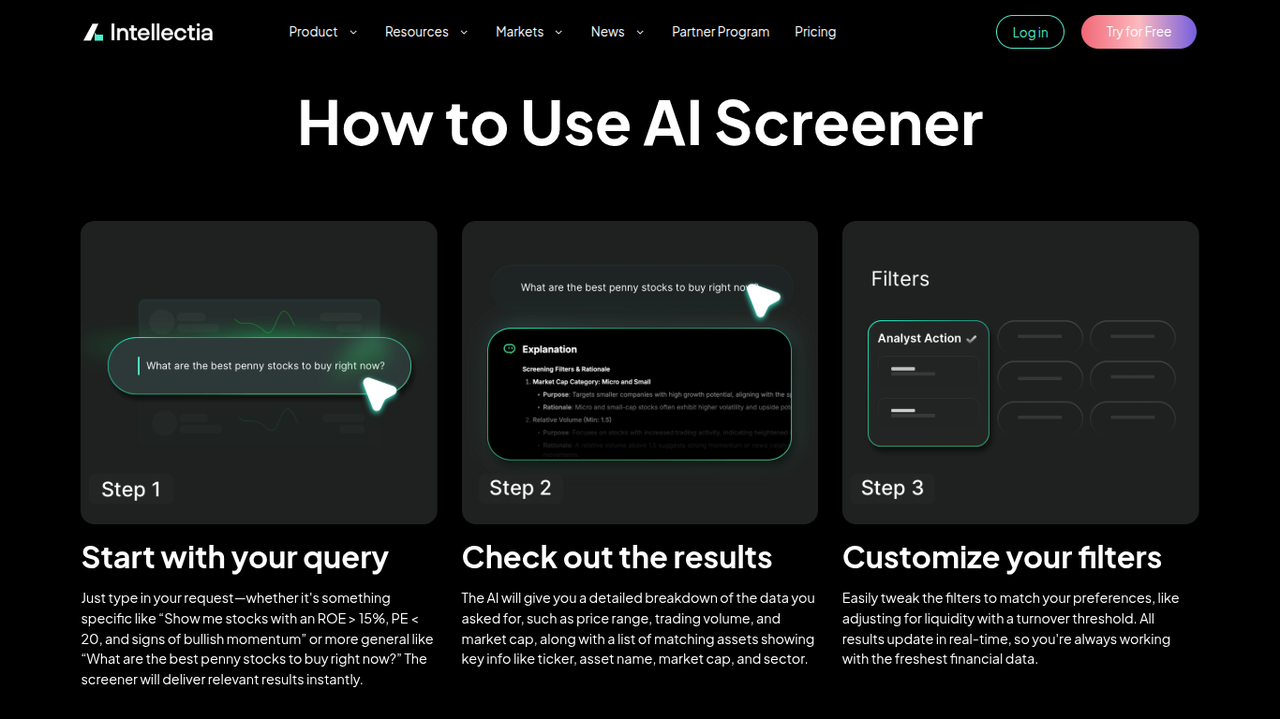

Once you have identified a watchlist of potential AI stocks, the next challenge is knowing when to buy, sell, or hold. This is where AI-powered investment tools can give you a significant edge. Instead of relying solely on headlines, you can use data-driven insights to guide your decisions.

Platforms like Intellectia.ai offer a suite of features designed for modern investors. You can use an AI Stock Screener to discover other companies in the AI supply chain with strong fundamentals. For more active trading, the Swing Trading tools and AI trading signals can help you pinpoint optimal entry and exit points based on market momentum and technical analysis. By leveraging these tools, you can navigate the volatile AI market with greater confidence.

The Smart Way to Invest in the AI Revolution

While you can't buy DeepSeek AI stocks today, the investment opportunity surrounding this innovative company is immense. The true value lies in identifying and investing in the foundational companies that are powering not just DeepSeek, but the entire AI revolution. Stocks like NVIDIA, Microsoft, Arista Networks, Super Micro, and TSMC represent the critical infrastructure that will fuel AI's growth for years to come.

To navigate this fast-moving market and make the most of these opportunities, you need the best tools at your disposal. Sign up for Intellectia.ai to get daily AI-powered insights on these top stocks and more. Subscribe today to receive actionable AI trading signals, in-depth market analysis, and advanced screening tools to build a smarter, more successful AI investment portfolio.