Key Takeaways

- Our list of best penny stocks for 2025 covers companies focused on innovative future technology that has potential long-term growth

- Penny stocks are known to be high-risk returns, before investing it is best you do your own due diligence and financial analysis

- Our selection is based on market cap, trading volume, stock price, and whether the stock is NYSE-listed.

Introduction

Finding the best penny stocks for 2025 can be an arduous process, especially when you're looking to allocate a fraction of your investment portfolio toward these potentially lucrative investments. There are five penny stocks that come to mind, and stocks you too may find attractive.

What Are Penny Stocks?

Penny stocks are stocks of small companies that are usually trading below single-digit dollars. These types of stocks are generally traded via an Over-the-Counter (OTC) bulletin board. However, some penny stocks can also be traded on larger exchanges, such as the New York Stock Exchange (NYSE).

Five Best Penny Stocks For 2025

- Innoviz Technologies Ltd. (INVZ)

- BioLineRx Ltd. (BLRX)

- Cerus Corp (CERS)

- Ring Energy Inc (REI)

- Energy Vault Holdings Inc (NRGV)

Innoviz Technologies Ltd.

Market cap: $295.19 million

Revenue: $4.52 million

52-week range: $0.45 - $3.14

Industry: Autonomous driving technology

Innovbiz is an interesting penny stock, as the company sells Li-dar technology for safer autonomous driving. In a world that is increasingly demanding new autonomous technology, Innoviz is a well-positioned penny stock that may drive unexpectedly high returns.

BioLineRx Ltd.

Market cap: $107.42 million

Revenue: $4.94 million

52-week range: $4.60 - $39.50

Industry: Medical

Many pharmaceutical companies have shown increasing rates of returns in recent months, and BioLineRx is no exception. This FDA-approved company specializes in the development of new treatments for cancer and rare diseases.

Cerus Corp

Market cap: $293.43

Revenue: $46.02 million

52-week range: $1.38 - $2.58

Industry: Bio-medical

Cerus Corp focuses on the development, storage and distribution of blood across the globe. They specialize in ensuring blood is not contaminated during transfusion to patients. In addition, they monitor and check whether blood is safe to be transfused to a patient.

Ring Energy Inc

Market cap: $293.33

Revenue: $85.04 million

52-week range: $1.21 - $2.20

Industry: Oil and Gas

Ring Energy focuses on the surveying and extraction of fossil fuels such as oil-based in Texas, US. The company mostly specializes in extracting high-quality oils and natural gasses.

Energy Vault Holdings Inc

Market cap: $292.07

Revenue: $1.2 million

52-week range: $0.78 - $2.70

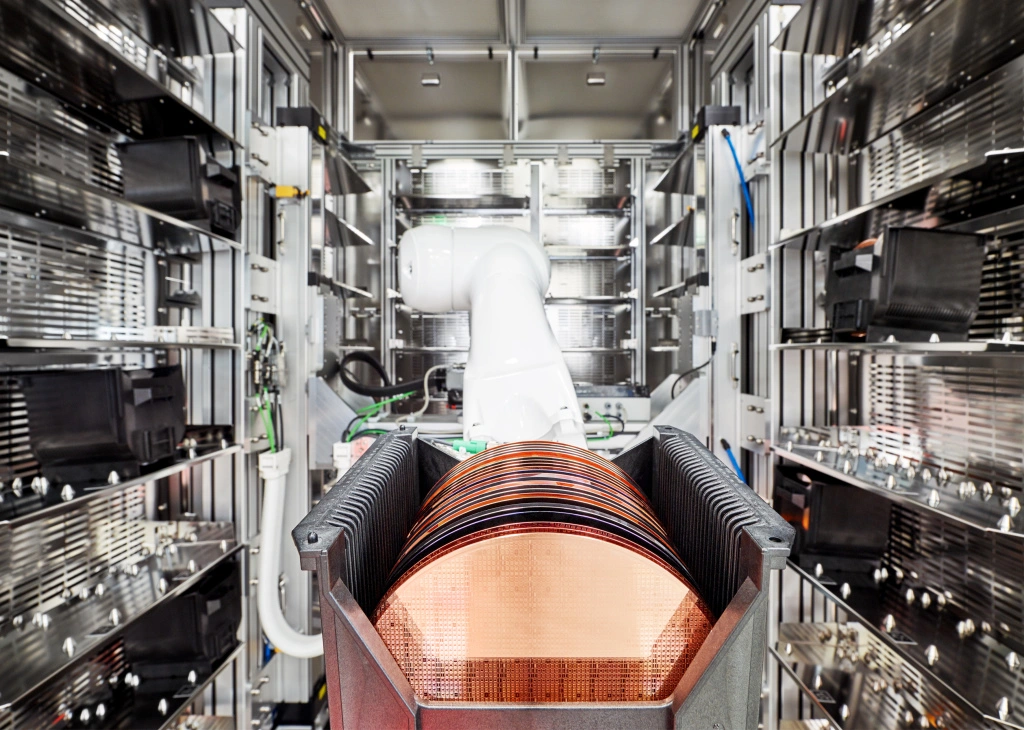

Industry: Sustainability

Energy Vault specializes in the storage of energy and facilitates the delivery of energy to power large data centres. Energy Vault offers multiple energy storage solution products to an array of different businesses.

Why these penny stocks?

In an ever-changing world, certainly, from a technological perspective, we can see that many penny stocks that are focused on delivering new innovative solutions are best positioned for future growth.

For example, autonomous driving is steadily increasing with the role out of more and more car companies integrating Li-Dar technology into their systems, whereas advances in the field of medicine are high-potential industries along with sustainability and energy sectors.

How do we choose our five best penny stocks?

These five penny stocks were screened using our AI financial screening feature. Our criteria screened out companies that are NYSE-listed, with a market cap of less than $300 million, stock price of less than $3 and a minimum trading volume of 100,000.

Where Can I Buy Penny Stocks?

You can trade the penny stock mentioned in this article on the New York Stock Exchange (NYSE). The broker you use to trade stock should offer you access to the NYSE, which can give you exposure to the penny stock discussed above.

Conclusion

As we are going through 2025, you can see that there are potential opportunities among penny stocks. However, trading penny stocks is a very high risk, which is why when conducting our research we focus on key elements such as their market caps, revenue, trading volume, etc...

Before you begin jumping in and adding penny stock to your portfolio, make sure you have conducted your own due diligence and financial research. If you're looking to understand stocks and their financials, we recommend you join the Intellectia platform.

Frequently Asked Questions

Is trading penny stocks profitable?

Like all financial instruments, there is potential for attaining high profits when trading penny stocks. However, you can also incur substantial losses.

Are penny stocks highly risky?

Compared to other stocks, yes penny stocks are more riskier. This is due to their high amounts of volatility, lower trading volumes, and unstable financials.

How can I trade penny stocks?

You can trade penny stocks on most online brokerage platforms, such as Trading212, Etoro, Robinhood, etc...