Key Takeaways

- You’ll find five top data center stocks thriving on AI, cloud, and digital growth in 2026.

- Our top picks indicate strong revenue, innovation, and market leadership in the data center space.

- The global data center market is set to grow at a 9.29% CAGR through 2033 reaching over $700 billion.

Introduction

The AI revolution has turned data centers into the backbone of modern computing. Training frontier models now consumes hundreds of megawatts—more than many cities use in their entire industrial base. As a result, the real scarcity isn’t GPUs—it’s power capacity and grid access.

In this environment, data center operators, hardware suppliers, and infrastructure innovators are all competing for the same goal: to deliver energy, efficiency, and uptime to the AI economy. Looking ahead to 2026, these AI and hyperscale data center stocks remain essential holdings for investors seeking both growth and resilience.

What Are Data Center Stocks?

Data center stocks represent companies that own, operate, or supply critical infrastructure enabling digital workloads—from AI training clusters to cloud computing and enterprise storage.

They generally fall into three categories:

- REITs (e.g., DLR, EQIX) – landlords providing space and power with multi-year leases.

- Hardware & Server Firms (e.g., QCOM, NVDA) – building the systems that make AI compute possible.

- Infrastructure Providers (e.g., VRT) – powering and cooling hyperscale facilities for reliability.

These groups collectively form the foundation of the AI ecosystem, and their earnings are now directly tied to how fast hyperscalers like Microsoft, Amazon, and Meta can expand capacity.

Best Data Center Stocks to Watch in 2026

Here's a lineup of data center stocks that you should keep an eye on throughout 2026:

- Analog Devices (ADI) – Best for analog and AI chip stability

- Equinix (EQIX) – Best for global reach

- Qualcomm (QCOM) – Best for AI and connectivity innovation

- NVIDIA (NVDA) – Best for AI hardware

- Vertiv (VRT) – Best for infrastructure technology

Why These Stocks Lead the 2026 Data Center Boom?

Researching and figuring out which stocks would serve your portfolio is no easy feat. We ensured each stock represents a unique area of the industry and shows strong potential for long-term growth.

Selection criteria include:

- Growth drivers: Strong AI, cloud, or 5G industry exposure.

- Revenue strength: Stable revenue of over $1 billion per year.

- Market positioning: Leadership within high-growth areas of cloud computing.

- Analyst approval: Consistent positive ratings from major analysts.

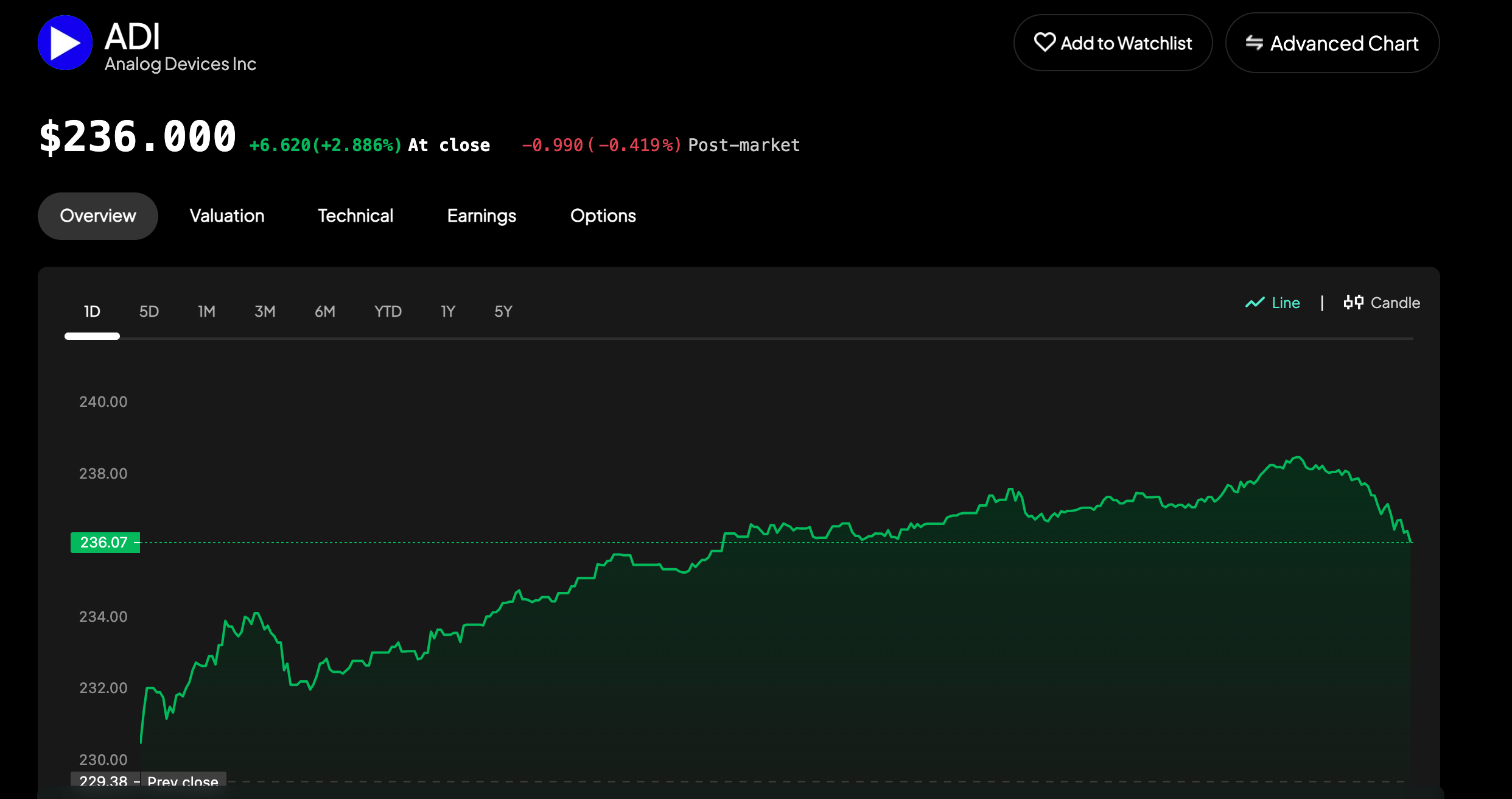

Best for Analog and AI Chip Stability

Digital Realty (ADI)

Analog Devices (ADI) is a global leader in high-performance analog and mixed-signal semiconductors, essential for AI infrastructure, automotive, and industrial applications. In 2024, the company reported $11.5 billion in revenue, showing resilience despite semiconductor market volatility.

Why Analog Devices?

With its focus on power efficiency and signal precision, ADI’s chips are key enablers of 5G, robotics, and energy-efficient systems. Its strong dividend record (around 2%) and consistent cash flow make it a reliable pick for long-term investors.

However, slower industrial recovery and cyclical chip demand could limit short-term growth, though ADI’s diversified portfolio supports its long-term stability.

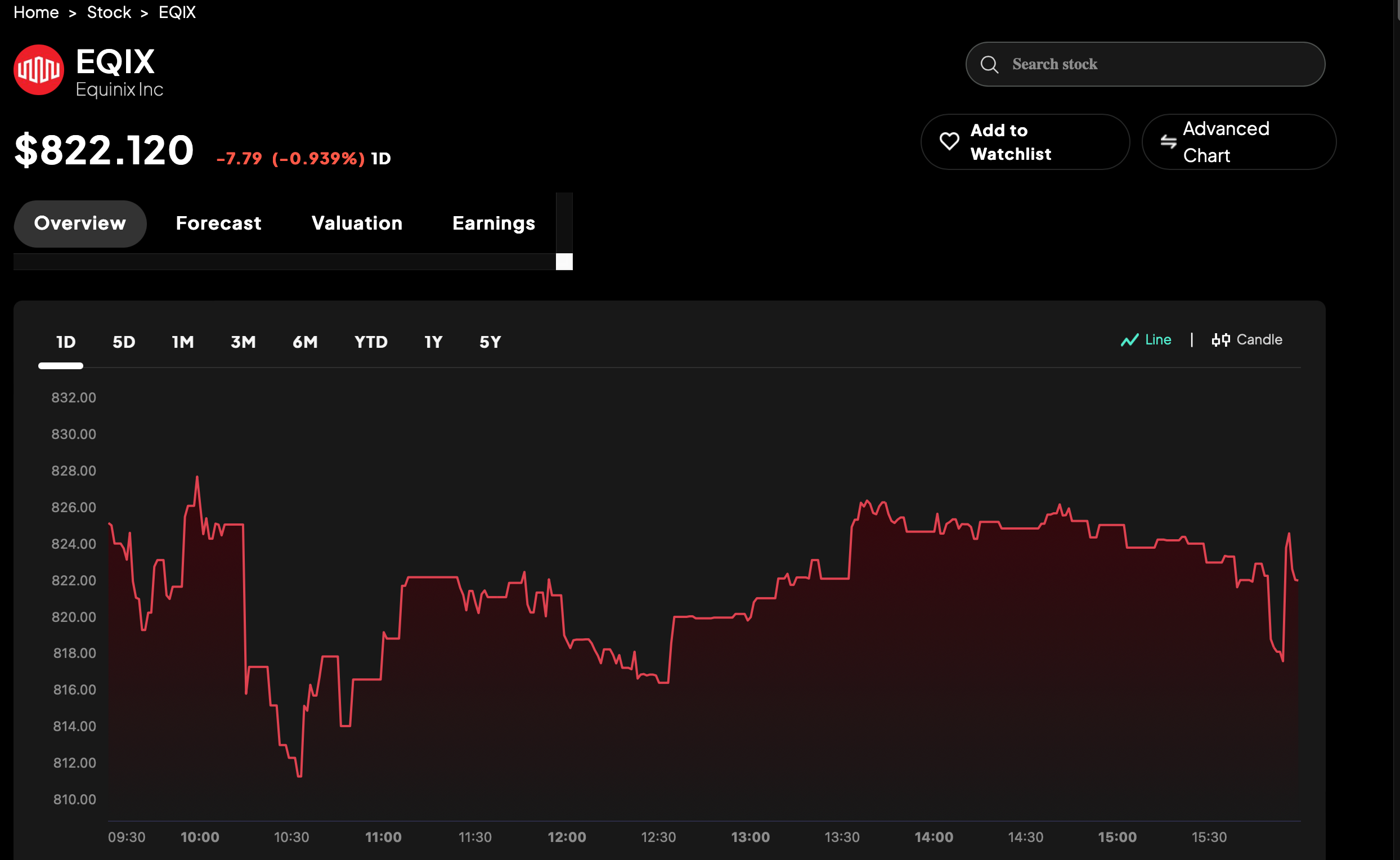

Best for Global Reach

Equinix (EQIX)

Considered the global kingpin for the data center industry. Equinix currently manages over 270+ facilities across 70 markets. The company mostly focuses on powering interconnectivity for cloud and AI workloads, and in 2024, Equinix''s revenue was $8.7 billion, an increase of 7% compared to the previous year.

Why Equinix?

Equinix is in a strong position to capitalize and benefit from the data center industry. The company has created over 463,000 interconnections in Q4 2024, up 5% compared to Q3 2024, and has contributed a further 90 MW of capacity to the industry through its xScale program.

However, the company still has potential risks it needs to overcome, such as, intense competition from Digital Realty and hyperscalers potentially leading to market saturation (rental rate growth slowed to 5% in Q3 2024), and its reliance on hyperscale clients like AWS creating concentration risk, exposure to geopolitical and economic volatility across 30+ countries.

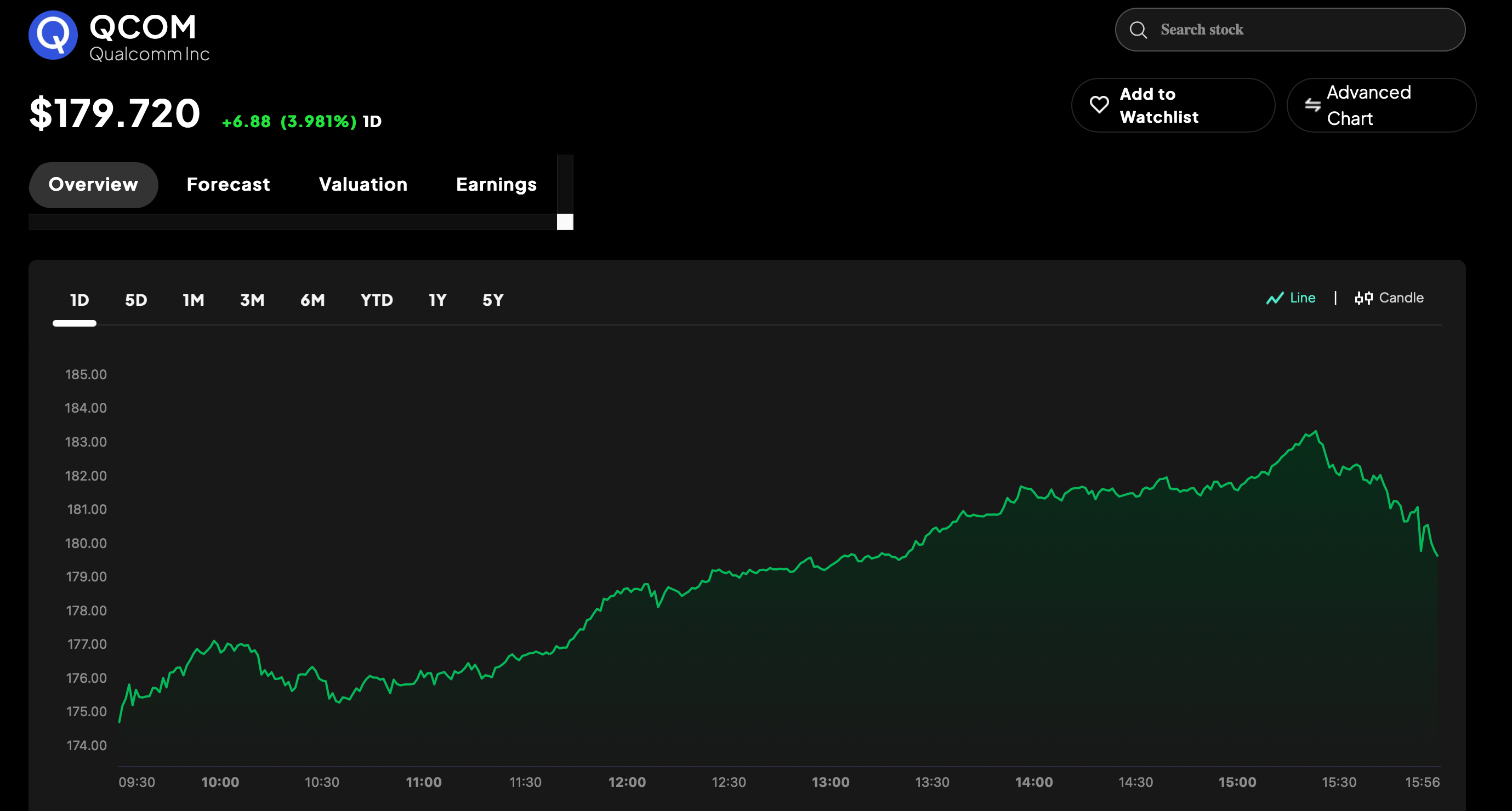

Best for AI and Connectivity Innovation

Qualcomm (QCOM)

A long-standing favorite of investors seeking stability and innovation in the semiconductor sector. Qualcomm is a global leader in wireless technology and AI-driven chip design, powering not only smartphones but also AI PCs, automotive systems, and edge computing solutions. The company reported FY2024 revenue of $38.6 billion, reflecting a steady rebound from the mobile slowdown and strong growth in its automotive and Internet of Things (IoT) segments.

Why Qualcomm?

As AI continues to expand beyond data centers into devices and edge infrastructure, Qualcomm is uniquely positioned to benefit. Its Snapdragon X Elite chip series brings on-device AI processing to next-generation laptops, while the AI 100 and Cloud AI 100 Ultra accelerators aim to compete in the growing AI inference market. Moreover, Qualcomm’s partnerships with Microsoft, Meta, and major automakers strengthen its foothold in the AI and connectivity ecosystem.

However, investors should note that Qualcomm still faces intense competition from NVIDIA, AMD, and Apple’s in-house chip development, which could pressure margins. While not as speculative as pure AI plays, Qualcomm offers a balanced exposure—combining AI innovation, connectivity leadership, and long-term stability, making it an attractive choice for investors looking for sustainable AI-driven growth.

Best for AI Hardware

Best for AI Hardware

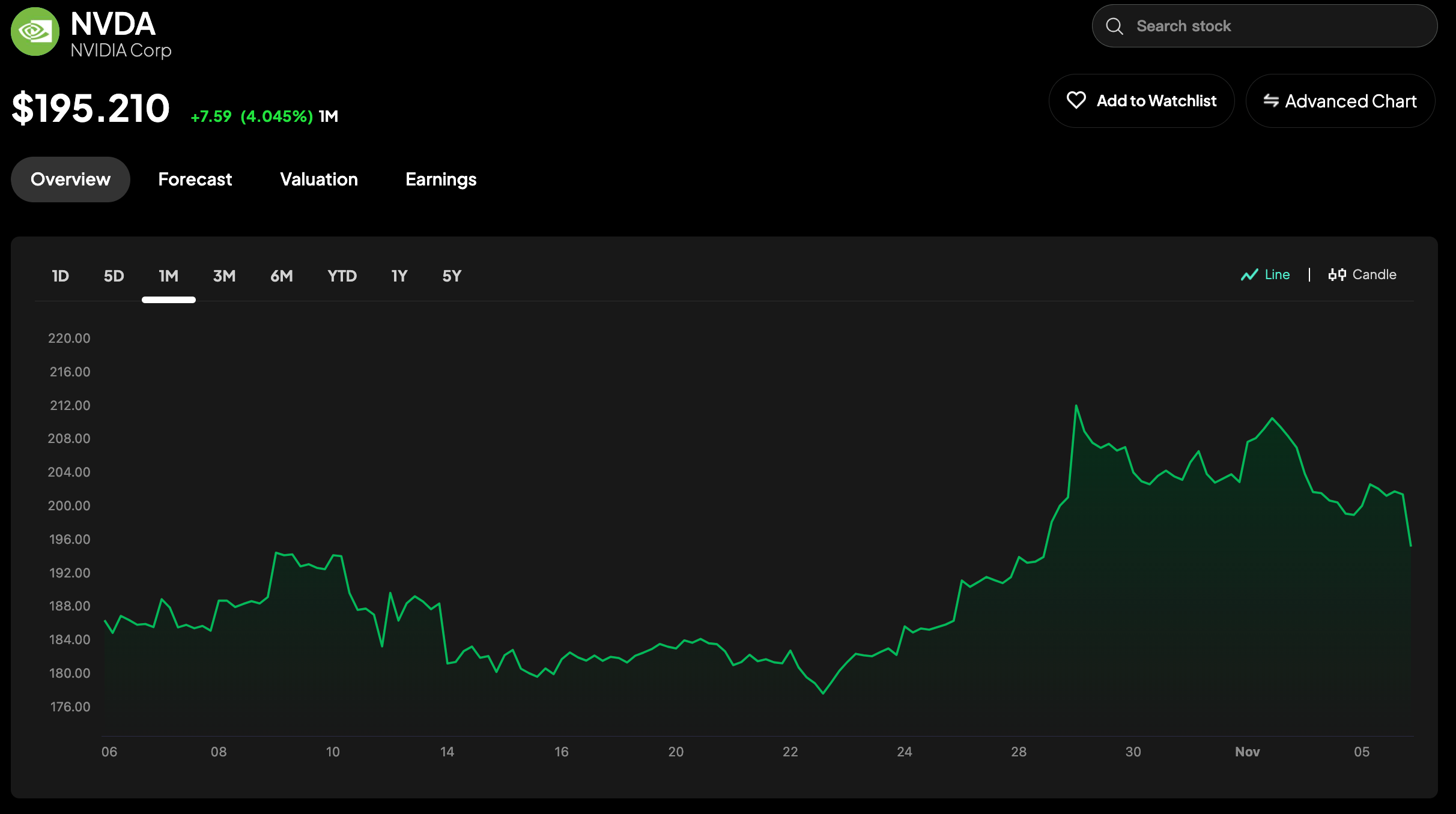

NVIDIA (NVDA)

Where would we be if I didn't mention Nvidia? This stock has already achieved substantial heights and solidified it as the most important company for data center and AI services globally. In 2024, Nvidia's stock surged by 171% and becoming the highest-valued company in history.

Why Nvidia?

Surely, it goes without saying, however, the AI industry will likely not be capable of processing its solutions without Nvidia's GPUs. Although Nvidia's stock price dipped after the announcement of the Chinese alternative to ChatGPT, the company's GPU chips have proven AI development is accessible to large corporates and startups across the board.

However, Nvidia's current stock price-to-market cap may deter investors. Nvidia's P/E ratio is 42+ (whereas the industry average is 20/25), and there are mounting concerns over sustainability as Nvidia has seen a 5-year surge in price, generating a bubble that could falter and wreak havoc across the financial markets.

Best for Infrastructure Tech

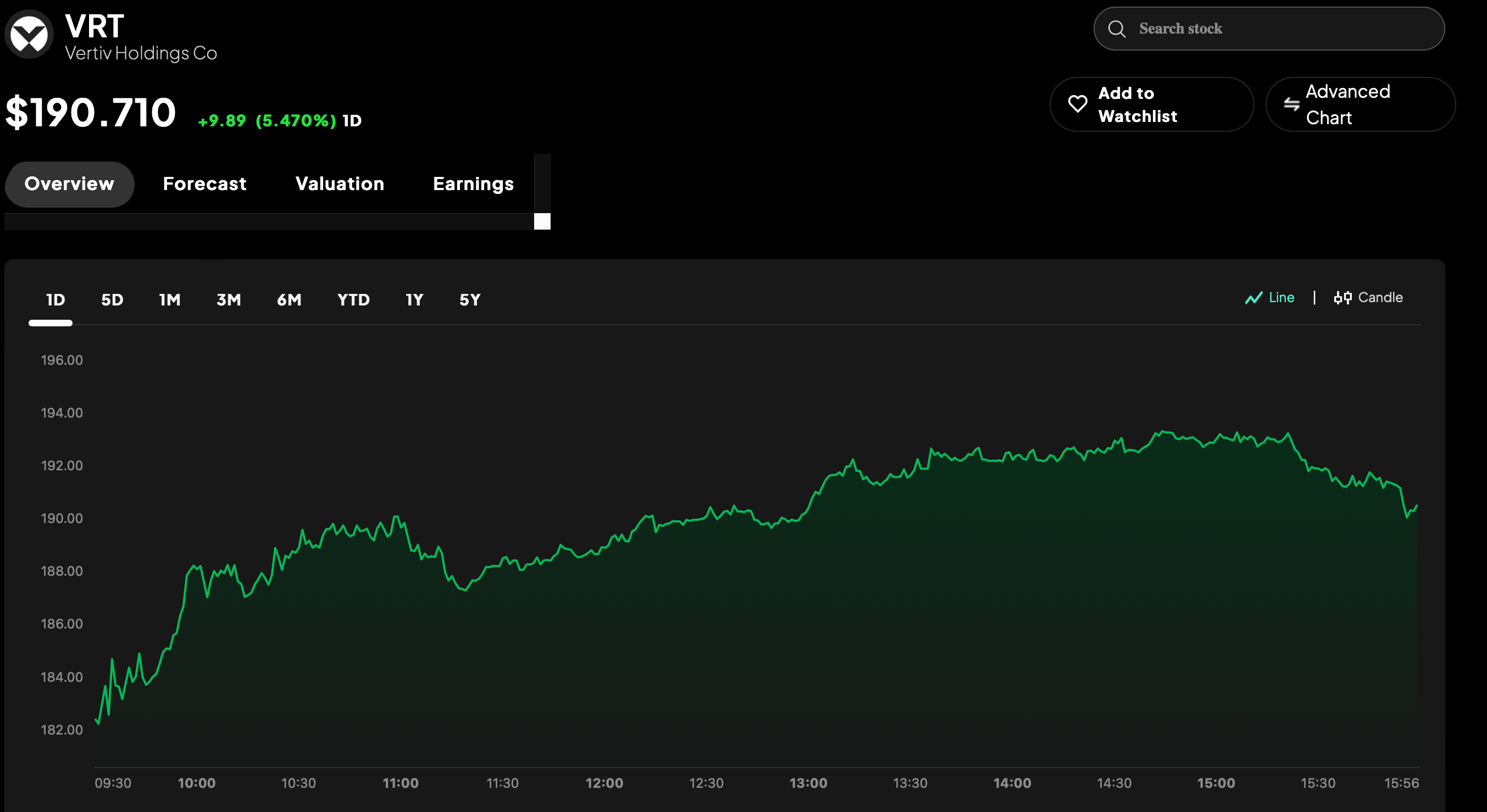

Vertiv (VRT)

Critical to the data center infrastructure, mainly focused on power and cooling services. The company's sales increased by 19% YoY capturing $1.94 billion in revenue throughout 2024 and projected to increase this by 16% throughout 2026.

Why Vertiv?

The company has a strong partnership with Nvidia, and focuses on generating energy-efficient innovations such as liquid cooling, a key component for AI-drive data centers. Numerous analysts have given Vertiv a "buy" rating, forecasting its stock price to reach $145+ in 2026.

However, its stock dropped 15% in late 2024 amid fears of an AI spending slowdown. Its reliance on a few hyperscale clients for growth exposes it to demand fluctuations, and thinner margins (EBITDA margin 20.7% in Q3 2024) compared to peers like NVIDIA could pressure profitability if costs rise. These could indicate careful sentiment prior to investing in VRT.

Conclusion

There's a list of 5 bullish data center stocks for you to consider. We are all aware the AI industry is booming and it seems a new AI company pops up every day, and this growth will require the expansion of data centers to support all these "AI companies."

These stocks are very much riding the AI, cloud, and digital waves, backed by solid financials and strong sentiment. The data center market’s 9.29% CAGR through 2033 screams opportunity. Now it's down to you to decide which stock best suits your needs.