Key Takeaways

- Rising global tensions are boosting defense budgets, making military stocks a stable choice for your portfolio amid economic uncertainty.

- Companies like Lockheed Martin and RTX are delivering strong earnings beats driven by massive government contracts and AI integrations.

- Palantir stands out for its AI-driven data analytics in military ops, while General Dynamics just secured a $3.5 billion deal for advanced vehicles.

- Focus on stocks with solid dividends and innovation to maximize long-term growth.

Introduction

Markets feel unstable, and your portfolio deserves something solid. With rising geopolitical tensions and soaring defense budgets, military stocks offer rare stability. Giants like Lockheed and RTX are outperforming—but which ones are still undervalued in 2026?

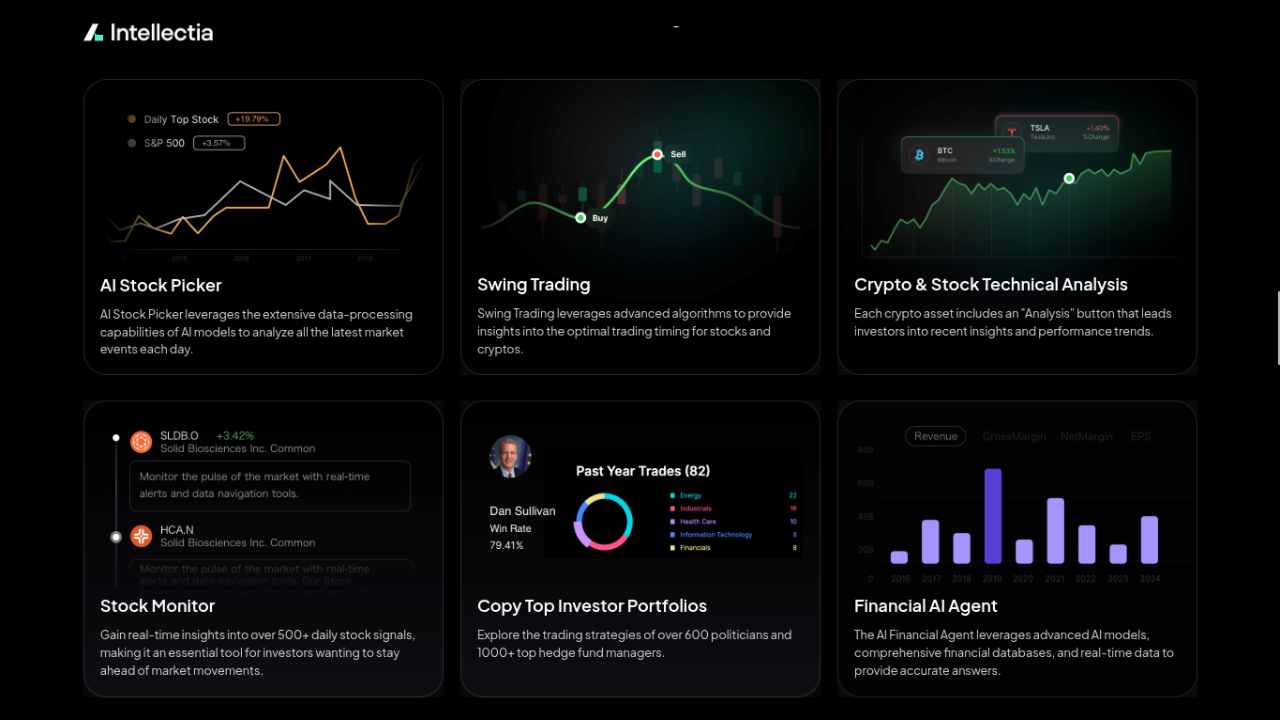

That’s where Intellectia.ai helps—using AI to scan earnings, news, and defense trends in real time. It pinpoints stocks with strong revenue, innovation, and dividend potential. Let’s dive into the top military picks driving both stability and growth in 2026.

What Are Military Stocks?

These firms deliver defense equipment, aerospace systems, cybersecurity, and AI-based military tech. Your investment taps into government-backed stability, unlike volatile consumer sectors.

Military Stocks Types

- Defense Contractors: Giants like Lockheed Martin build jets and missiles—core to U.S. ops.

- Aerospace & Drone Companies: Focus on unmanned systems for surveillance and strikes.

- Cybersecurity & AI Defense Firms: Palantir leads with data analytics for threat detection.

- Industrial Suppliers Supporting Military Production: Provide components for tanks and subs.

Explore more with Intellectia.ai's AI stock picker to filter these by growth metrics. As global conflicts evolve, these categories offer diversification for your long-term holds.

Why Invest in Military Stocks?

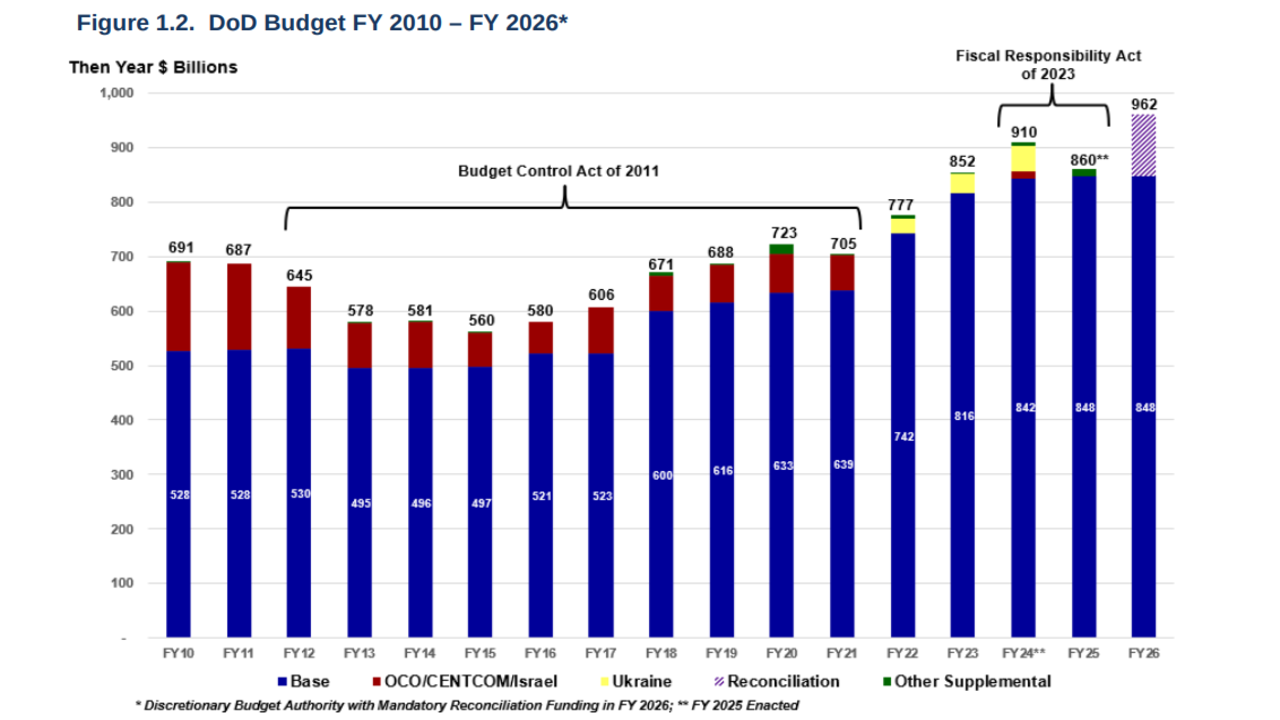

You're eyeing resilience in uncertain times—military stocks deliver just that. With U.S. defense budgets topping $800 billion annually. These picks thrive on consistent funding.

1. Rising Global Defense Spending

NATO allies boost outlays amid US-China tensions and Middle East unrest. Lockheed's recent $30 billion awards on PAC-3 and F-35 underscore this surge.

2. Stable Demand During Economic Cycles

Unlike retail, military contracts lock in revenue—your buffer against recessions. RTX's 11.89% Y/Y revenue beat shows aviation recovery pairing with defense steadiness.

3. Innovation in AI Military Technology

AI transforms warfare; Palantir's Foundry platform integrates with Snowflake for smarter decisions. This edge drives 48% revenue growth, per Q2 transcripts.

4. Strong Dividends and Government Contracts

Enjoy yields up to 1.5% with secure cash flows. Northrop Grumman's EPS beat highlights backlog strength, ensuring payouts even in supply crunches.

Check Intellectia.ai's hedge fund tracker for institutional bets in this space—they're piling in for good reason.

Criteria for Selecting Top Military Stocks

You want picks that balance growth and safety—here's your blueprint. Prioritize firms with ironclad contracts and cutting-edge tech.

- Revenue Growth & Government Contracts: Look for 5-10% Y/Y increases backed by multi-year deals. Lockheed's $179 billion backlog signals reliability.

- Technological Innovation (AI & Automation in Defense): Seek AI integrators like Palantir, whose platforms enhance targeting—key for future dominance.

- Global Presence & Export Capabilities: Firms with European and Asian footholds, like General Dynamics' $3.5 billion German win, hedge U.S. reliance.

- Dividend Strength & Financial Stability: Target yields above 1.5% with low debt. RTX's beat and raised guidance exemplify fiscal health.

- ESG and Ethical Considerations in Defense Investments: Balance profits with sustainability—focus on ethical AI use. Use Intellectia.ai's stock technical analysis to weigh risks. This framework keeps your selections sharp amid ethical debates.

5 Best Military Stocks to Buy

You've got the criteria—now meet the lineup. These stand out for earnings beats, AI edges, and backlogs amid 2025's strong sector quarter.

| Company Name | Ticker | Sector | Market Cap | Key Strengths | Dividend Yield | YTD Price Return |

|---|---|---|---|---|---|---|

| Lockheed Martin Corporation | LMT | Defense / Aerospace | $118B | Record $179B backlog, F-35 dominance | 2.7% | ~1% |

| Northrop Grumman Corporation | NOC | Defense / Aerospace | $86B | Missile systems, global contracts | 1.5% | ~28% |

| RTX Corporation | RTX | Aerospace / Defense | $215B | Engine tech, commercial rebound | 1.7% | ~50% |

| Palantir Technologies Inc. | PLTR | AI / Cyber Defense | $431B | AI platforms, 48% revenue growth | N/A | ~140% |

| General Dynamics Corporation | GD | Land Systems / Defense | $91B | $3.5B European deals, diversified | 1.8% | ~29% |

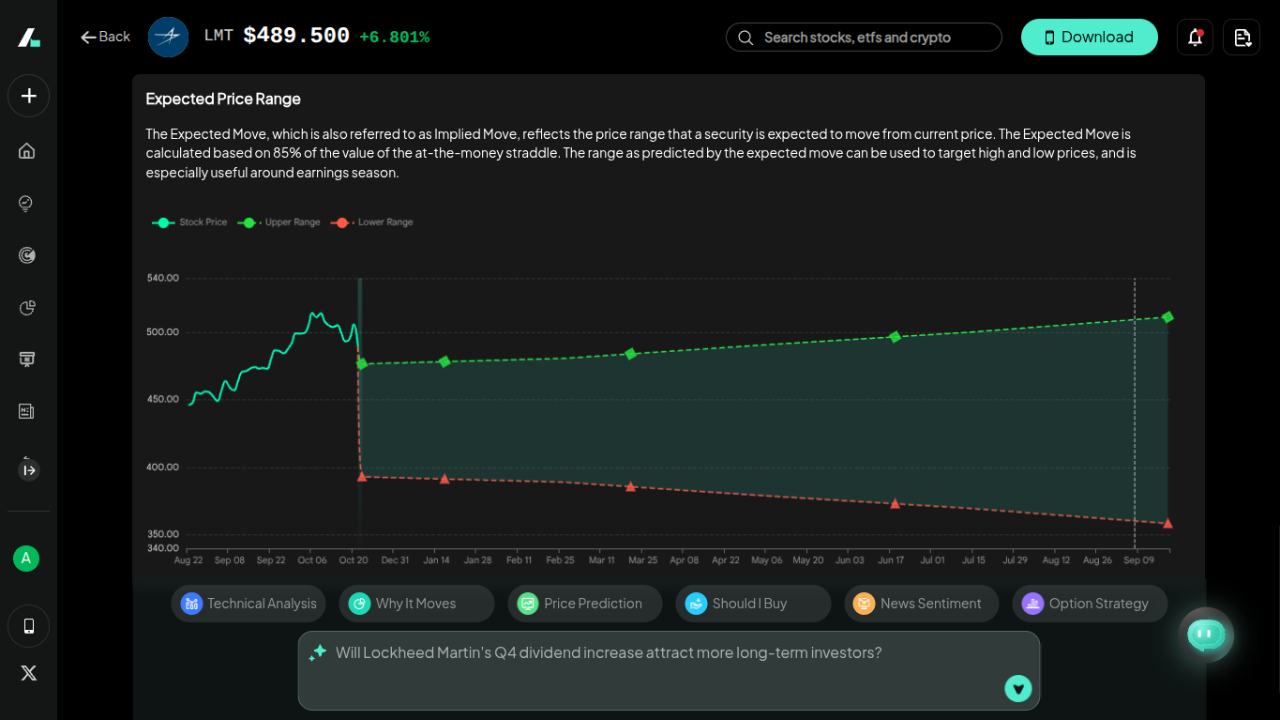

Lockheed Martin (LMT)

Lockheed Martin leads as the premier defense contractor, crafting F-35 jets and hypersonics. Recent Q3 highlights? EPS of $6.95 beat estimates by $0.60, with revenue at $18.61 billion up 8.80% Y/Y. That $179B backlog—your guarantee of multi-year revenue—drove a sales outlook hike to $74.25B–$74.75B, per CEO Taiclet's remarks on marquee wins like $11 billion in F-35 Lots 18/19.

What sets it apart? Unmatched scale in stealth tech, outpacing peers in export wins—big chunk of backlog now international, buffering US cuts. If you seek stability with growth, LMT fits your dividend-focused strategy, with 2.7% yield compounding amid 9% organic growth forecasts. Unique analysis: In US-China scenarios, F-35's interoperability with allies could spike orders. Growth potential is coming from backlog conversions, plus AI upgrades in sustainment.

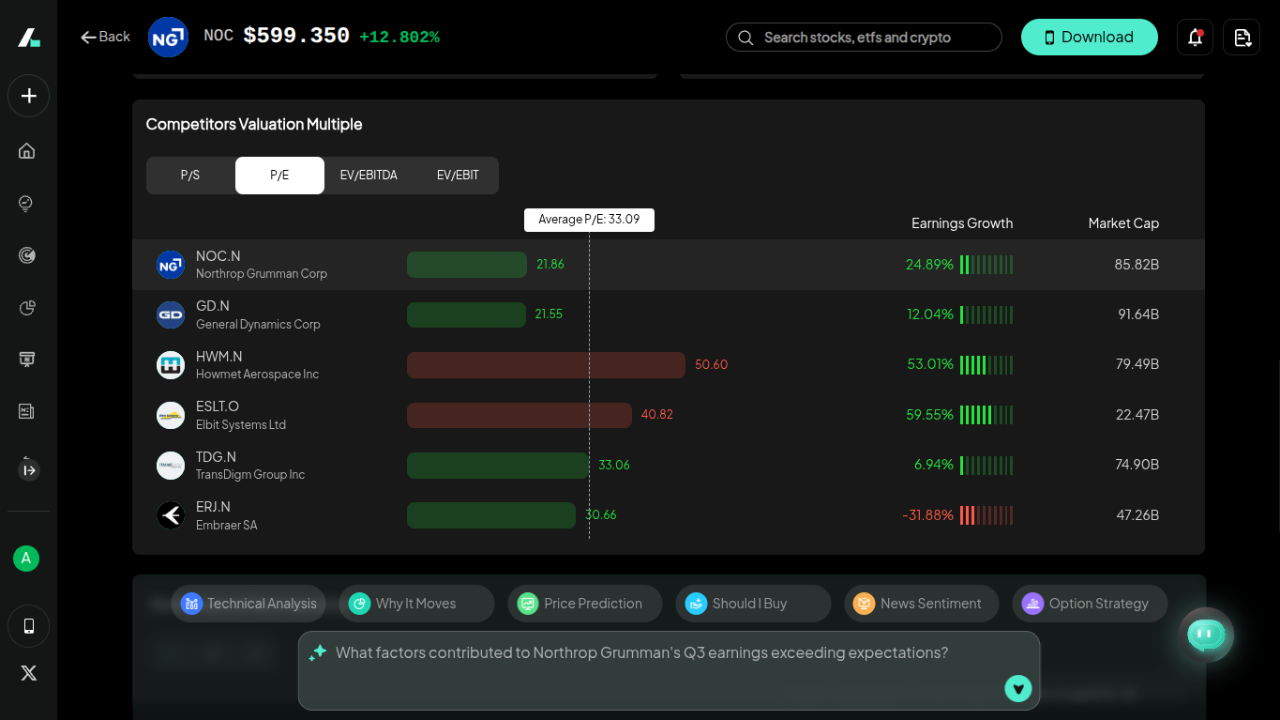

Northrop Grumman (NOC)

Northrop Grumman excels in space and missile defense, powering B-21 bombers and satellites. Q3 EPS hit $7.67, beating by $1.21, though revenue missed slightly at $10.42 billion. Still, global demand for advanced systems shines through, with CEO Warden emphasizing backlog stability despite 4.27% Y/Y dip.

Its edge? Deep expertise in autonomous drones, differentiating from hardware-heavy rivals—think NGAD program leadership, where AI swarms could cut costs. NOC stock is ideal if your portfolio needs cyber-AI exposure, especially as Ukraine and Middle East tensions drive billions in missile replenishments.

You can expect NOC stock upside from NATO spending ramps, with the space segment adding growth. Also, supply chain tweaks post-Ukraine have boosted margins.

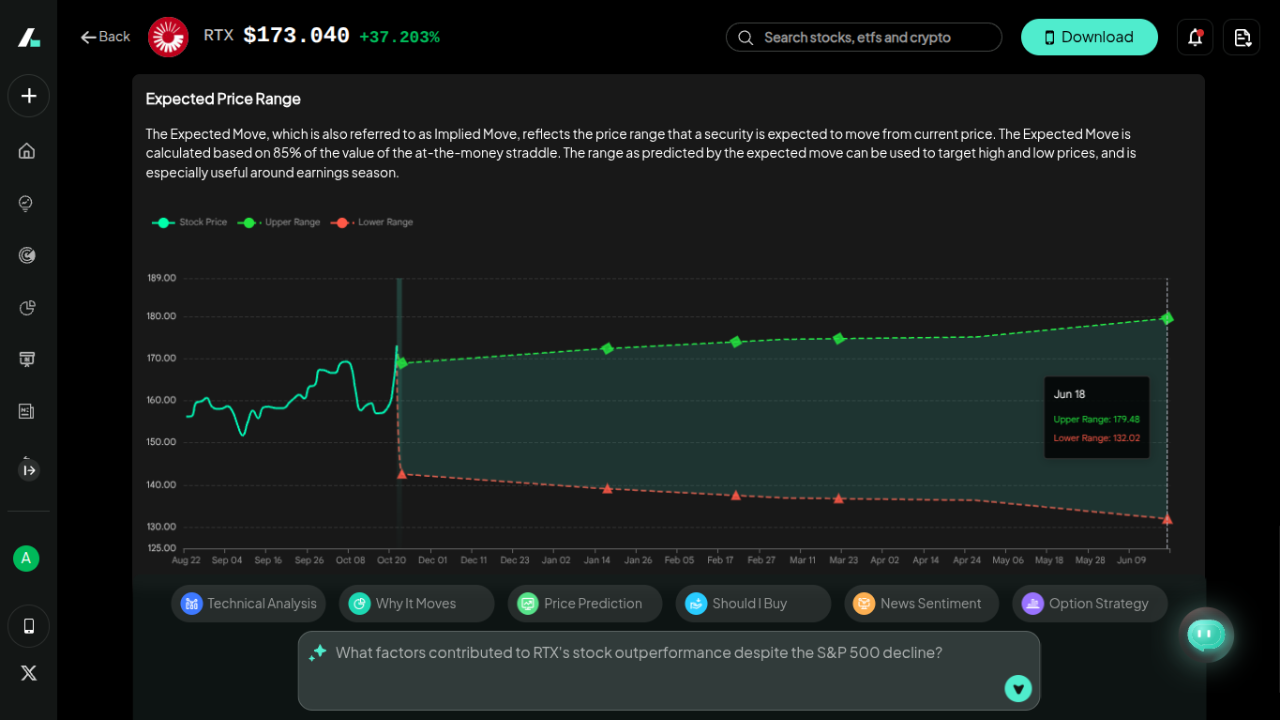

RTX Corporation (RTX)

RTX blends defense with commercial aviation, via Pratt & Whitney engines and Raytheon missiles. Q3 crushed with $1.70 EPS (beat by $0.29) and $22.48 billion revenue, up 11.89% Y/Y—fueled by air travel recovery and backlog addition. CEO Calio highlighted dual-stream resilience, with defense at 40% of mix.

Why top pick? Dual revenue streams buffer pure-defense risks, unlike single-focus peers—commercial's rebound offsets missile delays. Suits your balanced industrial play, RTX is a diversified aerospace pick. Potential is coming from backlog execution, with AI in radar tech unlocking upgrades. There are risks like Engine recalls that have shaved GD’s bottomline, but resolutions by Q1 2026 clear the path.

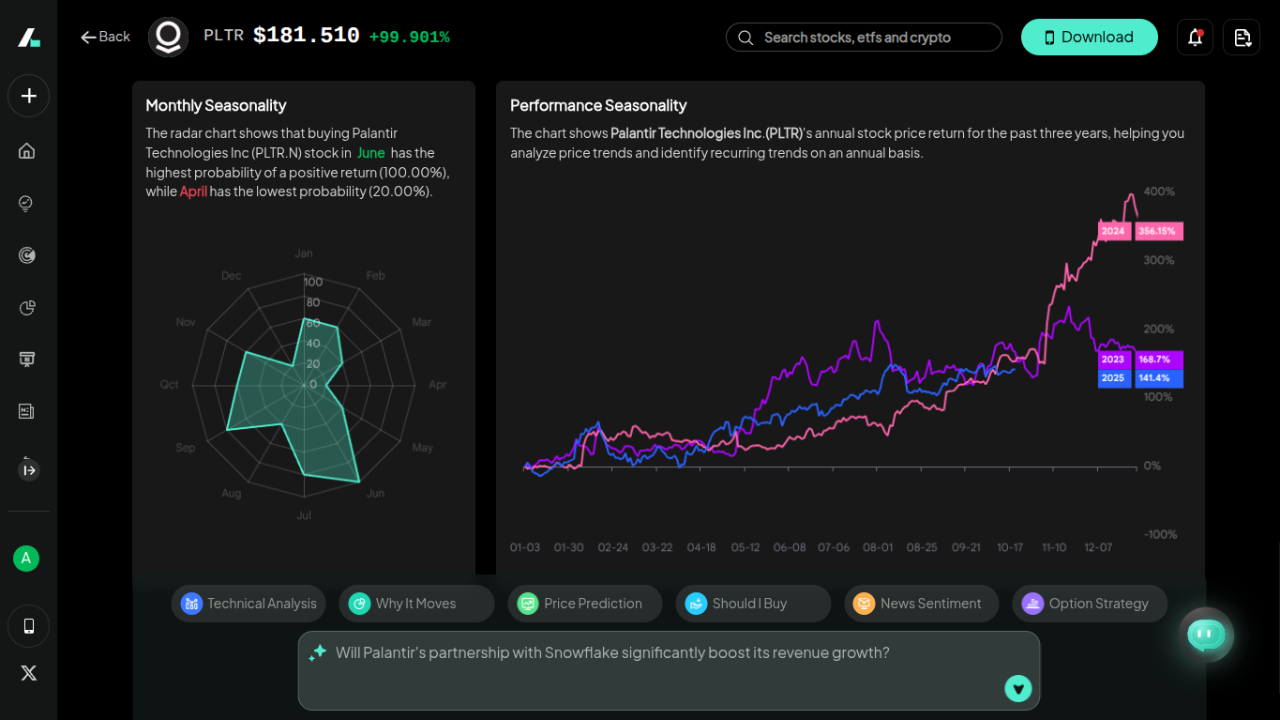

Palantir Technologies (PLTR)

Palantir revolutionizes military AI with data platforms for intel and logistics. Q2 revenue soared 48% to $1 billion, EPS $0.16 beating estimates, plus a Snowflake tie-up for AI cloud integration—CEO Karp touted it as force multiplier for DoD ops.

Stands out for software scalability—pure growth vs. hardware costs of others, with 80% gross margins fueling R&D. Ideal if you chase top military AI stocks, as ARK's bets signal ETF gains tied to such crossovers. Stock upside depends on defense contracts, amplified by commercial bleed-over in predictive analytics.

In cyber threats, PLTR's ontology tech detects anomalies faster, positioning it for TAM expansion.

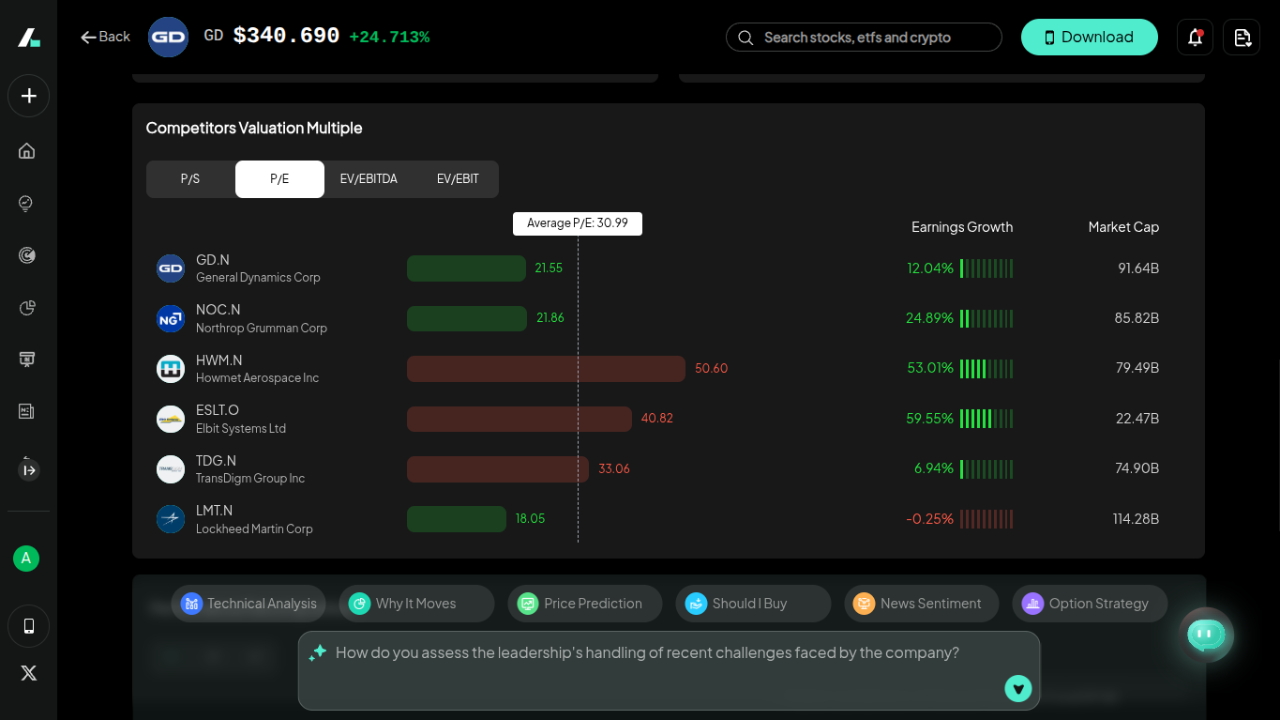

General Dynamics (GD)

General Dynamics dominates land and marine systems, from Abrams tanks to subs. Q2 EPS $3.74 beat by $0.19, revenue $13.04 billion up 8.89%, capped by a $3.5B German reconnaissance vehicle deal—CEO Novakovic stressed European pivot for 10% export growth.

Its differentiator? Broad diversification into IT via GDIT, reducing volatility—defense 70%, but tech adds recurring revenue. GD stock is good for your undervalued industrial stocks hunt, as NATO funnels billions to allies like Ukraine. With Columbia-class subs securing billions over decade, Combat Systems’ margin lift makes GD a quiet compounder.

Investment Strategies for Military Stocks

Ready to deploy? Time your moves with these tactics to maximize returns on top military stocks, leveraging 2025's $2.7T spend forecast.

Cyclical Investing: Timing the Economic Cycle

Buy during defense budget peaks, like now with U.S. hikes and NATO's 5% shift. Use Intellectia.ai's stock monitor for real-time alerts on bill passages—enter on dips post-Fed hikes, as rates compress multiples.

Thematic or ETF Investing

Bundle via ITA ETF for broad exposure, or zero in on AI military stocks with targeted picks like PLTR. Intellectia's AI agent simulates scenarios, blending themes for alpha over benchmarks.

Pair Trades or Sector Rotation

Long LMT, short cyclicals—hedge volatility. Rotate into industrials during rate cuts, pairing GD's exports against domestic laggards for spread capture.

Dividend Reinvestment

Compound yields from NOC or GD for long-haul growth. Intellectia's earnings trading flags optimal reinvest points, turning yields into higher effective income via DRIP in rising spend eras. Overlay options for theta decay on backlogs—sell calls on RTX during aviation booms.

Leverage Intellectia.ai's swing trading for signals on these—your edge in sector plays, especially with US-China flashpoints spiking volatility.

Conclusion

You now have the roadmap—from Lockheed’s unmatched backlog to Palantir’s AI edge, these defense stocks position your portfolio for strong, stable gains in 2026. Don’t stay on the sidelines while defense giants dominate 2026. Join Intellectia.ai now for real-time AI stock picks, strategy insights, and alerts on LMT, NOC, and PLTR moves. Your next breakout investment could be just one signal away.